I am by no means a trained quantum physicist, but a famous thought experiment from that field seems to best express options pricing in the current market environment. Somehow protective puts they are both expensive and cheap at the same time.

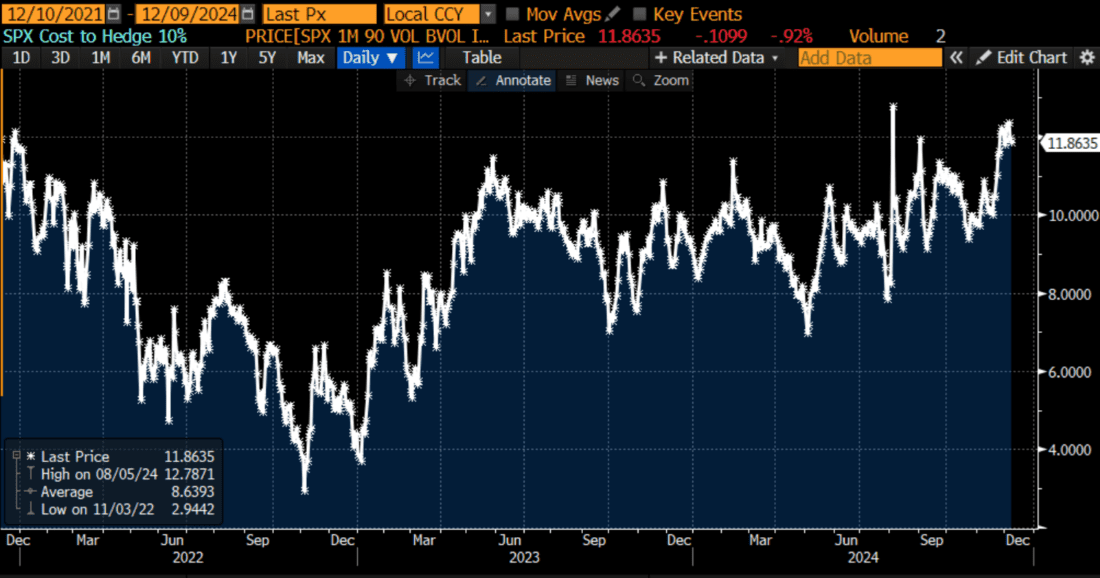

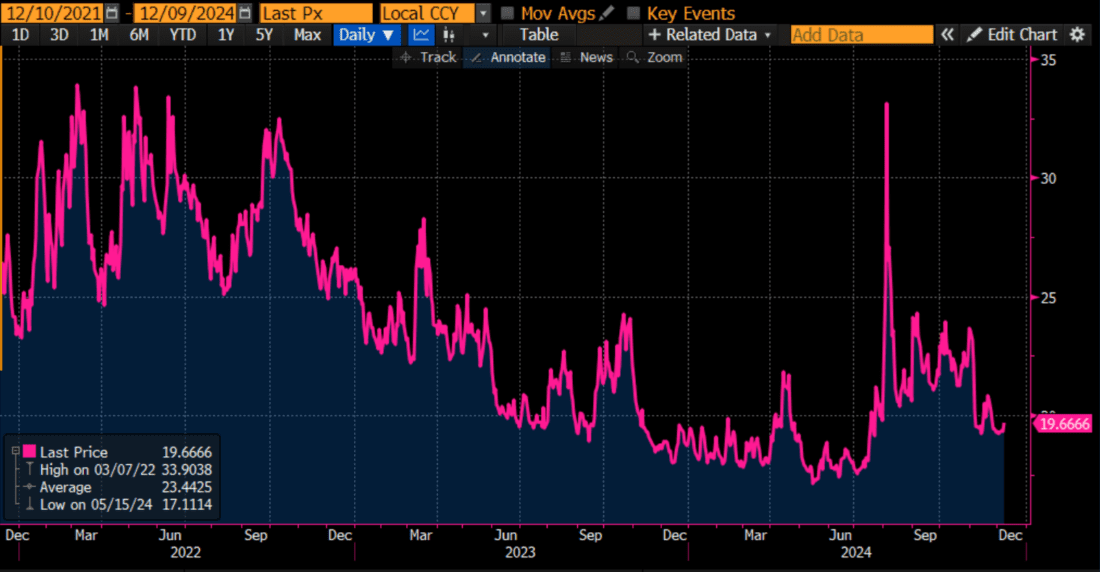

You might ask yourself how that can be. In a piece last week, we pointed out that for S&P 500 Index (SPX) puts with 1-month to expiration, the implied volatility of options with 90% moneyness (aka 10% out of the money puts) was at a multi-year high versus those with 100% moneyness (or at-money options). Yet at the same time, in absolute implied volatility terms, those protective puts were trading near multi-year lows. Updating those charts, we see that is still generally the case:

