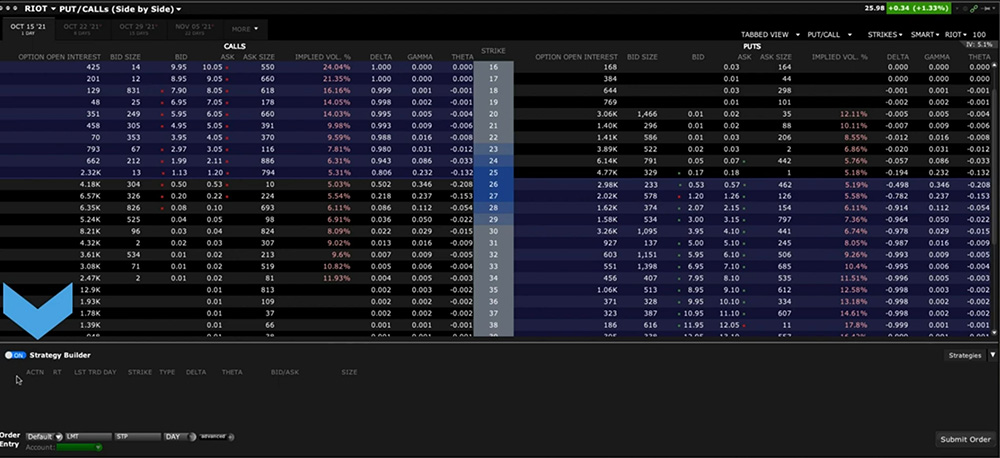

With an underlying symbol loaded in the Order Entry panel, locate and select from the dropdown menu to the upper right, the Strategy Builder. Upon opening you might notice that this looks identical to the Option Chain window. You are correct. The difference is simply that the Strategy Builder on/off button is set to on. That means that by interacting with one or more options legs will not close down the window. Rather, by remaining open, you may add and subtract multiple legs to the Strategy builder area below, and when ready, create and submit orders for execution without leaving the open software. In addition, you can access multiple prebuilt strategies and easily select your desired strikes and expirations.

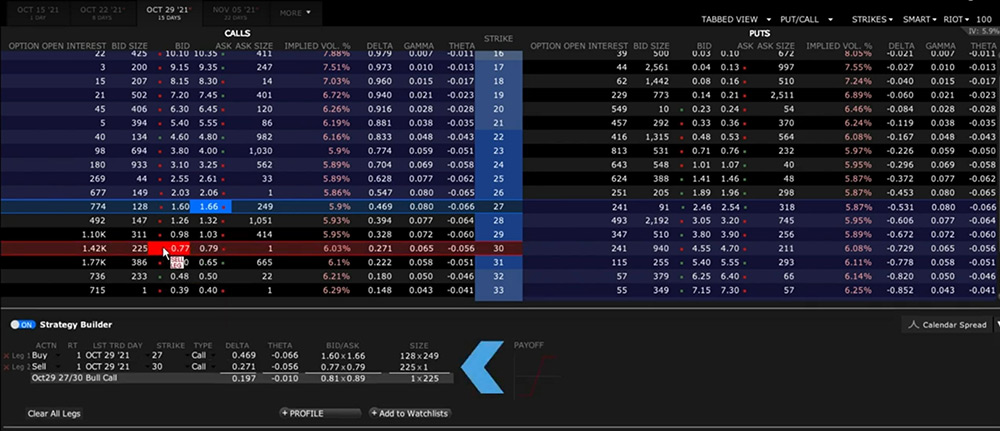

Adding Combinations – Let’s start by populating the Strategy Builder area manually. First, select the desired expiration date using either the tabbed or list views. In this example I will build a vertical call spread. In order to populate the Strategy Builder area below, all I have to do is click the bid or ask price for each required strike. Remember, clicking the bid price will by default create an order to sell, while clicking the ask price will create an order to buy. So for this vertical call spread, or debit spread, I will click the ask price of an out-the-money call option and click the bid price of a higher strike call option. Both legs will migrate to the Strategy Builder area. Note that you can see where you clicked in the Option Chain area.

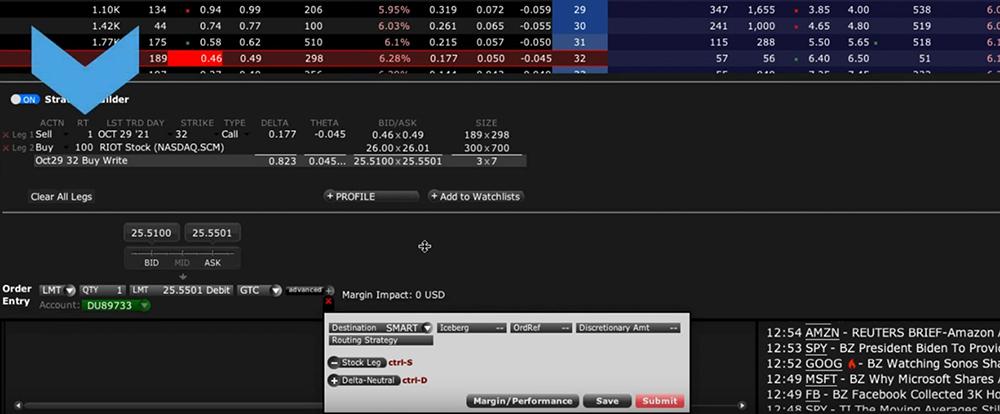

Each of the strikes is displayed as a separate line item and quoted. Note that the combined quote is also displayed along with the Greek values.

