Bitcoin is soaring to a new record following President-elect Donald Trump’s selection of Paul Atkins to head the SEC. Atkins, a crypto aficionado, is being celebrated by investors due to mounting evidence that the incoming administration remains committed to easing regulations. But Trump and Atkins weren’t the only folks providing a boost to crypto. Fed Chair Powell remarked during an interview yesterday at the New York Times DealBook Summit that bitcoin is a competitor to gold rather than the dollar. The comments quelled concerns that the central bank views the digital currency as a challenger to the US currency, while propelling hopes that more monetary policy leaders will embrace the space. Meanwhile, there’s certainly some rotation occurring in markets today, as commodities, bonds and the greenback are suffering losses while stocks are down to a lesser extent, but bitcoin is surging; it’s up 5% and trading near $104,000, well above the critical $100,000 mark.

Folks Look Abroad

The economic calendar is pretty quiet today, featuring European retail trade, which contracted more than expected, while stateside unemployment claims arrived mixed across the initial and continuing segments. But political and central banking developments from across the world are quite eventful. Topping the list is a relief rally in French assets on the back of National Rally leader Marine Le Pen expressing optimism over the ability for Paris to pass a budget in a matter of weeks. President Emmanuel Macron is expected to deliver a statement at around 2:00 pm ET after Prime Minister (PM) Michael Barnier’s resignation resulting from no-confidence votes by both left- and right-leaning members of Parliament. Macron seeks to replace Barnier with a PM who can appease both sides of the Assembly and successfully pass next year’s budget, a difficult task. Shifting east to Vienna, OPEC+ delayed plans to introduce additional barrels of crude oil from this January to April. The original proposal was to begin increasing production last October, but weaker prices and abundant supplies have contributed to continued delays. Furthermore, OPEC+ is extending production cuts an additional 12 months to year-end 2026. Turning to Tokyo, a top BoJ dove, board member Toyoaki Nakamura, appeared open to further rate hikes, which is strengthening the yen and boosting odds of an interest rate climb later this month.