Difference in Implied Volatilities between 1-Month SPX Options with 90% vs. 100% Moneyness, 3-Years

Source: Bloomberg

Note that outside August’s one-day hiccup when the yen carry trade imploded, the prior high for the spread was in December 2021. A multi-year top for SPX occurred on January 3rd, 2022. Just saying…

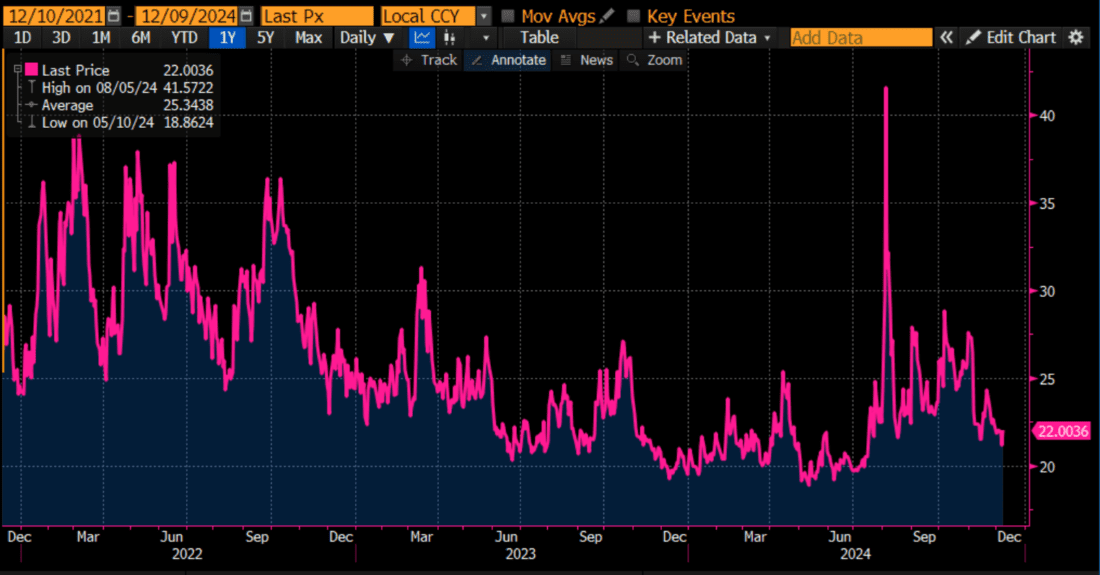

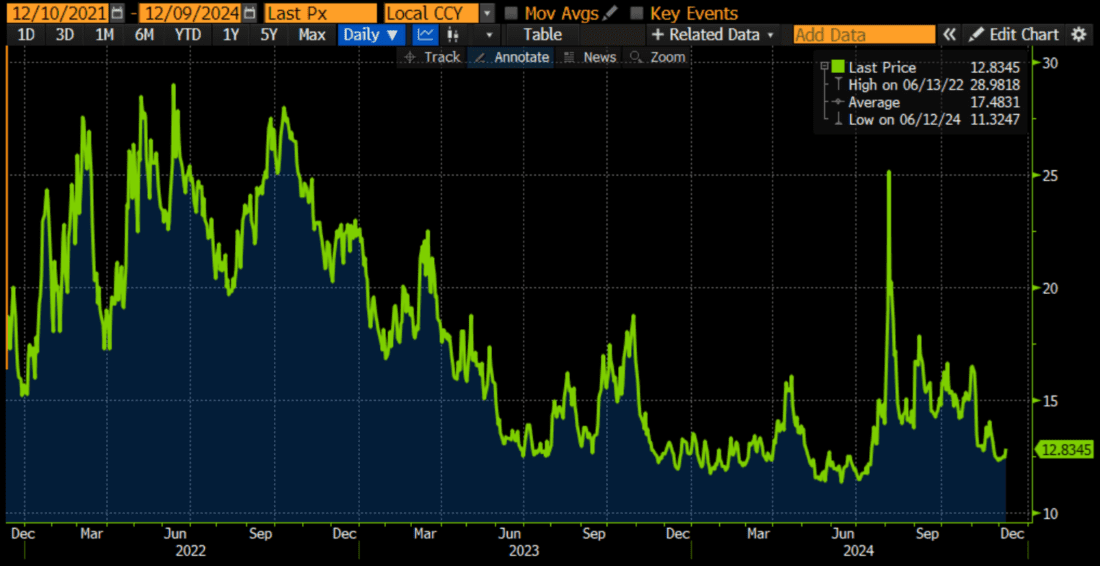

