The Option Chain, available on the IBKR GlobalTrader app, allows the investor to view expirations, calls, puts, and each strike available to trade in a clearly defined, user-friendly screen. Through the GlobalTrader the investor has access to over 30 market centers to trade options.

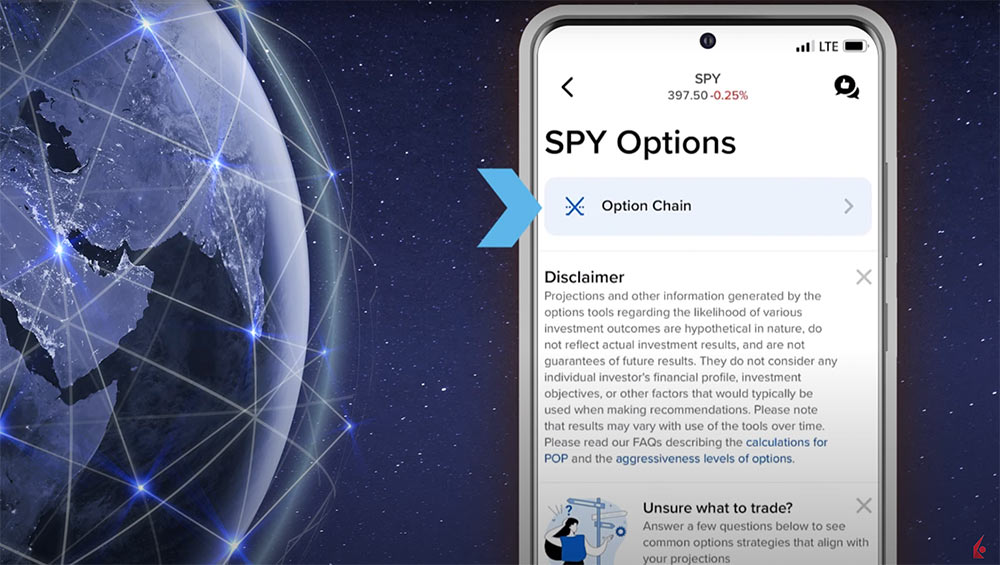

The investor can access the Option Chain by choosing a symbol in the Watchlist, Portfolio, or Explore screen and tapping on the Options icon in the bottom right-hand corner. The Investor can also tap on the blue Trade icon in the lower right-hand corner of any screen, tap on Options and type a symbol or the name of a company into the search bar.

At the top of the screen, the investor taps on the Option Chain icon to bring up the option chain. In the top right corner, the investor can tap on the three dots to bring up the Option Chain settings.

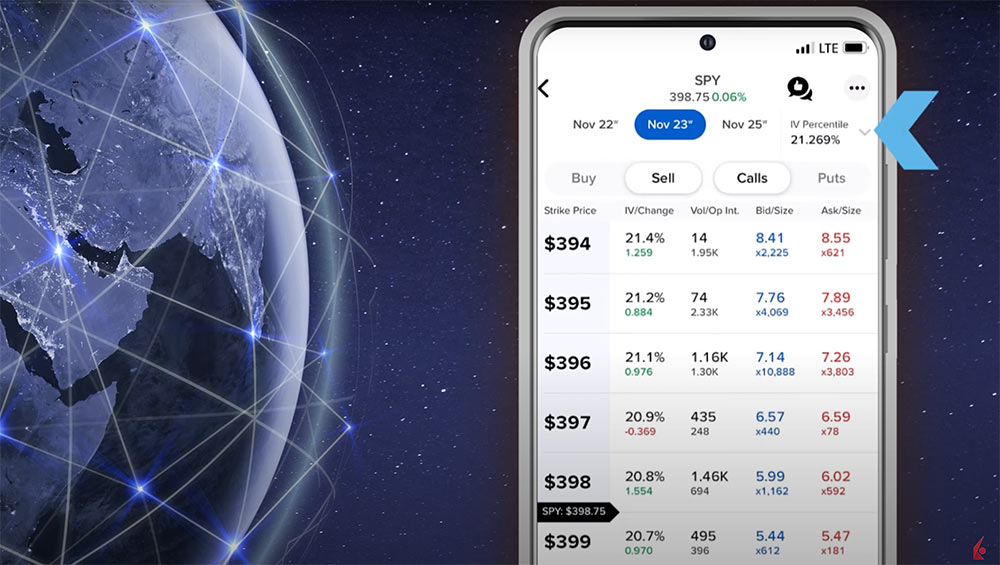

They can choose either simple or detailed columns. The Simple column displays data columns for the breakeven price of the underlying, probability of profit, and either the bid or ask price depending on whether the investor plans to buy or sell. The Detailed column displays data columns for implied volatility, implied volatility change %, open interest, volume, bid price and size, and ask price and size. The investor can also choose to hide or display weekly options, default the view to the Options Chain, or go back to the Option Wizard.

Once the investor has made their setting choices, they should click “done” in the upper right-hand corner to be brought back to the option chain screen. At the top of the screen, the investor can scroll through the expirations and tap on the expiration date they want to create an order for. The investor can expand the information panel by tapping on the arrow next to implied volatility to see the underlying symbol’s:

- Open and closing price,

- Today’s volume and the average volume,

- Dividend amount and the next ex-dividend date if applicable,

- VWAP or Volume-Weighted Average Price,

- Implied volatility

- Implied volatility as a percentage of historic volatility: if the value is greater than one than the implied volatility is greater than the historic volatility, and

- Open Interest

The investor can tap on the “i” at the end of the row to see the data definitions for these terms.

