In our previous lesson, we demonstrated how to use the Global Bond Scanner to search, sort, and filter specific criteria for U.S. Corporate Bonds. We’ll now show you how to use the scanner for other fixed-income products.

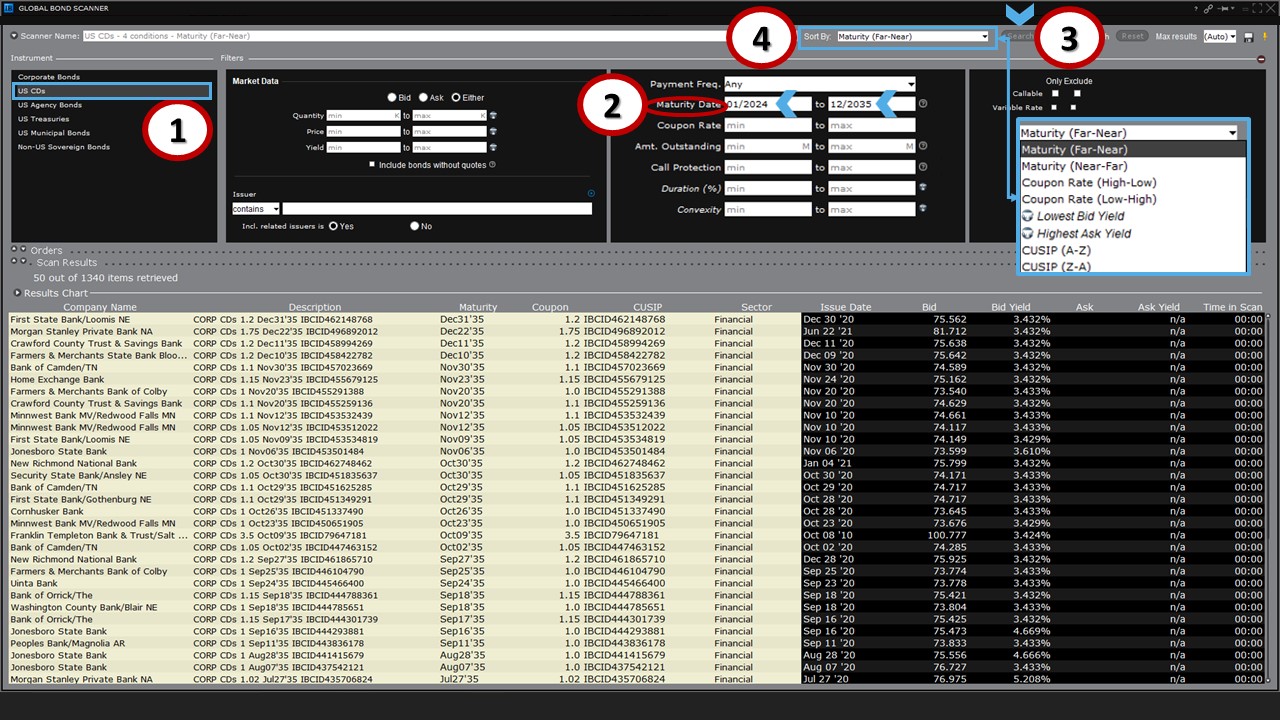

U.S. CDs

When you (1) select U.S. CDs (Certificates of Deposit) in the Instrument section, you can see how the simplified Bond Scanning filters reflect the nature of this instrument. To create a list of available CDs within a date range, (2) enter minimum and maximum maturity dates in the input fields, remembering again to use the month-year format ‘MM/YYYY’.

When done, (3) conduct the search, and thousands of CDs will have been retrieved in the scan results. You can see the various companies that issue the instrument, and, using the (4) Sort By menu or clicking on a column header, you can resort the results by highest or lowest yield.

To examine all CDs from a single entity, enter its name in the issuer input field. For example, (1) type “Ally” and (2) search – this will reduce the results (a) to only those CDs issued by Ally Bank.

(Recall also that these results are limited to the date range you already entered as part of your search.)

