“How many people are working” is one of the most significant questions in economics and answered in the monthly labor force report. Employment represents the number of people actively working while the year-over-year and month-over-month percentage changes represent employment growth, also provided in the report. Additionally, the report breaks down employment by age, state, territory, gender, full-time/ part-time and more.

Information and specifics on employment as well as several other labor market indicators are included in the monthly labor force report. Since certain industry groups, including retail, construction, and tourism, have varying employment rates throughout the year, seasonally adjusting the figures is important. The data is generally collected via surveys conducted in person, on-line and by telephone from approximately 26,000 households and 50,000 individuals. The labor force report data release is published by the Australian Bureau of Statistics near the 17th day of each month at 11:30am Canberra time. The Bureau publishes employment information and a wide variety of other data to support the decision making of Australian individuals, communities, businesses and governments.

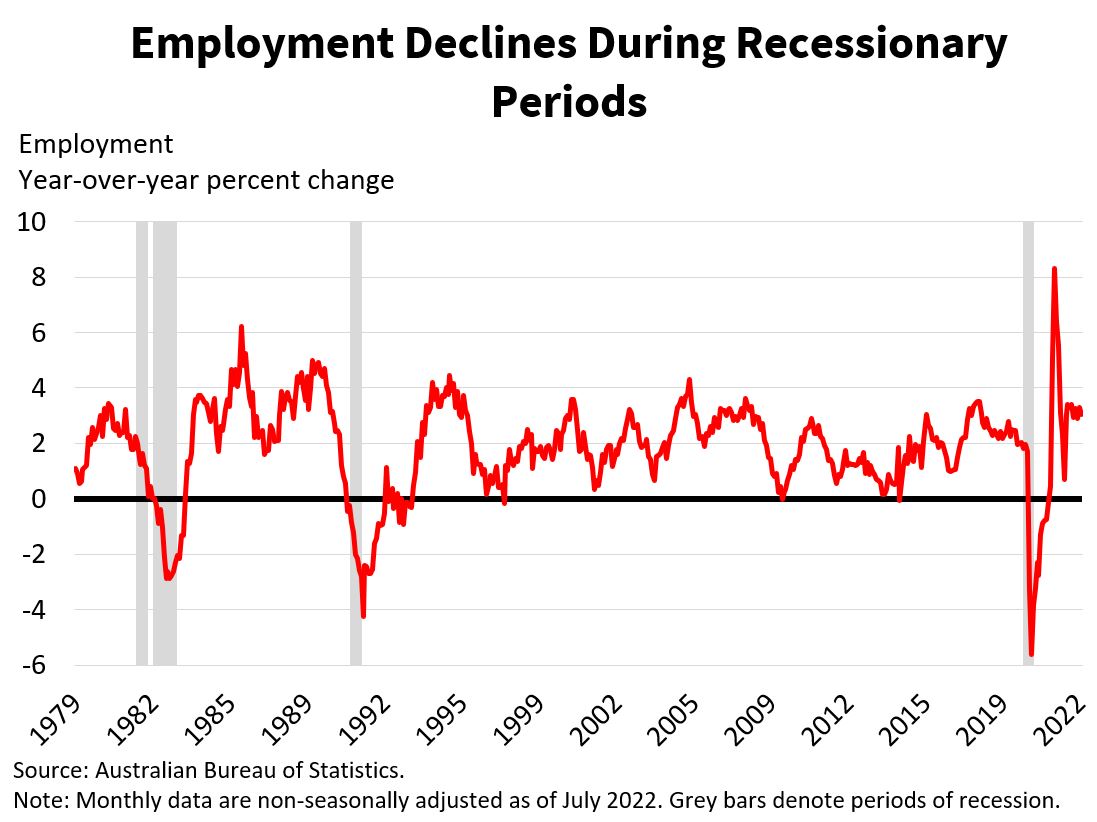

The report reveals the expansion of employment, or the speed at which employers are hiring staff, which acts as a key indicator of the economy’s productivity. An economy with high employment growth rates means businesses are adding to supply to meet consumer demand by hiring additional workers. The rate of employment growth is low or negative when there is a weakening economy, as businesses slow hiring or lay off employees due to weak demand from consumers. In response to weakening consumer demand during the 1991 recession, the 2008 financial crisis and the COVID-19 recession, companies laid off workers to cut expenses. As a result of the globalized nature of the international economy and the notable influence of Australia’s largest trading partners, a weakened Australian labor market results in a weakened global economy.

The labor force report also contains other useful data points. Considering the unemployment rate is useful when analyzing the tightness or laxity of the labor market, or, in other words, is it generally troublesome or easy to find work? A good leading indicator of what may happen in the near future can be found in the hours worked data point because businesses may cut hours before laying people off. Based on the employment to population ratio, we can determine the percentage of the working-age population that is currently employed. It is wonderful news when the employment to population ratio is high as it means many people are working, encouraging firms to grow and boosting the economy.

Together with the other indicators in the report, employment provides crucial information on the state of the Australian labor market. An Australian labor market characterized by increasing productivity and incomes is essential for the foundation of financial markets.

To forecast employment, we can look at leading economic indicators such as hours worked, building approvals and consumer and business sentiment since they tend to deteriorate prior to employment falling, the unemployment rate rising and the economy decelerating. The new orders and employment parts of the Purchasing Managers’ Index for manufacturing to find signals of how demand and employment are holding up in the capital intensive and interest rate sensitive manufacturing sector. Additionally, watching retail trade for trends in revenue and demand is useful for determining if layoffs might follow weakening data. Listening in on company earnings calls for hiring plans, layoffs, hiring freezes, etc., may provide useful information since these tend to occur prior to the overall economic situation deteriorating.

The release of employment information may move markets in a major way. On balance, if the employment number is worse than anticipated, the market will decline more, and if the number is better than anticipated, the market would rise more. The creation of more jobs leads to increased economic activity, higher productivity, and a more enthusiastic environment for financial assets and global economic growth.

Australia’s employment growth plays a crucial role in determining the health of its economy and its financial markets.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!