This video lesson will review Broker Commission Markups via the Fee Per Trade Unit method discussed in the previous video.

The Fee Per Trade Unit method allows brokers to charge their clients a fee per share, per contract or a percentage of trade value. Fee Per Trade Unit can be configured for each asset class (e.g. stocks, options, etc.), exchange and currency and the trade unit (per share, per contract or % of trade value) depends on the asset class and currency selected since it is determined based on the unit IBKR uses for its commission schedule.

To configure a template with the Fee Per Trade Unit markups, navigate to the Fee Administration tab within the Broker Portal and select Client Fee Templates. Create a new template by selecting the plus sign in the top right corner and enter a name for the template.

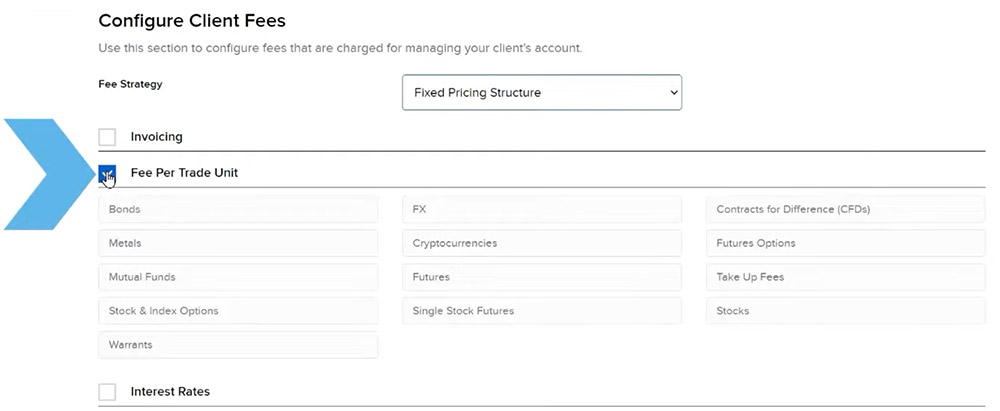

For the examples in this video, Fixed Pricing structure will be the selected Fee Strategy indicating that IBKR’s Fixed Pricing schedule will be the base of the markup calculations.

Once Fee Per Trade Unit is selected, the section will expand to view the available asset classes that can be configured. For this video, USD stocks will be configured as an example. However, brokers can select multiple asset classes and currencies to be configured at the same time.

For each asset class/currency, a broker can select from the following fee-per-trade client markup types:

For each asset class/currency, a broker can select from the following fee-per-trade client markup types:

- Absolute Markup

- Absolute Amount

- Percent (%) Markup

- Ticket Charge

- Minimum Amount

- Maximum Amount

Absolute Markup is a specific amount that is added on top of IBKR commissions. The units listed in Currency/Exchange/Product Unit column will indicate if the markup is being applied on a per share, per contract or % of notional trade value basis. The Absolute Markup amounts can include up to three decimal places.

For example, the broker enters 0.03 into the Absolute Markup column for USD stocks. This means the broker intends to charge $0.03 per share for USD stock on top of IBKR’s commissions.

Therefore, if the client placed a trade for 500 shares of USD stock, then the markup would be $0.03 x 500 shares = $15 so the client would be charged $17.50 ($15 broker markup + 2.50 IBKR commissions).

Therefore, if the client placed a trade for 500 shares of USD stock, then the markup would be $0.03 x 500 shares = $15 so the client would be charged $17.50 ($15 broker markup + 2.50 IBKR commissions).

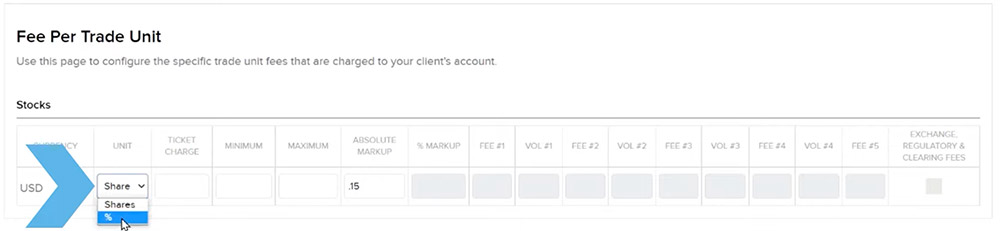

If percent was selected in the Unit column, then the % of notional trade value will be used as the trade unit. For example, a broker enters 0.15 into the Absolute Markup column for USD stocks and selects % units. This indicates the broker would like to markup 0.15% of the trade value on top of IBKR’s commissions.

