Your Privacy

When you visit any website it may use cookies and web beacons to store or retrieve information on your browser. This information might be about you, your preferences or your device and is typically used to make the website work as expected. The information does not usually directly identify you, but can provide a personalized browsing experience. Because we respect your right to privacy, you can choose not to allow some types of cookies and web beacons. Please click on the different category headings to find out more and change our default settings. However, blocking some types of cookies may impact your experience on our website and limit the services we can offer.

Strictly Necessary Cookies

Strictly necessary cookies are necessary for the website to function and cannot be switched off in our systems. They are typically set in response to actions made by you which amount to a request for services, such as setting your privacy preferences, logging in or filling in forms. While you can set your browser to block or alert you about these cookies, some parts of the website will not work. These cookies do not store any personally identifiable information.

ALWAYS ACTIVE

Functional Cookies

Functional cookies enable our website to provide enhanced functionality and personalization. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies then some or all of these services may not function properly.

Marketing Cookies and Web Beacons

Marketing Cookies and web beacons may be set through our website by our advertising partners. They may be used by those companies to build a profile of your interests and show you relevant adverts on other websites. They do not directly store personal information, but uniquely identify your browser and internet device. If you do not allow these cookies and web beacons, you will experience less targeted advertising. Our website does not track users when they cross to third party websites, does not provide targeted advertising to them and therefore does not respond to "Do Not Track" signals.

Interactive Brokers Group Cookie Policy

What are Cookies and Web Beacons?

Cookies are pieces of data that a website transfers to a user's hard drive for record-keeping purposes. Web beacons are transparent pixel images that are used in collecting information about website usage, e-mail response and tracking. Generally, cookies may contain information about your Internet Protocol ("IP") addresses, the region or general location where your computer or device is accessing the internet, browser type, operating system and other usage information about the website or your usage of our services, including a history of the pages you view.

How We Use Cookies and Web Beacons

Interactive Brokers Group collects information from cookies and web beacons and stores it in an internal database. This information is retained in accordance with our Privacy Policy. This website uses the following cookies and web beacons:

Strictly Necessary Cookies

These cookies are necessary for the website to function and cannot be switched off in our systems. They are usually only set in response to actions made by you which amount to a request for services, such as setting your privacy preferences, logging in or filling in forms. You can configure your browser to block or alert you about these cookies, but certain areas of the site will not function properly. These cookies do not store any personal data.

Performance Cookies and Web Beacons

These cookies and web beacons allow us to count visits and traffic sources so we can measure and improve the performance of our site. They help us to know which pages are the most and least popular and see how visitors move around the site. All information that these cookies and web beacons collect is aggregated and, therefore, anonymous. If you do not allow these cookies and web beacons our aggregated statistics will not have a record of your visit.

The website uses Google Analytics, a web analytics service provided by Google, Inc. ("Google"). Google Analytics uses cookies to help analyse how you use this website. The information generated by the cookie about your use of this website (including your IP address) will be transmitted to and stored by Google on servers in the United States. Google will use this information for the purposes of evaluating your use of the website, compiling reports on website activity for website operators and providing other services relating to website activity and internet usage. Google may also transfer this information to third parties where required to do so by law, or where such third parties process the information on Google's behalf. Google will not associate your IP address with any other data held by Google.

Functional Cookies

These cookies enable the website to provide enhanced functionality and personalization. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies, some or all of these services may not function properly.

Marketing Cookies and Web Beacons

These cookies and web beacons may be set throughout our site by our advertising partners. They may be used by those companies to build a profile of your interests and show you relevant advertisements on other sites. They do not store personal information that could identify you directly, but are based on uniquely identifying your browser and internet device. If you do not allow these cookies and web beacons, you will experience less targeted advertising. The website does not track users when they cross to third party websites, does not provide targeted advertising to them and therefore does not respond to Do Not Track ("DNT") signals.

