In an article I penned for last week’s Barron’s, I asserted that investors shouldn’t fight the tape, but instead insure against it. The current market environment is clearly “risk-on”, as we see major indices at or near all-time highs and an ever-present demand for speculative and often volatile stocks. Yet the evidence shows that someone has been buying insurance against a 10% correction in the S&P 500 (SPX), even though – or perhaps because – we haven’t seen one in months.

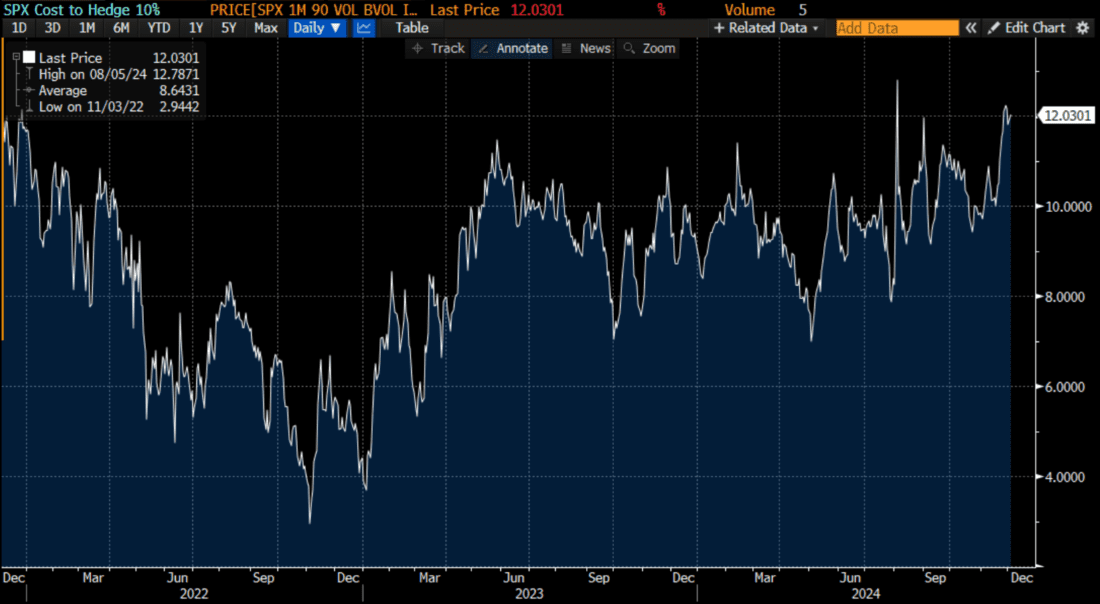

The “cost to hedge” against a 10% correction is around the highest levels that we’ve seen in three years. This is an index I created that subtracts the cost of at-money SPX options with one month to expiry from options with 90% moneyness (i.e. 10% below market) with the same expiration. Below market options typically have higher implied volatilities than at-money options – that is the familiar downside skew – but in arithmetic terms, the difference has become quite substantial:

SPX Cost to Hedge 10%

Source: Bloomberg

Implied volatilities reflect demand for the options in question, so it is clear that someone is demanding out-of-the-money puts. One month,10% below market options currently trade with a roughly 22 implied volatility while their at-money counterparts are around 10%. Since longer-term SPX options are more popular with institutions than retail investors, one must assume that there are institutions seeking to hedge their holdings.

Two caveats:

- These findings imply caution, not an imminent worry on the part of institutions. Those investors might be simply seeking protection for some of their holdings even as their net exposure is quite long.

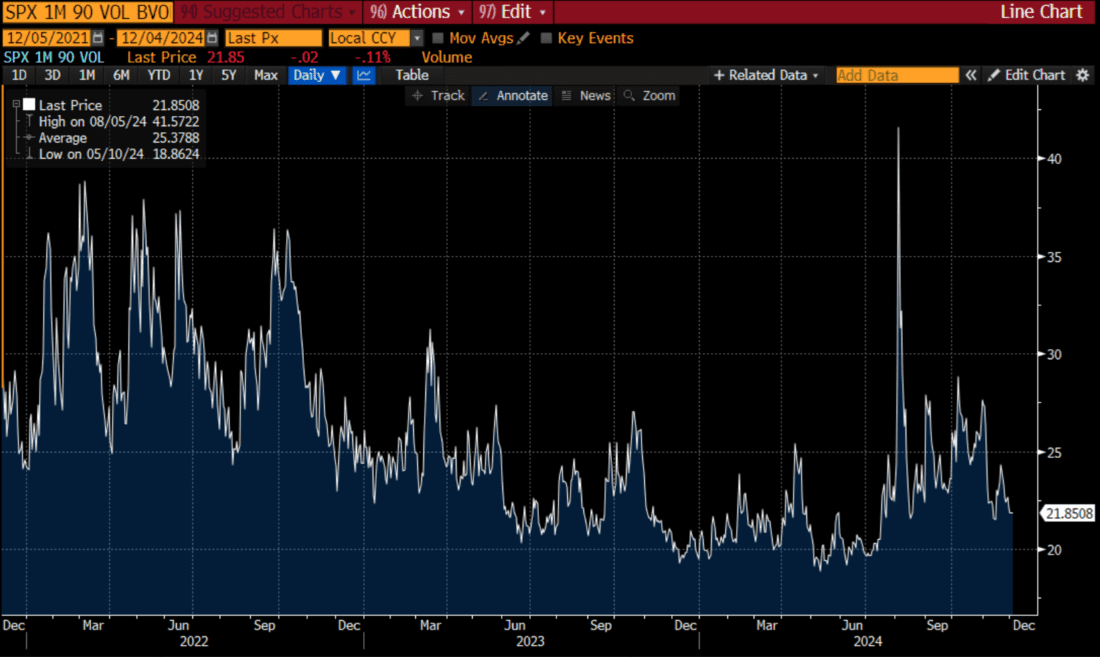

- Because we’re looking at the relative relationship between two moving targets, the absolute level of implied volatility for those protective puts could be relatively low. And indeed it is:

Implied Volatility for SPX Options with 1-Month to Expiry and 90% Moneyness

Source: Bloomberg

Thus, in absolute terms, it is indeed not all that historically expensive to hedge one’s holdings. Perhaps that’s why some may be seeking to do just that, even if things seem wonderful right now.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

AN EX OF A ‘PROTECTED PUT WOULD HAVE BEEN APPRECIATED.

I’m thinkin’ its a “let’s make hay while the sun shines!” kind of market.

It is me. I am buying insurance against Trump. No tax break will offset what he has already started. I will not argue. Just wait.

How did you do bearish the last 4 years he was in office? Keep losing money buying puts for the next 4 years lmao

FYI Averaging 28% a year. Educate yourself, there is something called non-directional trades, Vol trades etc lmao

Those are rookie numbers lol

Educate yourself, bearish is directional

Not a bad idea.

much more likely they SOLD otm puts

could look at where put prices were versus the bud ask spread at the time, to see if prices were cliser to the bid (bought) ir ask (sold) to see if they m the put volumes were longs were “seeking income” or “seeking insurance”?

Exactly, you didn’t delineate where those were sold short or purchased. Big difference. The automatically assumes those are all long puts which would be incorrect

I don’t think you need to look at the bid/ask prices. The argument is that the overall price of hedging has gone up (relative to past prices), which implies that it is being driven by buyers. If it was being driven by sellers, the price would be going down.