Implied Volatility of SPX 1-Month, 90% Moneyness Options

Source: Bloomberg

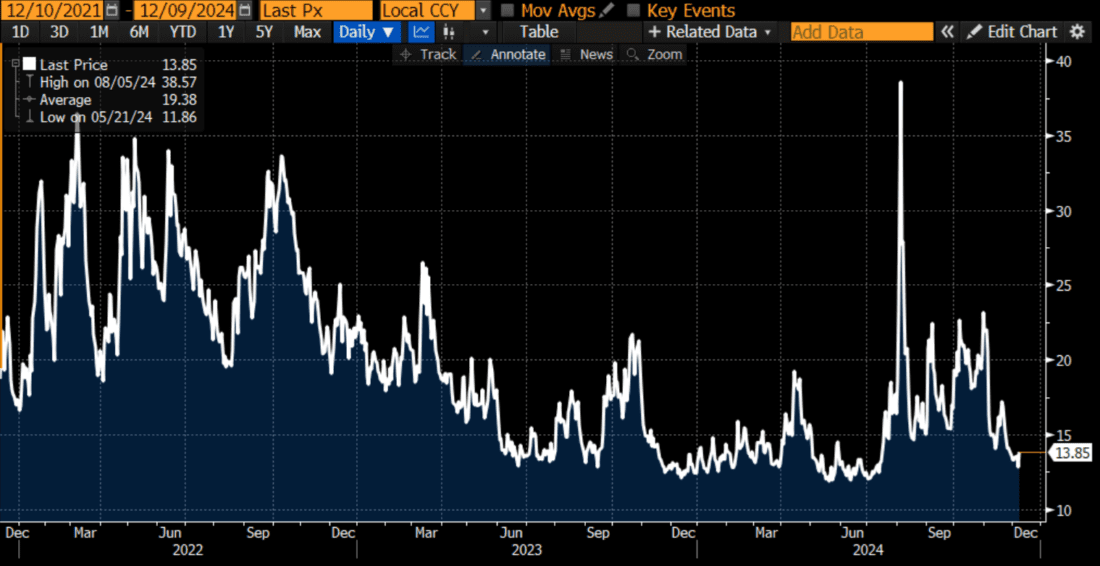

The reason for the seeming disparity is that the implied volatility of at-money SPX options has plummeted even faster than the below-market options. Note that we saw that implied volatility fall into single digits on Friday, before recovering slightly today on this morning’s modest market selloff.

