Weekly Market Commentary: August 19, 2024

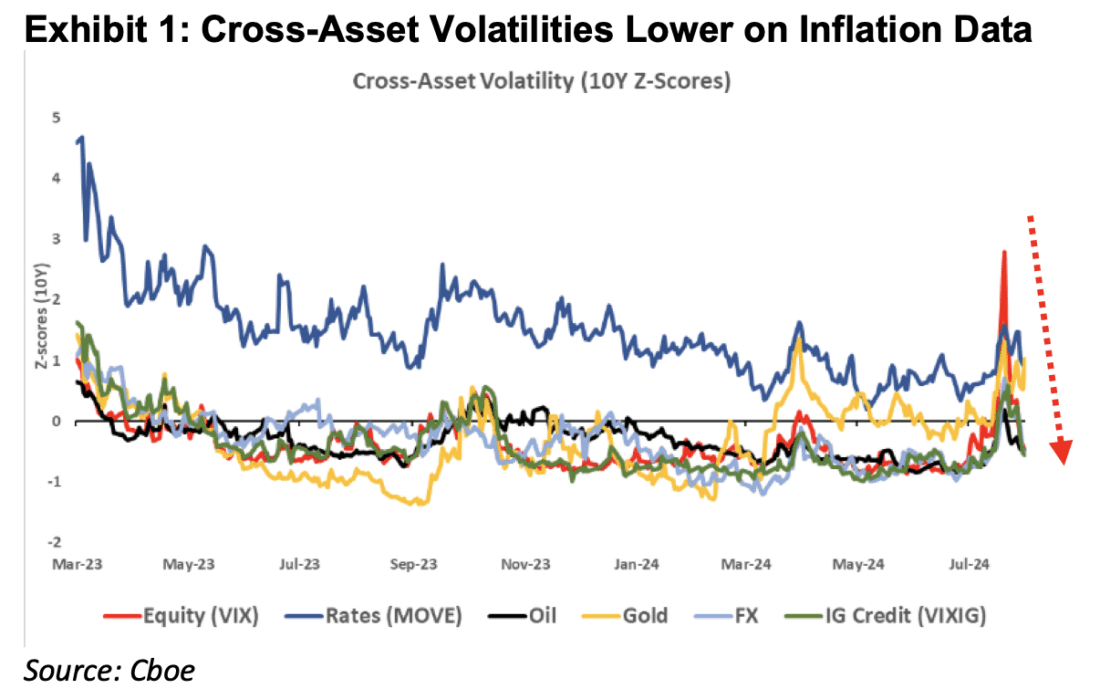

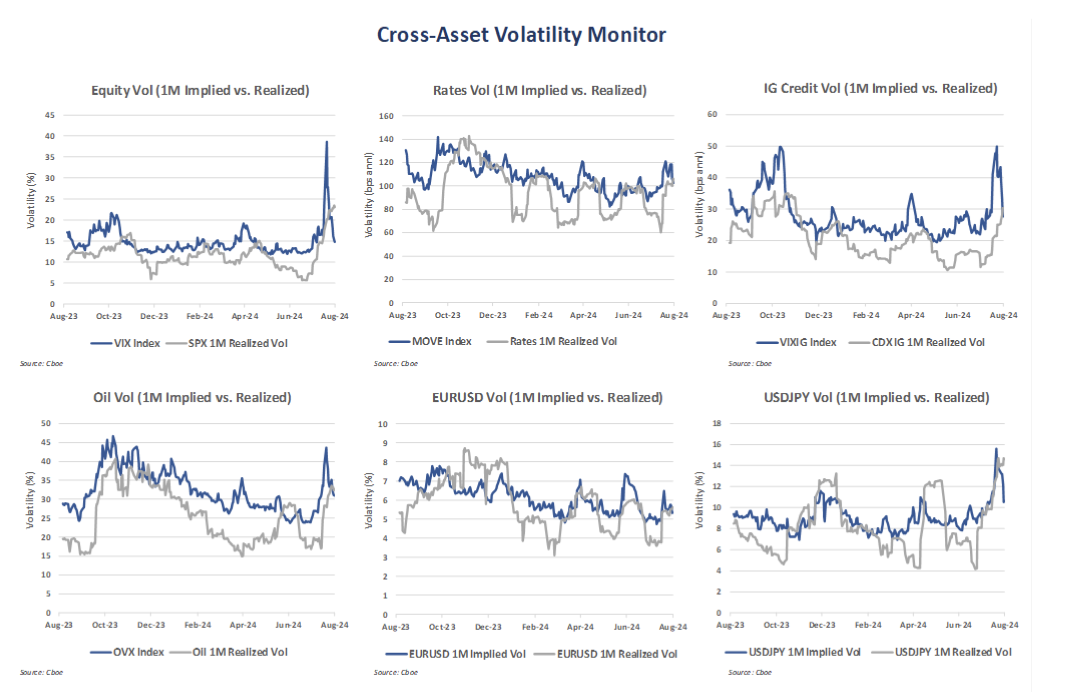

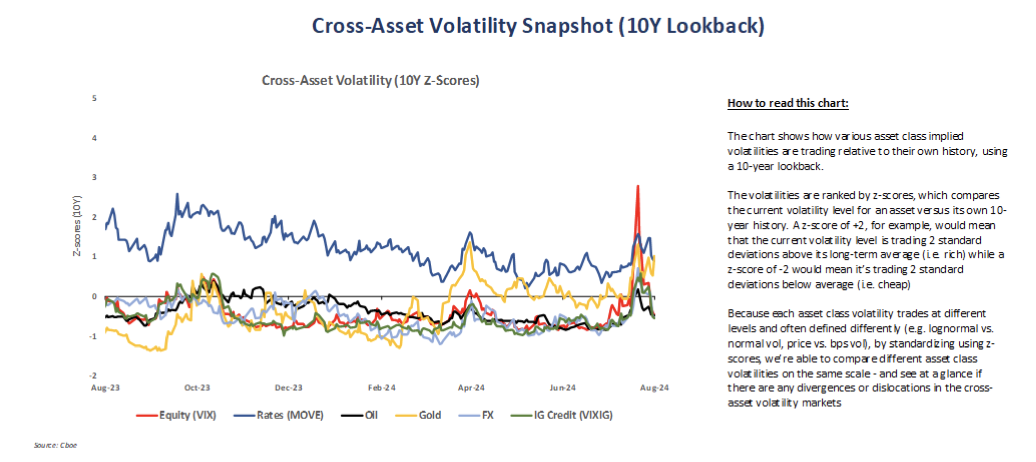

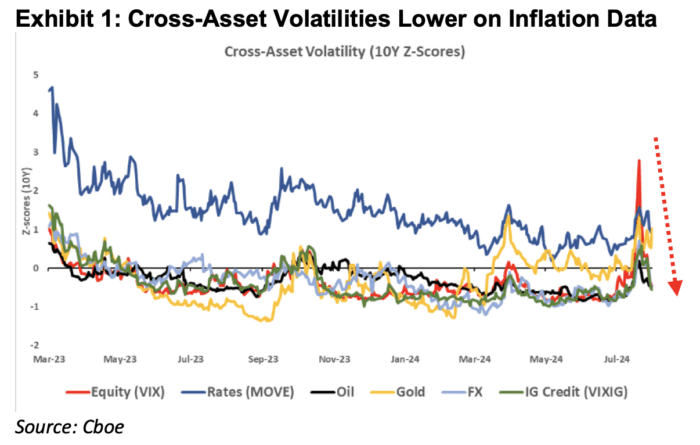

Cross-Asset Volatility: Cross-asset implied volatilities on the whole continued to normalize towards its lower pre-Yen-carry unwind levels on the back of better economic data. Most notable was the sharp wk/wk reversion in USDJPY implied volatilities from its 98th percentile highs at nearly 16% to 10.6% (53rd percentile) as of Friday. NKY implied volatilities followed suit with the VNKY index declining from 45.3% to 26.5%. As a result, the 1M NKY-SPX® volatility spread has tightened considerably and currently trades at just a 1 pt vol premium vs. seasonal historics. The only major asset to evidence higher implied volatility levels was gold (1M imp vols @ 18.0%, 99th percentile) which has seen an increase in bids for downside puts as it broke all-time highs. Nonetheless, with spot gold at $2508, gold skew currently reflects a modest asymmetry to the upside with options traders pricing in ~5% chance that gold rallies 20% above $3000 by year-end vs a ~1% chance it falls -20% below $2000.

