The IBKR Advisor Portal offers Financial Advisors and RIAs an integrated suite of CRM tools. This lesson will review how advisors can track goals, create risk score questionnaires, run Account Queries, and use the RMD Calculator.

These tools can be located by opening the left side menu and expanding the Administration & Tools section. This section contains CRM functionality including Client Account Queries, Goal Tracker, ESG Impact Preferences, the Required Minimum Distribution (or RMD) Calculator and Risk Score Questionnaires.

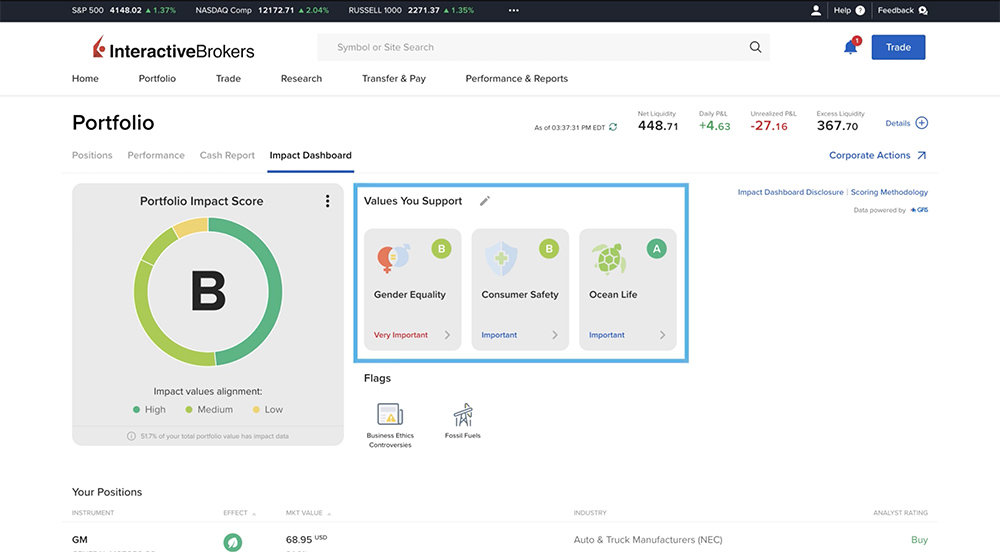

ESG Preferences

ESG Impact Preferences help the advisor understand the client’s preferences related to socially responsible and impact investing. Select the client accounts to send Impact invitations to and the clients can select their personal investment criteria from several impact values that they support and are most important to them and they can select from a set of business practices or flags they would like to avoid. The ESG Impact tool will then analyze how closely the client’s portfolio and their holdings align with their selected values.

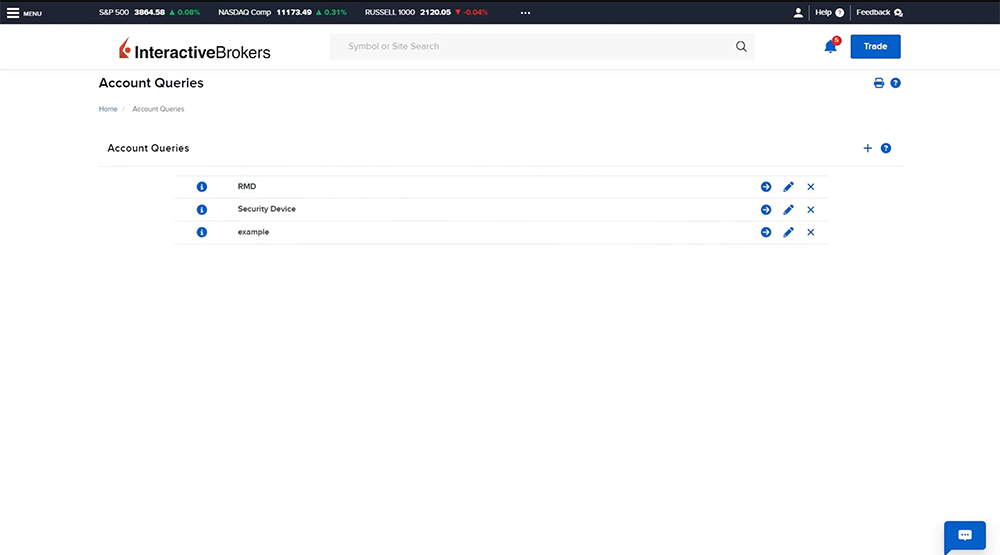

Account Queries

Account Queries allow advisors to search for accounts based on certain criteria such as account type, trading permissions, fee configurations, IRA contributions, and more. Note, the advisor must have a Two Factor Authentication device, such as IB Key, configured in order to access and use Account Queries. Advisors can save Account Queries and run them at any time by clicking the blue arrow. Account Queries can also be edited by selecting the pencil Edit icon or deleted by selecting the X icon.