U.S. Agency Bonds

The filter selections for U.S. Agency Bonds are very similar to those for CDs described above. However, Interactive Brokers currently supports only a small selection of agency bonds.

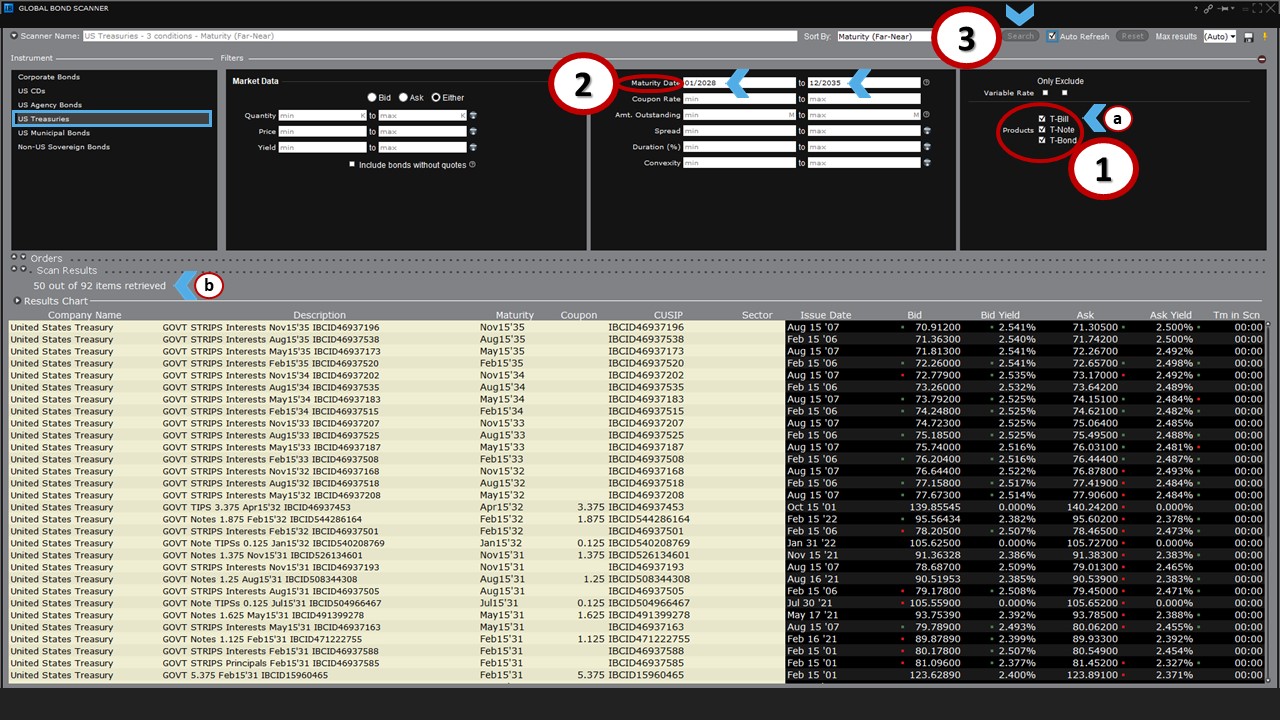

U.S. Treasuries

The scanner’s filters for U.S. Treasuries are similarly straightforward.

Note that in the right section of the filters, (a) the ‘T-bill’ box is checked by default. Before beginning your scan, be sure to (1) check the appropriate boxes for notes and bonds. For example, if you (2) enter a minimum and maximum maturity date range, be sure to also check notes and bonds, as needed, and then (3) click Search. You should then see an array of resulting instruments (b) on which you may wish to conduct further research.

