The Money Supply tells us how many Euros are available in the economy. It is calculated by the European Central Bank, also known as the ECB. It generally includes the cash in circulation, cash in bank accounts, and marketable instruments like money market funds, repurchase agreements and short-term debt securities.

The ECB sums up all these components to calculate the total money supply. The ECB also regulates banks, has access to bank information and publishes data on the banking system. These data are released on or around the 28th day of each month at generally 9:00am London time. It’s published within the Monetary Developments in the Euro Area press release, to inform the public of the amount of liquidity or cash in the financial system and with detailed information for each component; historical data is also available.

The Money Supply is influenced by the ECB, an independent agency but also one that is ultimately accountable to the public and to the nineteen member nations that use the Euro. If the ECB thinks the economy is weak and in need of accommodation, they may reduce the reserve requirement for European banks to make money more available, they may purchase bonds from banks in exchange for cash to also make money more available and they may lower interest rates to incentivize borrowing and investment.

If the ECB thinks the economy may be overheating and needs to cool off, they’ll likely implement a restrictive monetary policy. A restrictive monetary policy may include increasing the reserve requirement for European banks to make money less available, they may sell bonds to banks in exchange for cash to also make money less available and they may increase interest rates to disincentivize borrowing.

Accommodative financial conditions or “loosening” leads to a boost in the money supply while restrictive financial conditions or “tightening” leads to a stable money supply.

The Euro is one of the most stable and liquid form of exchanges around the world, the ECB is the second largest central bank globally and the actions of the ECB are widely followed by other central banks around the world. Due to the ECB’s global influence, if the Euro money supply rises, there’s pressure on global interest rates to drift lower and on global prices to rise. Significant inflation may be the result of an excessive rise in the money supply absent a commensurate rise in productivity.

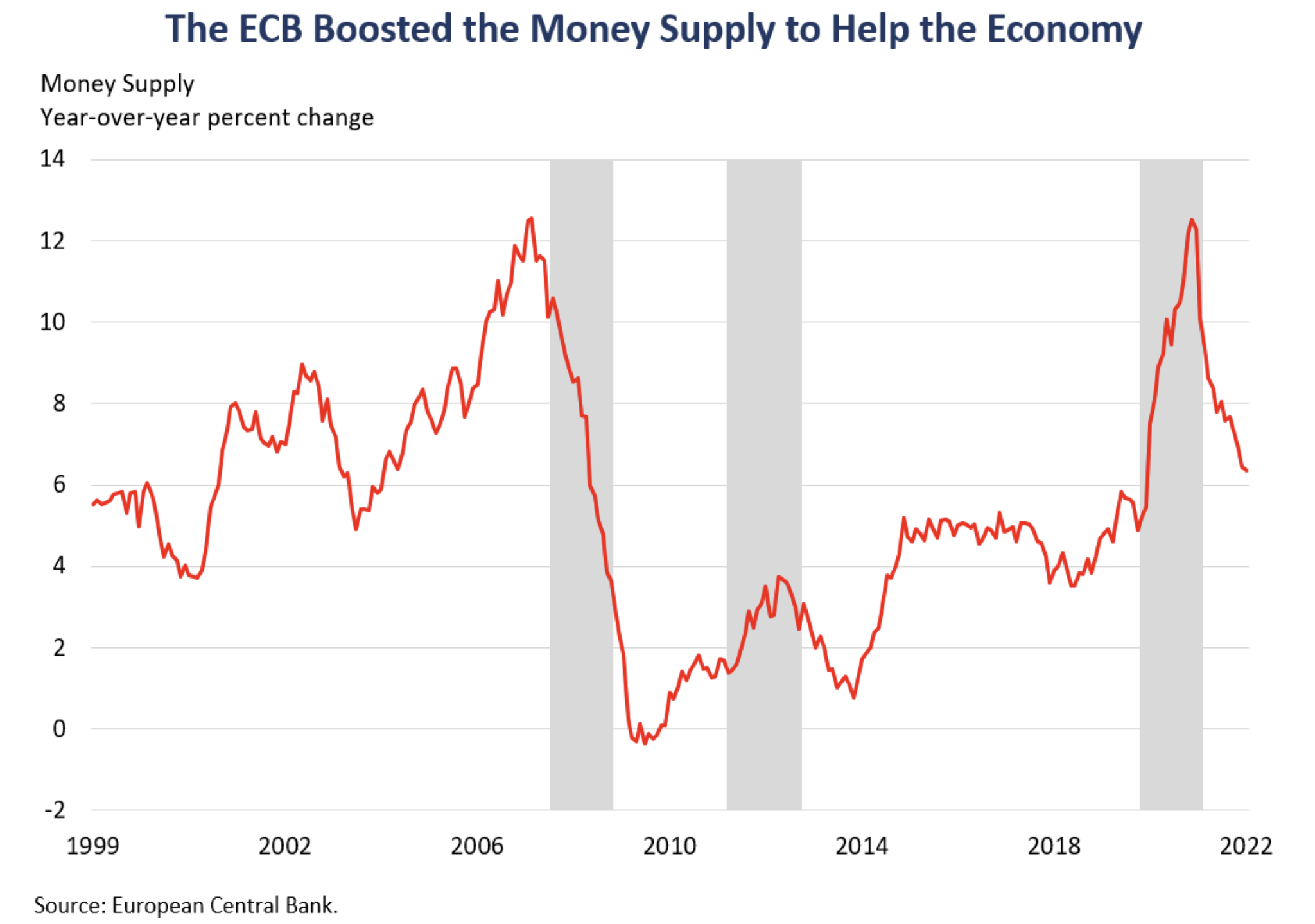

In the 1940s Greece experienced rapid inflation due to rapid money supply growth without simultaneous productivity growth. In the 70s the world witnessed the same dynamic in Chile. Bolivia in the 1980s. In the 90s in Bulgaria and Lithuania. Zimbabwe in the 2000s, and Venezuela in the 2010s. The COVID-19 pandemic in the 2020s led to economic shutdowns which impeded productivity growth and plunged the Euro economy into recession. The ECB resorted to an accommodative monetary policy to help the weak economy struck by the health crisis.

The ECB boosted the money supply to help the economy and expected inflationary pressures to be transitory or temporary. Unfortunately, the productivity deficiency due to the shutdowns combined with the money supply boost were too powerful of a combined force and this led to the highest and most persistent inflation trend in decades.

If we would have realized that a large rise in the money supply alongside weak productivity would mean more Euros chasing fewer goods and services, we could’ve understood why inflation wasn’t going to be transitory and could’ve forecasted inflation approaching a lot stronger than expected.

Paying close attention to the meetings and actions by the ECB and to developments in the Euro economy are useful to forecast the direction and quantity of the money supply. Any insights on whether the ECB is pursuing a dovish or hawkish policy is integral to understanding the direction and quantity of economic growth in the Euro Zone. A dovish perspective means they are leaning accommodative while a hawkish one means they are leaning restrictive. Inflation is very unpopular by the population and acts as a limit to excessive dovishness by central banks.

People don’t like being charged higher prices for goods and services, they don’t like experiencing cash savings depreciation, and they don’t like facing challenges planning for their futures due to unpredictable, volatile prices.

It may be tempting for governments and central banks to attempt to solve some of their most complex problems by boosting the money supply. However, once inflation is created and embedded in the financial system, it can be very difficult and painful to get rid of. Depending on money supply growth for economic growth is a short-term solution that will likely lead to longer term sacrifices.

Additional Links

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!