I’m senior economist Jose Torres for Interactive Brokers. In this lesson I’ll be explaining the consumer price index, one of the lagging economic indicators of the Australian economy.

Prices are important, people think about the costs of goods and services before completing a purchase. The Consumer Price Index or CPI measures up the expenses of a basket of goods and services every quarter. Food, clothing, housing, financial services, health, transportation are some of the eleven industrial categories included in the CPI. Categories that represent a higher share of Australian budgets like housing, food and transportation comprise more of the index. Through the CPI, businesses and governments adjust several economic series for inflation-free dollars, including business contracts, wage contracts, pension payments, and more. As certain goods and services fluctuate in prices and sales throughout the year, like travel and retail, the CPI is seasonally adjusted. Approximately 100,000 price observations are collected from a wide variety of retailers each quarter to calculate the CPI. The numbers are released by the

Australian Bureau of Statistics roughly one month after the previous quarter’s end around the

26th day, within the Consumer Price Index data release at 11:30am Canberra time. The Australian Bureau of Statistics publishes CPI information and a wide variety of other data to support the decision making of Australian individuals, communities, businesses, and governments.

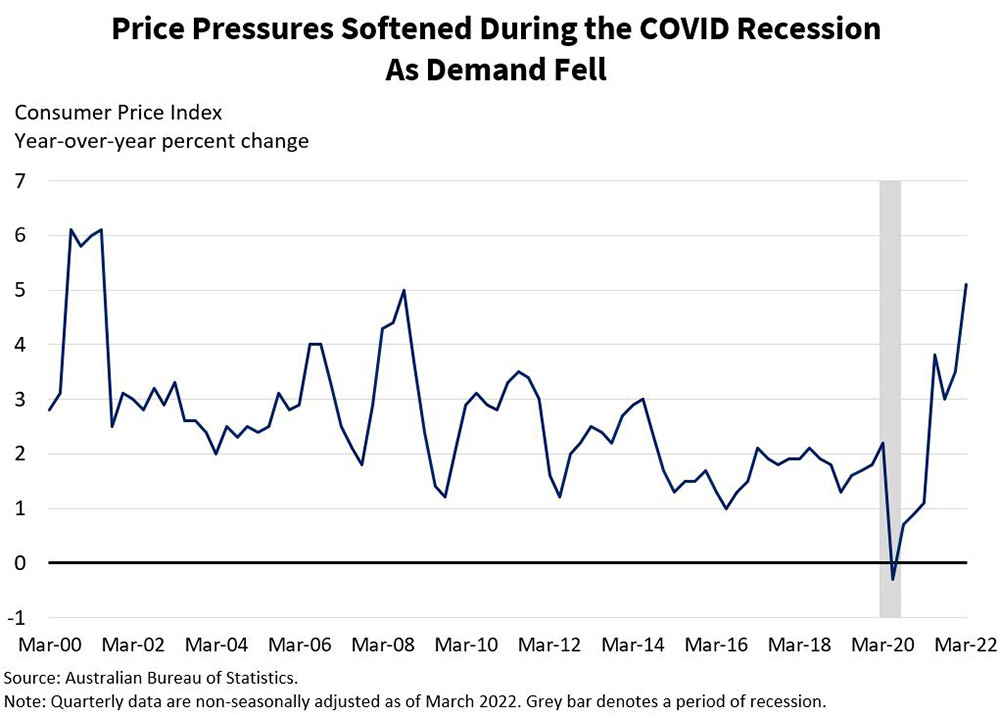

Supply and demand, as well as the Australian economy’s health, are partially determined by prices. Inflationary pressures are propelled in a landscape where the demand for goods and services exceeds supply because of more dollars following a disproportionately low amount of goods and services. On the other hand, inflationary pressures decline if demand decreases while supply remains steady as businesses lower their prices to sell their merchandise. Consumer prices are analyzed from a year-over-year perspective and from a month-to-month perspective by market players and economists. A substantial portion of the index’s value is affected by the price of food, transportation and housing, which is why the index is analyzed independently from them as well. There are many moving parts within the CPI, and some categories can disproportionately shift the index, so tracking all of them is vital to understand how prices are changing and how the economy is evolving.

Advancing consumer prices may cause affordability to worsen and trigger longer-term inflationary issues. To soften price rises, sustain inflation expectations at a shielded level, and reimpose economic balance, the Reserve Bank of Australia may tighten its monetary policy. When consumer prices start to slow down or fall altogether, a phenomenon known as deflation, it can signal that an economy is trailing behind, population growth is decelerating, and/or the economy is in or approaching recession. When demand declines for a long period of time, wages could be reduced, jobs could be lost, and investment portfolios could be cut substantially. Since the Great Depression of the 1930s, central banks have prevented deflationary episodes and have opted for prices rising in a moderate and gentle manner to accommodate economic and population growth; the Reserve Bank of Australia targets an inflation rate of two to three percent, very similar to the 2 percent target maintained across many developed economies.

As a result of utilizing monetary policy to control inflation, demand for goods and services could soften. The dollar is likely to rise in value if interest rates are lifted, which may negatively affect Australia’s net exporter status since foreign purchasers would have to pay more for Australian exports. As the dollar firms up, Australian corporations may experience a reduction in their international sales and profitability as a result. In an inflationary period, when the Reserve Bank of Australia needs to tighten monetary policy in order to keep inflation in check, it is likely that the valuation of equities and fixed income products will deteriorate.

As a result of utilizing monetary policy to control inflation, demand for goods and services could soften. The dollar is likely to rise in value if interest rates are lifted, which may negatively affect Australia’s net exporter status since foreign purchasers would have to pay more for Australian exports. As the dollar firms up, Australian corporations may experience a reduction in their international sales and profitability as a result. In an inflationary period, when the Reserve Bank of Australia needs to tighten monetary policy in order to keep inflation in check, it is likely that the valuation of equities and fixed income products will deteriorate.

A prediction of CPI can be made by examining the money supply to see if there is inflation risk arising from an increase in money supply without a corresponding increase in productivity. Because commodity prices serve as insertions to many goods and services, forecasters can estimate future consumer prices by analyzing daily commodity prices. The tightness of the labor market could be measured by tracking wages, employment, and unemployment. The combination of increasing wages coupled with a tight labor market can lead to tenacious and more difficult to control inflation. Furthermore, retail trade can also be used to gauge how much demand there is as well as sales intensity.

Generally, consumers are forced to deal with constricted budgets, reduced buying capacity, and struggles planning when they’re faced with inflation. Frequently, a recession occurs after a period of high inflation, because central banks tighten monetary policy aggressively in an attempt to suppress it. To determine the speed and direction of price increases or declines, it is crucial to take the CPI into account when analyzing economic trends.

Regarding a Qn on Australia’s CPI calculation /publication in this topic’s quiz.

Just letting you know, as of this year, as a result of stated change in procedure in the last Au federal budget, Au will join with most other higher developed economies and return to a monthly cpi calculation (using a few indicator contributors only) + publishing, and do a consolidated (full, more included attributes hence more accurate) evaluation, on a quarterly basis.

Hi, thank you for reaching out. This change is now reflected in the quiz. We appreciate your feedback!