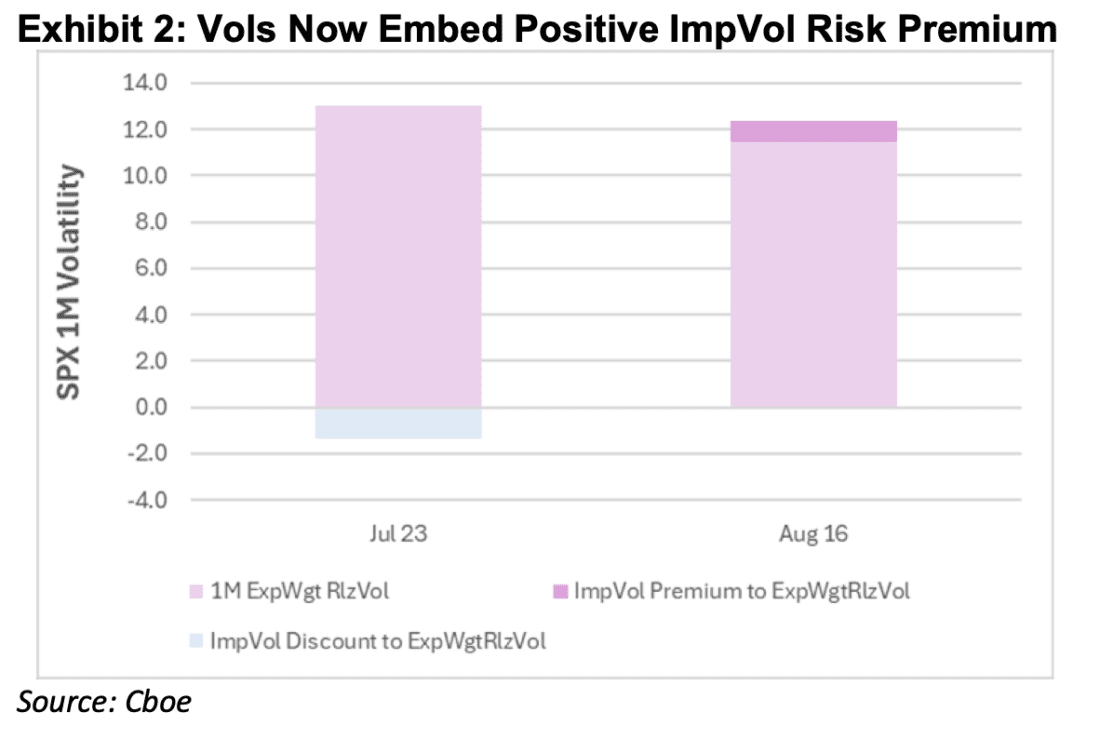

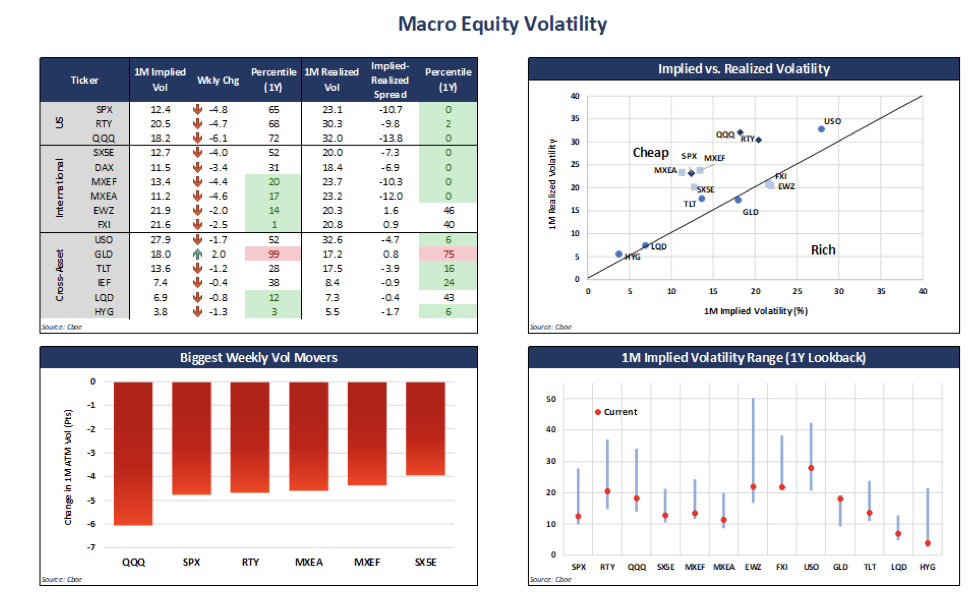

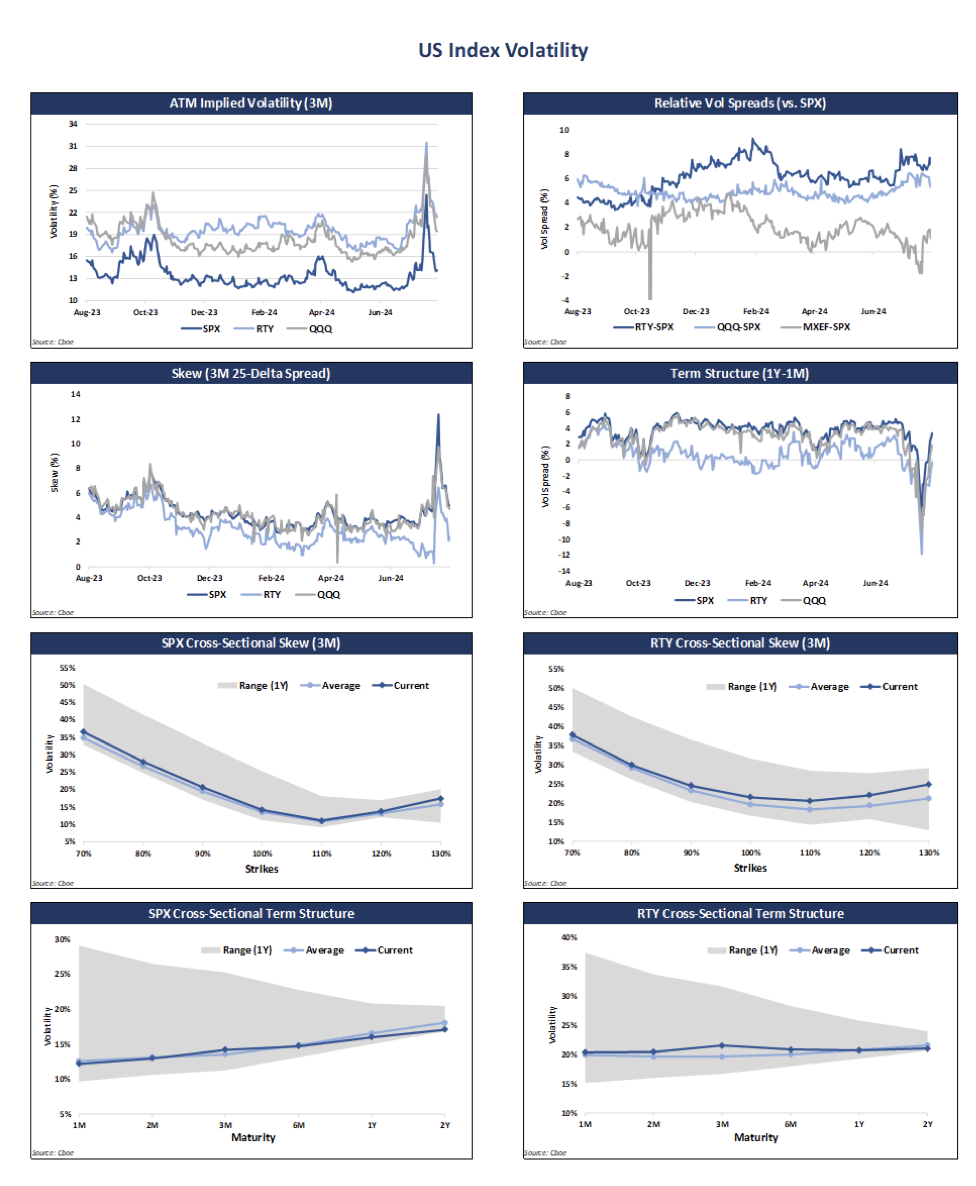

Equity Volatility: Within a span of two short weeks, the US equity markets appear to have made a full recovery from the aftermath of the Aug 5 Yen-carry unwind. Accordingly, we examine whether that shock has had any lasting implications upon the market’s pricing of equity risk. To that end, we referenced the volatility market structure as of July 23, 2024 when the closing price of S&P-500 index was virtually identical to last Friday’s close (5555.74 vs 5554.25).