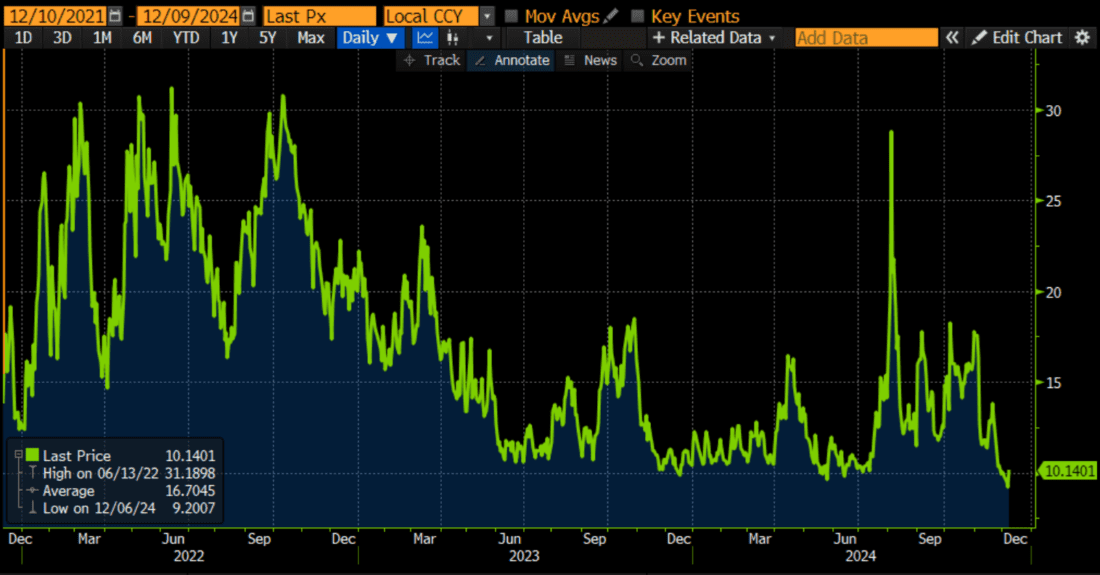

Implied Volatility of SPX 1-Month, 100% Moneyness Options

Source: Bloomberg

But then it occurred to me that we may not be focusing on the proper time period. Normally, one-month is a reasonable timeframe for contemplating portfolio hedges. This year, however, might be an exception. We are in a bit of a post-election honeymoon, and the new administration won’t be inaugurated for another six weeks. That means that any talk of potential tariffs, or changes in immigration or tax policy is purely speculative until then. Other than the FOMC meeting on the 18th, we are entering a seasonally quiet period. Then throw in the fact that both Christmas and New Years occur on Wednesdays this year, and one can make the case that we will end the year and likely start the new one with two very light volume weeks. Barring an exogenous shock, the momentum can continue for longer than a month.

So, I thought we should take a look at the same metrics using 3-month, rather than 1-month options. The view is similar, but not as dramatic.

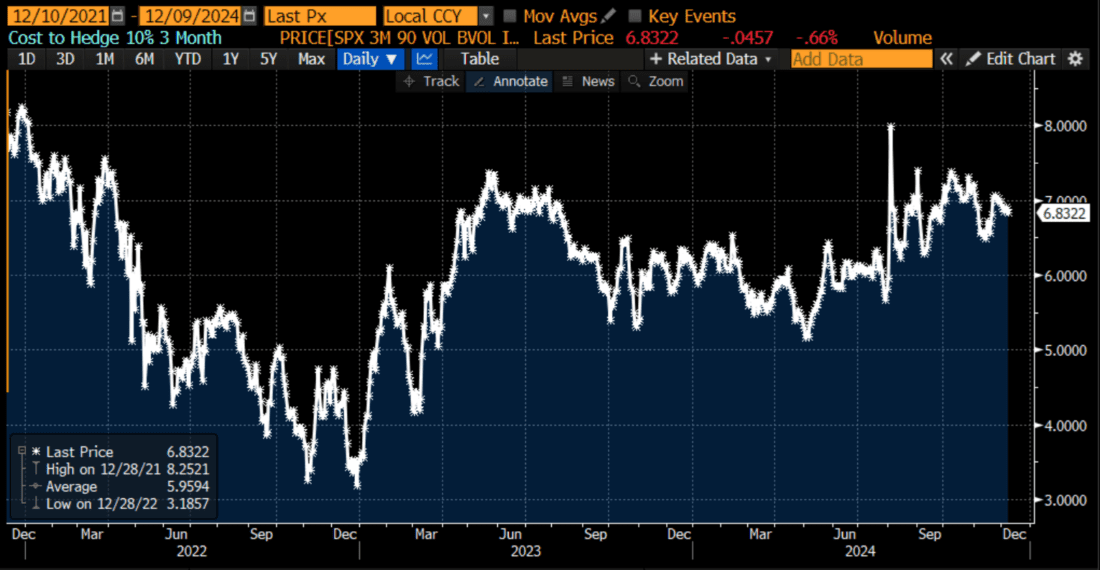

Difference in Implied Volatilities between 3-Month SPX Options with 90% vs. 100% Moneyness, 3-Years

Source: Bloomberg

Implied Volatility of SPX 3-Month, 90% Moneyness Options

Source: Bloomberg

Implied Volatility of SPX 3-Month, 100% Moneyness Options

Source: Bloomberg

Looking at the 3-month options, the implied volatility spread between 90% and 100% options is a bit less extreme, and the same can be said for the dips in both the below-market and at-money implied volatilities. I believe that the explanation is that the market is a bit less sanguine about the medium-term than it is for the short-term. Traders are considering the possibility of volatility stemming from changes in governmental policy, or simply thinking that the current momentum could simply take a breather after a few weeks.

