Accessing Option Chains

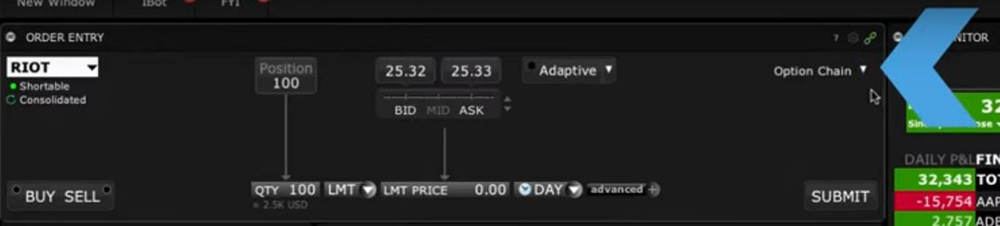

The easiest way to view an array of options in Mosaic is by loading an underlying symbol into the Order Entry panel. Then use the dropdown menu to the upper right to locate Option Chain. This enables you to quickly see call and put prices at select strike prices and by expiration. [this is shown in order entry below]

Configuring Option Chains

There are two layouts to view options List and Tabbed view. Let’s walk through each.

Tabbed View

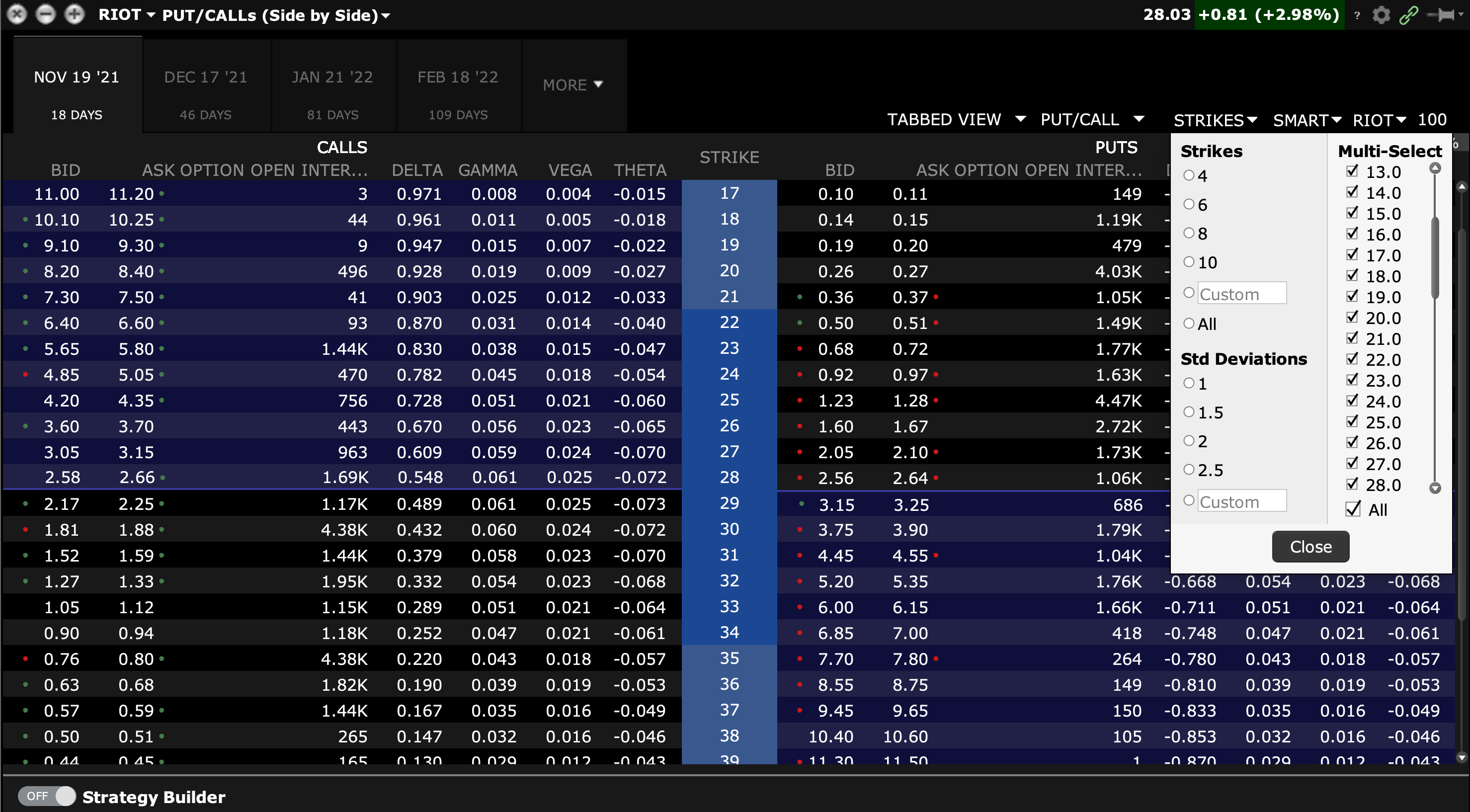

Using Tabbed View, call options are displayed to the left and puts to the right of the window.

The center column displays the strike price. Hover over the strike price to reveal a pop-up display indicating the distance from the underlying measured by Standard Deviation. The center column is color-coded to reflect how far the strike is from the underlying price.

Solid blue colors are close to at-the-money while lighter blue and grey colors are increasingly out-the-money.

The underlying price is displayed to the upper right along with the change on the day. And to complete this data snapshot, see the 30-day Implied Volatility reading over here. You can display either daily or annual volatility. To change, right-click any column header and change the selection. Click on the expiration tab you want to display. If you do not see it, click the More dropdown menu. Weekly options are displayed with a yellow background and monthlies have a light grey background. See the checkbox to include/exclude weeklies.

