Investors may want to know the impact on their margin value in the event they want to change positions from day-to-day. To do this, TWS users can open IBKR Risk Navigator and look at the Margin Sensitivity tab to judge the impact on Initial and Maintenance Margin values from increasing or reducing part of their holdings.

In part, margin requirements are influenced by the riskiness of the security, portfolio concentration and composition. What investors are charged in margin terms is also influenced by the account type they hold. To contrast margin requirements for your portfolio under different account structures, use the Settings dropdown menu and select Reference Margin Type to select from the list of available alternatives.

You may see your actual margin needs in a real Risk Navigator environment. But remember that you can replicate your actual portfolio holdings in a what-if portfolio and then make as many adjustments to positions to judge the resulting impact on margin.

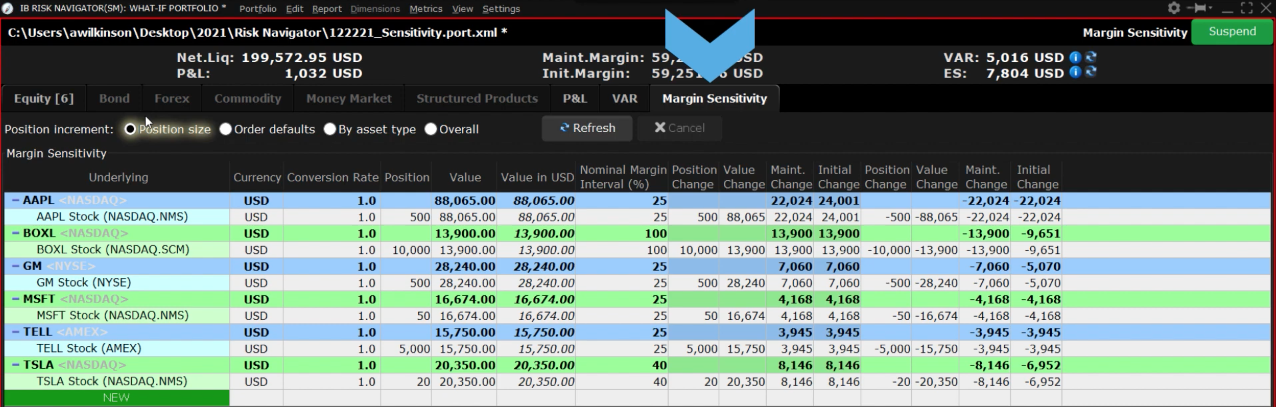

Here is a what-if portfolio populated with a handful of positions. To start with I’m looking at the positions on the Equity tab. Here you may see prices, positions, P&L and so on. In the dashboard above you can also see net liquidation value along with maintenance and initial margin requirements. Before we change tabs, remember that in the what-if environment you can use the include/exclude checkbox to assess the impact on margin of changing the portfolio mix.

Next, let’s click on the Margin Sensitivity tab. Use the +-drill button to expand all position data. The purpose of this tab is to display current positions and associated margin requirements. But you may also use the Risk Navigator to measure the impact on margin from changing positions. Let’s just explain a couple of items on display.

The position carries over from the Equity tab and the value is shown in base currency and in USD terms. The nominal margin interval column is IBKR’s percentage rate applied to the underlying and multiplied by the position value. The rate at which margin is applied will differ between stocks as you can see here. Less liquid and more volatile stocks will likely require higher margin.

So, you can see value multiplied by nominal margin interval equals maintenance margin. Notice the radio buttons beneath the tabs for Position increment.

With Position size selected, the margin calculations to the right of the page will reflect increases and decreases in keeping with the current magnitude of your positions. Look at the Position column and the position Change column (they should be the same). If I have an open position of 500 shares in AAPL, you can see position changes of +500 and -500 along with resultant Value Changes to the portfolio. And you can also see how margin values rise and fall for the associated change.

Next, let’s select the Order defaults radio button instead. This maybe, for example, 100 shares, which is the default TWS setting. But remember that you may have changed to an alternative value in Order Presets. In my case, the default order size is indeed 100 shares. The screen my take a moment to refresh here. When it updates, you will see +100 shares and -100 shares in the Position Change columns, and the resultant associated margin changes. This is useful in displaying the incremental change to margin requirements in your account.

The Overall position increment button enables you to apply an overall factor increase. When checked, you will see an input field with a default setting of 1.0. If I want to know the margin impact of adding a specific number of shares to each underlying position, I can enter the value and wait for the page to update. For example, entering 500 into the Overall input field will allow me to display the +/- impact on margin requirements for a change of 500 shares on each position.

If you select the button By asset type from the position increment row, you will activate the Edit button. Click to edit default position size by asset class. As you can see here, my default stock position change is 100 shares. Other assets are greyed out as I don’t currently have any positions in those classes.

In the lower right corner, you can select a specific underlying and isolate its position on the display and make adjustment to the single position only. You can revert to the portfolio view by selecting All underlyings from the dropdown menu.

When you make changes, the page will update, but you may use the Refresh button to manually provoke changes.

The Margin Sensitivity tab is helpful in enabling you to measure the impact on margin requirements in advance of making changes to underlyings within your portfolio.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!