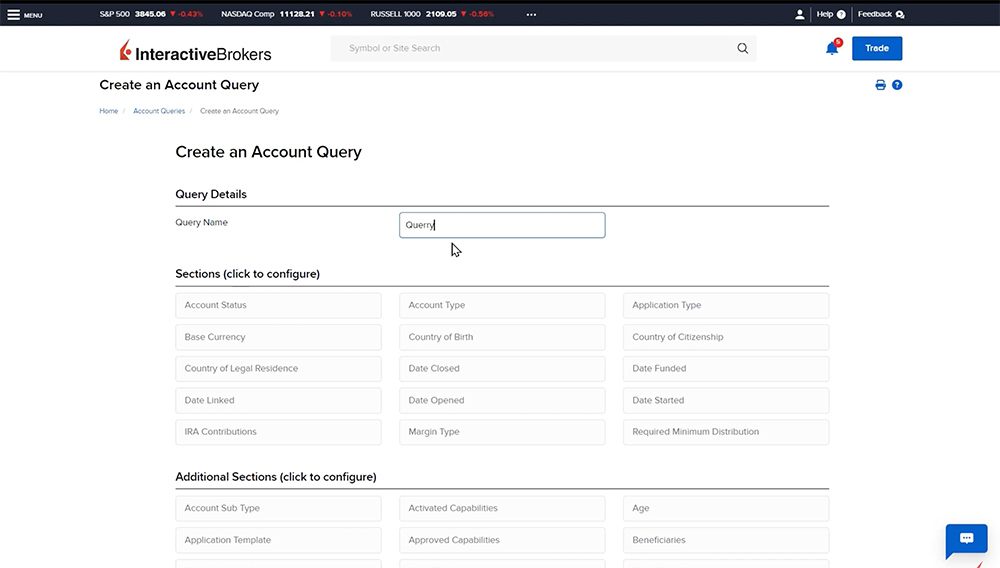

To create a new Account Query, click the blue plus sign in the upper right corner. Enter a name for the query and select the main Sections to be considered. These sections will act as filters to allow the advisor to specify the account criteria to be included in the report. For example, the advisor can click Account Type and choose only IRA, Individual and Joint accounts.

Once the main Sections have been selected, the advisor can click any of the additional sections to be included. The Additional Sections will be data columns that are populated in the report. For example, the client’s Date of Birth, Tax Lot Matching Method, and the Net Asset Value.

Once satisfied with the selections, click Continue to review the query then click OK. Once the query is run, the results are displayed in a table which can be downloaded by clicking Export to CSV.

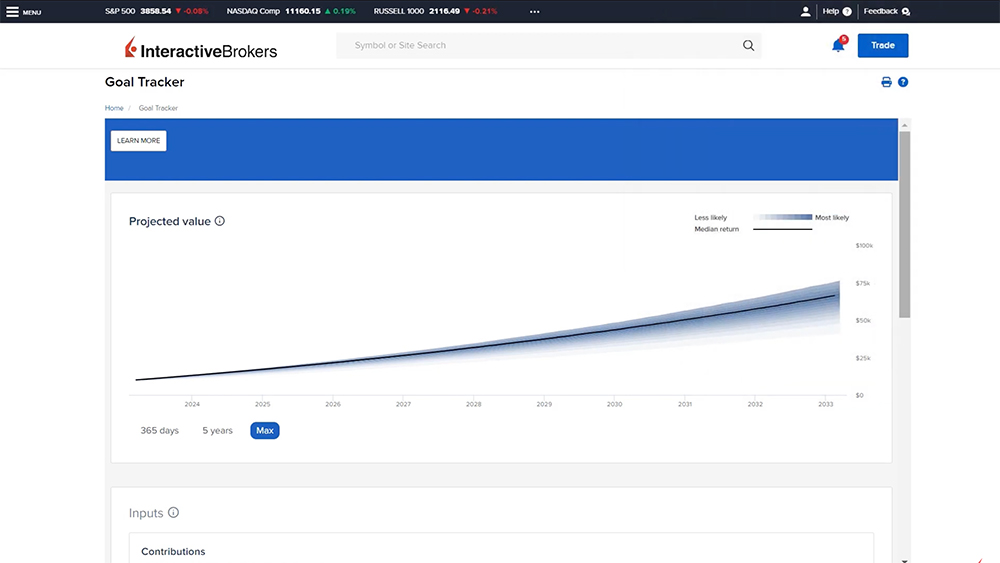

Goal Tracker

Goal Tracker is a planning tool that projects the hypothetical performance of the client’s portfolio and monitors how likely they are to achieve their goals, such as college savings or retirement goals. The advisor set the inputs – such as monthly contribution amount and target risk and return as well as the client’s goals – and the advisor can view the projections and the likelihood of achieving those goals.

