Brick by brick, investors are building a towering wall of worry. Trump administration actions, evolving Federal Reserve (Fed) monetary policy, relentless inflation, the DeepSeek debate, and a US economic growth scare have all contributed to rising investor anxiety in recent weeks.

Importantly, this note is neither an endorsement nor an indictment of Trump policy. It’s an apolitical attempt to assess the economic and capital market reaction to the early days of the second Trump administration.

It may be hard for investors to believe, but there is more to market volatility than reacting to the latest Trump executive action. Trump administration policies are fundamentally contradictory. Some will boost growth and inflation while others may curtail growth and be disinflationary. The size, timing, and impact are highly uncertain. Many investors support the president’s pro-growth business agenda, but the administration’s frenetic approach to policymaking is unsettling.

Despite the S&P 500 hitting three all-time highs so far this year, extraordinarily tight credit spreads, and mild measures of market volatility, there is noticeable uneasiness in news headlines, client meetings, and market sentiment. The American Association of Individual Investors (AAII) Investor Sentiment Survey from February 26 revealed that more than 60% of respondents were bearish about the stock market in the next six months, a 20% increase from the prior week.

This is a healthy departure from the near-euphoric sentiment levels reached in early December.

And following the typical Election Day to Inauguration Day rally, it’s common for investor doubts to surface regarding the new administration’s developing agenda. Those concerns plagued the early days of the Obama, Trump 2017, and Biden administrations, but the S&P 500 produced solid returns in all of their first years. According to Strategas Research Partners, the S&P 500 has had a positive return in nine of the past 10 first years of the four-year presidential term. And over the past 20 years, year one has delivered the best average performance of the four years.1

So, let’s examine four bricks in the monumental wall of worry and determine whether investors should keep scaling the wall despite the risks.

The Messiness of Making America Great Again

Voters elected Donald Trump and investors celebrated his victory with a post-election rally. So, why the investor nervousness now that the Trump administration is aggressively pursuing its promised policy goals?

In just the first six weeks of Trump’s second term, investors have been asked to digest a substantial number of executive actions, lawsuits, tariff announcements, tougher immigration policy, Department of Government Efficiency (DOGE) activity, and a rapidly changing new world order.

This is all unfolding with a possible government shutdown looming on March 14. It’s a lot. Understandably, investors are anxious, and they’re trying to assess the risk and return impacts in real time, in a very fluid environment.

There have been 108 executive actions —73 executive orders, 23 proclamations, and 12 memorandums — signed by President Trump. The president signed more executive orders in his first 10 days in office than recent presidents signed in their first 100 days. More than 90 lawsuits have been filed challenging Trump’s executive orders and moves to reshape the federal government. The incredible amount of activity makes it difficult for investors to determine the potential economic impact from the executive actions and lawsuits.

Trade policy from the self-proclaimed Tariff Man is a prime example. Tariffs on Mexico and Canada went into effect on March 4 after a 30-day delay and an existing 10% tariff on China doubled. On February 13, the president issued a memorandum on the development of a comprehensive plan on reciprocal trade and tariffs, citing the economic and national security threat posed by the trade deficit. Tariffs are planned for steel, aluminum, copper, autos, semiconductors, and pharmaceuticals. The list of products and countries threatened by tariffs grows daily.

The Trump administration views tariffs as a tool to address trade imbalances, raise revenues for the federal budget, and pursue policy goals such as immigration enforcement. But unpredictable tariffs have contributed to an increase in consumer inflation expectations and created challenges for businesses.

Market participants also will be watching the impact of the next phase of immigration policy. Border Patrol Chief Mike Banks recently told CBS News that illegal border crossings at the US southern border are down 94% from the same period last year. Banks credited the many executive actions taken by President Trump for the significant decline in illegal immigration. Cracking down on illegal immigration and arresting criminals is good policy, but it’s very different from the worst fears of mass deportations threatened on the campaign trail.

