As we noted yesterday, this week is consequential for corporate earnings overall, and the “Magnificent Seven” specifically. There is a reasonable probability that this afternoon’s reports from two behemoths — Microsoft (MSFT) and Alphabet (GOOG, GOOGL) – could cause a significant broad market jump or drop if their stocks move sharply in the same direction. We noted:

… MSFT and the pair of GOOG+GOOGL represent about 11% and 16.4% of those two indices [S&P 500 (SPX) and NASDAQ 100 (NDX)], respectively.

Above and beyond their heft in key indices, the relative importance of these stocks in key areas of technology – search, operating systems, cloud computing, AI adoption – reflect upon myriad companies, large and small alike. I don’t like to succumb to hyperbole, but today’s earnings have importance well beyond the two companies reporting.

As a result, it seems important to check in to see whether options markets seem concerned. As of now, the short answer is “not really.” And it is quite fascinating to see that the implicit expectations for both stocks are quite similar.

Beginning with MSFT, the consensus estimates are for EPS of $2.65 and revenues of $54.54 billion. Its average post-earnings move is 3.78%, though three of the last 5 moves have been well above that figure (-3.76%, +7.24%, -0.59%, -7.72%, +6.69%). We see that the implied volatility for at-money options expiring Friday is priced around the historical level:

MSFT – Volatility Term Structure, Expressed in Daily Percentage Terms

Source: Interactive Brokers

Bear in mind that last week we saw Tesla (TSLA) options trading with implied volatilities well below the stock’s average post earnings move. Traders do not seem inclined to repeat that mistake.

Meanwhile, the IBKR Probability Lab shows a slight upward bias, with peak probability in the 332.5-335 range even with the stock at $330.94:

IBKR Probability Lab for MSFT Options Expiring October 27th

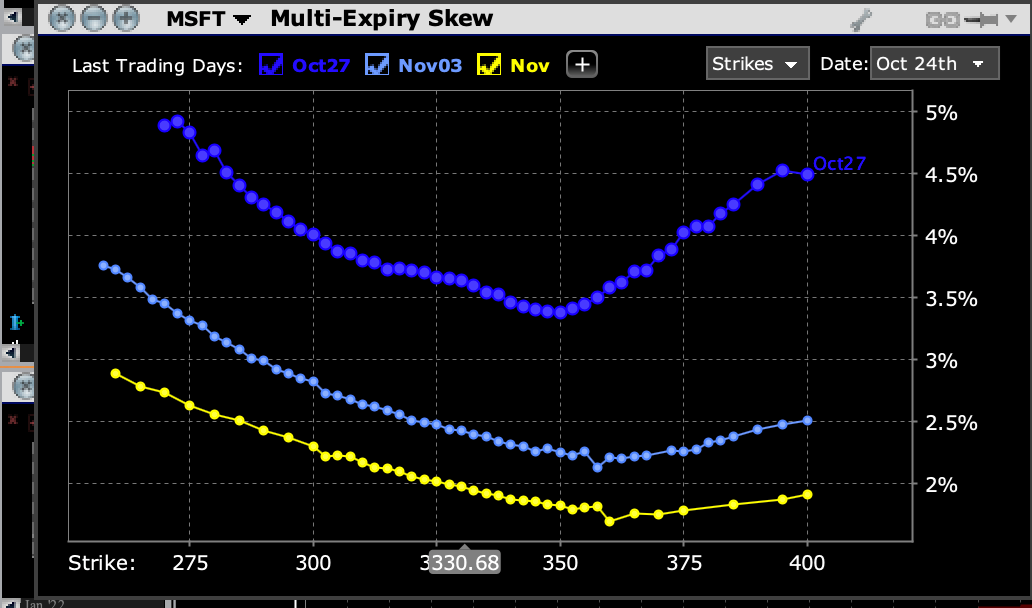

The skew for options expiring Friday is generally symmetrical, with a notable dip in implied volatilities above the market. This indicates that there are roughly equal levels or speculation for a significant rally as there are hedgers protecting against a large decline. Skew for options expiring on the following Friday and the monthly November expiration are more typical, though also showing an bias toward near upside.