Managing Your Cookie Preferences

You have many choices with regards to the management of cookies on your computer. All major browsers allow you to block or delete cookies from your system. However, if you do decide to disable cookies you may not be able to access some areas of our website or the website may function incorrectly. To learn more about your ability to manage cookies and web beacons and how to disable them, please consult the privacy features in your browser or visit www.allaboutcookies.org.

This website may link through to third party websites which may also use cookies and web beacons over which we have no control. We recommend that you check the relevant third parties privacy policy for information about any cookies and web beacons that may be used.

How can I change the chain strikes from high (top) to low (bottom)?

Thank you for your question, masoud. Please click the column header “Strike” once and it should sort the strikes from high to low. You can click it again to sort it from low to high again. We hope this helps!

Unfortunately, it does not work for me either. Neither left nor right nor double click changes the order of the strikes. Initially I thought it was an issue with the early version, but even in the latest one on MacOS I cannot change from high to low. As I am used to the high-to-low layout, it is very difficult for me to use IBKR Desktop at all right now.

Hello again Wolfgang, we are sorry to hear this. If you are facing an issue with a particular feature, please submit a web ticket or report the bug in IBKR Desktop (speech bubble with thumbs up icon) so it goes to the development team. https://spr.ly/IBKR_TicketCampus

We would appreciate the opportunity to turn around your experience.

Hi, how can I see the margin requirement and probability of profit before open a position?

And for futures, how can I choose the month of the contract when I use the search bar?

Thank you.

Thank you for asking. Please review our margin rates and requirements on our website:

https://www.interactivebrokers.com/en/trading/margin-requirements.php

You can use the Probability Lab to analyze the market’s probability distribution, which shows what the market believes are the chances that certain outcomes will occur and adjust based on your own forecast. Please view this Traders’ Academy course for more information: https://www.interactivebrokers.com/campus/trading-lessons/ibkr-probability-lab/#:~:text=Use%20the%20IBKR%20Probability%20Lab%20to%20analyze%20the,stock%20is%20different%20from%20that%20of%20the%20market.

When buying futures, it is possible to view the month of the contract by searching the contract in the search bar, clicking More/ Multiple, then selecting the month you desire.

We hope this helps!

Strangely, I can toggle the toggle the strikes from high-low-high on TWS options chain but not the desktop.

additionally, could someone confirm volume profile indicator is only available on Desktop chart and not TWS advance chart?

Hello Jerry, the Volume indicator is also available on TWS Advanced Charts. We hope this helps!

Basically, when I sell OTM call & put on same day expiration, with an objective of pocketing both the premiums what should I do in IBKR mobile app?

1) buy short strangle strategy or

2) sell short strangle strategy

NOTE: Following is easy to understand, but involves two orders.

3) sell the put & sell the call legs

Hello, thank you for reaching out. Please note that IBKR does not provide investment advice.

How to place a sell vertical put for credit .

Hello Nitin, thank you for reaching out. To sell a put vertical spread in TWS:

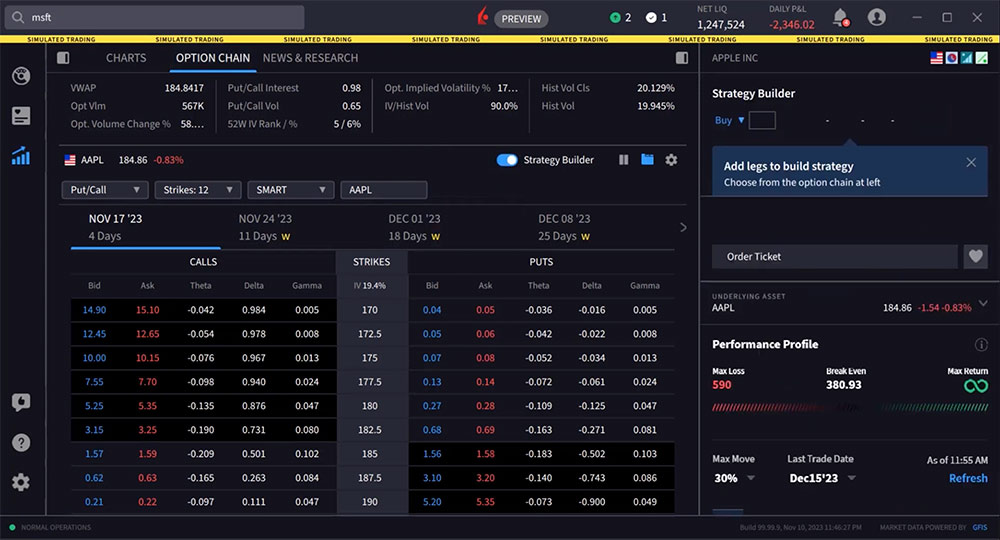

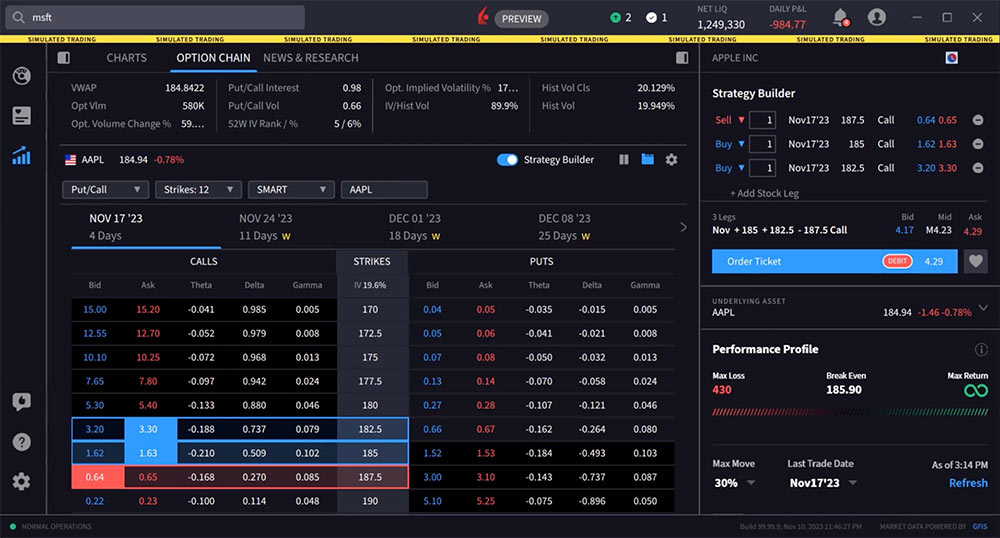

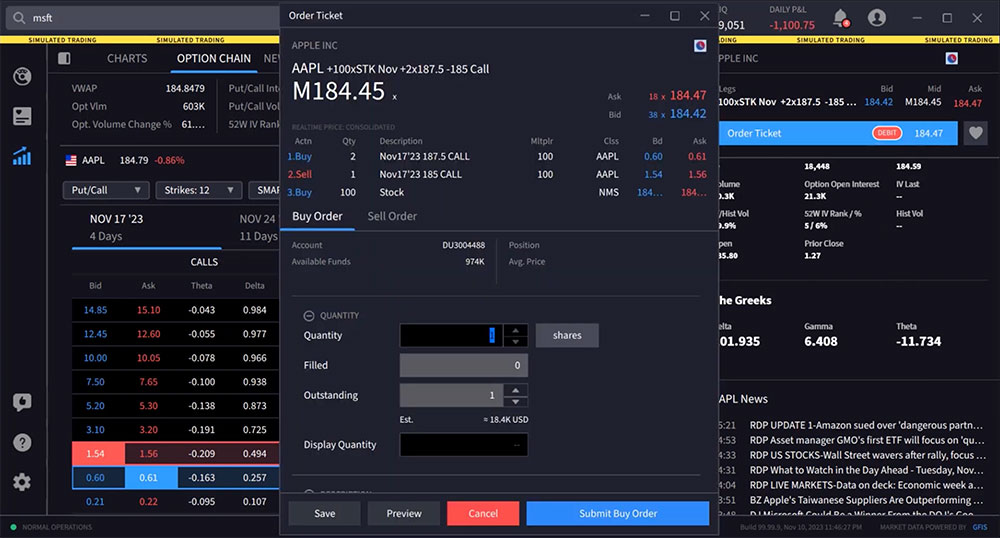

1. Open the Strategy Builder in TWS.

2. Select “Calls and Puts” view.

3. Click on the Bid price of the put option you want for the long leg to add it to the strategy.

4. Click on the Ask price of the put option with a lower strike that you want for the short leg.

5. Define the order parameters like quantity and price in the Order Entry section.

6. The debit or credit amount will be shown. Since this is a put credit spread, you should see a credit.

7. Review the order and transmit it to sell the put vertical spread.

Please review this tutorial on IBKR Campus for additional information:

https://www.interactivebrokers.com/campus/trading-lessons/vertical-credit-spread/

how to add futures in strategy builder? for the purpose of studying hedging?

Hello, thank you for reaching out. The Strategy Builder allows you to easily build complex, multi-leg option strategies for equity options and futures options. You can type the symbol into the upper left hand corner and the data should populate. Please reach back out with any additional questions. We are here to help!

on the TWS Strategy Builder what does the RT column do?

Thank you for asking. The RT column is the ratio column. We hope this answers your question!

Hi, I’m using the desktop platform in Australia. I can enable the strategy builder when trading AP for example, but I can’t enable the strategy builder when ES E-mini S&P 500 options chain is selected. I have been able to enable it for ES before. Don’t know why I cant now. Any ideas?

Thank you for reaching out. We cannot replicate this situation. After clicking “Quote” on the left-hand side of the screen, click Options Chain and toggle on the Strategy Builder. If you continue to experience difficulties, we recommend contacting Client Services or submitting this feedback directly to our developers using the instructions provided in this FAQ: https://www.ibkr.com/faq?id=32653353

