Now that you’ve become familiar with how to apply and configure watchlists in TWS, we’ll now explore how to search for, and select, specific fixed-income instruments to add to them.

Since the Monitor panel has been configured with information you may want on-hand, you can start to locate and add bonds to your watchlists. In this lesson, we’ll demonstrate several different methods you can use to add U.S. government debt securities.

When bonds are issued, they are designated a unique identifier known as a CUSIP. If you know a bond’s CUSIP, you can type it into a cell to load that bond. IBKR also has its own unique identifier known as an IBCID, which may also be used.

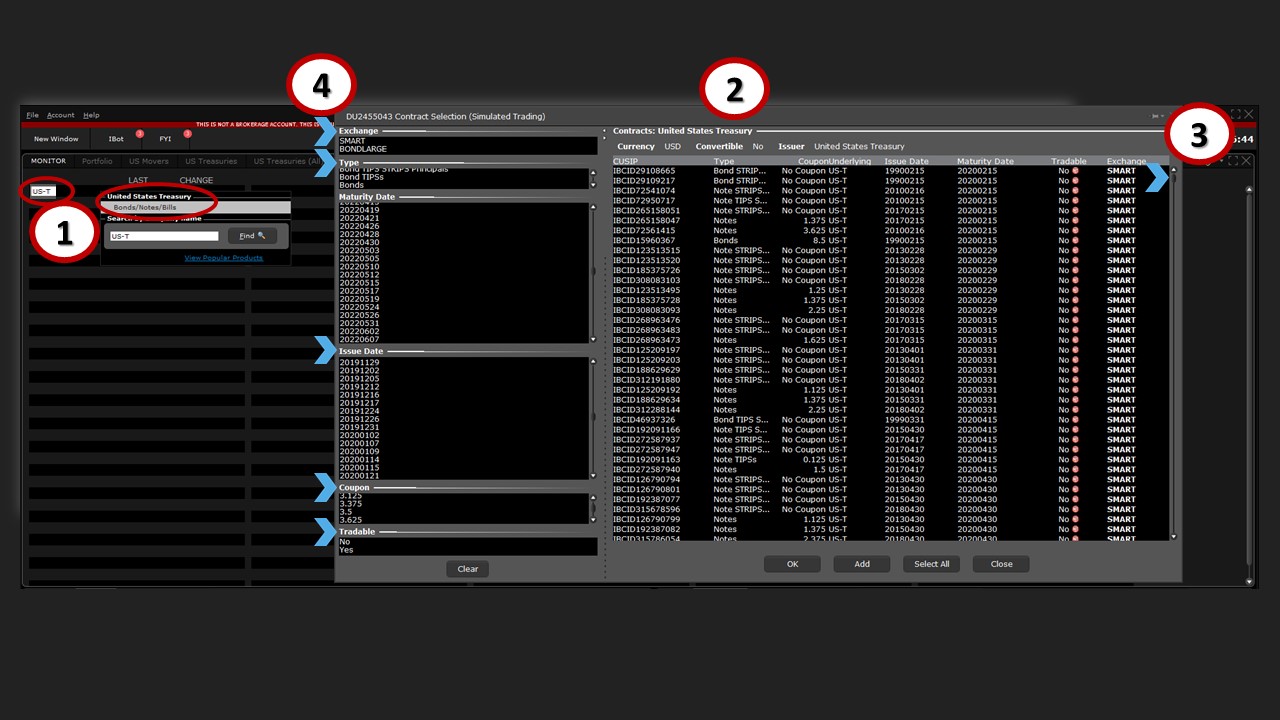

While we’ll examine using CUSIPs and IBCIDs later in this lesson, for now, to locate any U.S. government-issued debt, simply (1) type ‘US-T’ into a cell and select enter.

You may choose to add bills, notes, and bonds to your watchlist by pressing the enter key, or by clicking to open (2) the Contract Selection box. From here, you can locate products you wish to trade and add them to your display. To the right, you’ll see (3) a scrollbar, which, when you drag it down, you can see the vast selection of debt instruments from which to select.

The filters in (4) the column to the left of the Contract Selection tool are designed to help refine your search by:

- Exchange,

- Type,

- Maturity Date,

- Issue Date,

- Coupon, and

- Trading Availability using TWS.

In later examples, you’ll also see a currency filter.

Exchange Filter

Select Bondlarge from the Exchange filter to enable you to see on-the-run or active maturities. Notice that there are just a handful of active U.S. Treasuries at any one time, and the display is ranked by Maturity Date from nearest to farthest. Notice also under the CUSIP column that each bond is assigned its unique IB identifier – the IBCID. The instrument type is also listed, as well as coupons.

Meanwhile, selecting Smart from the Exchange filter displays all available issues.

Type Filter

The Type filter displays the available number of bond or bill types. The type is also displayed above the contracts listed in the center of the page. When you click on each debt type from this filter, the display returns just those instruments that match the selection.

