This lesson reviews the ability for Introducing Brokers to markdown or markup Interactive Brokers’ interest rates and borrow fee rates.

Within the Broker Portal, Brokers can mark down credit and short proceeds credit interest rates, or they can markup debit interest rates. To do so, navigate to the Fee Administration page and select Configure Client Fee Templates. Click the plus sign in the right corner to create a new template and enter a name for the template.

Check the box to the left of Interest Rates and the section expands to show the available currencies that can be configured. For this video, USD will be selected as an example but Brokers have the ability to select multiple currencies to configure at once.

Markups and markdowns are entered as a percentage with the following fields available for input:

- Pay Client No Credit Interest

- Credit Markdown

- Debit Markup

- Short Credit Markdown

- And either Fixed or Variable Borrow Fee Markups

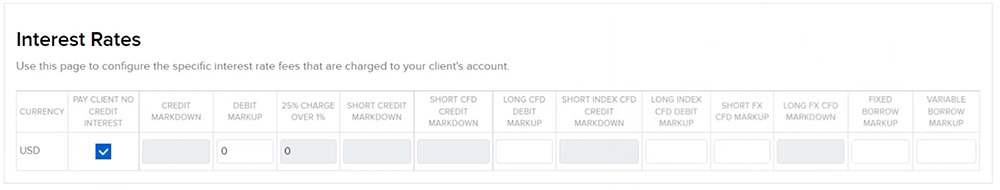

Pay Client No Credit Interest indicates that all credit and short proceeds credit interest will be paid to the broker and the client will not receive any revenue. If the box is checked, the boxes to markdown credit interest will be grayed out automatically.

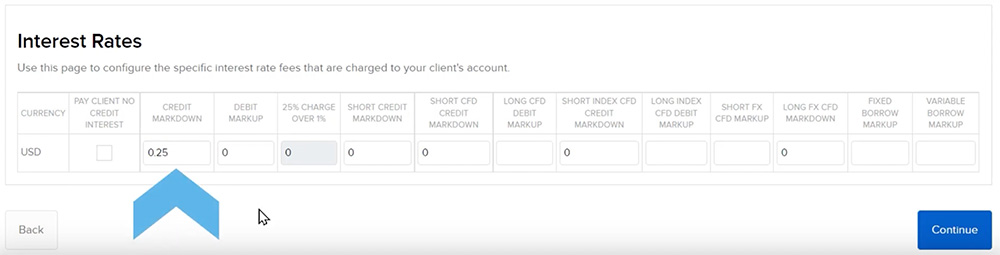

Credit Markdown indicates that a percentage amount will be subtracted from the credit interest to be paid to the client and will be given to the broker. For example, if the credit interest to be paid was 1%, the broker can specify 0.25% in the Credit Markdown section so that the client will receive 0.75% credit interest and the broker will receive 0.25%.

Credit Markdown indicates that a percentage amount will be subtracted from the credit interest to be paid to the client and will be given to the broker. For example, if the credit interest to be paid was 1%, the broker can specify 0.25% in the Credit Markdown section so that the client will receive 0.75% credit interest and the broker will receive 0.25%.

Note that clients will not be charged negative interest so if the markdown is greater than the currently available credit interest rate, then no interest will be paid to the client.

Note that clients will not be charged negative interest so if the markdown is greater than the currently available credit interest rate, then no interest will be paid to the client.

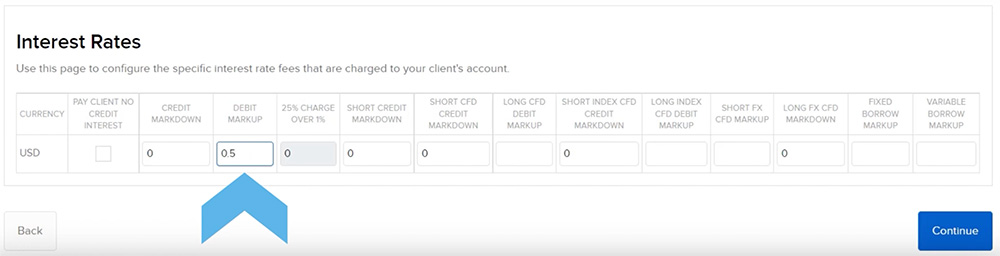

Debit Markup indicates that a percentage amount will be added to the debit interest rate. The maximum markup that can be entered is 5%. For example, if the debit interest to be paid to IBKR is 2%, the broker can specify 0.5% in the Debit Markup column. Therefore, the client will pay a total of 2.5% in debit interest with 2% being paid to IBKR and 0.5% being paid to the broker.

