In investing, margin refers to the use of borrowed funds from a brokerage to purchase securities, allowing investors to leverage their positions. Rather than paying the full price of an investment upfront, an investor can deposit a fraction—called the initial margin requirement—and borrow the remaining amount from their broker. This strategy can amplify both gains and losses, making it a powerful but risky tool for experienced traders. Margin trading is common in equity markets and is also used in derivatives, futures, and foreign exchange trading.

The core concept underlying margin is leverage, which magnifies exposure to price movements. For instance, if an investor buys $10,000 worth of stock using $5,000 of their own money and $5,000 borrowed on margin, a 10% increase in the stock’s value yields a 20% gain on the investor’s equity. However, the opposite is also true—if the stock falls by 10%, the investor loses 20% of their invested capital. Because of this, brokers require a maintenance margin, which is the minimum equity an investor must maintain in their account. If the account falls below this threshold, the broker will issue a margin call, demanding additional funds or the liquidation of positions.

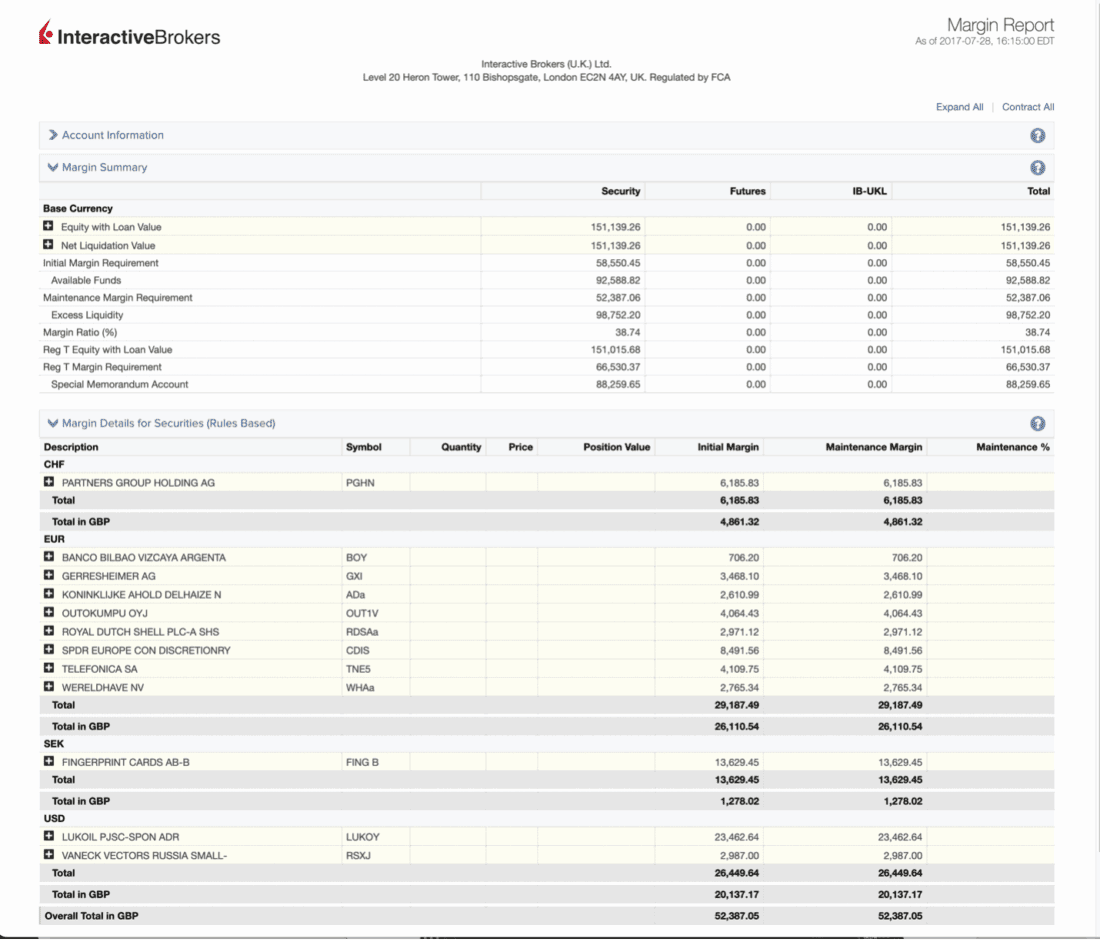

Sample Client Portal Margin Report

Regulatory bodies such as the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) set minimum margin requirements to ensure market stability. For example, under Regulation T, investors must initially fund at least 50% of the purchase price of a margin security. However, brokers may impose higher requirements based on the volatility of the security or the risk profile of the investor. These rules help to limit systemic risk by preventing investors from overextending themselves with excessive borrowing.

