The economic sentiment index, or ESI, measures the monthly change of consumer and business sentiment in the economy. The headline number is a seasonally adjusted, weighted average of the following 5 confidence indicators: industrial confidence comprises forty percent, service confidence thirty percent, consumer confidence twenty percent, construction confidence five percent and retail trade confidence five percent.

The headline number is reported based on its percentage change from the long-term-average between years 2000 and 2021 which is indexed to 100. Numbers above 100 indicate confidence above the long-term average while numbers below indicate confidence below the long-term average. The report is dense and provides many other indicators based on consumer and business surveys.

The components of the ESI are shown and explained in detail, as well as data points on employment expectations, business expectations, selling price expectations, consumer expectations, the business situation, financial services confidence, and the economic uncertainty index. Data are collected for each member country in the European union and then aggregated and weighted.

The economic sentiment report is produced by the Joint Harmonised EU Programme of Business and Consumer Surveys, comprised of the Directorate General for Economic and Financial Affairs and the European Commission. The publication is generally released near the 29th day of each month at 10:00am London time. The publication is released to support public and private sector decision making.

An economy’s health is closely tied to its economic sentiment. Specifically, the report provides insights into how consumers and businesses think and react to a changing economy. Statistics on economic sentiment are also watched by the European Central Bank to monitor and steer its economic and monetary policies. Europe, like most other regions globally, relies on domestic consumers to spend their money and on domestic businesses to invest their money to sustain the economy’s growth trajectory.

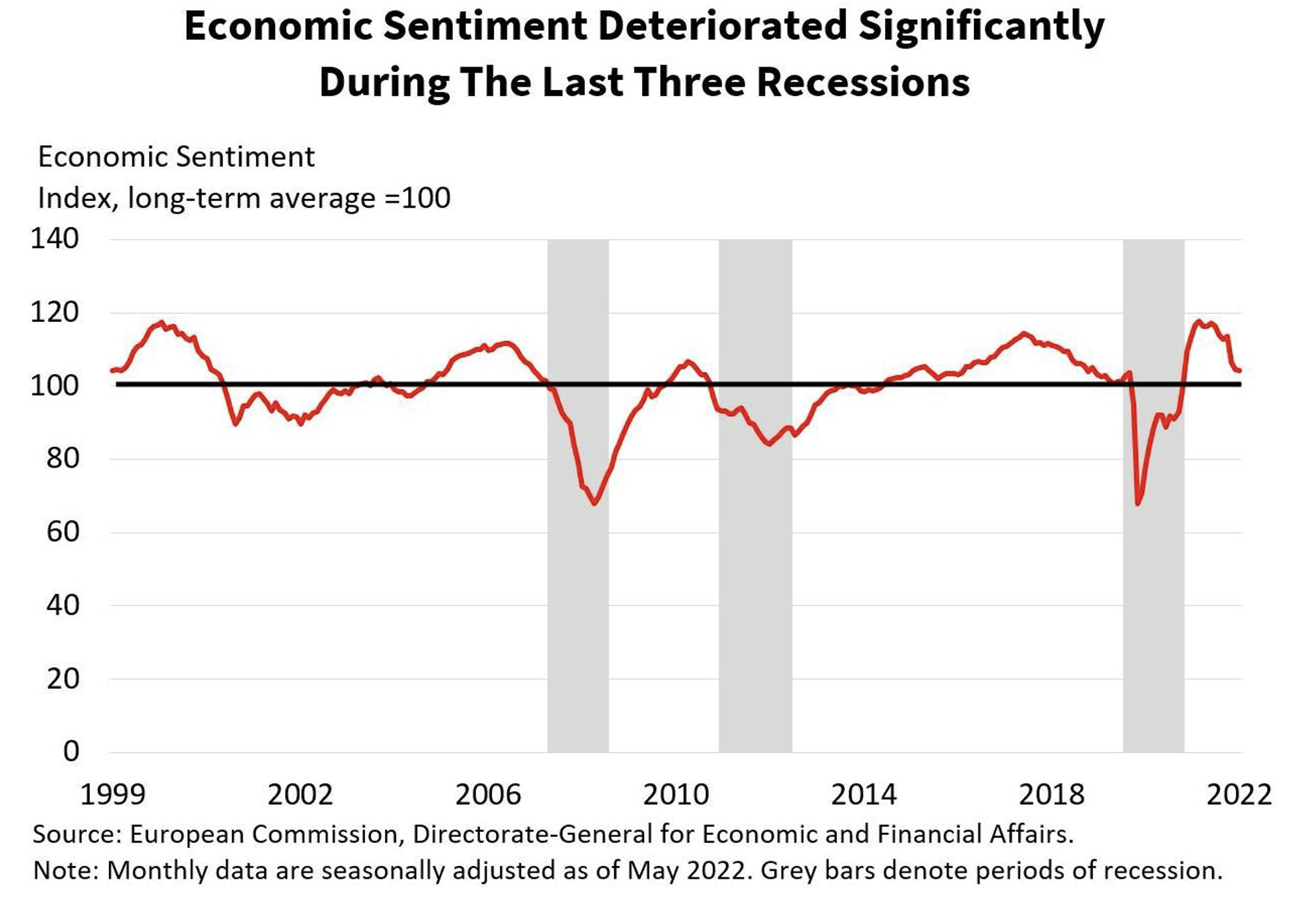

Elevated economic sentiment readings indicate that consumers and businesses remain confident about the economy as they continue to spend and invest. In the event of weak readings, consumers and businesses may be feeling increasingly risk-averse, and the economy might slow down. Firms increase revenue when sentiment is high, and the economy and businesses continue to grow. Consequently, it leads to the creation of more jobs, more investments, more loans, and higher tax revenues for governments. If the EU’s economic sentiment deteriorates significantly, as it did during the 2008 financial crisis, the 2011 Euro recession, and the COVID-19 recession, the world economy will be negatively affected due to the EU’s influential economic position.

Various economic indicators, such as retail trade, unemployment and employment are helpful in predicting economic sentiment and in examining the possible risk of layoffs hampering spending and investment. To determine whether consumers and goods are actively moving, foot traffic, port traffic, air passenger levels, and fuel sales can also provide valuable insights. Moreover, we would monitor the earnings calls and the stock performance of some of the most influential companies for signs of an economic slowdown or expansion.

Various economic indicators, such as retail trade, unemployment and employment are helpful in predicting economic sentiment and in examining the possible risk of layoffs hampering spending and investment. To determine whether consumers and goods are actively moving, foot traffic, port traffic, air passenger levels, and fuel sales can also provide valuable insights. Moreover, we would monitor the earnings calls and the stock performance of some of the most influential companies for signs of an economic slowdown or expansion.

The cost of capital-intensive goods and services may rise significantly when monetary policy tightens, and interest rates rise. Watching the economic sentiment report plays an important role in monitoring consumer and business behavior when monetary policy is being tightened. In the past, tighter monetary policy has resulted in weaker consumer spending, weaker business investment and, usually but not always, recession.

In most cases, economic sentiment is not a market moving data publication, however if the data are weaker than expected, the market may slump further, and if they are stronger than expected, the market may grind higher. Increasing economic sentiment leads to more economic activity and a more favorable environment for companies and consumers.

Emotional signals of an economic slowdown or expansion can be spotted early by observing economic sentiment.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!