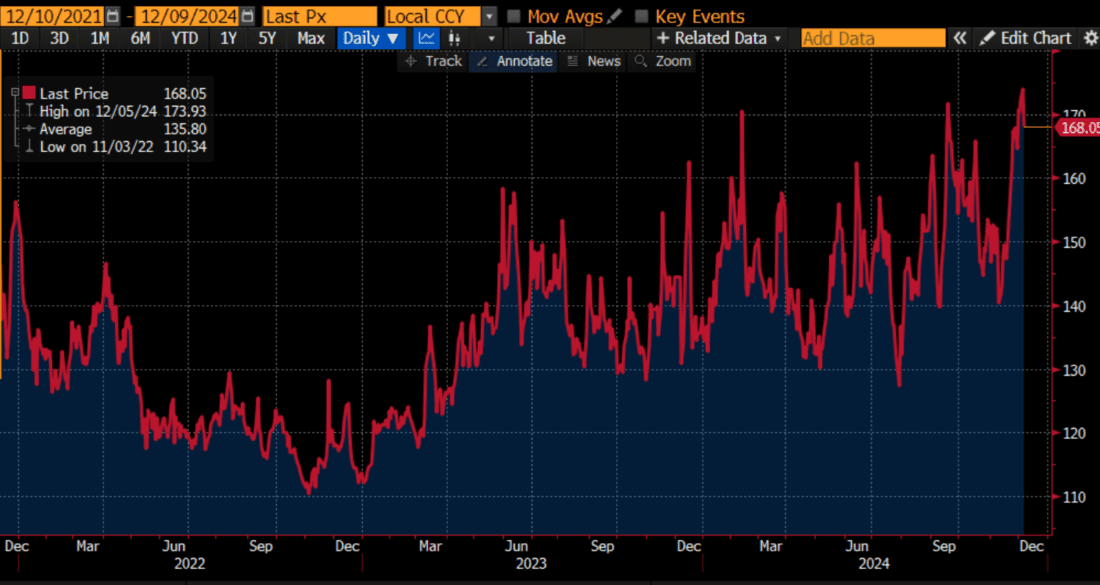

Two final thoughts. Remember that the Cboe Volatility Index is calculated to measure the market’s best estimate of volatility over the coming 30 days using SPX options. Even though at-money, 1-month SPX options are trading at lows, VIX is not – though it’s close. The reason is that the VIX calculation uses all SPX options with 23-37 days to expiration, and that includes both extreme above- and below-market options. Thanks to residual demand for hedging and the now-constant desire for speculative calls, the Cboe SKEW Index is at multi-year highs. The “wings” are keeping VIX somewhat afloat.

VIX, 3-Years

Source: Bloomberg

SKEW, 3-Years

Source: Bloomberg

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

soooo esoteric. wonder how many account holders are interested? certainly not relevant to my trading.

It is very relevant to mine

We are living a quantum moment indeed. A dual reality between the dream world of St. Trump with overvaluated Bitcoin, gold, stocks… and a real world with wars, governments falling, elections being manipulated, nuclear war threats, low economic around the globe, risk of tariffs wars. So, it depends of the viewer. Some are betting that the cat is alive in the box. Some know he is dead.

Well said!

Some are betting the cat is dead in the box and some know he is alive

Works until it don’t no more.

Tom Lee (Fundstrat & CNBC contributor) keeps pointing out that there is $7T (according to him) sitting “on the sidelines” looking for an entry point into the equity markets. I would add to that the possibility that in the wake of a possible economic meltdown in Europe – exacerbated by Trump tariffs – more cash may be heading for the US stock exchanges in 2025 (TINA). Any sudden sell off could just be a catalyst for dip buying similar to the post Covid period driving the market higher in the second half of 2025. This makes buying long dated puts on the S&P & NASDAQ risky, perhaps even more risky for the Mag8. The consensus is (according also to Goldman Sachs) is that US equities will underperform in 2025, but we all know the market can stay irrational longer than a long dated option strategy, and cheap (publicly available) analysts predictions aren’t at all reliable, nor historically accurate. Fixed interest and real estate are less predictable than stocks right now. Commodities could be a good bet but with gold still looking bullish I wouldn’t risk a hedge (put) until the technicals start to really turn negative.

Agree. Also there is a possibility that other regions starts growing. For example, this wasn’t very reported by the media, but Europe and South America Mercosul just signed the largest free market ever created: 700 million people. It is still needs to be ratified, but this is huge. While the US is locking itself in an isolationist frenzy, the world is doing business. The tariffs will shrink the US. Meanwhile, the globalized world is moving forward towards a free market capitalism.