Residential construction has far-reaching consequences throughout the economy. As such, the activity, which is measured by Housing Starts data, illustrates more than just how busy home builders are and it can be an important leading economic indicator. Indeed, it is used along with a handful of other data sets from the U.S. Census Bureau to measure the strength of the U.S. economy. Housing starts data indicates the number of groundbreaking projects implemented for privately owned residential units, including single-family homes, townhouses, condominiums and apartment buildings. The report provides details on three different segments of starts, the single-family segment makes up most of the data, the five units or more segment includes apartment buildings, and the smallest segment is the two to four housing units. Housing starts are calculated via survey with jurisdictions that frequently issue construction permits, and estimates by the Bureau of permits from jurisdictions that issue permits less frequently, don’t respond or refuse to participate. The Bureau releases the data on the 12th business day of each month at 8:30am eastern time within the New Residential Construction press release alongside building permits and completions. The U.S. government started producing housing starts data in 1959, so the information can provide not only forward-looking insights but also historical context.

At first blush, housing starts data is a simple indication of future demand for labor and building materials, such as lumber, construction aggregates, plumbing materials and electrical equipment, but a deeper understanding of the data shows how it can provide valuable economic insights. To that end, the information is provided by the Census Bureau so that Congress, policymakers, business and community leaders have the information they need for making decisions that shape the economy. Manufacturers, for example, carefully watch housing starts to assess if an increase in housing will support demand for household furnishings and other items while banks use the data to assess future demand for mortgages.

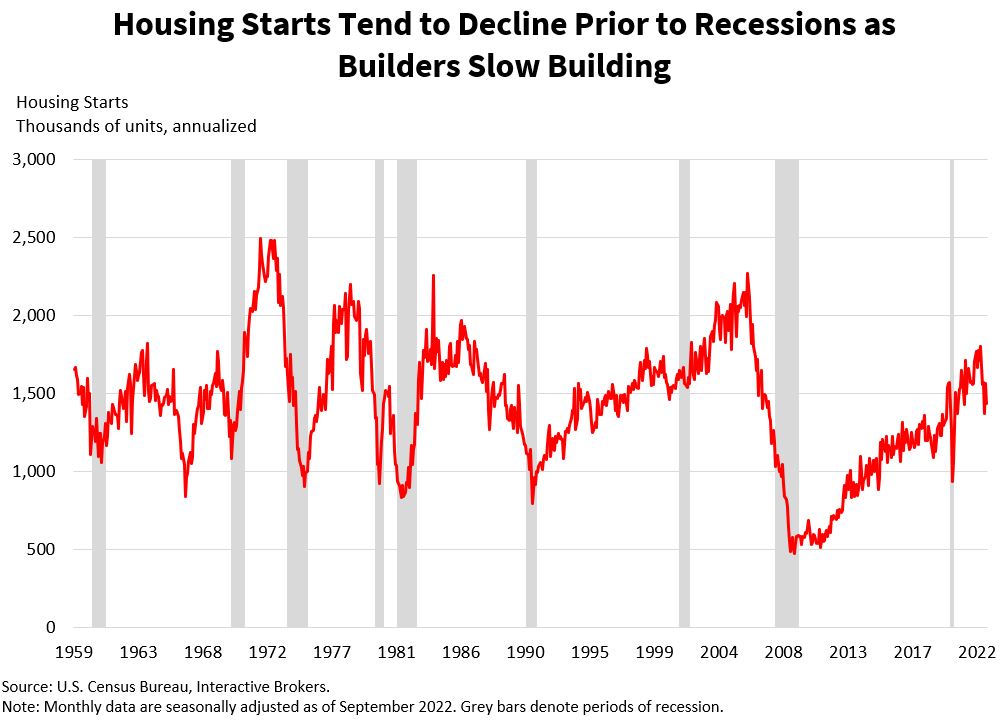

Importantly, the data indicates residential homebuilders’ overall sentiment toward the economy. Homebuilders increase construction when they believe favorable economic conditions will allow them to sell homes and they decrease their activity when the opposite occurs. Robust housing construction can kick off a positive sequence of events across the economy and gains across many economic data points can be expected. New homes often require appliances, electronics, furniture, kitchen housewares, landscaping products and other items. When individuals or families buy homes, they often splurge on those items, which creates demand for additional employees who manufacture those goods, distributors who ship the items and retailers that sell the products. Individuals who fill these jobs, in turn, contribute to additional economic growth as they spend a portion of their incomes.

The COVID-19 pandemic illustrates this point. It resulted in record-low interest rates as the Federal Reserve pumped liquidity into the economy to fight the economic downturn resulting from measures to contain the virus. Additionally, many households fled the nation’s largest cities for less densely populated areas. These developments propelled the number of starts to decade highs, levels only reached prior to the 2008 financial crisis. Strong demand for household items for making home offices as remote work became the norm accompanied this trend. Slowing construction activity, on the other hand, is typically an indication of underlying weakness in the economy and reflects one or more of the many variables that influence the real estate sector. If the real estate market slows down in the U.S. like it did during the 2008 financial crisis when housing starts declined dramatically, the information will likely reflect slowing economic growth and weakness across many economic data points.

The desire for homebuilders to supply housing, demand for housing from consumers, and the cost of capital and materials are important variables to analyze when looking at real estate markets. To forecast housing starts look at homebuilder sentiment, home sales, expected credit conditions, mortgage applications, and daily commodity prices to get an idea of how builders, banks, consumers and investors feel about the trajectory of the real estate market. Also, look at the price action and listen to the conference calls of some of the largest real estate builders, operators and providers. KB Home, Toll Brothers, Lennar, DR Horton, AvalonBay, Equity Residential, Essex Property Trust, Builders FirstSource, Lowe’s and NVR are some to pay attention to.

While not typically a market moving data release, the market will decline further if permits, starts and completions are worse than expected, and rise more if better than expected. More housing construction means more economic activity and an environment that will likely benefit stocks globally.

For a large portion of the world’s population, buying a home is the single largest transaction they’ll ever make. Tracking the capital intensive and interest rate sensitive real estate sector for signs of economic strength or weakness is an important aspect of economic analysis.

Additional Resources

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!