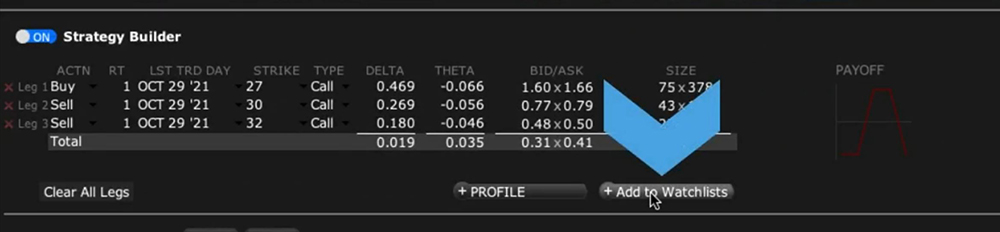

- If you wish to add a leg, just click back in the Option Chain area.

- If you want to delete a leg, click the red X button to the left of that leg.

- If you want to change from buy to sell, just make the selection from the Action dropdown menu.

- Likewise, change the ratio for the spread by entering a different value in the Ratio column.

- You can change the strike price using the Strike column,

- And you can change between Call and Put if you like.

- If you want to start over, click the Clear All Legs button.

If you wish to view a combination in detail, use the Profile button to display a plot through expiration including Greek values. We’ll cover this in more detail in another lesson). If you want to build and monitor multiple combinations, you can add it to the current Watchlist by clicking the Add to Watchlist button.

The Order Entry panel at the bottom of the page will update with the item you are building in the Strategy Builder area. Change your quantity, price, order type and time-in-force as required and use the Submit Order button to the lower right of the window to create an Order Confirmation before Transmitting your order.

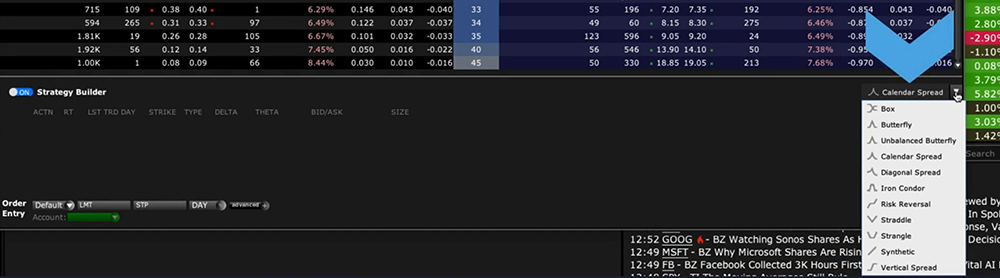

Strategies

Use the Clear All Legs button to start over, and we’ll take a look at the commonly used predefined strategies available within the tool. Before starting, just ensure that you can see the legs you want to use in a combination displayed on the page. Click the dropdown arrow to the right of the Strategies button to reveal available combinations.

I will select the Vertical Spread. You will see an instruction on the screen. Hover your cursor above the bid value of the higher strike call you want to sell. By doing so, the software will highlight the opposing leg of the spread. Use the mouse wheel to widen and narrow the required spread.

When you are hovering above the appropriate strike prices to populate your combination, click on one of the legs to populate the Strategy Builder window. If satisfied, you may adjust price, quantity, order type and time-in-force as necessary before submitting the order.

Covered Call and Buy Writes

One popular combination is a buy write or covered call, in which an investor buys stock and sells or writes a call option at a strike price above the current price of the underlying. The general aim is to receive the premium income through expiration of the option and perhaps use the strategy to exit the long stock position by having it called away upon expiration.

- To create a covered call, open the Strategy Builder and ensure that the button is set to ‘On’.

- Locate the call option you wish to sell. Since you are writing or selling the call option, click on the bid price.

- The option loads into the Strategy Builder area.

- Locate the Advanced button at the bottom of the window.

- Click the expansion button and select ‘Stock Leg’.

- TWS will compute the appropriate number of stocks relative to the selected number of options. Generally, a single option contract covers 100 shares.

- Contract the Advanced button by clicking on the red X icon.

