In this video, we will discuss how to use Trader Workstation’s (TWS) Risk Navigator to view your account’s margin requirements under different margin conditions. Risk Navigator can be launched in Mosaic or Classic TWS. To launch it in Classic TWS, click Analytical Tools on the top menu and scroll to the Portfolio Section. Hover over Risk Navigator then click Open New What-If from the sidecar menu. In Mosaic, click New Window and scroll to Portfolio Tools towards the bottom of the menu. Again, hover over Risk Navigator and click Open New What-If from the sidecar menu.

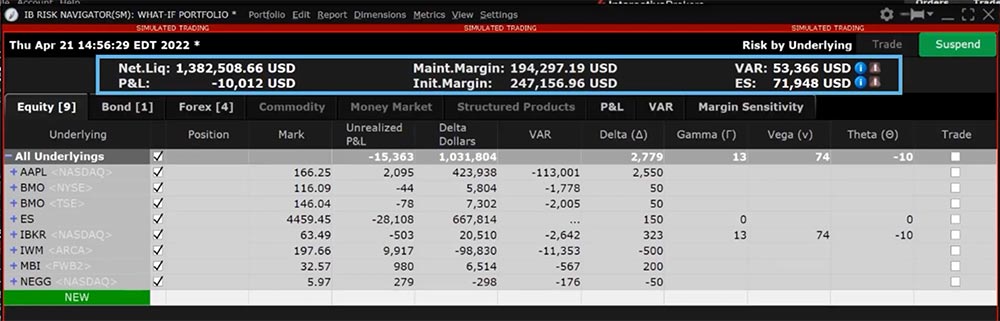

When the What-If Portfolio is launched, you can elect to populate with your actual portfolio positions or start a new hypothetical portfolio from scratch. In this scenario, I will elect to populate the What-If portfolio with my existing positions and the What-If Portfolio will open in a separate window.

By default, Risk Navigator will display the margin requirements at the top based on the current margin configuration for your account.

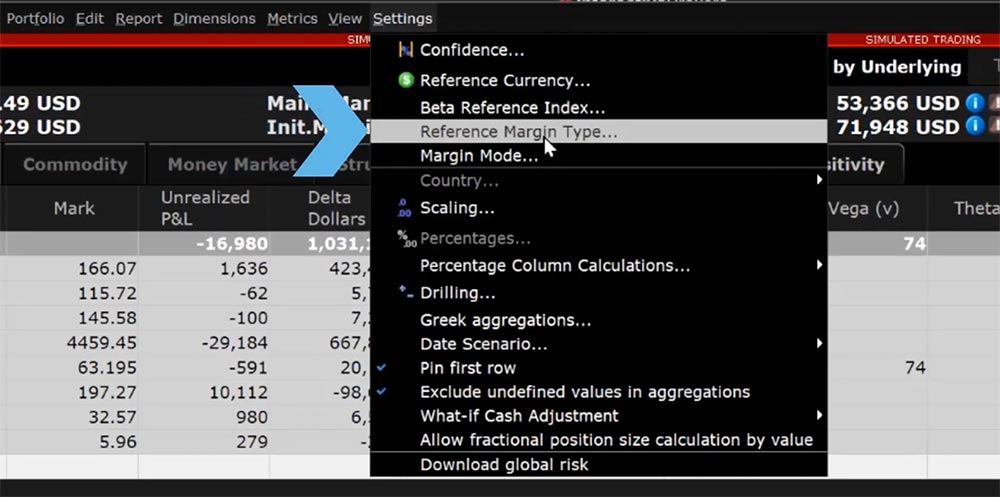

However, it is possible to view how your margin requirements would differ for the same portfolio under a different margin configuration. For example, if your account is currently configured for Reg T Margin but would like to see your projected margin requirements under Portfolio Margin, you can change the reference margin type within Risk Navigator.

However, it is possible to view how your margin requirements would differ for the same portfolio under a different margin configuration. For example, if your account is currently configured for Reg T Margin but would like to see your projected margin requirements under Portfolio Margin, you can change the reference margin type within Risk Navigator.

To do so, select Settings at the top of the window and click Reference Margin Type.

