1/ An Upcoming CPU Boost?

2/ Insurance Down Under

3/ Singapore Versus the World

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

An Upcoming CPU Boost?

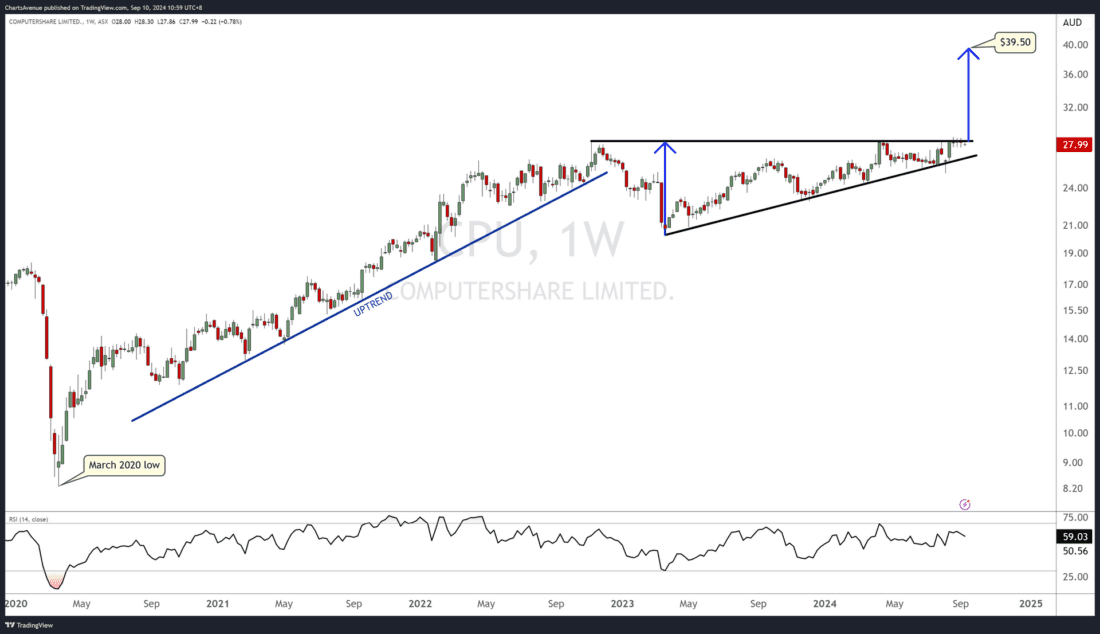

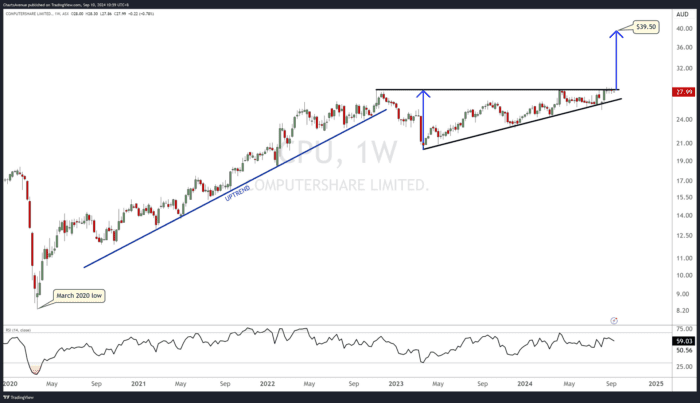

Computershare Limited (technology services sector in Australia – stock code CPU), has been in an uptrend from its March 2020 low to its late 2022 high, followed by a sideways drift. This price consolidation is about to complete a 2 year ascending triangle formation which normally carries a bullish connotation. A projected target of AUD 39.50 can be calculated by taking the height of the triangle at its widest spread and adding it to the breakout area.

It is worth noting that the price has yet to lift through this resistance area (i.e., the top of its ascending triangle around AUD 28.50). As long as the price stays below that level, it is still in consolidation… But as and when this breakout happens, we have a plan, with a defined risk and reward. Definitely one to keep on the watchlist.