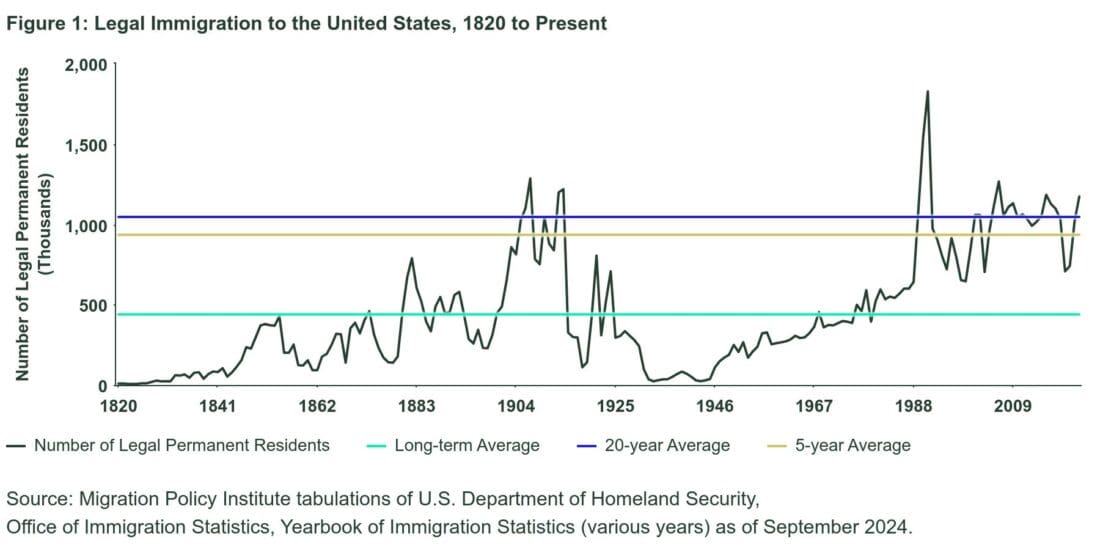

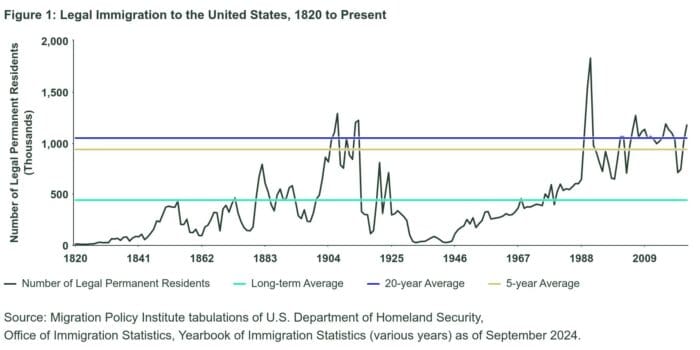

The number of legal permanent residents entering the US has been remarkably consistent since 2017 — averaging roughly one million per year, except for an understandable dip during the pandemic. Legal immigration is good for the US economy.

—

Originally Posted March 4, 2025 – Why Investors Should Continue to Climb the Wall of Worry

Footnotes

1 Policy Outlook, Strategas Research Partners, January 17, 2025.

2“Personal Income and Outlays, January 2025,” Bureau of Economic Analysis, February 28, 20205

3 National Association of Realtors, February 27, 2025.

4 S&P Global Flash US PMI®, February 27, 2025.

5 News Release, Bureau of Labor Statistics, February 27, 2025.

6 Bloomberg Finance, L.P., February 27, 2025.

7 S&P Global Flash US PMI®, February 27, 2025.

Disclosure

Important Risk Information

The views expressed in this material are the views of Michael Arone through the period ended March 4, 2025, and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Commodities and commodity-index linked securities may be affected by changes in overall market movements, changes in interest rates, and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities.

Diversification does not ensure a profit or guarantee against loss.

AdTrax Code: 7697251.1.1.GBL.RTL

Expiry Date: 3/31/2026

© 2025 State Street Corporation – All Rights Reserved.

Disclosure: State Street Global Advisors

Do not reproduce or reprint without the written permission of SSGA.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

State Street Global Advisors and its affiliates (“SSGA”) have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing in high yield fixed income securities, otherwise known as “junk bonds”, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These Lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

COPYRIGHT AND OTHER RIGHTS

Other third party content is the intellectual property of the respective third party and all rights are reserved to them. All rights reserved. No organization or individual is permitted to reproduce, distribute or otherwise use the statistics and information in this report without the written agreement of the copyright owners.

Definition:

Arbitrage: the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

Fund Objectives:

SPY: The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

VOO: The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

IVV: The investment seeks to track the investment results of the S&P 500 (the “underlying index”), which measures the performance of the large-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index.

The funds presented herein have different investment objectives, costs and expenses. Each fund is managed by a different investment firm, and the performance of each fund will necessarily depend on the ability of their respective managers to select portfolio investments. These differences, among others, may result in significant disparity in the funds’ portfolio assets and performance. For further information on the funds, please review their respective prospectuses.

Entity Disclosures:

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

SSGA Funds Management, Inc. serves as the investment advisor to the SPDR ETFs that are registered with the United States Securities and Exchange Commission under the Investment Company Act of 1940. SSGA Funds Management, Inc. is an affiliate of State Street Global Advisors Limited.

Intellectual Property Disclosures:

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s® Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

BLOOMBERG®, a trademark and service mark of Bloomberg Finance, L.P. and its affiliates, and BARCLAYS®, a trademark and service mark of Barclays Bank Plc., have each been licensed for use in connection with the listing and trading of the SPDR Bloomberg Barclays ETFs.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

ALPS Distributors, Inc., member FINRA, is distributor for SPDR® S&P 500®, SPDR® S&P MidCap 400® and SPDR® Dow Jones Industrial Average, all unit investment trusts. ALPS Distributors, Inc. is not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. For SPDR funds, you may obtain a prospectus or summary prospectus containing this and other information by calling 1‐866‐787‐2257 or visiting www.spdrs.com. Please read the prospectus carefully before investing.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from State Street Global Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!