Say the client placed a trade for 400 shares at $10 per share so that the trade value is $4,000. The markup would be calculated as 0.0015 x $4,000 = $6. Therefore, the client would be charged $8 = $6 broker markup + $2 IBKR commissions.

Say the client placed a trade for 400 shares at $10 per share so that the trade value is $4,000. The markup would be calculated as 0.0015 x $4,000 = $6. Therefore, the client would be charged $8 = $6 broker markup + $2 IBKR commissions.

Notice that when a value is entered in the Absolute Markup field, the % Markup and Absolute Amount fields are greyed out since it is not possible to use both Absolute Markup and either % Markup or Absolute Amount methods for the same asset. However, the Ticket Charge, Minimum and Maximum fields are all still able to be configured which we will discuss later in this video.

Absolute Amount is the specified per trade amount the client will be charged from which IBKR commissions are subtracted from. It is similar to Absolute Markup, but Absolute Markup is in addition to IBKR’s commissions whereas IBKR’s commissions are subtracted from Absolute Amount. In practice, this means the value entered by the broker should be greater than IBKR’s commission for the broker to capture any profit.

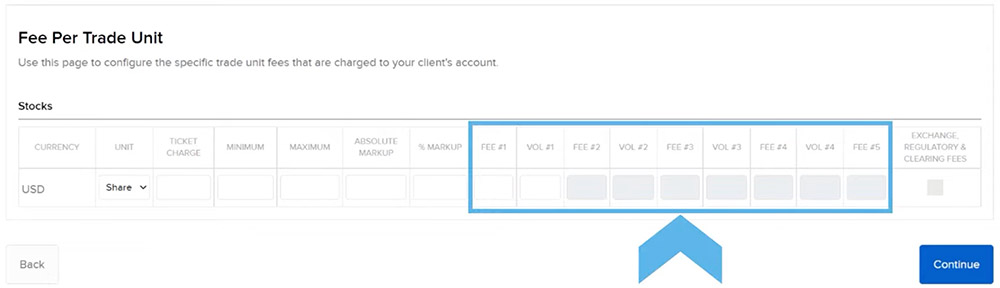

Absolute Amount uses the Fee and Volume columns since brokers can set multiple tiers based on volume breaks on a per trade basis.

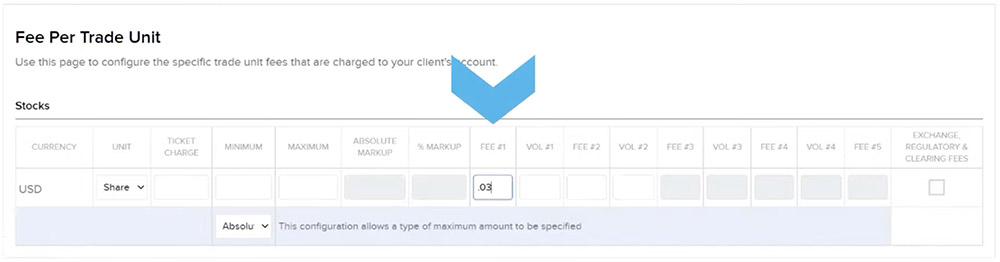

For example, a broker enters 0.03 into the Fee #1 section for USD stocks. This indicates the Broker would like to charge the client a total of $0.03 per share.

For example, a broker enters 0.03 into the Fee #1 section for USD stocks. This indicates the Broker would like to charge the client a total of $0.03 per share.

When the client places a trade for 500 shares of USD stock, the client would be charged $15 = 500 shares x $0.03. Of the $15, $2.50 would be paid to IBKR for commissions and the broker would make $15 – $2.50 = $12.50.

When the client places a trade for 500 shares of USD stock, the client would be charged $15 = 500 shares x $0.03. Of the $15, $2.50 would be paid to IBKR for commissions and the broker would make $15 – $2.50 = $12.50.

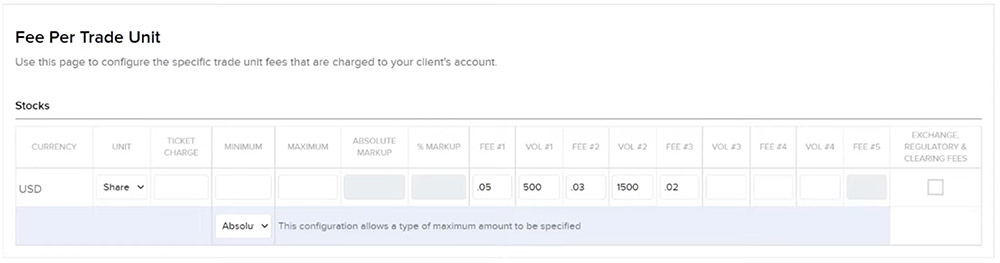

As mentioned earlier, brokers can set multiple tiers for Absolute Amount based on volume breaks on a per trade basis using the other Fee and Volume columns. For example, a broker would like to charge the client a total of $0.05 per share for up to 500 shares, $0.03 per share for the next 1,000 shares up to 1,500 shares, and $0.02 per share above 1,500 shares.