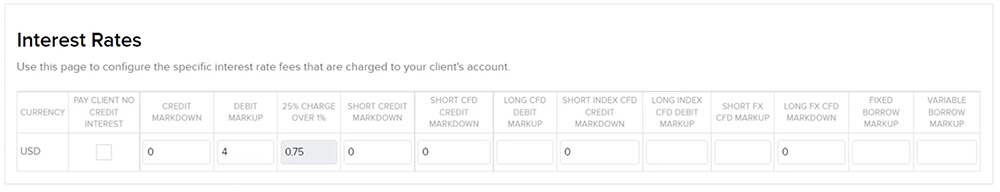

If the broker enters a debit markup above 1%, then 25% of that markup will be collected by IBKR. The 25% charge over 1% column is grayed out since it will automatically calculate and populate based on what the broker enters in the Debit Markup column.

If the broker enters a debit markup above 1%, then 25% of that markup will be collected by IBKR. The 25% charge over 1% column is grayed out since it will automatically calculate and populate based on what the broker enters in the Debit Markup column.

For example, the broker specifies a debit markup of 4%, then the charge over 1% is calculated as 3% multiplied by 25% which equals 0.75%. If the debit interest to be paid to IBKR is 2%, the client will pay a total of 6% debit interest since 2% plus the 4% markup equals 6%. However, IBKR will receive the 2% plus 0.75% which equals 2.75% and the Broker will receive 4% minus 0.75% which equals 3.25%.

Short Credit Markdown operates like the credit markdown discussed earlier such that a percentage amount will be subtracted from the credit interest to be paid to the client and will be given to the broker. However, instead of a percentage being subtracted from credit interest paid on positive idle cash balances, the percentage is subtracted from the credit interest that is paid on short proceeds, or in other words the interest paid on the cash collateral value resulting from shorting a stock.

Short Credit Markdown operates like the credit markdown discussed earlier such that a percentage amount will be subtracted from the credit interest to be paid to the client and will be given to the broker. However, instead of a percentage being subtracted from credit interest paid on positive idle cash balances, the percentage is subtracted from the credit interest that is paid on short proceeds, or in other words the interest paid on the cash collateral value resulting from shorting a stock.

For example, if the credit interest to be paid was 1.5%, the broker can specify 0.5% in the Short Credit Markdown section so that the client will receive 1% and the broker will receive 0.5%.

Brokers also have the ability to configure separate markup or markdown schedules for debit or credit interest on CFDs and Index CFDs using the columns towards the right.

Brokers also have the ability to configure separate markup or markdown schedules for debit or credit interest on CFDs and Index CFDs using the columns towards the right.

Lastly, Brokers can also charge markups to their clients based on stock borrow rates, entered as a variable or fixed percentage of the borrow rate. The Fixed Borrow Fee Markup is a fixed percentage added to the borrow rate. The broker can enter values ranging from 0 to 1%. The Variable Borrow Fee Markup is calculated as the Borrow Rate x (1 + Variable Markup Percentage). Here, the broker can enter values ranging from 0 to 25%. It is possible to enter both types of markups and the system will apply the markup rate that results in the larger total amount.

For example, the broker enters the Fixed Borrow Markups as 1% and the Variable Borrow Markup as 20%. If the client shorts stock ABC that has a borrow fee rate of 35%, the Fixed Borrow Markup is calculated as 35% + 1% = 36%. The Variable Borrow Markup is calculated as 35% x (1 + 20%) = 42%.

For example, the broker enters the Fixed Borrow Markups as 1% and the Variable Borrow Markup as 20%. If the client shorts stock ABC that has a borrow fee rate of 35%, the Fixed Borrow Markup is calculated as 35% + 1% = 36%. The Variable Borrow Markup is calculated as 35% x (1 + 20%) = 42%.

In this scenario, since the system will apply the markup rate resulting in the larger total amount, the Variable Borrow Markup would be applied so the client would pay a total of 42%. Interactive Brokers would collect the 35% borrow fee and the Broker would capture the remaining 7%.

As we have reviewed in this lesson, Introducing Brokers on the Interactive Brokers platform have the ability to configure markups on interest rates and borrow fee rates.

Resources

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!