The Utility Sector is one of the foundational pillars of the economy, providing essential services such as electricity, water, gas, and waste management. It accounts for approximately 5% of the total U.S. GDP, accumulating approximately $1.3 trillion in 2023.[1] The sector’s growth has been steady, with a modest increase of 2.5% between 2021 and 2022, reaching a total market size of $1.2 trillion. The sector is comprised of 109 stocks and has reached a total market cap of $1.5 trillion.[2] As of 2022, the sector employed over 2.1 million workers, representing 1.4% of the total employment in the U.S., showcasing the sector’s contribution to job creation and economic activity. The sector is also closely intertwined and critical in supporting the other sectors of the economy, providing services to companies within the Energy and Materials sectors and their industries. The Utilities sector is widely considered a stable area of investing, as it is dominated by companies that offer singular services that generate constant demand. These companies in which one can invest offer dividend yields that pay well over long periods of time. Despite facing challenges such as regulatory and interest-rate changes, the sector remains resilient, offering investors opportunities for income generation through stable investments and capital appreciation through the constant demand within the sector.

Broader Utility Markets:

The broader Utility Market is characterized by its diversity and stable nature of its different components. The market has seen a gradual but consistent expansion, driven by the increasing demand for energy and infrastructure improvements. Despite the global focus on renewable energy sources, traditional utilities continue to play a crucial role, especially in maintaining grid reliability and supporting the transition to cleaner energy sources. Traditional utilities continue to comprise major industries that are closely interlinked on a private-public level worldwide. The transition to renewable alternatives and sustainable technology has also been catalyzed by the industries within these markets. Investment in infrastructure projects, such as smart grids and energy storage solutions, has been a focal point, aiming to enhance efficiency and sustainability. The sector’s resilience is evident through its ability to adapt to changing environmental regulations and consumer preferences, with a notable shift towards sustainable and green initiatives.

Industries of the Utility Sector:

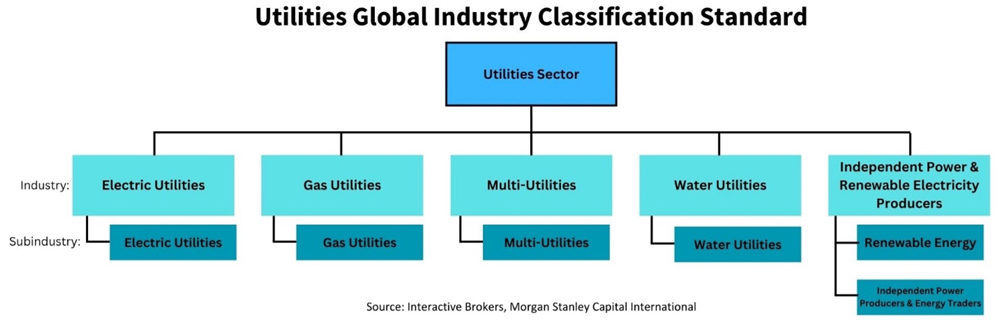

Under the umbrella of the Utility Sector, there are numerous industries and subindustries that comprise the sector and categorize the companies and businesses within it. Each of these industries plays a unique role in meeting the nation’s energy needs and managing essential resources. The Electric Utilities industry focuses on generating electricity from various sources, including fossil fuels and renewables. The Gas Utilities industry ensures the safe and efficient delivery of natural gas to residential, commercial, and industrial customers. The Water Utilities industry manages the provision of clean drinking water and wastewater treatment, while waste management and remediation services handle solid waste disposal and environmental cleanup. The Independent Power and Renewable Electricity Industry is at the forefront of developing and implementing sustainable energy technologies. Lastly, the Multi-Utilities Industry relates to companies that offer a wide range of services and products relating to energy, environmental services, disposal, or infrastructure.

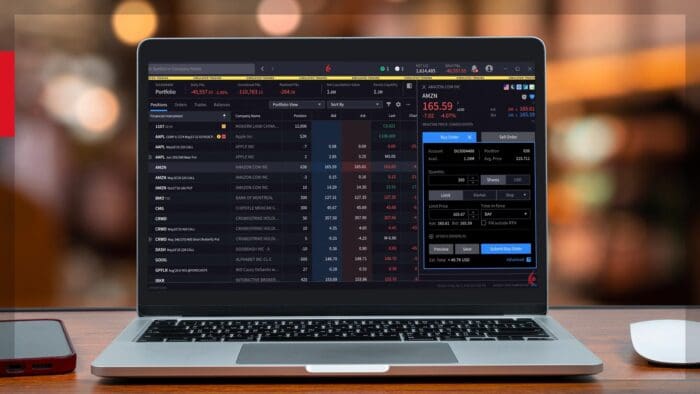

Investing in the Utility Sector:

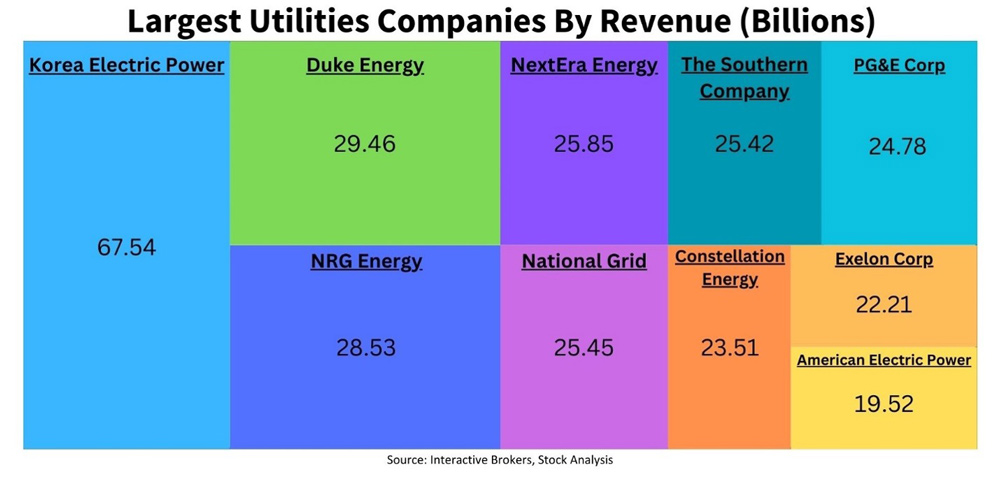

Investing in the Utility sector offers a potential stable and reliable return due to the essential nature of the services provided.When investing in the Utility Sector, one can choose to either invest in a variety of companies across the sector or purchase shares within an individual industry. However, there are certain risks that are common to all utilities. The first risk is that rising long-term interest rates can negatively impact the share price, especially as alternative investments become more attractive. Similarly, adverse regulatory or legal decisions, as well as changes is commodity prices such as natural gas and electricity, can negatively impact earnings, cash flow, and share price. The last risk is that a weak economy can also detrimentally impact share prices and liquidity.[3] Despite these risks, utilities are typically considered defensive stocks, offering lower volatility compared to other sectors, making them attractive for investors seeking stability in their portfolios. The sector’s regulated nature provides a level of predictability in earnings, as regulators often approve pricing adjustments based on cost-of-service studies. The sector faces some challenges such as the need for significant capital expenditure for infrastructure upgrades and the transition to greener energy sources. Investors should consider the impact of environmental regulations, technological advancements, and the pace of the energy transition on utility companies.Key players in the Utility sector include major companies like Duke Energy Corporation (DUK), NextEra Energy Inc. (NEE), and Southern Company (SO) in the Electric Utilities industry; Chesapeake Energy Corporation (CHK) and Williams Companies (WMB) in the Gas Utilities industry; American Water Works Company (AWK) and Xylem Inc. (XYM) in the Water Utilities Industry; Waste Management Inc. (WM) in Multi-Utilities industry; and First Solar Inc. (FSLR) and SunPower Corporation (SPWR) in the Independent Power and Renewable Energy industry.

Advantages and Disadvantages of Utility Sector Investing:

There are numerous advantages and disadvantages that one must carefully consider when deciding to invest in the Real Estate sector.

In terms of advantages, investing in the Utility sector offers potential cash flows and earnings due to the constant demand that utilities companies provide to people around the country. As previously mentioned, Utilities Sector stocks have the potential fordividend income, which can be particularly lucrative compared to other traditional investments.[4] The sector’s defensive characteristics also make it a reliable hedge against market volatility. In comparison to the S&P 500, the sector has historically performed below the index yet has proved more consistent. On a 5-year basis, the sector has grown 40.59% in comparison to the S&P’s 82.59% growth.[5]

However, the sector’s growth prospects are influenced by regulatory frameworks, environmental concerns, and the pace of technological change. The Utilities industries are heavily regulated, which means the companies within the sector have fewer competitors, giving them certain monopolistic capabilities. These regulations also allow the government to dictate how much these companies can charge customers, meaning that utilities have lower earnings potential and companies cannot adjust their prices when commodities costs rise.[6] Furthermore, the transition to renewable energy sources poses both opportunities and challenges for utilities, requiring them to invest in new technologies and business models. The sector’s reliance on long-term contracts and regulatory approvals introduces risks related to regulatory changes and the ability to pass through cost increases to consumers.

