GDP is a measure of the overall size of the economy. It’s used globally as a report card of how large an economy is and the speed at which it is growing or contracting at. It’s calculated with the sum of the final uses of goods and services measured in consumer prices, minus net exports, the difference between exports and imports. GDP is calculated by Eurostat, the statistical office of the European Union (EU).

Each country’s National Statistical Office submits their GDP estimates after compiling information from many different sources including population censuses, employment registers, income taxes and surveys on labor force, labor cost and business production. Eurostat collects the information and then performs aggregations and weightings. The data release aggregates GDP data for the Euro Area 19 nations that use the Euro currency and separately aggregates data for the European Union 27 nations to include the countries that don’t use the Euro currency. The data release is published quarterly, alongside employment data, generally near the 30th day of the month, one month after the referenced quarter at 9:00 am London time. Additionally, three GDP revisions are published later when more accurate information is available. For more detailed and comprehensive GDP data, the annual GDP report provides details including growth data by industry, consumption growth, investment growth, income growth, and is released in the June following the referenced year.

Eurostat’s mission is to provide high quality European statistics and data to support public and private sector decision making.

Globally, GDP acts as a foundation for financial markets. The quarter over quarter, seasonally adjusted annualized rate of change in real GDP is top of mind for market participants. In addition to adjusting for seasonality and inflation, the headline number tells us whether an economy is growing quickly, slowly or whether it is in recession. A decline in real GDP indicates a fall in economic activity and recession. Declining GDP prevents companies from growing collectively as fewer transactions are taking place and fewer incentives exist to invest. Using GDP as a global measure of economic growth is helpful in determining which economies are growing the slowest or fastest.

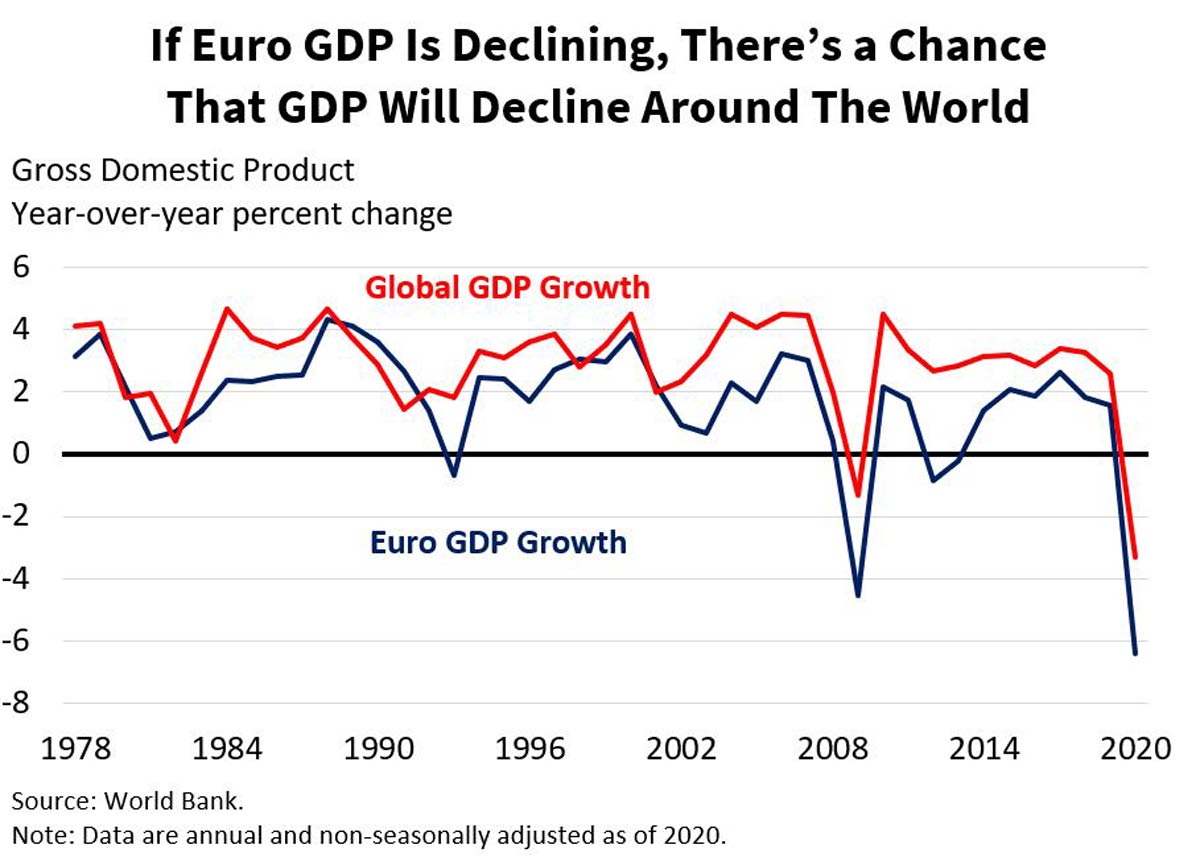

The positive chain reaction of GDP growth can be witnessed across numerous fronts of the economy. Businesses are motivated and have an incentive to invest, consumers are optimistic and spend their money and governments can collect taxes from the robust economic activity. This results in increased wages for workers, increased revenue and profit for businesses, and greater fiscal flexibility for governments. If GDP in the E.U. is declining, there’s a chance that GDP will decline around the world, due to the influence Euro consumers, businesses and investors have as the Euro economy comprises 15 percent of global GDP. In addition to higher stock prices and interest rates, higher GDP growth likely leads to increased happiness and prosperity. Weaker GDP readings on the other hand are likely to lead to reduced investment returns and a decline in opportunities for individuals, businesses and governments.

To forecast GDP, look at leading economic indicators such as economic sentiment, building permits, purchasing managers’ index for manufacturing, retail trade, the yield curve, and the money supply which provides a powerful predictive insight as to the direction of economic growth. These leading indicators cover the strength and sentiment of consumers and businesses, the capital-intensive and interest rate sensitive manufacturing and real estate sectors, along with the amount of inflationary pressure in the pipeline, and finally, the level, positioning and balance of interest rates.

Higher interest rates and tighter credit conditions, in general, impede GDP growth and may precipitate recessions. From a historical perspective, Central Banks have found it challenging to engineer “soft landings”. Soft landings are an ideal scenario that occur when an economy is growing too fast and/or inflation is running too hot and central banks tighten policy just enough to cool the economy while dodging recession. When central banks begin hiking interest rates, there’s a chance that a recession will manifest due to the difficult nature of tightening policy with the “just right”, adequate precision to avoid economic decline.

If there is a surprise in either direction, GDP may be the key driver of the market’s trend. Using leading economic indicators to predict GDP is a popular practice used by economists and market participants.

GDP is a barometer for opportunity and prosperity. When making global investment decisions, it is critical to keep track of economic trends and analyze the acceleration, slowdown, or reversal in GDP. Strong economic growth will likely result in strong financial asset growth.

Financial asset values won’t sustainably grow if GDP is declining.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!