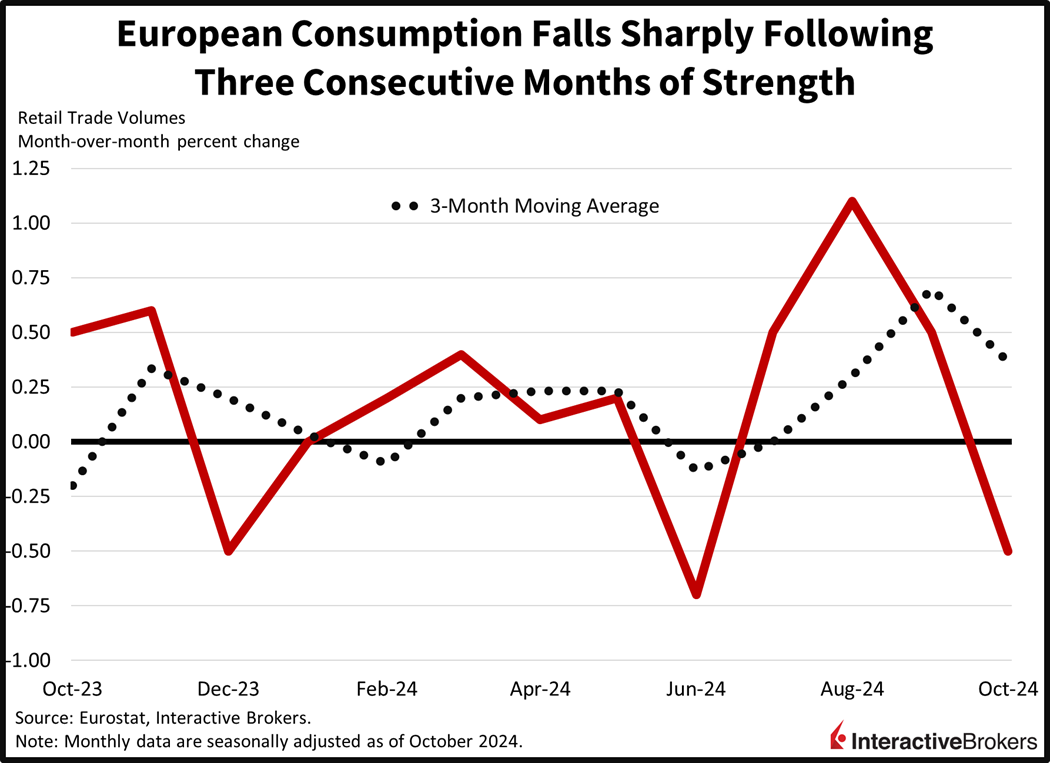

Euro Shoppers Take a Breather

European consumption fell sharply in October following three consecutive months of strength. Retail trade volumes, which are adjusted for inflation, dropped 0.5% month over month (m/m), beneath the 0.3% contraction expected and the 0.5% growth rate from the prior period. Folks took a sizable break from purchasing goods and gasoline, with quantities slipping 0.9% and 0.3% m/m. Conversely, households increased their orders modestly in the food, drinks and tobacco category, which advanced 0.1%.

