The Option Strategy Lab enables you to enter either price or implied volatility assumptions through a stock option’s chosen expiration date. TWS will compute strategies for you to evaluate and provide an array of risk metrics. You can compare competing strategies and, if you choose, can enter trades directly from the Lab.

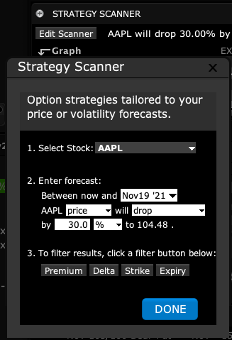

Access the Option Strategy Lab from the New Window dropdown menu to the upper left of Mosaic. Under Option Tools expand Option Analysis and select Option Strategy Lab. The Edit Scanner appears upon opening. In the Select Stock input field locate a recently used symbol or enter one. Choose an option expiry from the next dropdown menu to match your selected time horizon.

From the next input field, select either Price or Volatility as a variable parameter.

By selecting Price you can then enter a direction for the underlying of rise, drop, be rangebound or move at least. By selecting rise or drop, you must then enter either a percentage or dollar value associated with the anticipated move. If you select remain rangebound, you would then enter percentage or dollar values for both upside and downside. Should you choose move at least, again enter the upside extent and the downside extent away from the current price of the underlying using dollars or percentage values. At this stage, you are ready to click the button marked Done.

Additional Filters

However, there are additional filters if you wish to use them that would restrict the strategies delivered by the software. For example, by selecting Delta you can program the software to return either only debit or only credit strategies. What would you enter into those delta filters?

In the same way you can select an expiration date through the chosen time horizon or ask the software to work only with specified strike prices.

I will enter a price drop of 20% for this example and click Done.

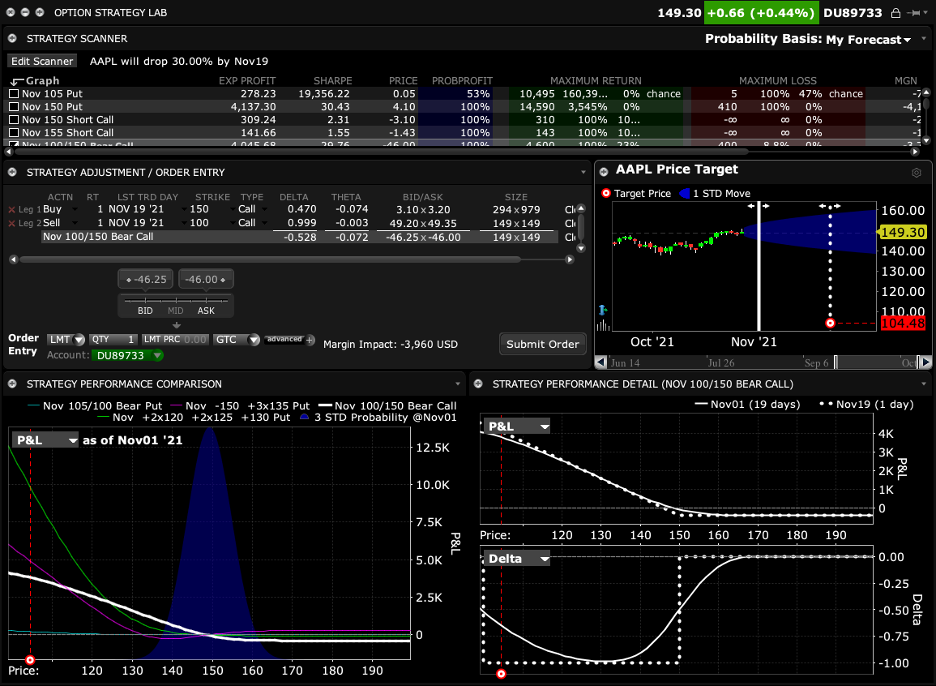

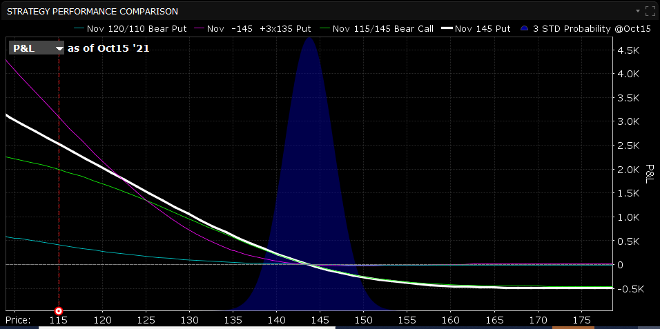

The Strategy Scanner at the top of the screen will return multiple option combinations for you to evaluate and compare. To the left of each strategy is a checkbox. Several strategies may be checked by the software. Each strategy is color-coded and those checked are displayed in the Strategy Performance Comparison window below. It’s important to note that, by design, one of the strategies has a white checkmark, and that this strategy will be the one displayed in the Strategy Adjustment Order Entry area. Clicking any strategy will change its checkmark to white and it will appear in the Strategy Adjustment Order Entry area.