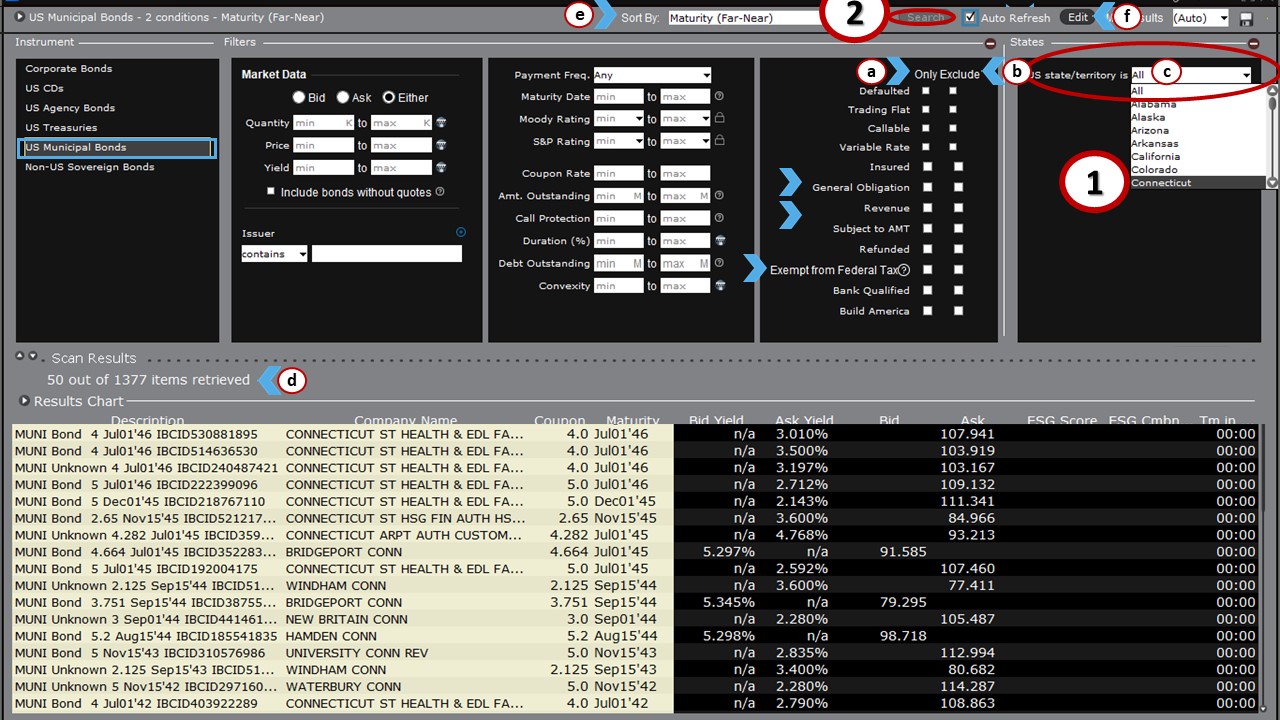

U.S. Municipal Bonds

The U.S. Municipal Bond scanner offers additional filters specific to the character of muni bond issues. For example, you can (a) include or (b) exclude General Obligation bonds, Revenue Bonds or those Exempt from Federal Tax.

To locate bonds available to you as a resident of a specific state, use (c) the dropdown menu to select a state. As the default universe is for all state, you may wish to select one from the list. For this exercise, (1) choose Connecticut, and then (2) click Search. With this search, more than 1,000 issues (d) are returned.

Use the (e) Sort By menu, or click on any column header, to sort the results. You may also use the (f) Edit button to return to the Bond Scanner for additional filtering.

Non-U.S. Sovereign Bonds

Select Non-U.S. Sovereign Bonds to conduct a search for government debt issued by countries outside of the United States.

Among the available filters and input selections that may be used to help home-in on your search are the listings for (a) Issuer Country and (b) Currency. For example, (1) selecting France as the Issuer country and (2) clicking on the Search button will yield a healthy (c) list of results.

But how many of the resulting issues are made in euro currency? To find out, (1) choose EUR for euros from the Currency selector and then (2) Search. You will then see that (a) the same number of bonds is returned, meaning that none is denominated in any currency other than euros.

Note: If you are not seeing Market Data, it could be that either the local market is closed or that you do not currently have market data permission for the exchange where those bonds trade.