Maturity Date Filter

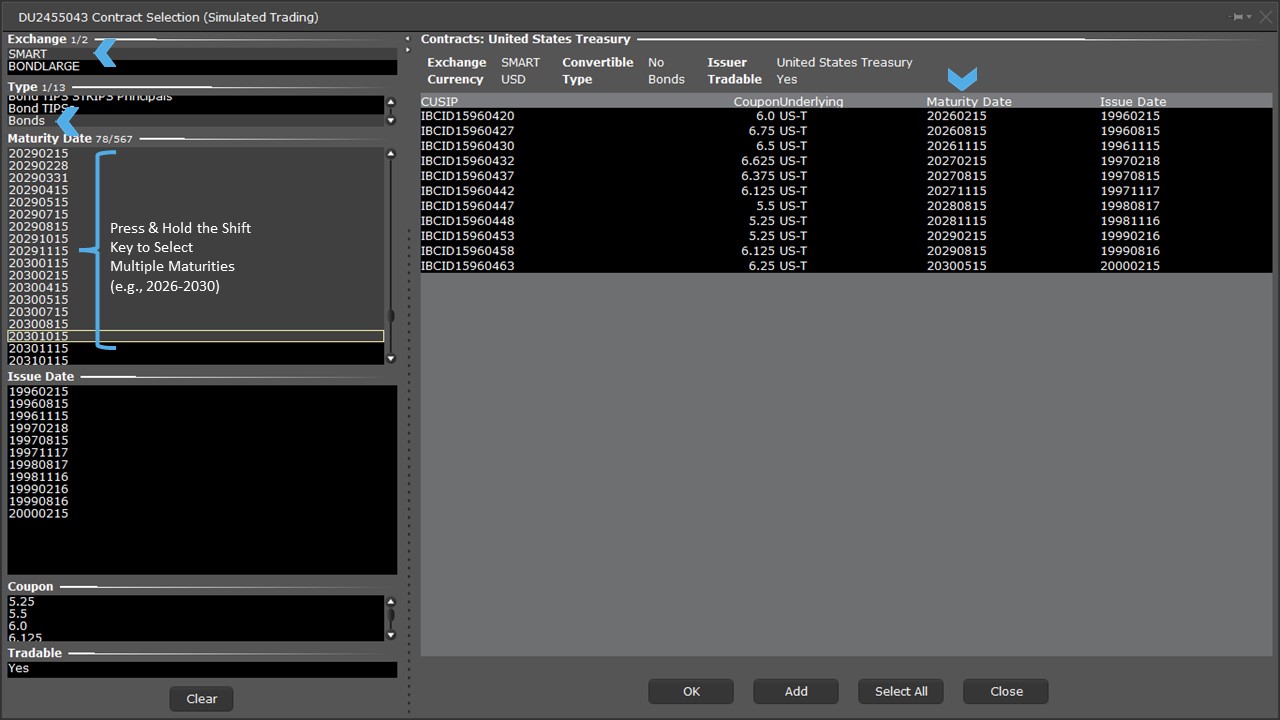

By selecting a specific Maturity Date for your search, the number of available issues should shrink dramatically. You may select multiple dates at the same time by holding down the shift key and clicking suitable maturity dates.

For example – by selecting Bonds from the Type filter, the search will only return a single issue for each Maturity Date. You can also see a single-Issue date in the filter below from that year. Below that you will see a single coupon listed to describe that bond’s unique profile.

You may also select a range of dates — for example, from 2026 through 2030 – and the search will return a list of bonds within that range from which to choose.

Issue Date and Coupon Filters

Each bond has its own issue date, and the Coupon filter also reflects this change to the search. This may help you locate a bond within a suitable maturity range and specific desired coupon.

To add one of these to your Monitor, click on the line in the Contract Selection tool and use (1) the Add button at the bottom of the page.

Click additional bonds if you wish and click Add. You may also select multiple bonds by depressing the shift key and clicking Add, or choose the Select All button, which will highlight all instruments on display and then Add them to the Monitor page.

Remember – if you wish to add any U.S. government securities, always start with ‘US-T’ for U.S. Treasury.

Hello, I am new to IBKR. I was buying (at Market Price) $171,000 face value of the Treasury Bill (CUSIP: 912796CX5). I placed the buy order around 08:30 am EDT on 11/02/2023. During the whole day, it had only filled $111,000 with $60,000 open order remaining. Why it is not instant and why it takes so long and is still not completely filled. At Charles Schwab, when I bought a U.S. T Bill, the buy order was filled instantly. Am I doing something incorrect? What if I need to buy a lot more dollar amount of T Bills? Thanks.

Hello, thank you for reaching out. If you have an account-specific question or concern, please contact Client Services: http://spr.ly/IBKR_ClientServices

Customer Service | Interactive Brokers LLC

Interactive Brokers Customer Service contact and mailing information and erroneous trade policy

spr.ly

I am using IBKR Trader Workstation simulator version Build 10.28.0a, and although I have followed the instructions on this tutorial, I did not see the Exchange filter in the Contract selection tool.

Hello Ivan, thank you for reaching out. Please ensure that you have configured your settings correctly in TWS. This can be done by pressing Edit> Global Configuration> Features. Please make sure that all of the settings on this screen are enabled. Please view this User Guide for more detailed instructions: https://ibkrguides.com/tws/usersguidebook/configuretws/configgeneral.htm

We hope this helps!