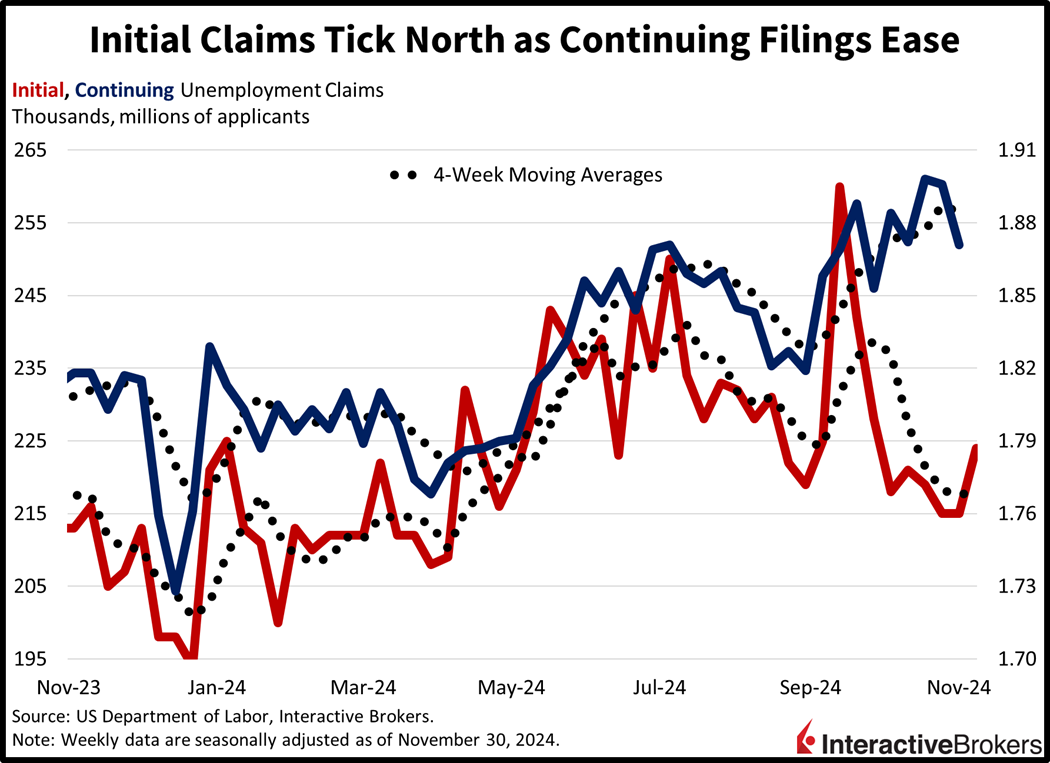

First-Time Unemployment Claims Jump

Initial unemployment claims jumped last week while the ability for displaced workers to find new positions appears to have remained unchanged, according to this morning’s Department of Labor report. It depicts a labor market that is solid even as it eases modestly. Initial unemployment claims for the week ended Nov. 30 totaled 224,000, up from 215,000 in the preceding period. Analysts expected no sequential change. Continuing claims, however, eased slightly but lingered near their recent highs, with a total of 1.871 million for the week ended Nov. 23, falling below the consensus forecast of 1.910 million and the preceding week’s 1.896 million. Continuing claims illustrate the difficulty or ease that idle individuals experience when pounding the pavement. Four-week moving averages, which help smooth out volatility in weekly data, depicted a similar trend. The averages for both components changed from 217,500 and 1.887 million to 218,250 and 1.884 million.

Manufacturing Leads in Layoffs

In a related matter, Challenger, Gray & Christmas’ Challenger Report revealed that businesses announced 57,727 job cuts last month, a 3.8% m/m increase and 26.8% higher than the same month in 2023. The data confirms recent reports from ADP and the Institute for Supply Management of contracting manufacturing employment. According to Challenger, automotive parts manufacturers and suppliers experienced the largest number of layoffs as companies responded to competition from China while bracing for potential tariffs and shifts in subsidies for electric vehicles.

Holiday Shopping Outlook is Mixed

American Eagle (AEO) withheld holiday cheer and instead downgraded its current-quarter guidance, explaining that sales have dropped off quickly after promotions ended. While third-quarter earnings exceeded expectations, sales fell short of the consensus forecast. American Eagle expects fourth-quarter comparable sales to advance 1% y/y. It believes total revenue will drop 4%, a result of having one less selling week. Wall Street expected comparable sales to climb 2.2% and total cash register activity to head south by 1%. Dollar General (DG), meanwhile, raised the bottom end of its full-year sales growth guidance from 4.7% to 4.8% but lowered the upper range from 5.3% to 5.1%. Its third-quarter sales were resilient, climbing 5% y/y, but earnings per share sank 29.4% y/y, largely due to operational challenges associated with hurricanes Milton and Helene. Also in the retail sector, Five Below (FIVE) struck a somewhat optimistic tone by increasing its full-year sales guidance. It previously anticipated a 4% to 5.5% decline in comparable sales but is now targeting a 3% contraction. Strong Black Friday sales prompted the revision. Five Below’s third-quarter sales and earnings exceeded analysts’ expectations.

Investors Flock to Bitcoin

Investors are trimming their holdings of stocks, bonds, commodities and greenbacks today in favor of bitcoin, which is flying high. Bitcoin, up 5% and near $104,000, is experiencing gains as every major, domestic stock benchmark suffers losses. The Russell 2000, Dow Jones Industrial, Nasdaq 100 and S&P 500 indices are 0.8%, 0.2%, 0.2% and 0.1% lower. Sectoral breadth is in the middle, however, with 6 out of 11 segments losing on the session and led by materials, health care and industrials which have fallen 1.4%, 0.7% and 0.7%. Upside leadership is comprised of consumer discretionary, financials and utilities, which are up 0.8%, 0.7% and 0.6%. Treasurys and the greenback are also taking losses with the 2- and 10-year maturities changing hands at 4.17% and 4.21%, 4 and 3 basis points (bps) heavier on the session. The Dollar Index is lower by 46 bps, as rotations to bitcoin and the Japanese yen hurt the US currency. It’s depreciating versus most of its major, developed market counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian tenders. Commodities are tilted bearishly with lumber, silver, gold and copper lower by 1.1%, 0.4%, 0.3% and 0.3%. WTI Crude is higher by 0.4%, however, and trading at $68.95 per barrel on news that OPEC+ is delaying its production increase again as well as reducing the pace of future supply escalations.