Why am I not able to toggle the strategy builder button for future options?

I’m having the same issue. Why can’t it be switched on for Future Options?

Thank you for reaching out. We cannot replicate this issue. If you are experiencing a time-sensitive trading issue, please contact Client Services: http://spr.ly/IBKR_ClientServicesCampus

Thank you for reaching out. We cannot replicate this issue. If you are experiencing a time-sensitive trading issue, please contact Client Services: http://spr.ly/IBKR_ClientServicesCampus

Hi – Is there a way to close a covered call as one position rather than having to close the shares and the option separately? Thanks

Yes, you can close a covered call as one position instead of closing the shares and option separately. Please review this User Guide for more information on Combination Orders: https://www.ibkrguides.com/kb/article-1323.htm

We hope this helps!

HI, How to attach a bracket order on strategy builder for complex/ multi leg options strategy eg. Iron Condor or Vertical Spread? There’s no bracket order attached on the ‘Advanced’ tab after I built my strategy. Please advise. Thank you.

Can you add multiple stocks to the strategy builder? For example, a call ask for Tesla and a Put bid for Apple and see them together and out potential outcome on the strategy builder?

Hello, thank you for asking. You cannot add multiple products to the strategy builder at the same time. However, you can toggle between different products in the upper left-hand corner. We hope this helps!

IBKR desktop does not allow me to toggle between ascending/descending order. How do I do this?

I am referring to the option chain strike prices…

I’m in Option Strategy Builder, for SPX. Why are the strike prices 50 dollars apart mostly? I’m looking to get all the strike prices in between e.g. 5, 10, 15, 20, … , 45, 50. Thanks.

Hello Ivan, thank you for reaching out. Options exchanges set strike prices and intervals for options contracts. We hope this helps!