2/

Insurance Down Under

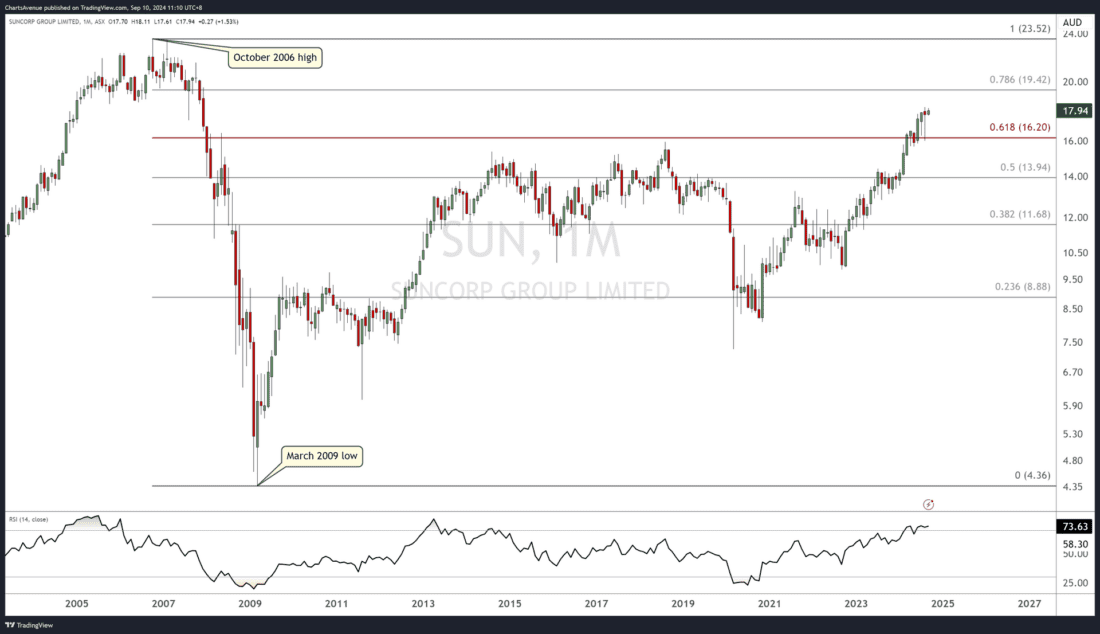

Suncorp Group Limited (finance/insurance sector in Australia – stock code SUN), has been in a price recovery mode since its impressive October 2006 to March 2009 decline. To help identify important technical levels of support and resistance within that range, Technical Analysts frequently use the Fibonacci retracements. These calculated levels then act as resistance on the way up and once the price surpasses them, they then act as support levels.

Back in June, Suncorp was able to move above the 61.8% Fibonacci retracement of the October 2006 to March 2009 decline, which is a positive technical input in the price chart, as the breakout suggests that the stock could rally back to the 2006 highs at AUD 23.52, i.e., a complete retracement of the decline, notwithstanding interim pullbacks.

3/

Singapore Versus the World

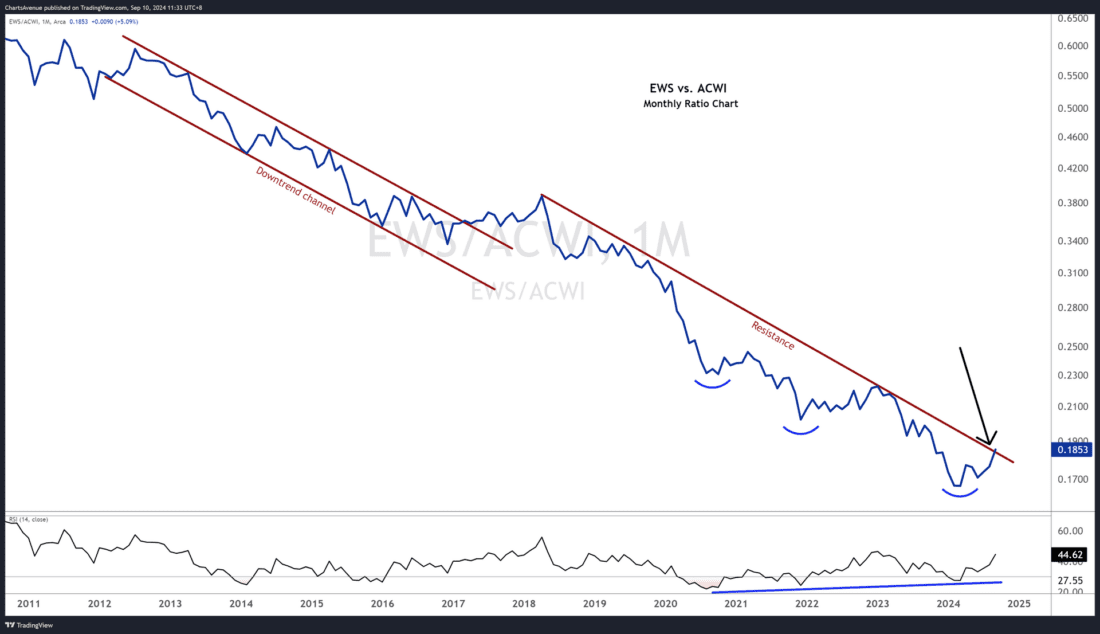

Using a relative-strength chart, is a simple yet very effective way to compare one asset to another. For this type of ratio analysis, a line chart is used instead of candlesticks or bar chart. Here, we compare the iShares MSCI Singapore ETF ($EWS) against the iShares MSCI All Country World Index ETF ($ACWI).

$EWS outperformed $ACWI from October 2008 until August 2010, and again from January 2017 to April 2018. Both periods were followed by steep downtrends. The ratio is currently at the downtrend-line resistance tested in 2019 as well as 2023. If the ratio can get above that level, meaning that $EWS starts a new period of outperformance, then the next step would be to look at $EWS holdings and find those individual stocks with a nice uptrend and/or a bullish setup.

—-

Originally posted 11th September 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!