I’m senior economist Jose Torres for Interactive Brokers, in this lesson I’ll be explaining one of the lagging economic indicators of the Australian economy: Gross Domestic Product or GDP.

GDP can be used to measure the size of an economy. Governments all over the world use GDP data, which is generally compiled by governments themselves and used to assess the size and growth rate of an economy. GDP is calculated by adding together the last use of goods and services in consumer prices, minus net exports, the difference between exports and imports. The quarterly report provides details on nineteen industries including manufacturing, construction, retail, finance, education, healthcare, professional, transportation and more. Statistics on foreign trade, consumer and producer prices, retail transactions, financial statements, government revenue, household and business surveys, and other data sources are used to produce the GDP data release. The numbers are released by the Australian Bureau of Statistics two months after the previous quarter’s end around the 30th day, within the National Accounts Gross Domestic Product data release at 11:30am Canberra time. Revisions are published later when better data are available. The Australian Bureau of Statistics publishes GDP information and a wide variety of other data to support the decision making of Australian individuals, communities, businesses and governments.

Gross domestic product provides the fundamental underpinning for global financial markets. Market observers and economists pay close attention to the quarter-over-quarter, seasonally adjusted, percent change in real GDP. Taking seasonality and inflation into consideration, this integral number shows if the economy is growing modestly, briskly, or if it’s not growing at all. A negative real GDP print indicates economic shrinkage and an imminent recession. In an economy that is in decline, companies cannot grow collectively since sales are lower and there are fewer opportunities to invest as a result. We can determine which economies are evolving slowly or rapidly by analyzing GDP, a global measure of economic growth.

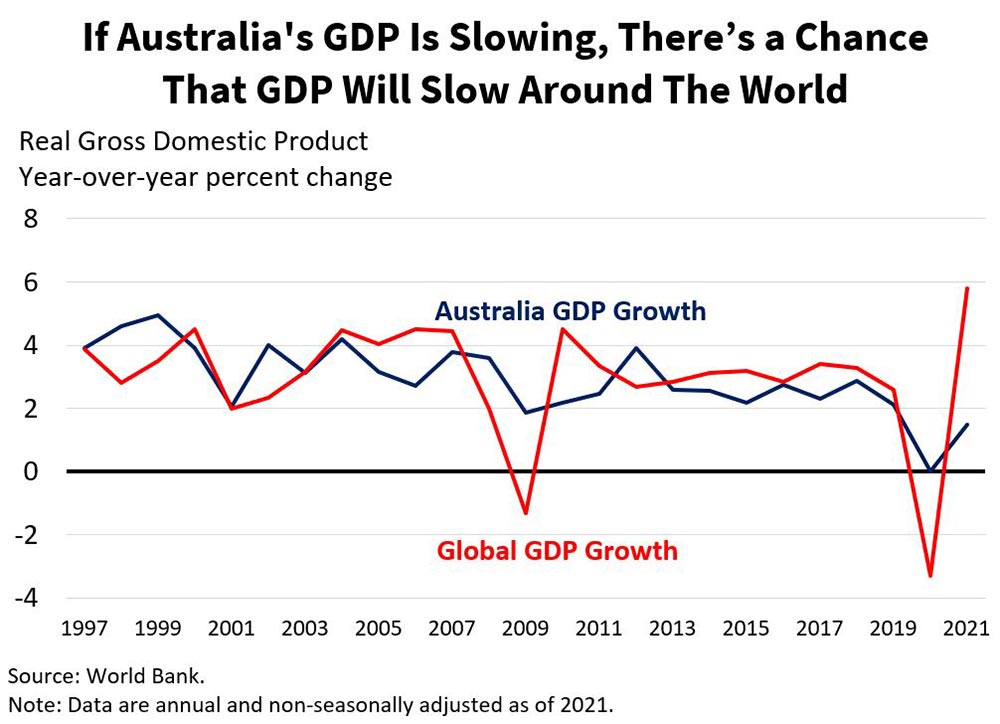

When GDP expands, there are various positive effects around a wide variety of economic sectors. Due to the solid economic climate, the business sector is motivated and has rewarding possibilities, the consumer field is happy and more likely to acquire goods and services, and the government can gain tax revenue through all the transactions and earnings. As an outcome, corporate earnings and revenues are uplifted, staff collect higher earnings and governing bodies are in a progressively superior budgetary situation. The globalization of the international economy and the massive influence of Australia’s largest trading partners, means that if the Australian economy is slowing, the world economy may also feel the pinch. The advancement of GDP often produces elevated satisfaction and optimism, in addition to climbing stock prices and rates of interest. Softer GDP readings, on the other hand, will produce softer investment returns, lessening cash flow creating opportunities for businesses, individuals, and governing bodies.

When GDP expands, there are various positive effects around a wide variety of economic sectors. Due to the solid economic climate, the business sector is motivated and has rewarding possibilities, the consumer field is happy and more likely to acquire goods and services, and the government can gain tax revenue through all the transactions and earnings. As an outcome, corporate earnings and revenues are uplifted, staff collect higher earnings and governing bodies are in a progressively superior budgetary situation. The globalization of the international economy and the massive influence of Australia’s largest trading partners, means that if the Australian economy is slowing, the world economy may also feel the pinch. The advancement of GDP often produces elevated satisfaction and optimism, in addition to climbing stock prices and rates of interest. Softer GDP readings, on the other hand, will produce softer investment returns, lessening cash flow creating opportunities for businesses, individuals, and governing bodies.

Consumer and business confidence, building approvals, purchasing managers’ index for manufacturing, retail trade, the money supply and the yield curve offer robust information that helps forecasters predict GDP. These leading economic indicators offer essential information concerning the firmness and sentiment of consumers and businesses, the capital intensive and interest rate sensitive real estate and manufacturing sectors, the level of inflationary stress in the financial system, and finally, the level, positioning and balance of interest rates.

GDP growth may be hindered as credit tightens and rates of interest rise, setting up the stage for a possible recession. When analyzing central banking history, we find that “soft landings” are infamously challenging to engineer. In the event that central banks tighten financial conditions “just enough ” to moderate the economy in reply to excessive inflation and/or growth without sparking a recession, soft landings are effective. Nevertheless, it is not easy to tighten financial conditions with the “just right ” level of precision.

Whenever there is a sizeable surprise in either direction, market moves can be significantly influenced by the GDP data release and more modestly when the numbers are in-line with economist expectations. Frequently utilized by economists and market players, GDP forecasts tend to depend on leading economic indicators.

The economic path, transition and prospects are studied through a country’s GDP. When making investment decisions, one must weigh the facts collected from analyzing economic trends to see if GDP is rising, stagnating, or slumping. In an environment of economic growth, one can expect investment returns to be positive. It is impossible for financial asset values to rise indefinitely when GDP is in decline.

what a gem integrative broker has got. A brief and precise explanation

by a great great expert.

It’s great to hear that we’re delivering! Please keep in touch.