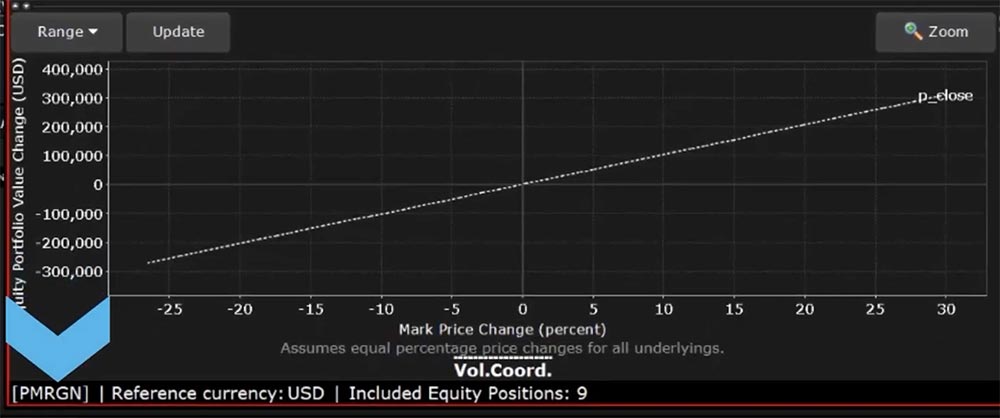

A pop-up window will open with a drop down of the available margin types to select from. To view your margin requirements under Portfolio Margin calculations, click on the drop down and scroll to select PMRGN then click OK. Alternatively, to view your margin requirements under Reg T Margin calculations, select STKNOPT from the list of reference margin types. Once the new reference margin type is specified, the Risk Navigator Dashboard will automatically update to reflect your choice. You can toggle back and forth between the Reference Margin Types. Note that the current Margin Type will be shown in the lower left-hand corner of the Risk Navigator window.

A pop-up window will open with a drop down of the available margin types to select from. To view your margin requirements under Portfolio Margin calculations, click on the drop down and scroll to select PMRGN then click OK. Alternatively, to view your margin requirements under Reg T Margin calculations, select STKNOPT from the list of reference margin types. Once the new reference margin type is specified, the Risk Navigator Dashboard will automatically update to reflect your choice. You can toggle back and forth between the Reference Margin Types. Note that the current Margin Type will be shown in the lower left-hand corner of the Risk Navigator window.

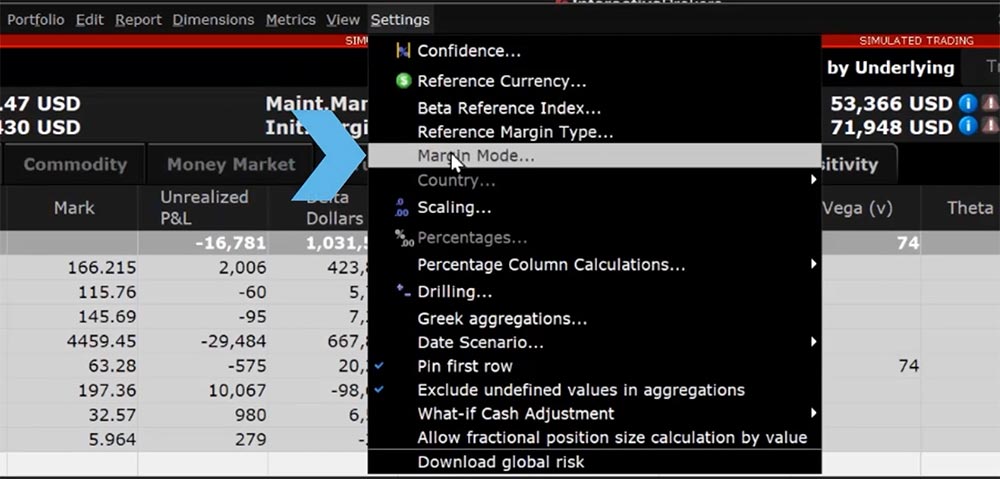

Additionally, Risk Navigator What-If Portfolios can be used to view the projected changes for your portfolio in the event that IB implements changes to the margin requirements based on market conditions. When such changes are made, a new Alternative Margin Calculator will be released so that clients can view their projected margin requirements once the changes are implemented. To open the Alternative Margin Calculator within a What-If portfolio, select Settings at the top menu and click Margin Mode.