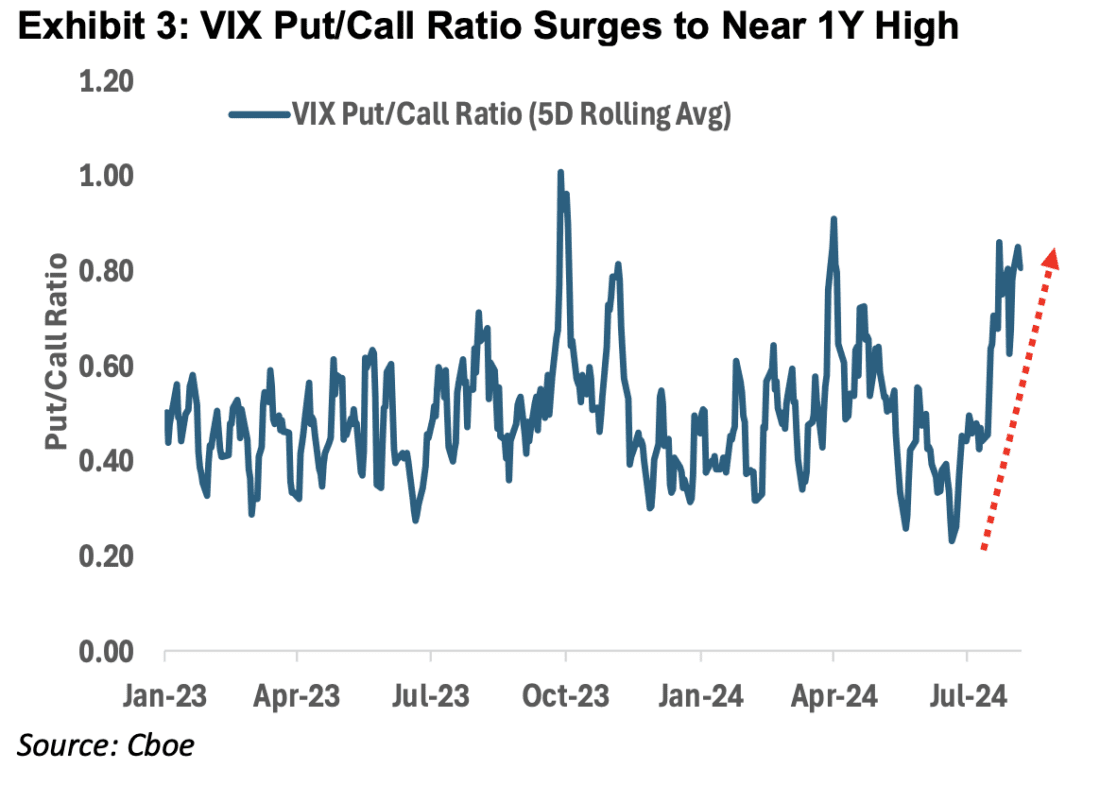

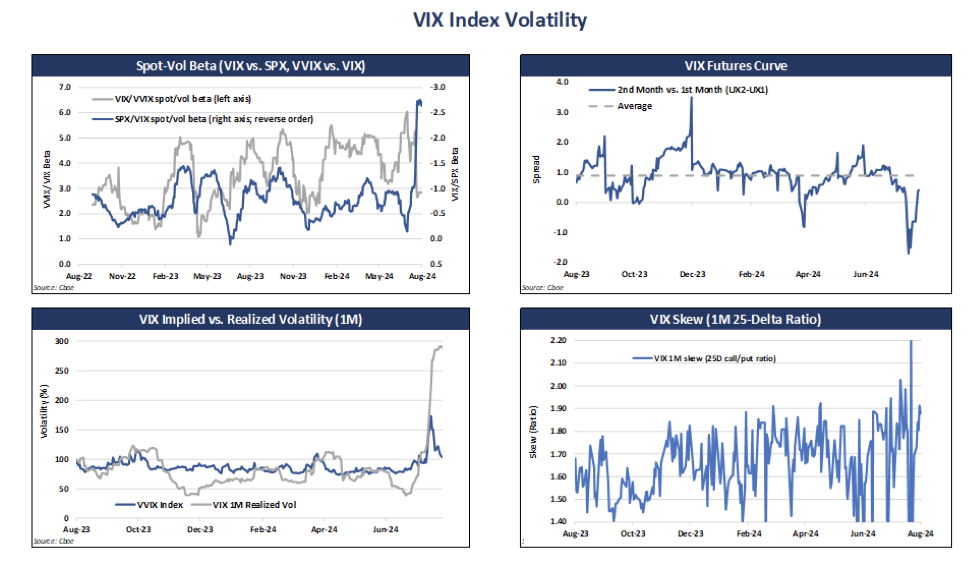

We find that although the nominal level of expected market risk between the two dates are also similar (VIX® Index at 14.72 vs 14.8) there are 2 significant differences post Aug 5. Whereas ATM SPX implied vols previously traded at a ~1 vol pt discount relative to 1-month exponentially weighted realized volatility (i.e., realized volatility weighted towards the most recent week’s market action) which reflects the demand to harvest yield by selling the implied volatility risk premium, SPX implied vols now trade at a +1 vol pt premium to realized volatility, indicating a net demand for market optionality by paying the implied volatility risk premium. In a similar vein, current vol-of-vol also trades at a 17% premium vs. Jul 23 (VVIX Index = 103 vs 87), signaling heightened uncertainty in the vol regime. While VIX put demand surged in the immediate aftermath of the recent vol spike, with the put/call ratio jumping to near a 1-year high, call demand has picked up in recent days as the VIX index has gone sub-15.

Skew: Skew flattened wk/wk on the strength of the market rally. Interestingly, a comparison of skew positioning relative to Jul 23 shows similar demand for downside puts but a notable decline in the demand for upside calls resulting in a comparably steeper negative S&P skew gradient now vs then.

—

Originally Posted August 20, 2024 – Volatility Normalizes Yet Caution Remains

Disclaimers:

| • The information provided is for general education and information purposes only. No statement provided should be construed as a recommendation to buy or sell a security, future, financial instrument, investment fund, or other investment product (collectively, a “financial product”), or to provide investment advice. • In particular, the inclusion of a security or other instrument within an index is not a recommendation to buy, sell, or hold that security or any other instrument, nor should it be considered investment advice.• Past performance of an index or financial product is not indicative of future results. |

