The quarterly employment report measures the strength of the EU’s labor market. It provides details regarding the pace of hiring on a seasonally adjusted quarter-over-quarter and non-seasonally adjusted year-over-year basis. The report also provides details on hours worked and labor productivity. Employment is calculated by Eurostat, the statistical office of the European Union (EU). Each country’s National Statistical Office submits their employment estimates after compiling information from many different sources including population censuses, employment registers, income taxes and surveys on labor force, labor cost and business production.

Eurostat collects the information and then performs aggregations and weightings. The data release aggregates employment data for the Euro Area 19 nations that use the Euro currency and separately aggregates data for the European Union 27 nations to include the countries that don’t use the Euro currency like Hungary, Bulgaria, Poland and others. The data release is published quarterly, alongside the second GDP estimate, generally near the 15th day of the month, one month and a half after the referenced quarter at 9:00 am London time. Additionally, two employment revisions are published later when more accurate information is available. For more detailed and comprehensive employment data, the annual employment report provides employment data by age, gender, participation and educational attainment and is released in the April following the referenced year. Eurostat’s mission is to provide high quality European statistics and data to support public and private sector decision making.

The published report reflects employment growth, or the speed at which employers are hiring employees, which acts as a significant indicator of the economy’s productivity.

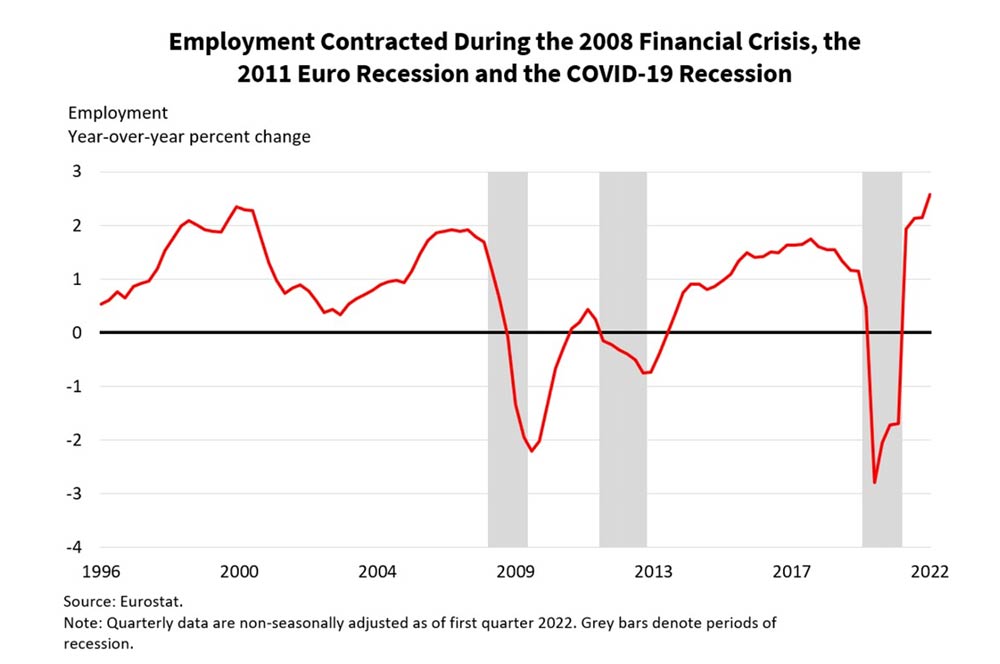

Elevated employment growth rates signal a productive economy with companies adding supply by hiring more employees in order to meet the demand from consumers. Depressed or negative employment growth rates signal a weakening or weak economy with companies slowing hiring or laying people off due to demand from customers being weak. Employment contracted during the 2008 financial crisis, the 2011 Euro recession and the COVID-19 recession as companies cut expenses by laying people off in response to weakening consumer demand. Weakened Euro economies impact the global economy, since the global economy is interconnected, and the European Union comprises 15 percent of it. Market participants are interested and concerned of employment performance in the European Union.

Other data points in the employment report also provide useful information albeit some of them are only released annually and not in the frequently released quarterly report. Hours worked is useful to analyze as a leading indicator of what may happen in the near future because businesses may cut hours before laying people off. The employment to population ratio provides information regarding the percentage of the working-age population that is currently working. A high employment to population ratio is terrific news, it means many people are working, thus helping firms grow and boosting GDP. Employment data by gender, age and educational attainment is helpful for analyzing the composition of the E.U.’s labor market. Employment growth alongside the other indicators in the report provide critical information regarding the state of the labor market in the E.U. Financial markets are reliant on a strong Euro employment market; higher productivity and incomes support global financial markets.

To forecast employment, we can look at leading economic indicators such as employment expectations, business expectations and consumer sentiment since they tend to deteriorate prior to employment falling and the unemployment rate rising. The new orders and employment parts of the Purchasing Managers Index for manufacturing to get a gauge of how employment and demand are holding up in the capital intensive and interest rate sensitive manufacturing sector. Listening to company conference calls for hiring plans, layoffs, hiring freezes, etc. provide useful clues because they tend to occur before the overall labor market deteriorates. In addition, watching retail trade and retail tradeconfidence to see if trends in business revenue and demand are weakening and may lead to layoffs is useful.

The release of employment alongside GDP information may move markets. Generally speaking, the market will drop more if employment growth and GDP are worse than expected, and it would rise more if the numbers reported are better than expected. An increase in employment means more economic activity, more productivity, and a more conducive environment for financial assets and global economic growth.

It is important to track employment growth in the European Union as it provides a powerful link to global economic conditions.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!