Once you select the expiration, you may want to determine which strike prices are displayed. To do so, Click on the Strike dropdown menu. You can choose a number of strikes by clicking the radio button, select a specific number of strikes determined by standard deviation from the price of the underlying. Or you can just select/ deselect strike by strike on the right or the checkbox for All. When you have made your selections, click the Close button to update the page.

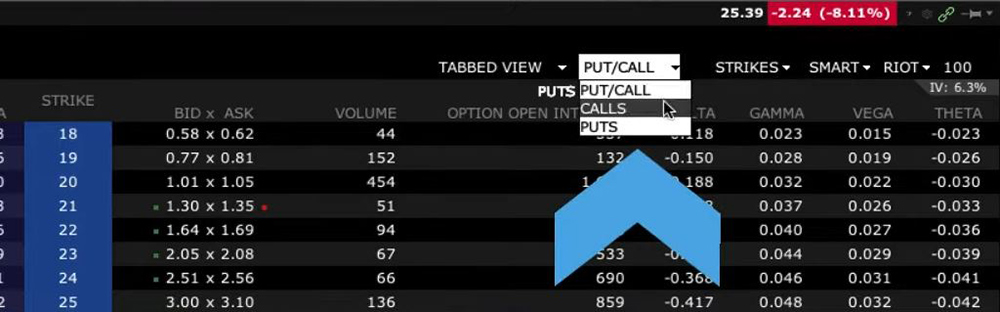

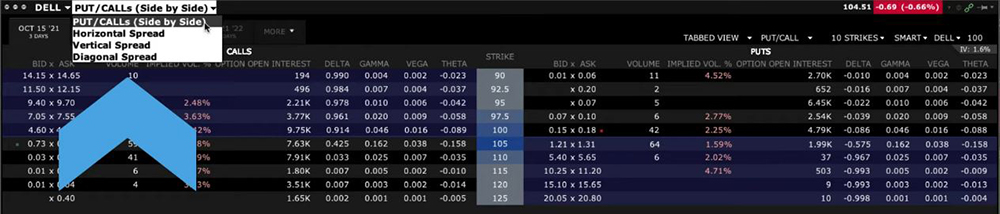

You may only want to show calls or only want to show put options. Use the Put/Call dropdown menu to make your choice. This comes in handy if you want to add a large amount of columns and want to have a clearer view of the data.

You may only want to show calls or only want to show put options. Use the Put/Call dropdown menu to make your choice. This comes in handy if you want to add a large amount of columns and want to have a clearer view of the data.

The columns may be configured to include Greek values, option bid and ask prices, quote sizes, volume, open interest and much more. To change the default Option Chain columns, right-click on any column header and select Configure Layout. Expand a group and select the value you want to add. Click Add to move to the Shown Columns list and click OK at the bottom of the window. The added columns will now display in the Option Chain.

You may also choose where you want to direct the order by clicking on the dropdown menu to the right of the strikes. Click on it and all the exchanges available will be shown, I recommend using our Smart router so that the order touches multiple exchanges and you get the best economic outcome for your fill.

List View

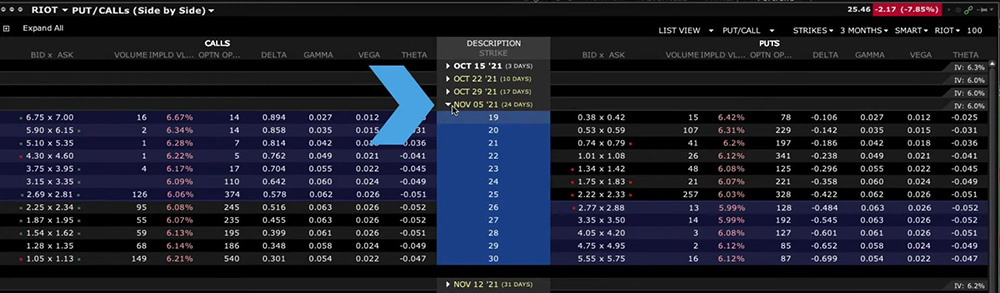

Using the List View, you can view the expirations and strikes down the center and collapse them too. When collapsed, you can view the implied volatility to the right for each expiration. You can view an isolated expiration by selecting the arrow. See view menus at the top, which are similar to the Tabbed view layout.

Trading a single option

To add the call or put option you want to the Order Entry panel, click on the Ask or Bid value, depending on whether you are a buyer or a seller of the option. By doing so, the Option Chain will automatically close and the selected option will replace the underlying symbol in the Order Entry panel. If you clicked on a bid price the Order Entry area will turn red. If you clicked on an Ask price the background displays blue. Update your order type, quantity and time-in-force and you are ready to Submit your order.

Adding a single option to a Watchlist

If you want to add a single option to a Watchlist, simply enter the underlying symbol into the watchlist and select options to open the Option Chain. Select the option you wish to add and click it. In this case, it doesn’t matter whether you want to buy or sell: Clicking either bid or ask will simply add the option to your Watchlist but will leave the Option Chain window open for you to select additional strikes if you wish. When you have made your selections, use the X in the upper right corner to exit and close the Option Chain window.

Accessing Spreads Using Option Chains

You can also quickly access horizontal, vertical and diagonal spreads using the Option Chain window. Look to the right of the active underlying and click arrow to reveal the choices. When selecting horizontal spreads, for example, the display alters to a matrix style enabling you to view and interact with nearby spreads. The quote for each is displayed in a cell. Click to add into the Order Entry area and make the usual adjustments before entering your order.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!