Jose Torres for Interactive Brokers, I’ll be covering one of the leading economic indicators of the Australian economy: Retail Trade.

The Retail Trade report examines turnover and volume trends in retail transactions. It provides data on sales activity across several industry groups. The six industry groups covered are food, household goods, clothing, footwear and personal accessory, department stores, other retailing, and cafes and restaurants. Detailed data on industry subgroups and transaction performance across states is also provided in the second data release. Seasonal influences, such as construction in the summer and retail spending during the holidays, are considered when reporting trade figures. The data is collected from approximately 700 large businesses and 2,700 small businesses through surveys conducted via telephone and mail. The Retail Trade data release is published by the Australian Bureau of Statistics near the 29th day of each month at 11:30am Canberra time. A more complete data release is provided about one week later when higher quality data are available. The Bureau publishes retail trade information and a wide variety of other data to support the decision making of Australian individuals, communities, businesses and governments.

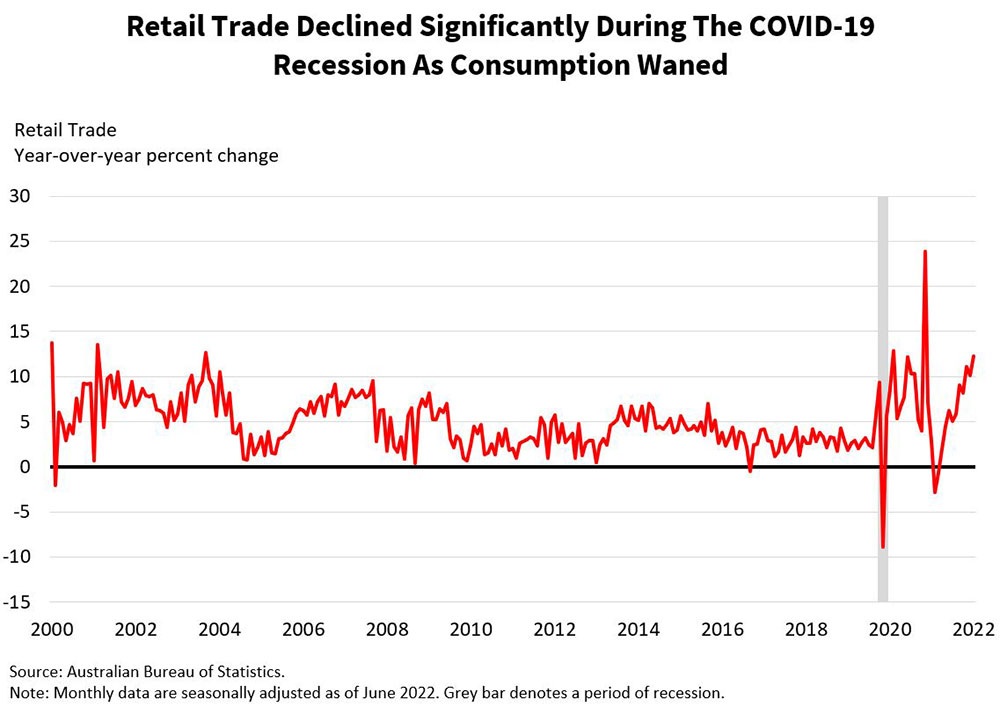

Retail trade is a decisive indicator of economic conditions. It shows how consumers think and behave against the backdrop of a constantly evolving economy. As with most countries globally, Australia relies on domestic consumers to spend their incomes to stimulate the economy as their spending generates incomes for other businesses and individuals. Furthermore, the Reserve Bank of Australia uses retail trade figures to monitor and guide economic and monetary policies.

A robust retail trade reading suggests consumers are feeling confident about the economy as they continue to purchase goods and services. If the readings are weak, it could signal alarm among consumers and a possible economic slowdown. Businesses and the economy both grow when retail trade is strong, since it boosts revenues, earnings and produces more jobs. In turn, this results in higher investment, more loan activity, increased tax revenue for governments and greater GDP. In light of the globalization of the international economy and the significant impact of Australia’s main trading partners, if retail trade in Australia slows, the global economy may decelerate as well.

To forecast retail trade, we can look at leading economic indicators such as consumer and business confidence to see how businesses and consumers feel about the present and future.

To forecast retail trade, we can look at leading economic indicators such as consumer and business confidence to see how businesses and consumers feel about the present and future.

Foot traffic, air passenger levels and fuel sales to see if consumers are moving around. Employment, unemployment and wages to see if a weakening labor market may add stress to consumer wallets and purses. In addition, we’d listen to the earnings calls and monitor the stock performance of some of the largest publicly traded companies for signs of a consumer slowdown or expansion.

During a time of tighter monetary policy and higher interest rates, durable items such as automobiles, refrigerators, and furniture will cost more to purchase. It is pivotal to analyze consumer behavior in response to monetary policy changes by keeping an eye on the Retail Trade Report. In the past, tighter monetary policy has resulted in diminishing consumer spending and sometimes but not always, recession.

Market participants value the month-over-month and year-over-year percent changes in retail trade. Retail trade is sometimes a major contributor to market moves. If retail trade is worse than expected, markets tend to decline more, whereas if it is better, they rally more. Rising retail trade leads to a more robust economy and a landscape that is advantageous to international equities.

Evaluating retail trade for signs of economic deceleration or acceleration is an integral part of economic analysis.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!