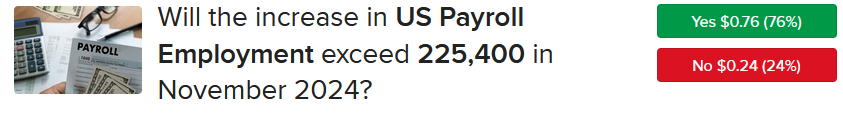

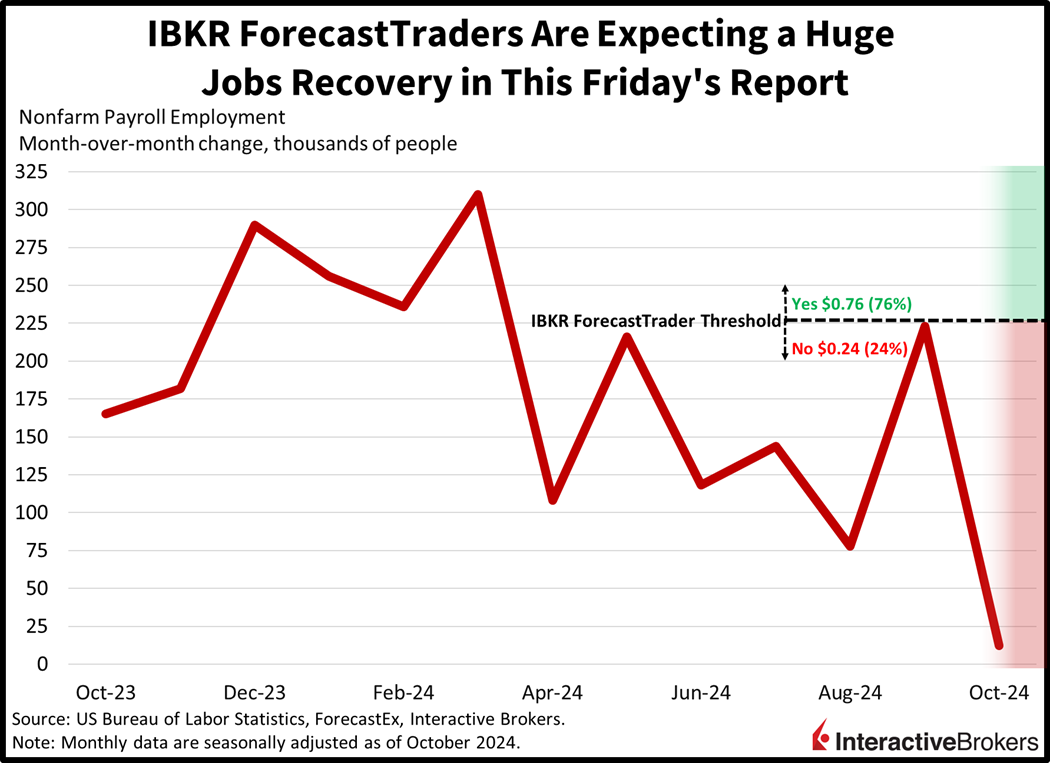

Anticipation Builds for Jobs Friday

Yesterday’s stock rally intensified following Fed Chair Powell’s speech and while today’s sluggishness is partially explained by bitcoin’s buoyancy, there’s also some hesitation due to tomorrow’s largely awaited Jobs Friday. It’s expected to be a noisy one, with the effects of two hurricanes, a Boeing labor strike and seasonal adjustment factors related to slower holiday hiring expected to influence the 8:30 am ET figures. Earlier this week, I shared with you all that the “No” ForecastContract expressing a view of a number at or below 225,400 offered a favorable risk-reward profile since it was priced with a probability of just 32% and my forecast is at 190,000. But this morning, ladies and gentlemen, the opportunity for a triple morphed into the chance for a home run, considering that the “No” now costs $0.24 and pays out a dollar if correct. If I liked it at $0.32, I love it at $0.24.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Digital Assets

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. Eligibility to trade in digital asset products may vary based on jurisdiction.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!