The Eurozone manufacturing PMI is based on a monthly survey sent by the US corporation S&P Global to about three thousand manufacturing firms. The headline number is a seasonally adjusted, weighted average of the following five components based on survey answers from

manufacturing purchasing managers’: New Orders comprise thirty percent, output twenty five percent, employment twenty percent, suppliers’ deliveries times fifteen percent and stocks of purchases ten percent. For each variable, survey respondents are asked to report an increase, decrease or no change compared with the previous month, and to provide reasons for any changes. The flash data release is generally published around the 24th day of each month at 10:00am London time to give insights to the health of the manufacturing sector. A final data release is released about one week later around the first business day of the month when better data are available. S&P Global provides PMI data to help governments, financial institutions, corporates and market participants forecast, analyze and plan for current and future economic developments. PMI is a popular indicator of manufacturing conditions and is published globally in the United States, China, India, Latin America and others by S&P Global and different providers. However, the different providers adopt a similar diffusion methodology.

The diffusion index the PMI is reported through uses a central index reading of 50 to indicate zero change relative to the prior monthly reading. If the PMI level is above 50 then the series is expanding and if it is below 50 then it indicates contraction. Investors tend to focus on the highly weighted New Orders component as a leading indicator on the health of the Euro economy. Separately aggregated national data are provided for Germany, France, Italy, Spain, the Netherlands, Austria, Ireland and Greece since those countries make up roughly ninety percent of Euro manufacturing activity in aggregate.

Multiple moving parts of the economy must be coordinated in the manufacturing sector, which is sensitive capital intensive and interest rate sensitive. Banks are often needed to lend money, commodities to put things together, people and heavy machinery for labor, and real estate to operate. Considering all the moving parts involved in the manufacturing sector, the PMI is a useful indicator of future economic growth. Whenever one of the many contributors to the manufacturing sector appears weak, it often indicates underlying economic weakness. Slowing manufacturing activity typically indicates that businesses are unwilling to invest, that credit is tightening up, or that demand from customers is weak. A high PMI reading would signal an active economy with businesses ordering goods because consumer and producer demand is high, credit conditions are favorable, and businesses are motivated to invest.