| • The views expressed herein are those of the author and do not necessarily reflect the views of Cboe Global Markets, Inc. or any of its affiliates. • There are important risks associated with transacting in any of the Cboe Company products or any digital assets discussed here. Before engaging in any transactions in those products or digital assets, it is important for market participants to carefully review the disclosures and disclaimers contained at: https://www.cboe.com/us_disclaimers/ • These products and digital assets are complex and are suitable only for sophisticated market participants. In certain jurisdictions, including the United Kingdom, Cboe Digital products are only permitted for investment professionals, certified sophisticated investors, or high net worth corporations and associations. • These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. • Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle. • © 2024 Cboe Exchange, Inc. All Rights Reserved. |

Disclosure: Cboe Global Markets

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies are available from your broker, or at www.theocc.com. The information in this program is provided solely for general education and information purposes. No statement within the program should be construed as a recommendation to buy or sell a security or to provide investment advice. The opinions expressed in this program are solely the opinions of the participants, and do not necessarily reflect the opinions of Cboe or any of its subsidiaries or affiliates. You agree that under no circumstances will Cboe or its affiliates, or their respective directors, officers, trading permit holders, employees, and agents, be liable for any loss or damage caused by your reliance on information obtained from the program.

Copyright © 2023 Chicago Board Options Exchange, Incorporated. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Cboe Global Markets and is being posted with its permission. The views expressed in this material are solely those of the author and/or Cboe Global Markets and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking the link below. Multiple leg strategies, including spreads, will incur multiple transaction costs. "Characteristics and Risks of Standardized Options"

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!