Markets, as we all know, don’t like uncertainty. And right now, there’s a lot of uncertainty surrounding U.S. trade policy.

While the Trump administration’s tariffs on Mexico and Canada have been delayed for a month, the 10% tariff on Chinese goods has gone into effect. The move has rattled markets, leaving many American businesses and consumers wondering what comes next.

Tariffs are a double-edged sword. On the one hand, they can serve as a powerful negotiating tool, as President Donald Trump has pointed out. The U.S. economy is the largest in the world, and many countries rely on American consumers to buy their goods. By imposing tariffs, the U.S. can pressure trading partners into more favorable deals and protect domestic industries from unfair competition.

How Key Industries Could Feel the Impact

On the other hand, tariffs raise costs for businesses and consumers. About half of America’s annual imports—more than $1.3 trillion annually—come from China, Canada and Mexico.

Certain sectors will be hit harder than others. The automotive industry, for instance, relies heavily on parts from Mexico and Canada. Energy prices could spike as well, given that over 70% of U.S. crude oil imports come from these two countries. Gas prices in the Midwest alone could rise by as much as $0.50 per gallon, according to the Council on Foreign Relations.

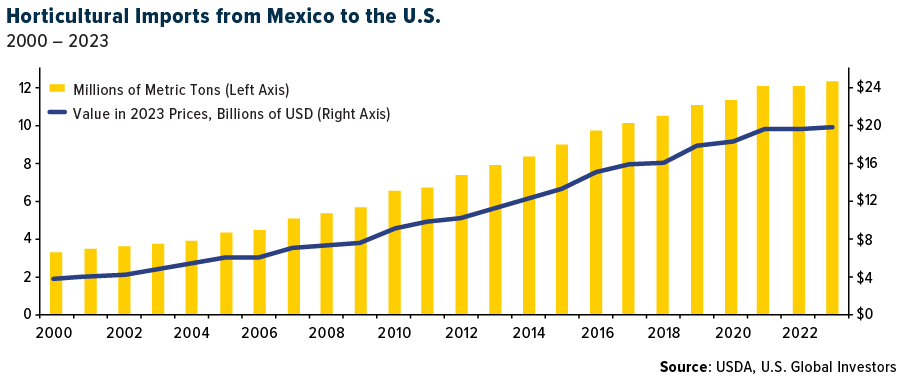

And then there’s food. Mexico supplies over 60% of the fresh vegetables and nearly half of all fruit and nuts consumed in the U.S. Higher import costs could mean higher prices at the grocery store.

A Historical Perspective on Tariffs

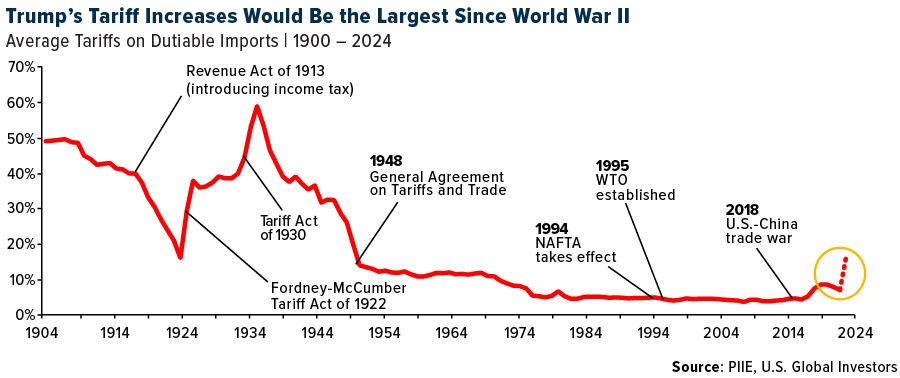

As a historical background, tariffs used to be a major source of government revenue. Between 1798 and 1913, they accounted for anywhere from 50% to 90% of federal income.

But times have changed. Over the past 70 years, tariffs have rarely contributed more than 2% of federal revenue. Last year, for example, U.S. Customs and Border Protection collected $77 billion in tariffs—just 1.57% of total government income.

