Construction spending data can be a meaningful tool for taking the pulse of the real estate market as well as the overall economy. The data, which is also called Value of Construction Put In Place, is released at 10 a.m. Eastern Time on the first business day of the month. It’s released by the U.S. Census Bureau and seeks to estimate how much has been spent on construction. It includes both private projects as well as government construction. The construction spending costs include labor, materials, overhead, interest, taxes, contractors’ profits and professional fees, such as engineering or architectural services. It includes the value of work done on new structures as well as improvements to existing structures.

In addition to being broken down by private and public projects, the data has various categories such as single-family and multifamily homes, lodging, office, commercial, health care, education, religious, amusement and recreation, transportation, communication, power and manufacturing. It also includes infrastructure projects such as highways and streets, sewage and waste disposal, conservation and development and water supply. It is available in both seasonally adjusted and non-seasonally adjusted versions.

To gather the data, researchers use mail-out/mail-back surveys that are completed by owners of sampled construction projects. Estimates from other federal agencies and private data sources are also used to compile the reports.

The report was started in 1964 and is used along with other data by the Bureau of Economic Analysis to produce GDP statistics. The data is also used by other government agencies while businesses, including construction companies, use it for making economic forecasts, financial decisions and conducting market research. In a similar manner, the data can be used when assessing capital expenditures that can expand the economy’s production capability, which can help curtail inflationary pressures by increasing supply of goods and services.

From a broader perspective, the construction spending report can provide insight into the overall economy. Increased construction activity is often associated with economic growth and since the data is included in GDP calculations, it can point to if the economy is expanding or contracting.

Perhaps more specifically, when the economy is strengthening, unemployment declines and wages improve, which means more individuals can afford housing, so demand for homes increases. Homebuilders respond to this increased demand by building more homes and may have to hire additional employees, which in turn supports economic growth as these new employees generate income to spend on goods and services. An increase in new homes can also drive an increase in demand for consumer goods as new homeowners need furniture, kitchen items, tools and other items.

On a less optimistic note, increased construction spending on apartments and decreased spending on single-family homes can imply that builders believe fewer individuals can afford homeownership and instead need to rent apartments. The data can also help assess the impact of rising interest rates on affordability. When mortgage interest rates increase and single-family home construction declines, builders may be concerned that the higher interest rates are pushing the cost of home ownership beyond the reach of Americans. Low interest rates, understandably, have just the opposite effect.

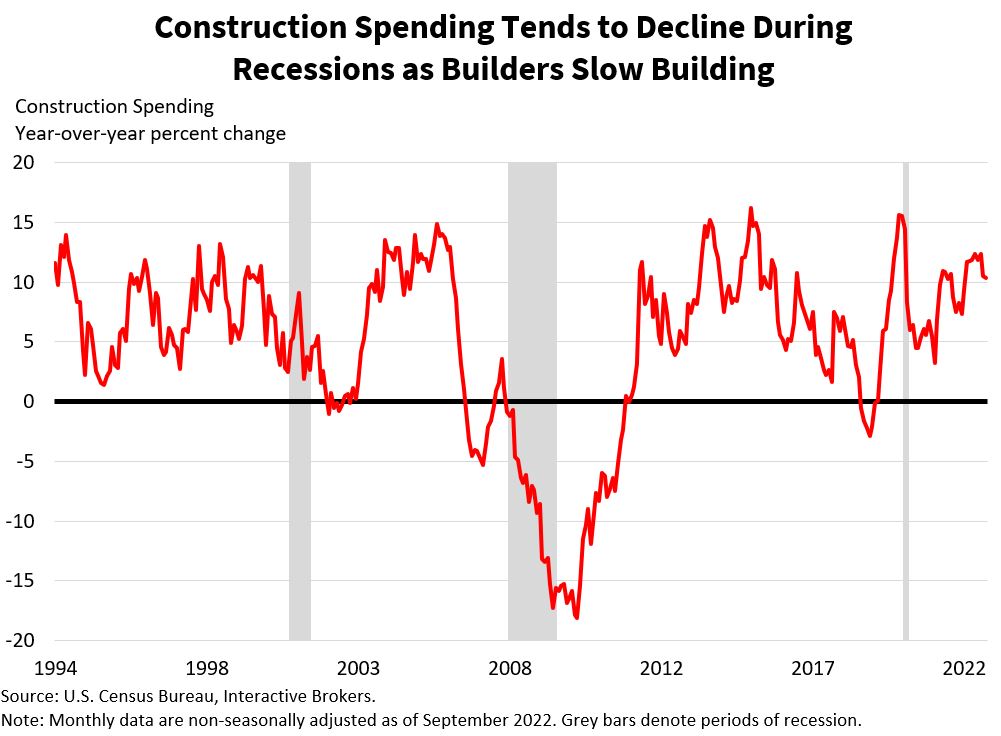

The COVID-19 pandemic illustrates this point. It resulted in record-low interest rates as the Federal Reserve pumped liquidity into the economy to fight the economic downturn resulting from measures to contain the virus. Additionally, many households fled the nation’s largest cities for less densely populated areas. These developments propelled construction spending to fresh record highs. As more Americans purchased houses, demand grew for items for making home offices because remote work became the norm. Slowing construction activity, on the other hand, is typically an indication of underlying weakness in the economy and reflects one or more of the many variables that influence the real estate sector. If the real estate market slows down in the U.S. like it did during the 2008 financial crisis when construction spending declined dramatically, the information will likely reflect slowing economic growth and weakness across many economic data points.

Looking beyond residential construction, commercial construction can also provide economic insights. Increased spending on offices, hotels and manufacturing facilities can show that businesses are experiencing increased demands for their goods and services and that they need to expand their operations. While some businesses that generate growth by capturing market share may need to expand their real estate footprint regardless of the economy, an increase in non-residential construction implies the economy is expanding. Additionally, commercial construction is an important component of capital expenditures.

Looking beyond residential construction, commercial construction can also provide economic insights. Increased spending on offices, hotels and manufacturing facilities can show that businesses are experiencing increased demands for their goods and services and that they need to expand their operations. While some businesses that generate growth by capturing market share may need to expand their real estate footprint regardless of the economy, an increase in non-residential construction implies the economy is expanding. Additionally, commercial construction is an important component of capital expenditures.

Such a trend of increased construction spending can imply that businesses will need to hire additional workers and buy new equipment. The data can also provide insight into the impact of monetary policy on the economic cycle. When the Federal Reserve raises interest rates, financing costs increase, so business may curtail their expansion and the Fed’s success in stimulating the economy by reducing rates can be determined by any potential increase in commercial construction.

The desire for homebuilders to supply housing, demand for housing from consumers and the cost of capital and materials are important variables to analyze when assessing real estate markets. To forecast construction spending, look at homebuilder sentiment, home sales, expected credit conditions, mortgage applications and daily commodity prices to understand how builders, banks, consumers and investors feel about the trajectory of the real estate market. Also, look at the price action and listen to the conference calls of some of the largest real estate builders, operators and providers. KB Home, Toll Brothers, Lennar, DR Horton, AvalonBay, Equity Residential, Essex Property Trust, Builders FirstSource, Lowe’s and NVR are some to pay attention to.

While not typically a market moving data release, construction activity can influence investor sentiment because construction is correlated with the economy. With the exception of times of high inflation and fears that the economy is overheating, stronger-than expected construction data can support enthusiasm for capital markets while worse-than-expected results can hurt investor sentiment.

Buying a home is one of the most significant transactions most individuals will undertake and tracking the capital intensive and interest rate sensitive real estate sector is an important aspect of economic analysis.

Additional Resources

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!