The home building industry is a powerful creator of construction jobs as well as a significant driver of overall economic growth. Home completion data can therefore provide valuable insights into not only the construction industry but also the broader economy. The data is provided by the US Census Bureau and is released on the 12th workday of each month at 8:30 a.m. eastern time along with housing permits and starts data. The US government started producing housing completion data in 1968 so that Congress, policymakers, businesses and community leaders have the information they need for making decisions that shape the economy.

The data is compiled for privately owned properties in all geographical areas within the US and is broken down into Northeast, Midwest, South and West regions. For a one-unit structure to be considered completed, all finished floors must be installed unless it is already occupied, in which case it is classified as completed. In multifamily complexes, all units are considered completed when 50% or more of the units are occupied or available for occupancy.

The Census Bureau uses its Survey of Construction to produce the data. It involves having field representatives gather samples of building permits from local building offices. The field representatives then interview the homeowners or builders to assess if the projects have been completed. The Census Bureau uses this data to estimate the total number of projects completed within each geographical area.

Since housing completion data indicates overall activity in the residential construction industry, an uptick in completed housing can depict a growing economy. Broadly speaking, builders will only complete projects if they are optimistic about finding buyers for the new homes as a result of the economy growing and supporting job creation and wage increases. Housing completions can also influence demand for consumer goods because new homeowners often feather their nests with appliances, electronics, furniture, kitchen housewares, landscaping products and other items. When individuals or families buy homes, they often loosen their purse strings to buy these items, which creates demand for additional employees to manufacture the items as well as logistics employees for shipping the goods and retailers that sell the products. Individuals who fill these new jobs, in turn, contribute to additional economic growth as they spend a portion of their new incomes.

The economic slowdown during the COVID-19 pandemic illustrates how real estate is an economic barometer. During the economic slowdown, the Federal Reserve pumped liquidity into the economy to offset the potential of a longer and deeper recession. Interest rates during this time plummeted dramatically and many households fled cities and flocked to less densely populated areas. These developments and optimism about the economy’s return to growth as the pandemic weakened supported residential construction and increased the number of housing completions. Strong demand for household items for new homes combined with demand for items for creating home offices for remote work ensued.

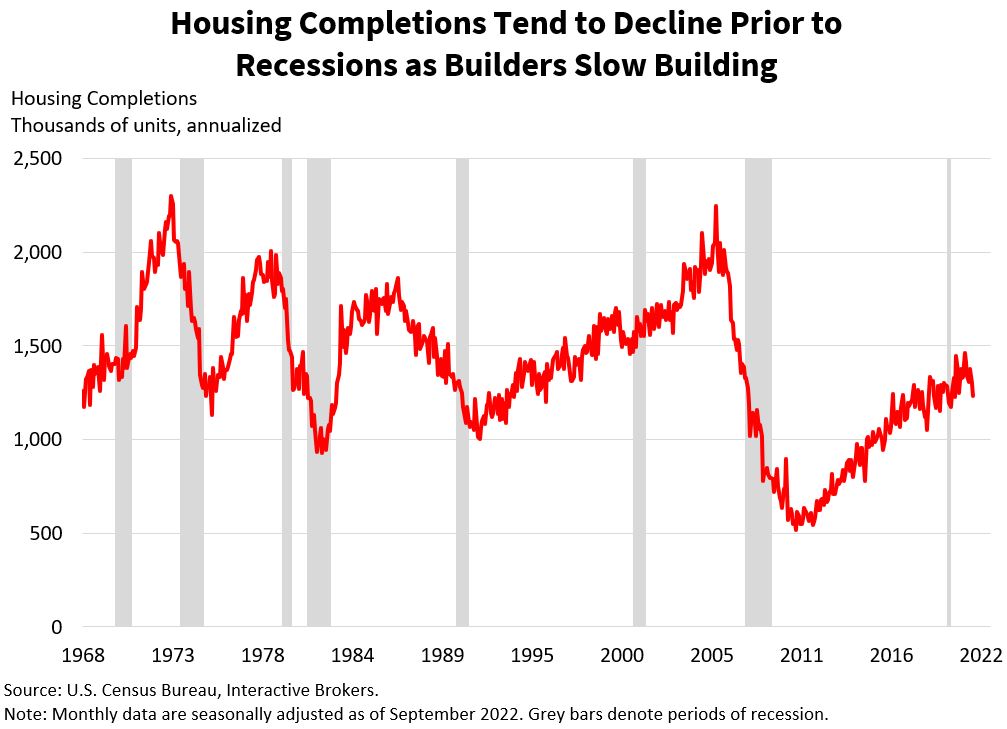

Declining house completion numbers, on the other hand, can indicate economic weakness. If the real estate market weakens in the U.S. like it did during the 2008 financial crisis when housing completions and other real estate data contracted, other data, such as retail sales and unemployment, are also likely to depict economic weakness.

Declining house completion numbers, on the other hand, can indicate economic weakness. If the real estate market weakens in the U.S. like it did during the 2008 financial crisis when housing completions and other real estate data contracted, other data, such as retail sales and unemployment, are also likely to depict economic weakness.

The desire for homebuilders to supply housing, demand for housing from consumers and the cost of capital and materials are important variables to analyze when looking at real estate markets. To forecast housing completions, look at homebuilder sentiment, home sales, expected credit conditions, mortgage applications, and historical volumes of construction permits and starts. Comments from home building industry executives during quarterly earnings call and other speaking engagements can also provide insight into the real estate market and overall economy. Some of these companies include KB Home, Toll Brothers, Lennar, DR Horton, AvalonBay, Equity Residential, Essex Property Trust, Builders FirstSource, Lowe’s and NVR.

While housing completions is not typically a market moving data release, investor sentiment will typically weaken when real estate activity slows and strengthen if better than expected results are released. More housing construction means more economic activity and an environment that will likely benefit stocks globally.

Buying a home is one of the most significant transactions most individuals will undertake and tracking the capital intensive and interest rate sensitive real estate sector is an important aspect of economic analysis.

Additional Resources

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!