Margin is also crucial in short selling, where an investor borrows shares to sell them, hoping to buy them back later at a lower price. In this case, margin serves both to secure the borrowed shares and to cover potential losses. Because short sellers face theoretically unlimited risk—since a stock’s price can rise indefinitely—margin requirements for short positions are typically stricter. This ensures that brokers are protected in case the investor cannot cover their losses.

Despite its advantages, margin trading is not suitable for all investors. It requires careful risk management, ongoing monitoring of account equity, and a deep understanding of market dynamics

Stock Margin vs Futures Margin

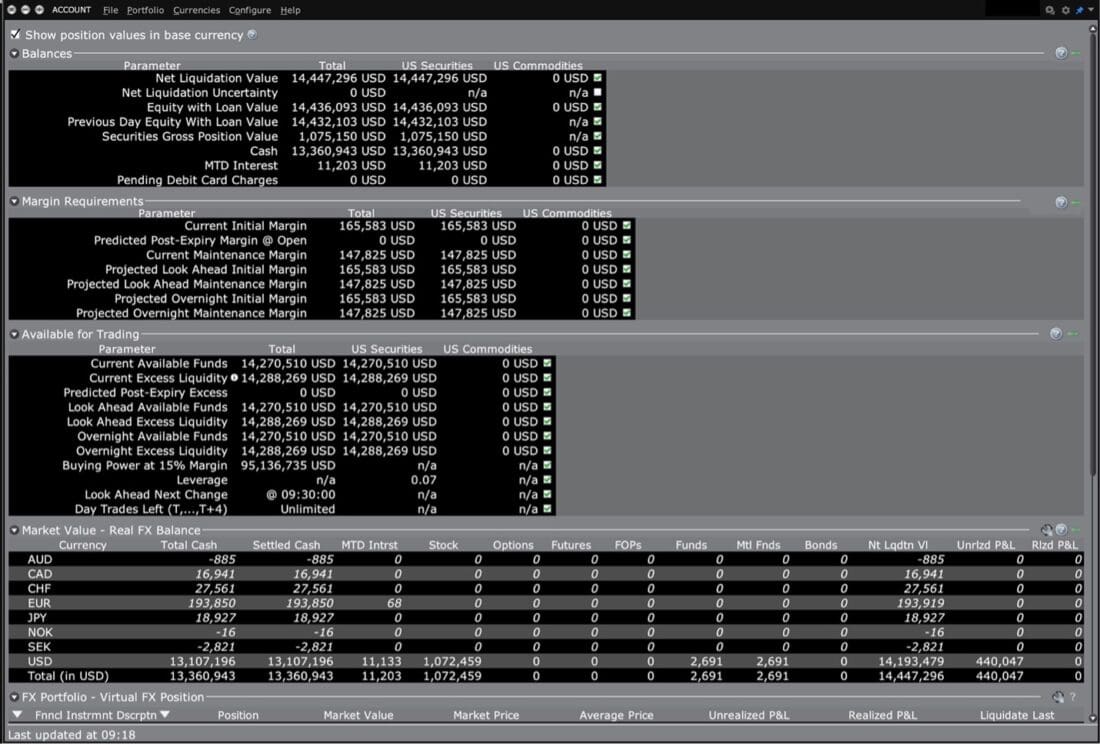

Interactive Brokers makes a clear distinction between stock margin and futures margin. For equities, margin involves borrowing funds—typically up to 50% of the purchase price—from the broker, while the rest comes from your account. Conversely, futures trading doesn’t involve borrowing; instead, you must maintain a cash collateral (initial margin) with the broker to cover potential losses. This requirement is set by the exchange and may include additional broker-defined buffer, functioning as a protective cushion.

Borrowing vs Collateral: Loan Comparisons

IBKR emphasizes the differing ways loans and collateral operate in margin accounts. In stock trading, borrowed cash is treated as a loan that must be repaid with interest. In futures (and options), collateral serves not for borrowing but as a reserve against potential market losses. This separation is essential: loans involve debt and interest, whereas collateral is a security mechanism ensuring coverage for adverse price movements.

