The lion’s share of home purchases is conducted with mortgage financing so the volume of mortgage applications can provide valuable insight into the strength of the real estate market and the overall economy. To this end, the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Report is a valuable tool in forecasting future real estate activity and understanding economic conditions.

The MBA compiles the report and its 15 indices by surveying mortgage originators. It estimates that its survey captures 75% of mortgage applications originated through retail and consumer direct channels. It breaks out its data and indices by region, product types, such as fixed rate or adjustable, repurchase or refinance, conventional and jumbo, and government applications, such as those backed by the Veteran’s Administration or the Federal Housing Administration. The report also includes interest rates for mortgages. The data is collected from Saturday through Friday and is released at 7 a.m. eastern time on the Wednesday following the data collection period.

The report was started in 1990 and is available with both seasonally adjusted and non-seasonally adjusted data. Within the mortgage industry, lenders use the data to benchmark how their loan volumes compare with increases or decreases across the overall industry and firms that offer mortgage-backed securities can use the data to assess near-term rates of prepayments. From a broader perspective, the data can point to future home sales volumes because homebuyers start the financing process four to six weeks before buying a home.

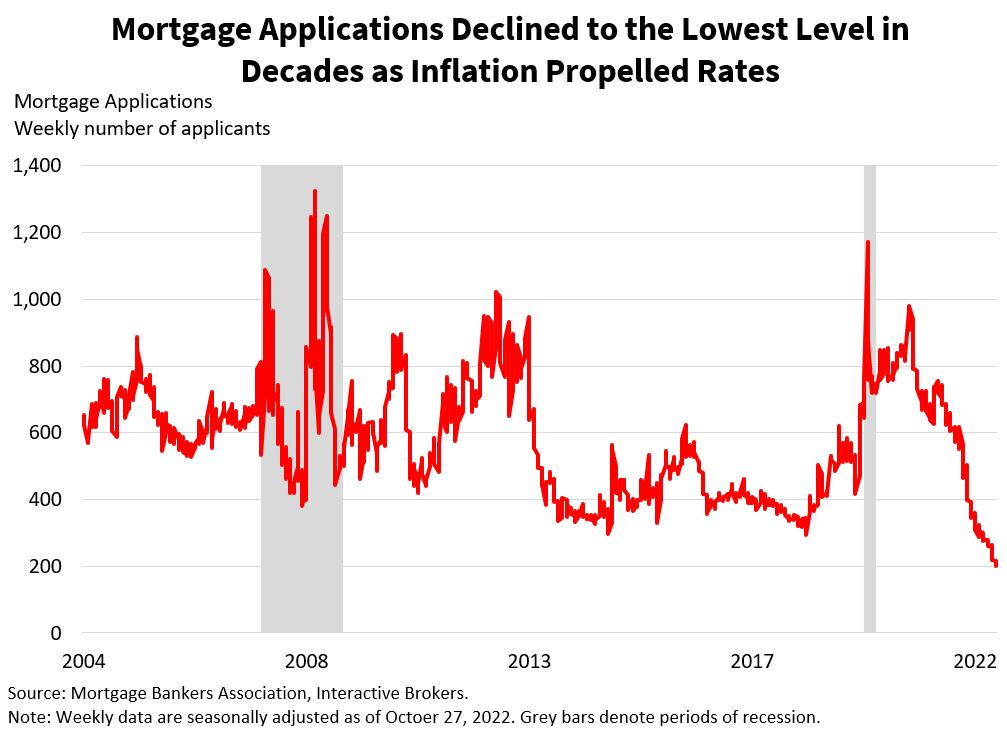

The data can also illustrate the impact of interest rates changes on consumers. On one hand, rising interest rates generally occur during periods of strong economic growth that often include low unemployment, wage increases and strengthening consumer sentiment. Those factors increase the numbers of individuals and families shopping for homes, which is reflected in mortgage application data. Too much of a good thing, however, may be problematic. Economic growth can lead to home price appreciation and higher mortgage interest rates, making home ownership unaffordable to many Americans, which in turn causes a drop in mortgage applications. Reopening the economy following the COVID-19 pandemic illustrates this point. The rapid economic growth occurring as the economy reopened combined with fiscal stimulus, supply chain issues, labor shortages and commodity prices sparked painful inflation and large increases in mortgage rates. Mortgage application volumes dropped to levels not experienced in at least two decades. Prior to the economy reopening, the opposite occurred with low interest rates and a broad flight out of cities caused a large increase in mortgage applications.

Weak economic conditions as indicated by mortgage applications can also result from negative consumer sentiment, which causes individuals and families to become apprehensive about buying homes. At such times, demand for rental homes or apartments may increase because fewer Americans can afford homeownership.

Weak economic conditions as indicated by mortgage applications can also result from negative consumer sentiment, which causes individuals and families to become apprehensive about buying homes. At such times, demand for rental homes or apartments may increase because fewer Americans can afford homeownership.

The significance of mortgage application data extends beyond real estate, with home purchases having an economic multiplier effect. In other words, the impact upon the economy of home sales extends beyond the simple value of the homes sold because new homeowners often splurge on furniture, appliances, kitchen items, electronics and other items. An uptick in mortgage applications can therefore point to increasing demand for those items and economic expansion, while a decrease in applications can point to a weakening economy.

Like most data points, looking at mortgage application volumes in a vacuum may not provide an accurate picture of the real estate market and the overall economy. During times when a shortage of real estate inventory exists, homes may continue to appreciate, at least for short-time periods, even when mortgage rates increase and more Americans drop out of the market. Additionally, homebuyers fearing higher rental costs driven by inflation may want to lock in their housing cost by becoming homeowners. With that in mind, assessing other data points, such as the volume of housing for sale, can provide a more complete picture of real estate.

The desire for homebuilders to supply housing, demand for housing from consumers and the cost of capital and materials are important factors when assessing real estate markets. To forecast mortgage applications, look at changes in interest rates, home affordability, employment trends and credit conditions. Comments from large homebuilders and real estate agencies during quarterly earnings reports and other speaking events can also provide insight into mortgage application trends. Some of these firms are KB Home, Toll Brothers, Lennar, DR Horton, AvalonBay, Equity Residential, Essex Property Trust, Builders FirstSource, Lowe’s and NVR.

While not typically a market moving data release, mortgage applications are correlated with the economy, so the information can influence investor sentiment. With the exception of times of high inflation and fears that the economy is overheating, stronger-than-expected applications can support enthusiasm for capital markets while worse-than-expected results can hurt investor sentiment.

As one of the largest purchases that most individuals make, home transactions and mortgage volumes can be a significant aspect of the overall economy. As such, tracking the capital intensive and interest rate sensitive real estate sector is an important consideration when conducting economic analysis.

Additional Resources

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!