Future Outlook and Opportunities:

The Utility sector is poised for potential growth, driven by the need for infrastructure modernization, the integration of renewable energy sources, and the pursuit of sustainability goals. The sector’s future will likely be shaped by the balance between maintaining reliability and affordability for consumers, while transitioning to a low-carbon economy. Investments in digital technologies, such as smart meters and grid management systems, offer opportunities for improved operational efficiency and customer service. It is likely that the transition to alternative energy sources will project the continued growth of this sector in the future.

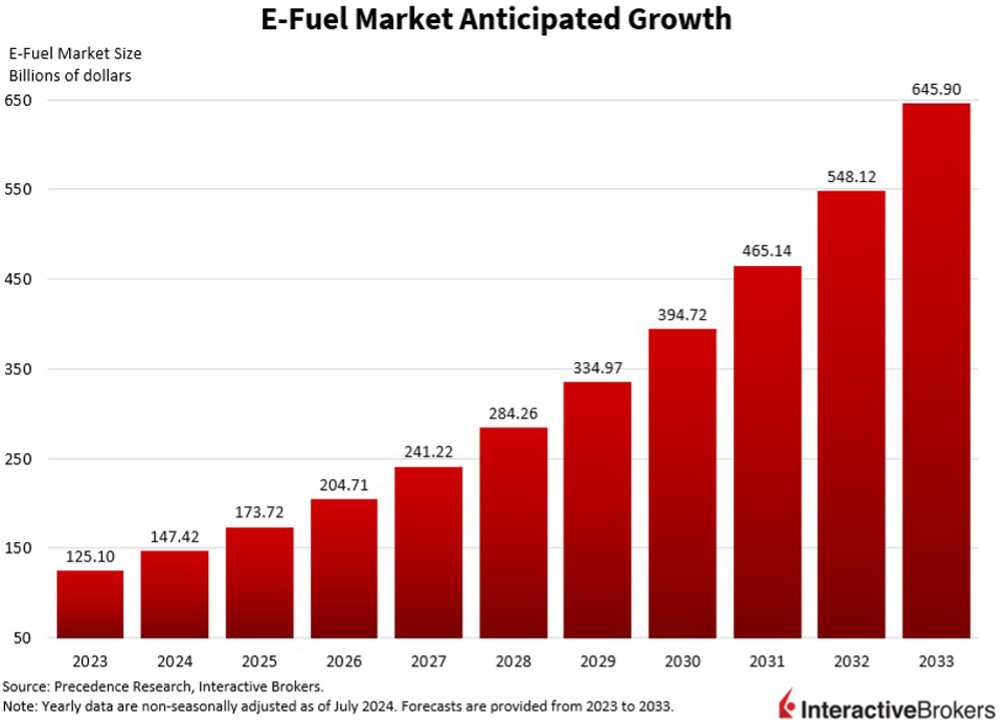

For example, the E-fuel market is expected to grow exponentially over the next ten years, at a compounded annual growth rate of 17.83%. The market is expected to reach a value of $645.9 billion by 2033.[7]

The Utility sector’s long-term outlook is supported by the increasing demand for energy and the need for reliable and sustainable infrastructure, despite the challenges posed by climate change and regulatory uncertainties. It is a valuable sector for investing as it provides stable returns and high dividends in a market that has constant demand.

Resources

https://www.spglobal.com/spdji/en/indices/equity/sp-500-utilities-sector/#overview

https://www.spglobal.com/spdji/en/indices/equity/sp-500-utilities-sector/#data

https://www.spglobal.com/ratings/en/sector/u-s-public-finance/utilities

[1] https://tradingeconomics.com/united-states/gdp-from-utilities

[2] https://stockanalysis.com/stocks/sector/utilities/

[3] https://www.edwardjones.com/sites/default/files/acquiadam/2023-06/investing-in-the-utilities-sector.pdf

[4] https://www.forbes.com/advisor/investing/best-utilities-stocks/

[5] https://finance.yahoo.com/sectors/utilities/

[6] https://www.chase.com/personal/investments/learning-and-insights/article/what-to-consider-when-investing-in-utilities [7] https://www.precedenceresearch.com/e-fuel-market

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!