Say the client placed a trade for 2,300 shares. Their fee would be calculated as follows:

Say the client placed a trade for 2,300 shares. Their fee would be calculated as follows:

- $0.05 x 500 shares = $25

- $0.03 x 1,000 shares = $30

- $0.02 x 800 shares = $16

So, the client would be charged a total of $71. Of the $71, $11.50 would be paid to IBKR for commissions and the broker would make $71 – $11.50 = $59.50.

When Absolute Amount is configured, it is possible for brokers to elect to pass any exchange and regulatory fees through to the client by checking the box for Exchange, Regulatory and Clearing Fees. This option is only available when Absolute Amount is set.

Percentage (%) Markup allows brokers to specify a percentage of IBKR’s standard commission to charge per trade. % Markup is entered as a percentage without the decimal point.

Percentage (%) Markup allows brokers to specify a percentage of IBKR’s standard commission to charge per trade. % Markup is entered as a percentage without the decimal point.

For example, the broker enters 150 in the %Markup column for USD stocks for an individual client which indicates that USD stock trades will carry a markup of 150% of IBKR’s commissions.

If a client placed a trade resulting in $10 of IBKR commissions, then the markup will be $10 IBKR commission x 150% = $15. Therefore, the client will be charged $10 IBKR commission + $15 broker markup = $25.

If a client placed a trade resulting in $10 of IBKR commissions, then the markup will be $10 IBKR commission x 150% = $15. Therefore, the client will be charged $10 IBKR commission + $15 broker markup = $25.

Ticket Charge is an additional flat fee per trade that the broker can specify. Ticket Charge can be used alone or with the Absolute Markup, Absolute Amount or % Markup methods.

For example, the broker enters $5 in the Ticket Charge column for USD stocks and charges an Absolute Amount markup of $0.01 per share (inclusive of IBKR commissions).

If the client placed a trade for 300 shares, the client would be charged a total of $8. The Absolute Amount markup is calculated as $0.01 x 300 shares = $3 which is added to the ticket charge of $5.

If the client placed a trade for 300 shares, the client would be charged a total of $8. The Absolute Amount markup is calculated as $0.01 x 300 shares = $3 which is added to the ticket charge of $5.

Minimum Amount is the minimum amount per trade that the client will be charged.

For example, a broker enters 10 into the Minimum column and charges an Absolute Amount markup of $0.03 per share.

If the client places a trade for 200 shares, the client would be charged the minimum of $10 since the calculated markup of $6 (200 shares x $0.03) was less than the specified minimum.

If the client places a trade for 200 shares, the client would be charged the minimum of $10 since the calculated markup of $6 (200 shares x $0.03) was less than the specified minimum.

However, if the same client places a trade for 600 shares, the client would be charged $18 (600 shares x $0.03) because the calculated fee markup is above the $10 minimum.

Note, there are limits that the entered minimum amount cannot exceed. For information on these limits, please see the IBKR website.

Additionally, it is not possible to specify both a minimum amount and a ticket charge for a single asset class or currency. Brokers can enter one or the other.

Maximum Amount is similar in that the broker can specify a maximum limit to charge per trade.

Continuing from the previous example, the broker can also enter 30 in the Maximum column indicating that the maximum amount charged per USD stock trade will be $30.

If the client placed the same trade for 600 shares, they would still be charged $18 (600 shares x $0.03) as the calculated fee is above the minimum of $10 and below the maximum of $30.

If the client placed the same trade for 600 shares, they would still be charged $18 (600 shares x $0.03) as the calculated fee is above the minimum of $10 and below the maximum of $30.

Now, if the client placed a trade for 2,000 shares, the client would be charged the maximum of $30 because the calculated fee of $60 (2,000 shares x $0.03) exceeds the specified maximum.

For certain currencies such as the USD, maximum amount can be configured as a percent of trade value instead of dollar amount by selecting Percentage in the drop down within the light blue field.

As reviewed in this video, there are numerous methods for brokers to configure markups involving a fee per trade.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!