Since the 1930s, the U.S. has moved away from protectionism in favor of trade liberalization. Agreements like the General Agreement on Tariffs and Trade (GATT) and its successor, the World Trade Organization (WTO), have dramatically lowered global tariffs. Today, roughly 70% of all products enter the U.S. duty-free.

Trump’s approach marks a shift back toward tariffs as a policy tool. And while it’s true that the U.S. has more leverage than most countries—many economies depend on access to the U.S. market—tariffs aren’t without consequences.

China has already retaliated, imposing its own tariffs on U.S. goods. These include a 15% duty on coal and liquefied natural gas (LNG), as well as 10% tariffs on agricultural machinery, crude oil and some vehicles. Beijing has also launched an antitrust investigation into Google—likely as a form of economic retribution.

The Case for a U.S. Sovereign Wealth Fund

In light of these developments, President Trump has floated an interesting idea: using tariff revenue to fund a U.S. sovereign wealth fund (SWF).

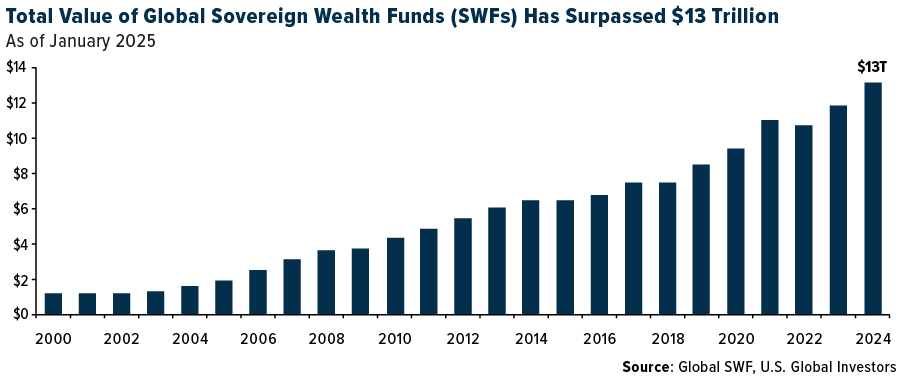

For those unaware, SWFs are government-owned investment funds, typically built from trade surpluses, resource exports or public savings. They serve as long-term savings vehicles, investing in assets like stocks, bonds and infrastructure to benefit future generations. Unlike pension funds, which individuals tap into for personal needs, SWFs are designed to generate national wealth.

Globally, SWFs hold just under $13 trillion in assets—more than ETFs, private equity or hedge funds.

The largest SWF belongs to Norway, which has accumulated a staggering $1.8 trillion thanks to oil and gas revenue. This fund owns roughly 1.5% of all publicly traded stocks worldwide, making it a financial powerhouse. Today, it’s worth four times the country’s GDP—comparable to the entire economy of Australia.

Could the U.S. benefit from a similar investment vehicle? An SWF could help finance infrastructure projects, advanced manufacturing, medical research, national security initiatives and more. If structured properly, it could provide long-term economic stability and reduce dependence on debt-financed government spending.

Could the U.S. Wealth Fund Hold Bitcoin?

Of course, there are challenges. Unlike Norway, the U.S. does not run a persistent trade surplus, nor does it generate excess revenue from oil exports. Most SWFs are built from surpluses, but the U.S. runs a trade deficit, meaning we import more than we export. Last year, the country ran a $1.2 trillion trade deficit, a new record.

An intriguing possibility is incorporating Bitcoin. Trump has previously hinted at the idea of a Strategic Bitcoin Reserve. This would align with broader trends of Bitcoin being treated as digital gold.

As always, the key takeaway is to remain diversified. Trade policy changes can create volatility, but long-term opportunities exist in sectors resilient to tariffs. Gold, energy, infrastructure and select equities may benefit from current market conditions.

—

Originally Posted February 10, 2025 – The Surprising History of Tariffs and Their Role in U.S. Economic Policy

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Digital Assets

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. Eligibility to trade in digital asset products may vary based on jurisdiction.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!