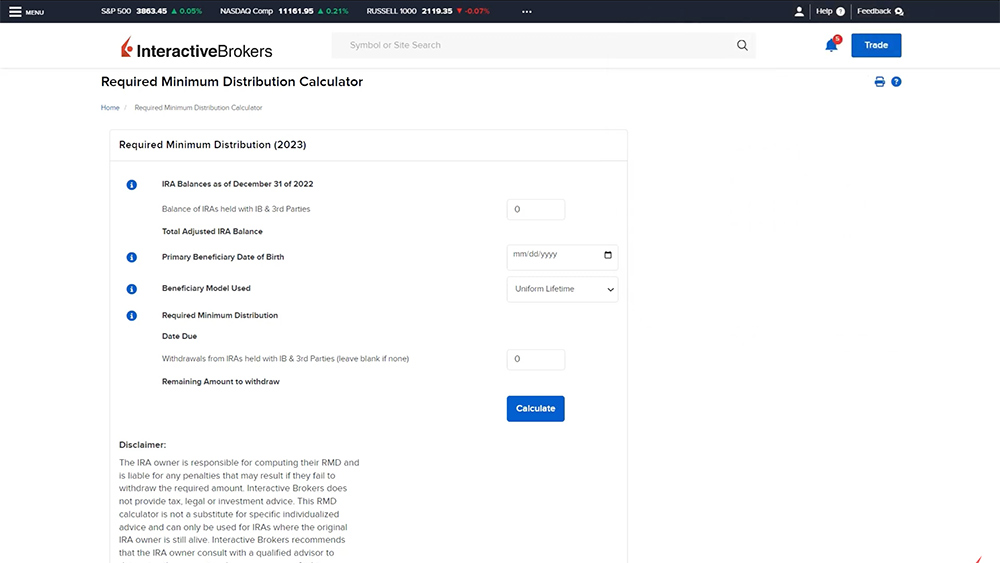

RMD Calculator

The Required Minimum Distribution Calculator provides the ability for advisors to calculate the Required Minimum Distribution (RMD) for all RMD applicable Individual Retirement Accounts (IRA). The advisor enters the IRA balances as of the end of the previous year, the date of birth, and the Beneficiary Model and then based on the inputs the system will calculate the RMD and populate with the date the RMD is due by.

Note that Interactive Brokers does not provide tax, legal or investment advice and the IRA owner is responsible for computing their RMD and is liable for any penalties that may result if they fail to withdraw the required amount.

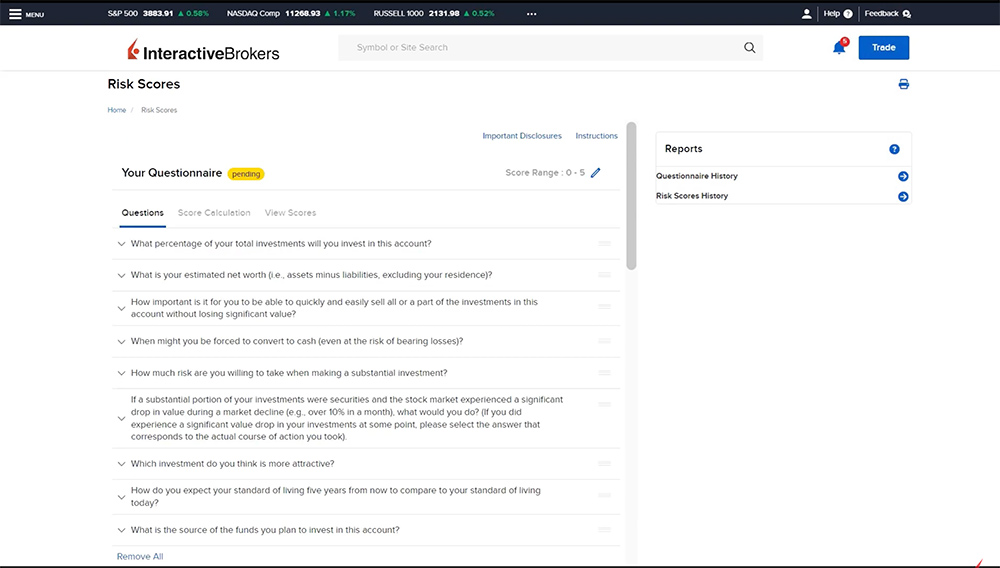

Risk Score Questionnaires

Advisors can use Risk Scores to understand client risk tolerances and recommend suitable investments for their clients. If this is the first time using the Risk Score Questionnaire in Advisor Portal, the advisor will first need to enable this feature by selecting Yes then clicking Continue. Once enabled, the advisor can build their questionnaire by selecting a minimum of 9 questions and at least 2 questions from each category: Capacity, Need and Tolerance. Click the plus sign next to add the question to the questionnaire. Once added, click on the question to view the available answer choices and the coordinating risk score.

Answers to questions are assigned a default Risk Score Value on a scale of 1 to 5, with 1 indicating lowest risk and 5 indicating highest risk. Advisors may modify the assigned value for any or all questions using this default 1-5 scale, or advisors can modify the Risk Score Scale and reassign values based on their own scale by clicking the pencil edit icon next to Score Range at the top of the page.

Each advisor can have one active questionnaire so once all the desired questions have been selected, the advisor can activate the questionnaire by clicking Make Active. Once activated, invite clients to complete the questionnaire by clicking the View Scores tab, select the client accounts, then click Send Invitations. If needed, advisors can have clients re-take the questionnaire to get an updated score.

As reviewed in this video, Interactive Brokers offers numerous Client Relationship Management tools in a single, integrated platform.

Resources

User Guide: Client Risk Profiles

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!