Completing monthly mortgage payments in a timely manner is one of the most important aspects of most consumers’ financial well-being. That means mortgage payment data can be a significant indicator of consumers’ financial health, the overall real estate market and the broader economy.

Homeowners face late payment penalties, potential damage to their credit ratings and the risk of foreclosure if they fail to complete timely mortgage payments. Foreclosures, of course, are painful. They involve damage to homeowners’ credit ratings plus late fees, foreclosure fees and potential loss of equity. Banks that own the mortgages can choose the price at which to sell homes and if the selling price is too low, homeowners may lose all, or at least a significant portion, of their equity.

With these points in mind, the Mortgage Monitor Report provided by technology and data company Black Knight can offer valuable insight into the real estate market and broader economy. The report includes mortgage delinquency data, foreclosure volumes and mortgage prepayment data. Black Knight provides a “first look” of the preliminary data late each month and then releases the final report around the seventh day of the month. The report includes various categories such as the number and national rate of loans more than 30 days past due but not in foreclosure, the number of properties that are 90 days or more past due but not in foreclosure disclosures, foreclosure pre-sale inventory, total U.S. foreclosure starts and monthly prepayment rates. Black Knight uses its technology to gather data on mortgage payment activities from banks and mortgage servicing organizations around the country. It provides the data so that investors, banks, homebuilders, and other businesses can make informed decisions.

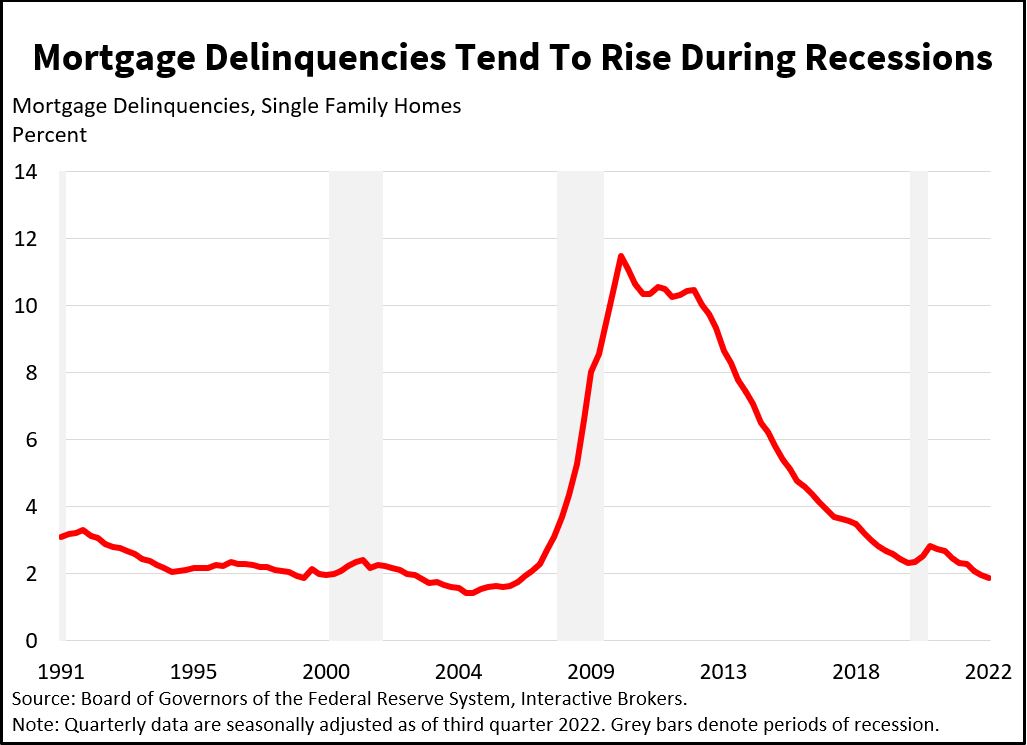

Delinquency data can often provide a clear picture of consumers’ financial well-being, the real estate market and the overall economy, but like many data points, it should be evaluated with other considerations rather than in a vacuum. Increasing delinquency rates point to Americans’ struggling with their finances, such as when wage increases trail inflation or when the economy contracts and unemployment spikes. Delinquency rates can therefore be an indicator of the future levels of foreclosures.

Important nuances exist, however. For example, if real estate values have appreciated strongly, individuals with substantial home equity may be more motivated to pay their mortgages if they are struggling with inflation or joblessness. Conversely, if real estate values drop below purchase prices and the outlook for real estate is negative, homeowners may have little incentive to pay their mortgages.

With mortgages based on real estate values that no longer reflect current values, homeowners may simply “walk away” from their loans. This can be even worse in the late stages of real estate market price increases causing affordability to decline so more consumers use adjustable-rate mortgages, or ARMs, to get lower initial interest rates. As their rates reset higher during periods of increasing interest rates and their home values decline, they are increasingly likely to default on their mortgages. This was a significant factor during the global financial crisis. As interest rates increased, delinquency among homeowners with ARMS increased and led to high rates of foreclosures and the sudden collapse of the real estate market.

Fiscal policy and regulations are additional factors. During the COVID-19 pandemic and its accompanying recession, the government sent stimulus checks to consumers, which in some instances may have helped unemployed or underemployed individuals avoid mortgage delinquency.

Increasing delinquency rates can point to declines in real estate values if the mortgages eventually go into foreclosures. In such cases, banks may sell homes below market values simply to get the homes off their balance sheets. The process can increase inventory and result in median home prices declining.

Loan delinquency data can often be correlated with job data, GDP and other economic data. Periods of economic growth and declining delinquency rates can support sentiment among homebuilders, causing them to increase construction, so building permits, home starts, and home completions are likely to increase. The opposite trend, understandably, can occur when the economy weakens and delinquency rates increase.

Capital markets typically don’t respond to delinquency data reports, but the information can point to overall economic conditions that are influencing investor sentiment.

When reviewing delinquency rates, also consider comments from real estate executives during quarterly earnings calls or other speaking engagements. Some of the largest firms include KB Home, Toll Brothers, Lennar, DR Horton, AvalonBay, Equity Residential, Essex Property Trust, Builders FirstSource and NVR. Comments from executives at retailers that serve the home construction and improvement industry, such as Lowe’s and Home Depot, can also provide insight into the real estate market.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!