Today’s stateside economic releases were bifurcated across ADP-employment and ISM-services, with the former arriving well below expectations while the latter posted an upside beat. Stocks were initially concerned about the slowest level of job creation since last summer, which featured a rare dip below 100,000, and what it portends about consumer spending and corporate earnings prospects. But today’s 10:00 a.m. EST ISM release depicting accelerating growth in the services sectors sent equities north despite the prices paid component, an inflationary indicator, jumping substantially. Meanwhile, investors are eagerly forecasting the level of the Trump put to gauge how much downside the administration is willing to accept in capital markets, just as the S&P 500 hovers near its pivotal 200-day moving average. The developments arrive on the heels of President Trump’s speech last night to a joint session of Congress, in which the Commander in Chief said there will be a little disturbance associated with tariffs, alluding to the short-term pain that may arise prior to the long-term gains envisioned by the Executive Branch’s policies. And despite the levies starting yesterday, Commerce Secretary Howard Lutnick is sustaining hope that the measures may be less draconian than feared by announcing that the White House may scale back duties on Mexico and Canada as soon as today.

Hiring Slows To a 7-Month Low

The private sector slowed its hiring significantly last month in light of significant policy uncertainty amidst a slowdown in consumer spending. Payroll processing company ADP reported February job growth of just 77,000, well below the median estimate of 140,000 and January’s 186,000.

Additions varied across sectors, but the following categories and their stated increases led the roster expansion:

• Leisure and hospitality, 41,000

• Professional and business services, 27,000

• Financial activities, 26,000

• Construction, 26,000

• Manufacturing, 18,000

• Other services, 17,000

The following four major categories trimmed workers as stated:

• Trade/transportation/utilities, 33,000

• Education/health services, 28,000

• Information, 14,000

• Natural resources/mining, 2,000

Furthermore, job losses were concentrated in small establishments with less than 50 employees, with the category experiencing a decrease of 12,000 workers. But mid-size (50-499) and large firms (500+) posted increases of 46,000 and 37,000, respectively.

Wage Pressures Continue

An important inflationary aspect of the ADP employment report hasn’t shown much progress in the last five months or so—wage growth rates for job changers and job stayers, which have remained well anchored from an annualized perspective. Indeed, the median year-over-year (y/y) change in annual worker earnings rose 6.7% and 4.7% across changers and stayers. January’s results were quite similar, at 6.8% and 4.7%, and the segments have been stuck in a holding pattern since September, when the levels were 6.6% and 4.7%. The compensation trends point to a lack of disinflationary cooperation from the labor market, and they are likely to continue on the back of immigration restrictiveness that is weighing on labor supply.

ISM Report Shows Services Expansion

Today’s Institute for Supply Management (ISM) print was one of the few recent reports pointing to an acceleration in stateside economic conditions, as the majority of data has been arriving on the weaker side. ISM’s Purchasing Managers’ Index for services rose to 53.5 in February, exceeding the 52.6 median estimate and the 52.8 from January. The print offered broad-based strength with activity, employment, new orders, exports and backlogs continuing to expand, sporting scores of 54.4, 53.9, 52.2, 52.1 and 51.7, well ahead of the contraction border of 50. The prices paid component did add to evidence of mounting inflationary pressures, however, rising to 62.6 from 60.4 month over month (m/m).

Markets Wait for Tariff Updates

Market trading shifted substantially as investors digested economic data prints while awaiting potential tariff relief from the White House. The Treasury complex is drifting toward a lower profile but in bull-steeping fashion, led by the short-end, as President Trump’s remarks on cost pressures, sticky wage increases from ADP and rising prices paid according to ISM-services lift inflation expectations, supporting loftier long-end yields. Optimism regarding monetary policy easing from the Federal Reserve is weighing on the greenback, however, as market participants speculate that the central bank is much more sensitive to labor demand weakness rather than the other side of its mandate.