Advanced Market Scanner

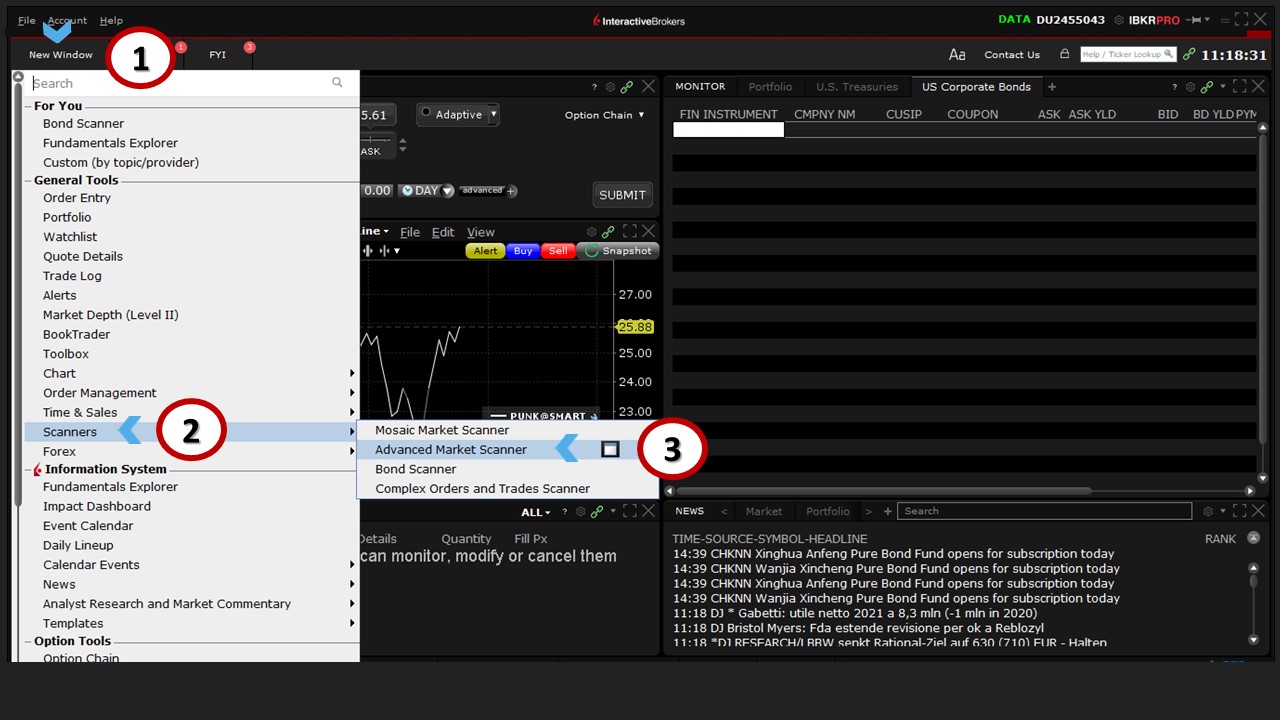

Now that you are more familiar with the Global Bond Scanner, let’s explore the Advanced Market Scanner.

To access this tool, (1) click on the New Window button, (2) select Scanners under the General Tools category, and (3) locate and click on Advanced Market Scanner. When you do, this, too, will open as a new window in TWS.

While this scanner looks very similar to the Global Bond Scanner, there are several other asset classes under (a) the Instrument field from which to select, including U.S. Stocks, U.S. Equity Exchange-Traded Funds (ETFs), U.S. Fixed-Income ETFs, and U.S. Futures, among others.

Scanner Relationship

The filtering capabilities for fixed-income products (e.g., U.S. municipal bonds, U.S. Treasuries, U.S. corporate bonds) in the Advanced Market Scanner are identical to those in the Global Bond Scanner; and configuring the Advanced Market Scanner, for example, by inserting columns such as CUSIP and Issue Date, will also automatically apply to the Global Bond Scanner (i.e., configuration of the two scanners occurs simultaneously. For instance, when a column is added/removed in one scanner, it will also be automatically added/removed in the other.)

Coming Up Next

In our next lesson, we’ll use the Advanced Market Scanner when we show you how you can apply and work with a dedicated Bond Scanner layout in TWS for generating charts and entering orders – all in one place.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!