Let’s examine the overall page display.

Your price projection is stated to the upper left, and maybe changed by clicking the Edit Scanner button. Multiple possible strategies are listed in the Strategy Scanner ad you will see several, but not all are checked to the left. You will see checked strategies appear in the distribution plot below. The Strategy Scanner displays an array of risk associated metrics including potential returns and losses.

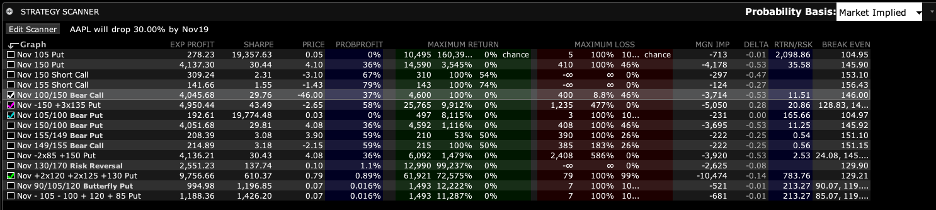

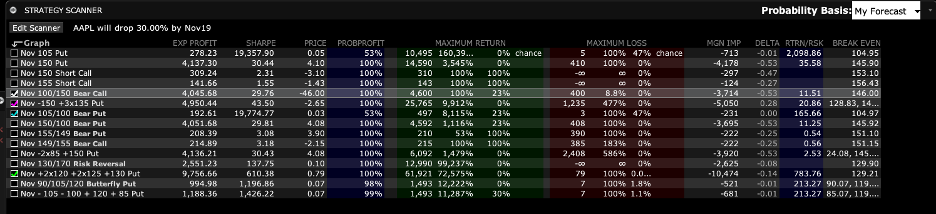

Because you are comparing market implied prices against your own estimates, the software allows you to view the Probability of Profit under prevailing market prices and your own. Compare the reading of the Probability of Profit from this dropdown menu first set to Market Implied and then view the difference in the reading when changed to My Forecast.

The Probability of Profit should be much more certain under your view than that of the live market. All things being equal, under current options market pricing there is no probability of a profit since both call and puts would expire worthless and all premiums for out-the-money options simply represent extrinsic or hope value.

You can resort the array of strategies by clicking on any column header. Potentially favorable trades are the ones with the highest Sharpe ratio, or the highest ratio of expected profit to variability of outcome.

Focus too on the final column here that displays the Break Even value or values associated with each of the strategies.

The stock chart displays the recent price history for the stock as well as the price target at your chosen expiration.

The Strategy Performance Comparison plot to the lower left shows the price range on the lower axis and in this case displays the price target. You will also see a three-standard deviation price distribution cone. This explains the statistical likelihood of a move through expiration based upon the 30-day price historical volatility of the underlying. You can compare this move measured by standard deviation with your own price projection. Several color-coordinated lines for the selected strategies are plotted so that you can see expected p/l at the date displayed across the range of prices. In this example, profits from options strategies grow as price declines further.

To the upper left of the plot is a dropdown menu. By default, p/l is displayed using an as of date, but you should be aware that you can change the display to show Greek values and also change the as of date through expiration. Click the dropdown menu to reveal the Greek variables.

In order to change the date you need to select from the Price target plot to the upper right.

Use your mouse to click and drag the solid vertical line towards the dashed line representing the option’s expiration. Stop at any point and release the mouse click button. This advances the date back down in the Strategy Performance Comparison panel and to the two panels to the right.

These show p/l and delta separately. Now try dragging the solid line all the way to the last date to see the at expiration view for the option strategies on display. Hover the cursor above any strategy on the plot to read the associated p/l at any given price.

The Strategy Lab enables you to make price and volatility models for an underlying through a specified time horizon. You can use the tool to evaluate potential outcomes in the event that your view turns out to be better or equal to the market.

Remembering that only one strategy – the one represented by the white line – can populate the Strategy Adjustment Order Entry panel, you can make changes to the ratio, strike, option type and so on. If you are ready to trade, determine the order size, price, order type and time-in-force before submitting your order.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!