S&P 500 Near Its 200-Day

Perhaps the most critical development for stocks from a technical perspective is that the S&P 500 is less than 1% away from its 200-day moving average, a closely watched indicator illustrating the intermediate trend of the market. And while equity benchmarks have shifted greatly throughout the morning, all major domestic equity indices are lower at the moment with the Nasdaq 100, Russell 2000, S&P 500 and Dow Jones Industrial gauges down 0.6%, 0.5%, 0.4% and 0.2%. Sector performance illustrates demand for defensive areas of the market as well as commodities on the back of the White House contemplating 25% tariffs on copper imports, sending the critical metal up 5% just today. Materials, industrial, healthcare and consumer staples are the only equity segments gaining out of the 11 majors in the session; they’re up 1.2%, 0.5%, 0.1% and 0.1%. Comprising the laggards are energy, utilities and technology, which are losing 3.3%, 1.5%, and 0.9%. Energy is underperforming due to WTI crude oil losing 4.1% as it trades at $65.22 per barrel on the back of economic slowdown concerns, OPEC+’s decision to raise production and an Energy Information Administration report depicting greater supplies stateside. The deceleration worries are also sending yields and the dollar south, with the 2- and 10-year Treasury maturities changing hands at 3.93% and 4.23%, 5 and 1 basis points (bps) lighter in bull steepening fashion. The Dollar Index is down 96 bps as the greenback depreciates relative to most of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie tender. Conversely, it is appreciating against the loonie.

Trump Bump or Slump By 4 p.m.?

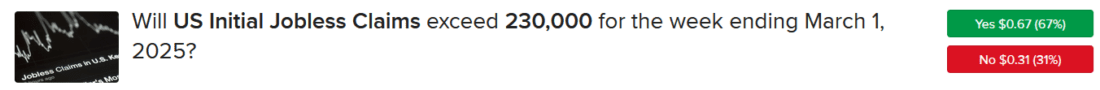

Today’s stock market finish may very well depend on whether an announcement concerning tariff relief for Canada and Mexico is presented by the close. A lack of a reprieve could lead to a Trump slump as the S&P 500 may drop below its critical 200-day moving average, which is hovering right around 5730. But a respite will likely generate a Trump bump to the upside as investors maintain a glass half-full view while hoping that the tailwinds of his policy proposals can counter the headwinds of aggressive trade, immigration and austerity measures. Today’s sharp decline in oil prices does preview that kind of offset, as the drill baby drill approach may further discount the pivotal liquid. But economists and IBKR Forecast Traders alike are gearing up for data pointing to further labor market weakness, with our prediction market pointing to a 67% likelihood that tomorrow’s initial unemployment claims report will exceed 230,000. Similarly, the Wall Street consensus is at 235,000.

International Roundup

Wholesale Inflation in Europe Picks Up

The European Union’s Producer Price Index (PPI) climbed 1.8% and 0.8% y/y and m/m, respectively, in January, pointing to price increases accelerating significantly from the preceding month’s 0.1% and 0.5% pace. Analysts forecasted a y/y rate of 1.4% and a m/m result that would match December’s. Among various categories within the PPI, the following experienced the stated m/m price increases:

• Energy, 1.8%

• Capital goods, 0.6%

• Durable consumer goods, 0.6%

• Intermediate goods, 0.3%

• Non-durable consumer goods, 0.2%

Singapore’s 2025 Retailing Starts Strong

Shoppers in Singapore opened their purses more frequently than anticipated to kick off the new year with retail sales climbing 4.5% y/y and 2.4% m/m, reversing December’s declines of 2.9% and 2%, according to the country’s Department of Statistics. The y/y result was more than double the 2.1% median forecast compiled by Bloomberg. With the Lunar New Year occurring during the first month of the year, shoppers appear to have celebrated by splurging on watches and jewelry, with the category increasing 10.3% m/m. The apparel and footwear segment was also strong, increasing 8%. It was followed by optical goods and books, which jumped 6.4%. Conversely, sales in the food and alcohol category sank 23.5% and the furniture and other household items group fell 10.2% m/m.

Australia GDP Growth Accelerates

Australia’s GDP during the last three months of 2024 climbed 0.6% q/q and 1.3% y/y, which exceeded the 0.3% and 0.8% rates in the preceding period. The q/q pace matched the analyst estimate while the y/y rate exceeded the forecast of 1.2%.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!