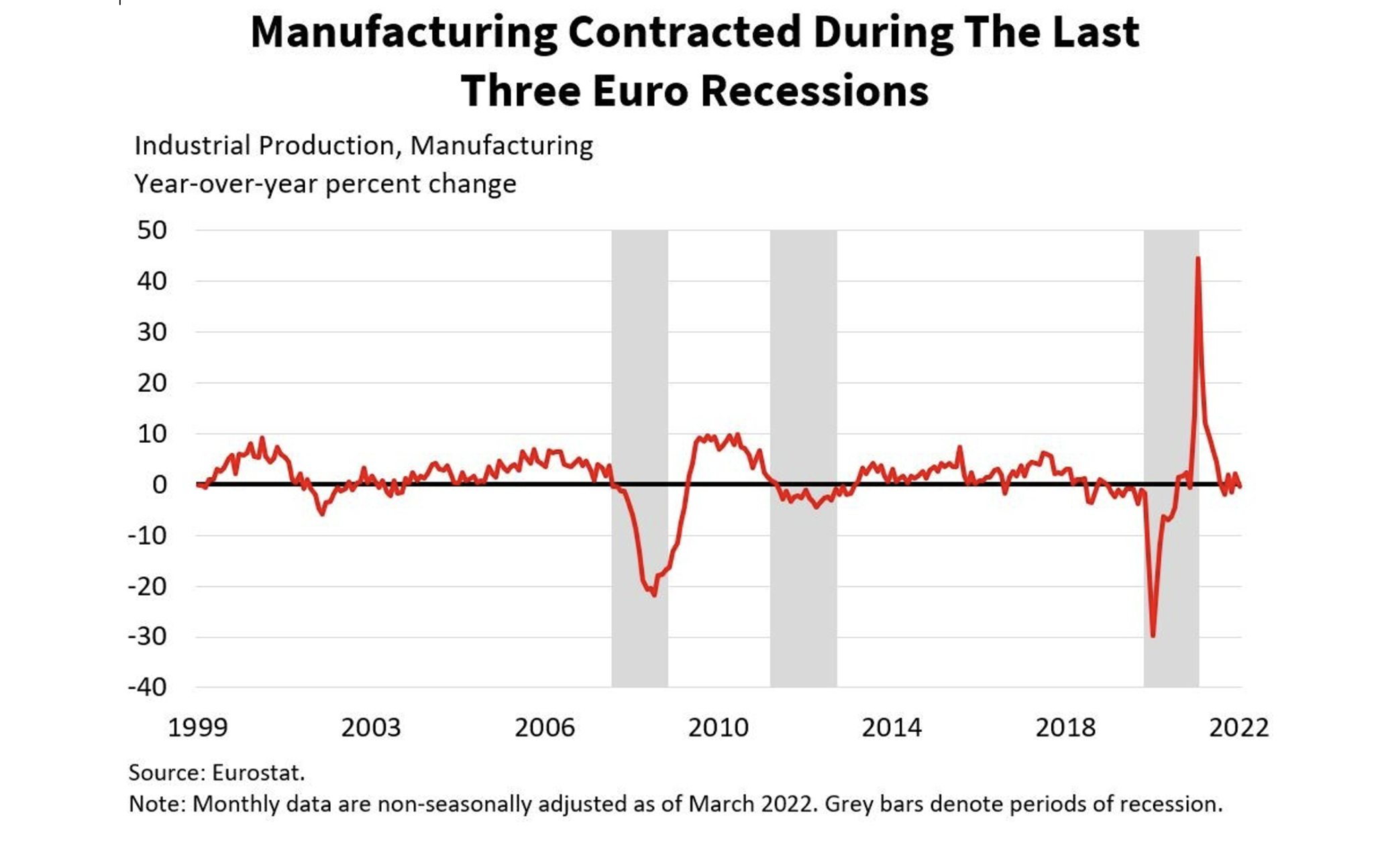

The expansion of the PMI is indicative of a strong economy, which will likely result in a sequence of positive events. Generally, stronger economic growth often contributes to higher consumption, employment, investment, capital flows, tax revenue, and ideally, more prosperity and opportunity. If manufacturing weakens in the EU like it did during the 2008 financial crisis, the 2011 euro recession and the COVID-19 recession, it will signal weakness for the Euro economy that could possibly negatively affect the global economy as well due to its interconnected nature alongside the influence Euro investors, companies and governments have. The EU makes up 15 percent of global economic activity. For a full and comprehensive look at manufacturing conditions globally, following the U.S. PMI and China PMI are useful as well since the U.S., China and the Eurozone represent roughly half of global GDP.

To forecast manufacturing PMI, we’d look at economic indicators such as retail trade as a measure of consumer demand, daily commodity price action to get a gauge of how manufacturing inputs are doing, and economic sentiment to monitor business and consumer confidence, expectations, and uncertainty.

To forecast manufacturing PMI, we’d look at economic indicators such as retail trade as a measure of consumer demand, daily commodity price action to get a gauge of how manufacturing inputs are doing, and economic sentiment to monitor business and consumer confidence, expectations, and uncertainty.

In addition, we’d listen to the earnings calls and monitor the stock performance of some of the biggest manufacturing companies for signs an economic slowdown or expansion. Volkswagen, Airbus, Mercedes Benz, Siemens, BMW, Unilever, ArcelorMittal are some to pay attention to. Paying attention to the European Central Bank meetings and commentary is important as well because higher interest rates and tighter credit conditions hamper business investment and constrain capital intensive industries like manufacturing and real estate.

A PMI reading below expectations may cause stocks to decline due to expectations of slower economic growth, though it is not always the main factor driving market movements. Stock prices may rise if the PMI reading exceeds expectations owing to economic optimism.

The purchasing manager is the individual responsible for approving or rejecting large purchases before the products are bought. They have a good grasp of the near-term prospects of manufactured goods. When considering possible economic slowdowns or recessions, as well as the potential benefits of economic growth, it is important to monitor the behavior and sentiment of purchasing managers.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!