Rules-Based vs Risk-Based Margin Frameworks

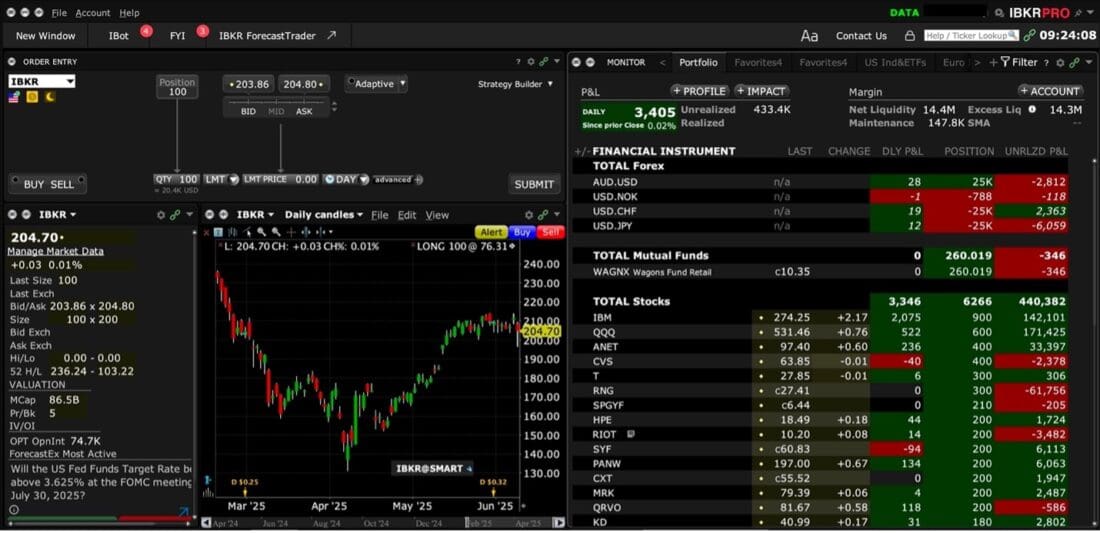

TWS Account Window

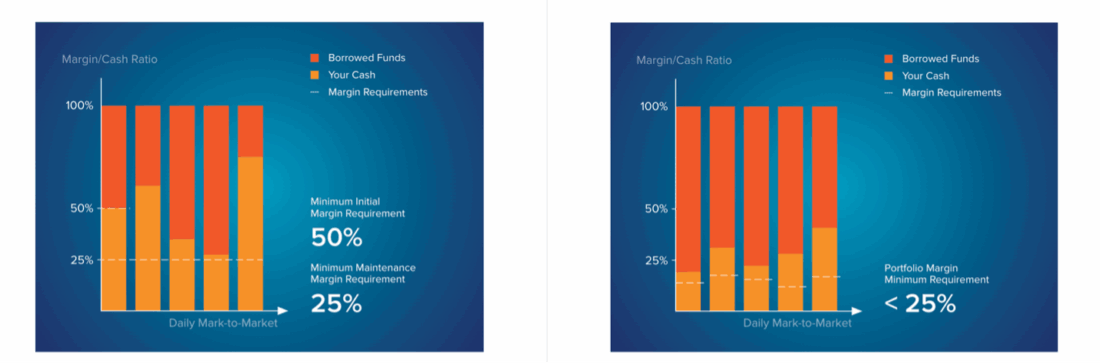

IBKR outlines two principal regulatory margin regimes: rules-based and risk-based. In a rules-based system (e.g. Reg T) margin obligations are formulaic—typically 50% initial margin for stocks—regardless of portfolio diversification. In contrast, risk-based margin aggregates overall portfolio exposures to calculate needed margin via stress-testing or scenario simulations. Th is method often rewards diversified portfolios with lower requirements but may demand more for high-risk positions.

U.S. Securities & Futures Margin Regulation

In U.S. markets, securities are regulated by the SEC while futures fall under the CFTC. Reg T stipulates a 50% initial margin for stocks. However, IBKR extends beyond these base rules by implementing sophisticated risk-based models for margin on futures, options, and securities. These methods help align margin demands more closely with actual market and portfolio risk.

Advanced Margin: Portfolio Margin Accounts

IBKR offers Portfolio Margin for qualifying U.S. accounts with a minimum Net Liquidation Value (e.g. ≥ $110,000). This system utilizes the TIMS (Theoretical Intermarket Margining System), which applies real‑world stress scenarios across positions to reflect actual risk more accurately. While this generally enables higher leverage for well-diversified portfolios, accounts with concentrated exposures may face even stricter requirements. Portfolio Margin is adaptive and continuously recalculated in real time.

Margin Outside the US

The global regulatory regime contrasts with that of the US because most other countries rely on risk-based margining.

Interactive Brokers is headquartered in the US but offers global market access to its clients on exchanges around the world. As a US clearing broker, we are sometimes required to overlay US requirements on top of those local requirements in other countries or regions.

Outside the US there is only one regulatory regime, not one for securities and another for futures.