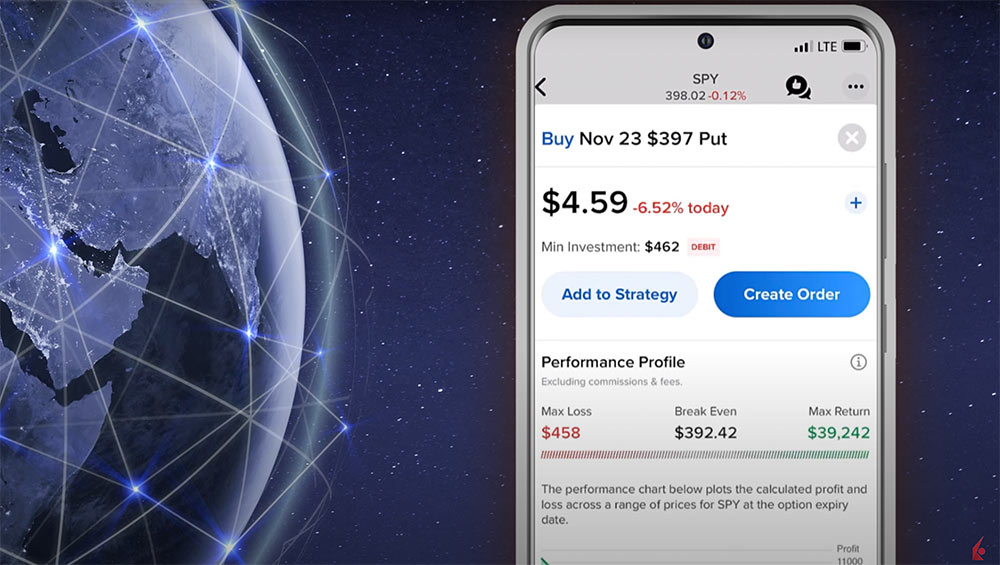

Next, the investor chooses whether they want to buy or sell calls or puts by tapping on the toggles. Once selected the Option Chain will populate with the prices and option data for each available strike in the expiration. Select the strike by tapping on the row and an option information screen will appear that will let the investor either create an order or add the leg to a multi-leg strategy.

The investor can also see the performance profile of the option showing the max loss, breakeven point, and the max return, the market implied probability of profit, as well as market data including:

- Today’s volume

- Open Interest

- Implied volatility percentile, and

- Implied volatility

The Delta, Gamma, Theta, and Vega are located directly below, and if applicable, the next ex-dividend date is at the bottom of the page.

For this example, the investor chooses to create a single leg option order by tapping on the blue Create Order icon and then can set the order type choosing between limit, market, or stop. Notice when order type is selected, a definition appears of each type available. Next, set the price, quantity, and time in force. When clicked, a definition of a Day and Good ’Til Cancel orders are displayed.

When ready, the investor can expand the Performance Profile to see data from the prior screen, tap the Preview button to see an order preview and the effect on margin if applicable, or slide the button in the lower left-hand side to submit the order.

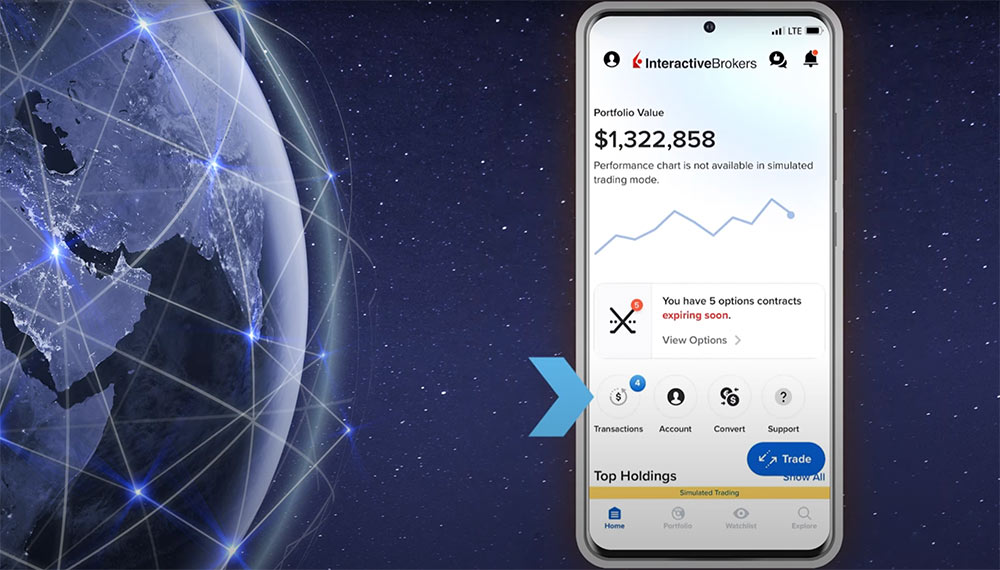

The investor will be notified if the order is filled immediately, or they can monitor its status by tapping on the Transaction icon in the Home screen.

Investors can find more information on Options on the Interactive Brokers website under Education at the Traders’ Academy Options section.

Resources

When will the GlobatTrader support futures options trading?

Hello, thank you for reaching out. At this time, GlobalTrader does not support futures trading. https://www.interactivebrokers.com/faq?id=250358987

However, we have passed your feedback to the appropriate team. Please reach back out with any additional questions. We are here to help!

Irresistible! Thank you so much for this kind and good service.your services is better than better. joinx001@gmail.com https://joinx.me/