The upcoming Fed meeting is like the climax to a lousy romantic comedy. By now, we know that the key players – in this case the FOMC and Mr. Market, rather than two attractive actors – will get together on Wednesday. But we don’t yet know the dynamics of the relationship. The FOMC is playing coy, and we still don’t know whether they will be willing to offer a chaste kiss (25bp) or something more enticing (50bp), and whether they are willing to offer the intense, passionate relationship that their suitor desires.

Early last week, the market seemed to think that a 25bp cut was far more likely until Thursday afternoon’s Wall Street Journal article from Nick Timiraos (a Fed whisperer extraordinaire). That report returned the more aggressive 50bp cut to the forefront of the discussion. Comments from former New York Fed President Dudley advocating for a half-point drop, along with a dearth of commentary pushing back on that notion has sharply increased the odds for a bigger cut.

According to the CME, the chance for a 50 bp cut was 14% on Wednesday. It was 50/50 on Friday and is 61% as I type this. The probabilities on the IBKR ForecastTrader have also changed dramatically. There is now a 60% chance that the Fed Funds target rate will be set above 4.875% on Wednesday, down from 90% last week.

Despite the evidence above, I’m still in the 25bp camp. This was the basis for a report I published around midday Wednesday, and I still stick with its premise. I still lean that way for four reasons:

- The Payrolls, CPI and PPI reports all revealed price pressures. Although Chair Powell reminded us that the Fed will be equally focused on the maximum employment portion of its dual mandate, stable prices still matter.

- In the Payrolls report, monthly hourly earnings rose by 0.4%, ahead of last month’s 0.2% and the 0.3% consensus

- In the CPI report

- Core rose 0.3% on a monthly basis, ahead of the 0.2% that was both the consensus and the prior readingReal Average Hourly Earnings rose 1.3%, more than the previous 0.7% (no consensus available)

- Core PPI rose by 0.3% on a monthly basis, also ahead of the 0.2% consensus, though the prior 0.0% was revised down to 0.2%

- The Fed doesn’t like to surprise markets. By definition, if we’re about 50/50, then half the folks will be offsides. Even if we’re 60/40 for a larger cut, we will still see many surprised investors.

- Though they’ll probably get accused of playing politics either way, they’ll get less pushback with 25bp rather than 50bp ahead of the election.

- The tone of the FOMC Statement and the Summary of Economic Projections (aka, “the dot plot”) will matter considerably. Markets are pricing in nearly 1.25% in cuts for the rest of 2024 (in other words, five 25 bp cuts in the three remaining meetings) and roughly 2.5% by the end of 2025. We have to wonder whether the Fed will want to signal that they foresee the sort of economic weakness that would justify that level of rate activity. (That plays into the political considerations as well)

We’ll find out the answers to the “will they, won’t they” on Wednesday, and whether we’ll need to stay tuned for the inevitable sequel.

