Before a construction company can begin building structures, they are generally required to secure building permits from their local authorities. The building permit data release tells us the square meters of the newly permitted structures that have been allowed to be built for residential and non-residential purposes. Permits fall into two categories in the release: single-unit and multiple-unit structures. Building permits are calculated by Eurostat, the statistical office of the European Union. Eurostat collects permit data from the National Statistical Offices of each country and then aggregates and weighs them. In addition, the data release aggregates permit data for the 19 EU nations that use the Euro currency and separately aggregates data for the 27 EU nations to include the countries that don’t use the Euro currency like Hungary, Croatia, Sweden and others. The data release is published quarterly, generally near the 1st day of the month, three months after the referenced quarter at 9:00 am London time. Eurostat’s mission is to provide high quality European statistics and data to support public and private sector decision making.

As a result of the data release, difficult and hard to gather information about the real estate sector can be analyzed. The release is vital to gathering and communicating information about the real estate industry, wealth indicators, capital intensive use levels, interest rate sensitivity, and consolidation of information across multiple industries. To construct a structure, you typically need approval from your jurisdiction, financing from a bank to pay for the land, materials to build, labor to assemble the materials, and durable appliances to put inside the unit once construction is complete. Building permits serve as an indication of economic health, since many intertwined moving parts in the economy must work and coordinate together to accomplish the mission of building a structure.

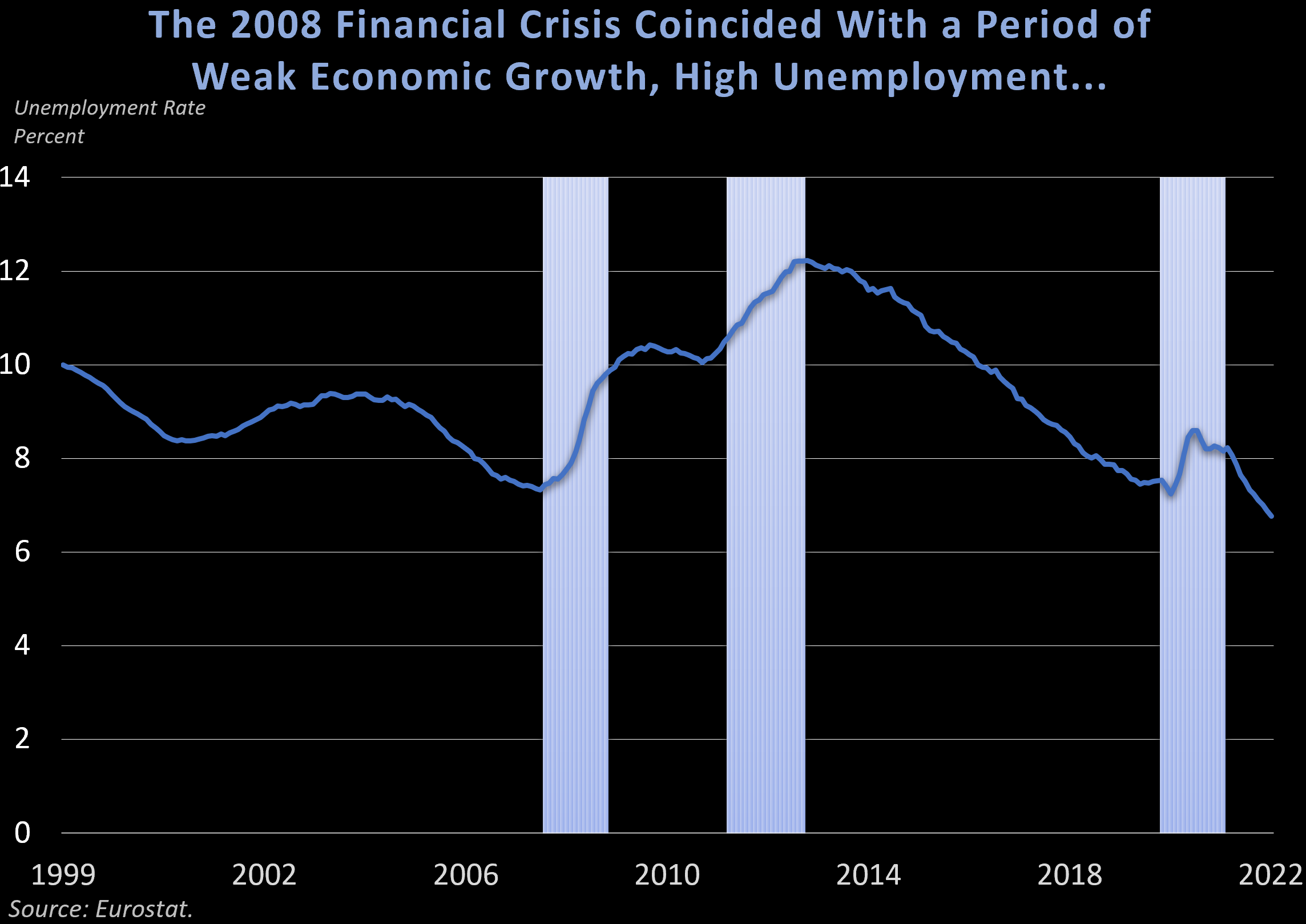

A positive sequence of events is likely to be felt across the economy if construction activity is robust, and we could see gains across many economic data points. If, on the other hand, building activity slows, it’s usually a sign of underlying economic weakness reflected in one or more of the numerous variables that impact the real estate industry. If there’s a global real estate market slowdown like during the 2008 financial crisis, it will likely reflect through slowing economic growth and weakness across many economic data points. The fall of construction activity because of the 2008 financial crisis coincided with a period of weak economic growth, high unemployment, higher interest rates and lower productivity in the EU and the globe.

When studying real estate markets, it’s crucial to analyze builder sentiment, consumer demand for housing, and the cost of capital and supplies. To forecast building permits look at economic sentiment, interest rates, real estate prices, sales, loans, and daily commodity prices to get an idea of how builders, banks, consumers and investors feel about the real estate market’s future.

While building permits are not normally a market moving data release, if they are worse than expected, the market may fall more, and if they are better than expected, the market may rise higher. Market participants generally look at the quarter-over-quarter and year- over-year percent changes in building permits to gauge economic activity. Greater building activity leads to more economic activity and a more favorable climate for companies throughout the world.

Construction investments are some of the most significant financial transactions individuals and companies make. Keeping an eye on the capital intensive and interest rate sensitive real estate sector for signs of economic strength or weakness is a key component of economic analysis.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!