MSFT: Skew for Options Expiring October 27th (dark blue), November 3rd (light blue), November 17th (yellow)

For GOOGL, the consensus estimates are for EPS of $1.45 and revenues of $75.54 billion on the top line and $63.04 ex-TAC. Its average post-earnings move is 4.62%, and as with MSFT, three of the last 5 moves have been well above that figure (+5.78%, -0.13%, -2.75%, -9.14%, +6.69%). We see that the implied volatility for at-money options expiring Friday is also priced around the historical level:

GOOGL – Volatility Term Structure, Expressed in Daily Percentage Terms

Also as with MSFT, the peak probability for GOOGL options is slightly above the current price, reflecting modest bullishness heading into earnings. The peak is in the $143-144 level with the stock just below $140:

IBKR Probability Lab for GOOGL Options Expiring October 27th

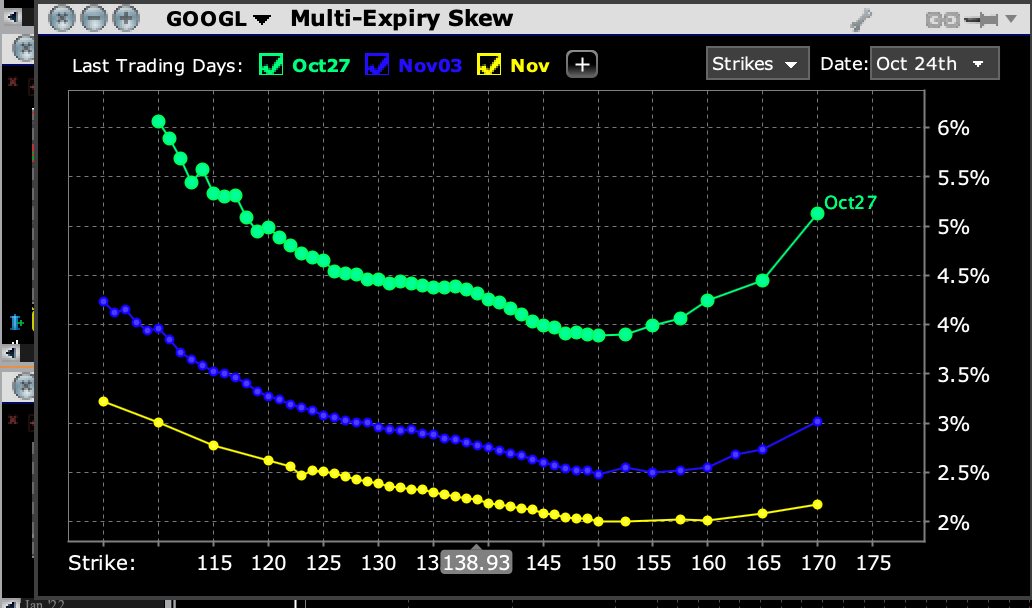

And regarding skew, we see another relatively symmetrical front-week skew and relatively normal skews for the coming weeks:

GOOGL: Skew for Options Expiring October 27th (dark blue), November 3rd (light blue), November 17th (yellow)

Bottom line, the options market is showing a reasonable regard for the likely post-earnings reactions for these behemoths. Both show near-term implied volatilities around the average moves. That said, the underlying tone is for a positive reaction. That fits with the bullishness that has accompanied these two companies along with their mega-cap tech peers.

Therein lies my concern. If the base case for the options market is positive, that means either that the “whisper number” is for better than consensus earnings or that guidance will be more robust than already expected. There is no reason to doubt that either outcome is possible, but it also raises the bar for both these companies. If “in-line” is not good enough, then the risks seem biased towards the downside. And if they both disappoint, even if only by coming in as expected, that can spill back into the broader market. We’ll know soon enough.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!