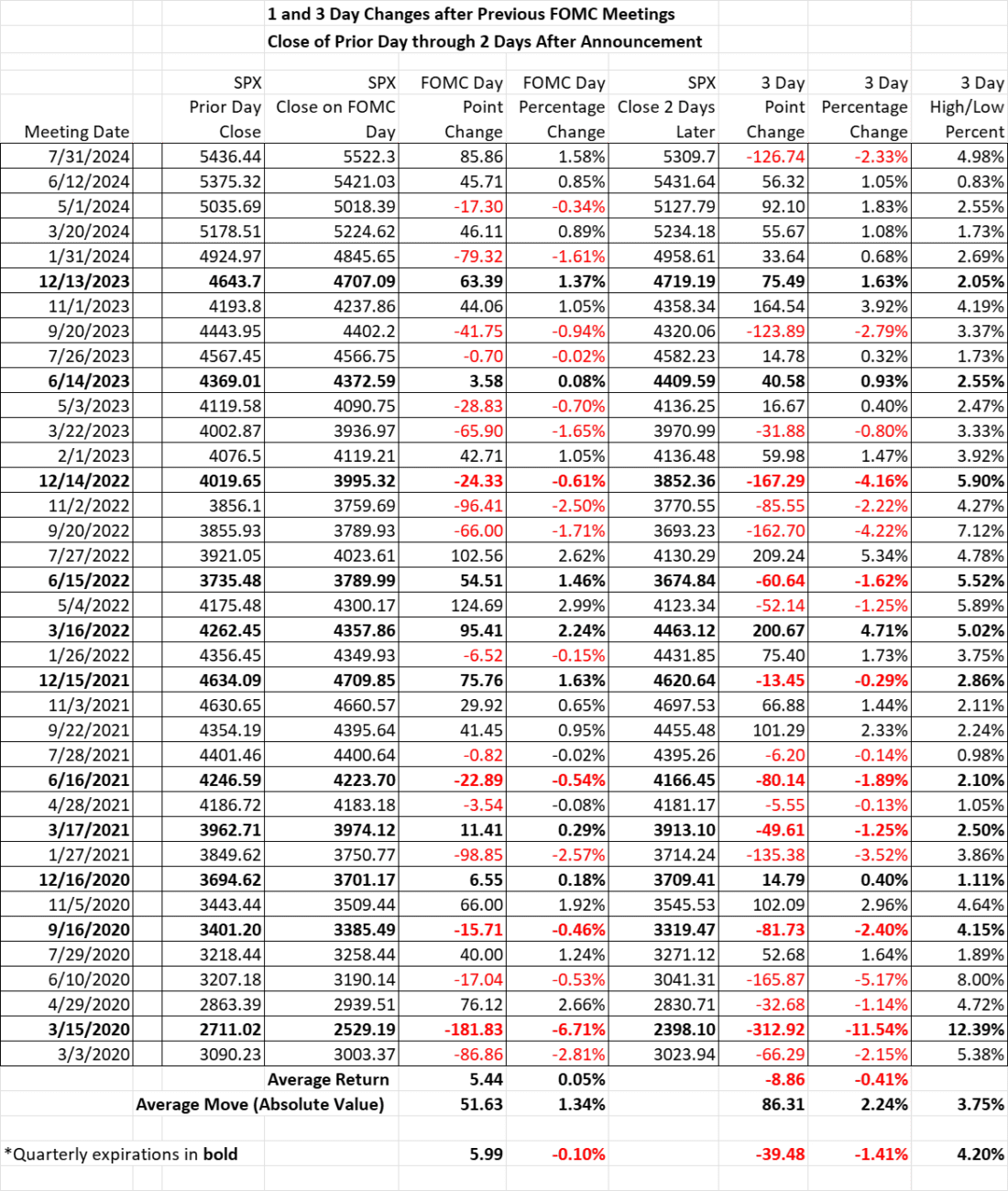

By the way, there was a Bloomberg article this morning that noted that traders were pricing in a 1.2% move for the S&P 500 (SPX) on Wednesday. The following table shows us that is actually a fairly typical post-Fed move:

Source: Interactive Brokers

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

How likely is it that we get a ‘sell the news’ reaction on Wednesday ? Add to that the probability of disappointed players if we get “only” 25 bp instead of the hyped 50bp and things might get sporty by Friday afternoon ?

If they go 50bps, does that reignite the Yen carry trade unwind? USD:YEN pair trading at a multi-month low. Bullish candlestick today on the pair suggesting the USD should appreciate vs the Yen but no confirmation yet. Just curious what others thing or maybe hearing?

I am starting to think they will go 50bps as they have a long way to get back to neutral, there’s arguably very little harm in jump starting that movement, and more prominent voices, including some left wing senators among others, will defend this approach

I am in the 25bps camp

Whatever happens, I am firmly staying with my call that the S&P is a LOCK to see 4500 again at some point, and I am increasing the probability of 4100-4200 from being a coin toss to 60%.

There is something very wrong with the Fed lowering interest rates when stocks and home prices are at or close to all time high valuations.