The stock and call option combination is now displayed in the Strategy Builder. The combination price is shown as the stock price less the premium received from selling the option. Adjust the quantity, price, order type and time-in-force as necessary. Note that if you initially entered a single option and added the stock leg of 100 shares, whatever you enter will magnify by that same ratio. So, for example, entering 10 as your quantity would result in 10 call options and 1000 shares.

If you are ready to enter your order, click the submit button. You may also add the order to a Watchlist or may preview the performance profile with those additional buttons below the combination price.

Please add bracket orders entries on the strategy builder window.

Hello Leonardo, thank you for reaching out. In the future, we would love to hear your suggestions for TWS at twsfeedback@interactivebrokers.com and/or you can post in the New Feature Poll in Client Portal. Bracket orders are currently available in the Advanced Orders Panel. Please review this page from our user’s guide to learn more: https://www.ibkrguides.com/tws/usersguidebook/mosaic/advanced%20orders%20panel.htm#bracket. We hope this helps!

The Advanced Orders Panel doesn’t show bracket order (take profit/stop loss) in Strategy Builder. It only showed in Order Entry, which won’t do combo order.

Hello Nam, what you describe is not currently possible within Strategy Builder. However, within Strategy Builder, you can click Add to Watchlist.

Once in the Watchlist, you can add to the Order Entry panel and from there, brackets, stops are available from the Advanced menu. You can also enter a combo in Order Entry. We hope this helps!

Hey team,

I had a specific question regarding building custom multi leg option strategies. Do you allow for customers to build their own strategies?

Thanks

Adithya

Hi Adithya, thank you for reaching out. Please check out our user guide page on Strategy Builder: https://www.ibkrguides.com/tws/usersguidebook/mosaic/strategybuilder.htm. You can manually create a strategy leg-by-leg to fit your needs. We hope this answers your question!

Hi Team,

I forgot to add a bracket order to a butterfly. How do I create it now that I have the position?

Most importantly, when I try and create a stop order for the position, there is no possibility to do that, I can only create a Limit order.

Thanks

Hello, thank you for reaching out. If you right-click the row of your current position > Integrated Stock Window > and type you should be able to you should be able to see all of the available order types. This should permit you to add the bracket order to the butterfly. We hope this helps!

IS IT POSSIBLE TO COPY PASTE THE SAME LEG TWICE WHICH IS ADDED FROM THE WATCHLIST WHICH WOULD BE FASTER IN TERMS OF EXECUTION.

Hello, thank you for asking. To quickly create multiple orders with the same details in TWS, you can use the “Create Duplicate” feature:

Create a new order and adjust the quantity to a smaller amount that will be accepted.

Right click on the order row and select “Create” then “Duplicate” from the menu. This will create another separate order with identical details.

Repeat to create additional orders.

Transmit all orders at once by clicking “Trade” then “Transmit” and “Transmit All Orders on Page”.

This allows you to easily create and transmit multiple orders without having to re-enter the details each time. The “Create Duplicate” feature works for both new orders and open working orders.

How do I access options strategy builder on IBKR mobile

Hello, thank you for reaching out. To access the options strategy builder on IBKR Mobile:

From a Watchlist, tap on a financial instrument to open the Instrument Details screen.

Tap on the Options tab.

Activate the Strategy Builder by tapping on the circle icon in the bottom right corner.

Within the Option Chains, tap on the Bid to add a sell leg or Ask to add a buy leg.

Once your strategy is complete, tap on Order to create an order or add it to a Watchlist.

We hope this helps!

Hello can you place strangles on the app ?

Hello Nicole, thank you for reaching out. Yes, you can create a short strangle options strategy using the Option Chain in IBKR Mobile. Please view these instructions:

Open the option chain for the underlying stock or ETF you want to trade.

Add a short call leg by tapping on the Ask price of your chosen expiration and strike.

Add a short put leg by tapping on the Bid price of your chosen expiration and strike.

Adjust the quantity on each leg as needed.

Review the strategy performance metrics and profit/loss graph.

Submit the multi-leg order to open the short strangle position.

Please view this FAQ for more information: https://www.ibkr.com/faq?id=145896749

We hope this helps!

I would like to automate option trades, based on price or technical patterns or indicator is that possible on IBKR?

Hello, thank you for reaching out. Unfortunately, we do not support triggering orders based on technical indicators. Please note that the most comprehensive configurable triggers are based upon alerts. https://www.interactivebrokers.com/faq?id=27288664

For information on trade alerts in the different trading platforms, see

https://www.interactivebrokers.com/faq?id=79469649

I want to add 8 legs (orders) to my strategy in Strategy Builder.. The permitted number of legs in strategy builder is 6.( A window pops up with a message” Max 6 legs allowed”. How do I extend the legs number.

Hello Baldev, thank you for reaching out, and we apologize for the delayed response. It is not possible to extend the maximum number of legs. Please reach back out with any additional questions. We are here to help!