Additionally, Risk Navigator What-If Portfolios can be used to view the projected changes for your portfolio in the event that IB implements changes to the margin requirements based on market conditions. When such changes are made, a new Alternative Margin Calculator will be released so that clients can view their projected margin requirements once the changes are implemented. To open the Alternative Margin Calculator within a What-If portfolio, select Settings at the top menu and click Margin Mode.

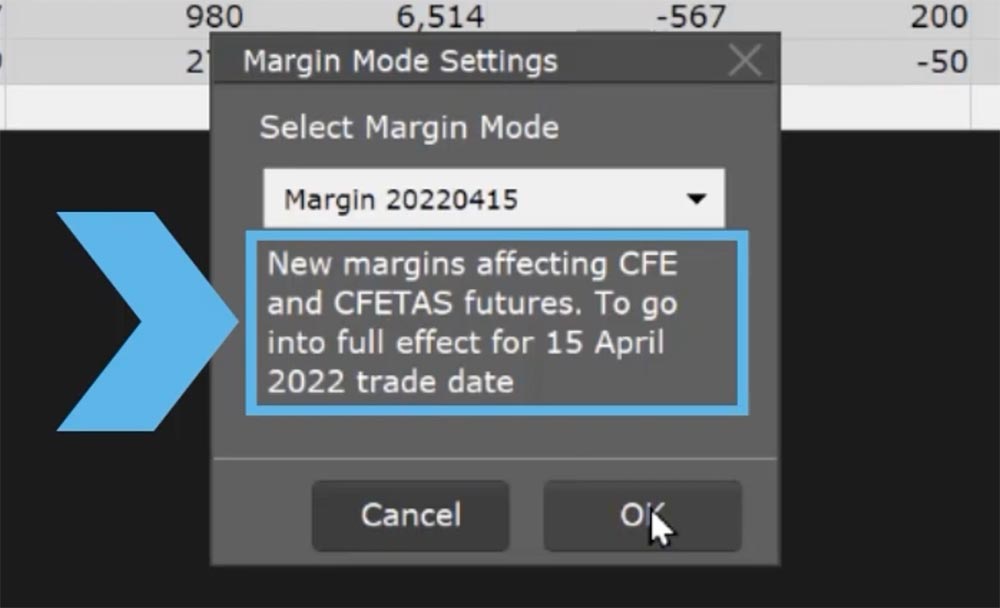

A pop-up window will appear titled Margin Mode Setting. Use the drop-down menu in that window to change the margin calculations from Default (the current margin policy) to the new margin setting (being the new margin policy). The exact title of the margin mode will vary depending on the date it will be implemented and will be specific to the new policy. Once you have made your selection, a description of the margin policy will be reflected underneath the drop down.

A pop-up window will appear titled Margin Mode Setting. Use the drop-down menu in that window to change the margin calculations from Default (the current margin policy) to the new margin setting (being the new margin policy). The exact title of the margin mode will vary depending on the date it will be implemented and will be specific to the new policy. Once you have made your selection, a description of the margin policy will be reflected underneath the drop down.

Click on the OK button and the Risk Navigator Dashboard will automatically update to reflect your new margin mode. The current Margin Mode will also be shown in the lower left-hand corner of the Risk Navigator window.

Click on the OK button and the Risk Navigator Dashboard will automatically update to reflect your new margin mode. The current Margin Mode will also be shown in the lower left-hand corner of the Risk Navigator window.

As we’ve discussed in this video, Risk Navigator What-If Portfolios can aid in viewing your margin requirements under different margin account types to help inform your decision should a different margin type be more beneficial for your objectives. Additionally, the What-If Portfolios can help view projected margin requirements for your portfolio in the event IB implements changes to the margin requirement calculations so that you can manage your risk accordingly.

As we’ve discussed in this video, Risk Navigator What-If Portfolios can aid in viewing your margin requirements under different margin account types to help inform your decision should a different margin type be more beneficial for your objectives. Additionally, the What-If Portfolios can help view projected margin requirements for your portfolio in the event IB implements changes to the margin requirement calculations so that you can manage your risk accordingly.

Resources:

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!