Market players are avoiding risk assets for the second consecutive day as a weaker-than-expected US consumer sentiment report adds to the case of softening revenue prospects. But while sector breadth is dreadful across equities, technology is once again the only gainer of the eleven major categories. Across the Atlantic and Pacific, meanwhile, Paris and Tokyo developments are also dampening animal spirits, as a controversial snap election in France coincides with tough choices on Japan’s monetary policy front.

Consumer Sentiment Trends Lower

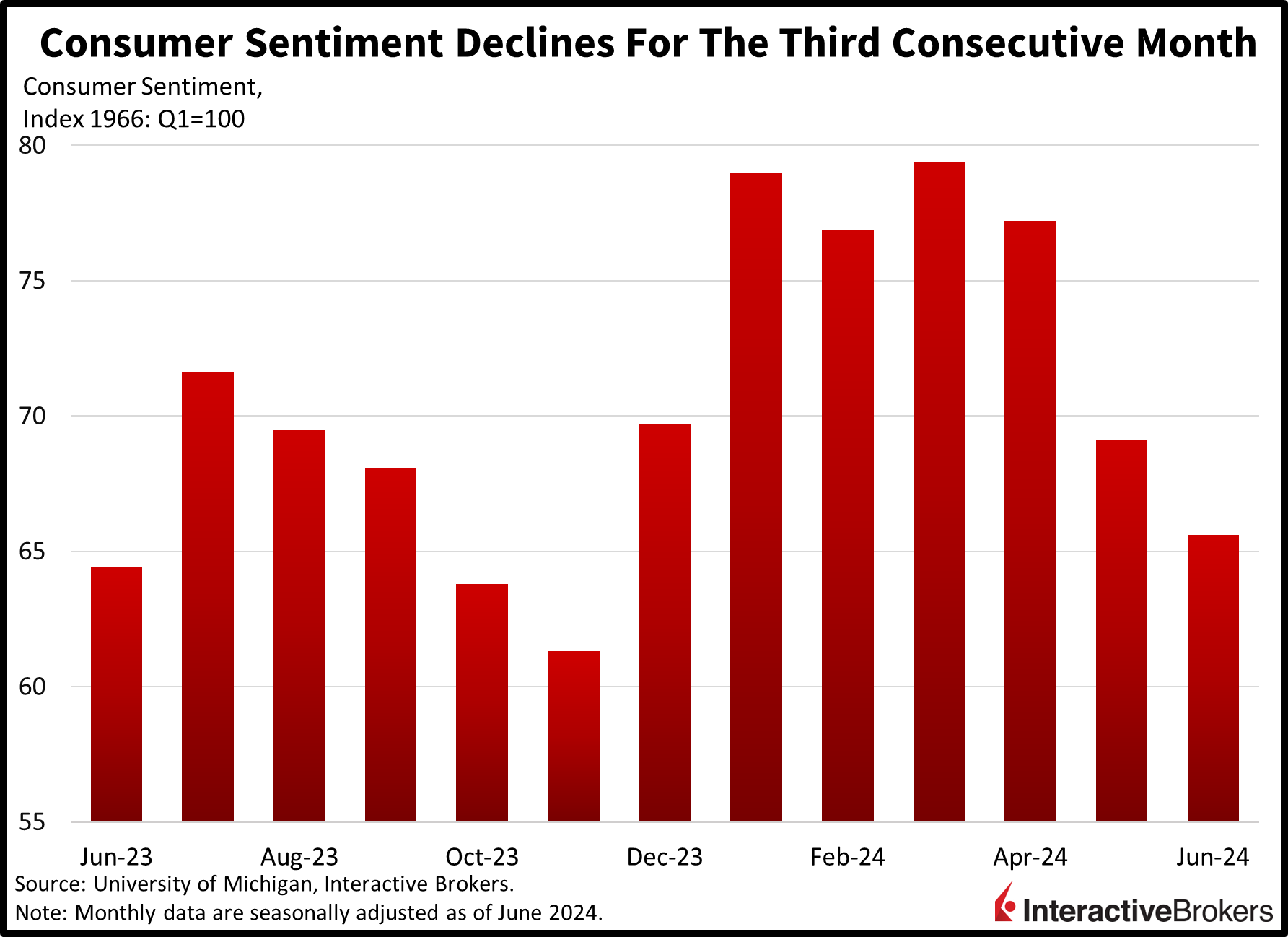

Lower gasoline prices failed to help consumer sentiment in the past few months, a significant occurrence when considering that the University of Michigan’s gauge of shoppers’ moods is strongly correlated with costs at the pump. June Consumer Sentiment declined for the third consecutive month to 65.6, below the median estimate of 72 and last month’s 69.1. Driving the drop was the Current Economic Conditions sub-index, which fell from 69.6 to 62.5 month over month. The Consumer Expectations sub-index also fell but at a more tempered pace, with the figure slipping from 68.8 to 67.6 during the period.

Elevated prices and weakening income opportunities caused survey respondents to report souring feelings regarding personal finances. The outlook for price pressures weighed upon results amidst marginal deterioration, with year-ahead inflation expectations of 3.3% remaining unchanged but five-year inflation projections inching up 10 basis points (bps) from 3.0% in May.

Father’s Day Spending Could Disappoint

Earlier this week, the National Retail Federation (NRF) forecasted that spending on Father’s Day gifts and entertainment is likely to decline from last year’s record high, following a trend of weaker spending on Mother’s Day. Still, Father’s Day spending is expected to total $22.4 billion, which would be the second-highest amount on record. The NRF anticipates consumers, on average, will spend $189.81, down from $196.23 last year.

Volatility Surges in Japan and France

The Bank of Japan (BoJ) sent the already anemic yen into a tailspin yesterday when it declined to provide a timeline for scaling back its bond purchasing, a process that many investors believe is essential for shoring up the country’s currency. As expected, policymakers announced no change to interest rates, but investor angst grew because the central bank failed to elaborate on cutting its bond buying plans, which could imply a delay in starting the program. The Japanese currency did pare losses, however, after BoJ Governor Kazuo Ueda kept the door open for a July hike, which served to partially offset the lack of details regarding asset purchases.

In Europe, French President Emmanuel Macron’s call for a snap election ignited a strong risk-off market rotation on fears that his centrist and pro-business Renaissance party would lose seats in parliament to the far-right National Rally party or a left-wing coalition. Macron’s announcements ignited fears of fiscal uncertainty in the country and even a possible euro crisis. Within parliament, the National Rally is proposing to increase government spending despite the country’s budget already running deficits. The party has also pledged to weaken the country’s ties to the European Union (EU). Similarly, the left is expected to increase government spending and has proposed refusing fiscal aid from the EU that includes regulations on debt and deficits. An equity selloff knocked out $200 billion in stock values while the weekly increase in premiums that investors require to buy bonds relative to German debt set a new record. The snap elections are scheduled for June 30 and July 7.

ECB Calls for Patience

Also across the Atlantic, European Central Bank Governing Council Member Mario Centeno called for patience regarding the pace at which the organization lowers interest rates. The bank announced its initial rate cut last week. In a Bloomberg interview this morning, Centeno said the pace of rate cuts must be done in a way that is neither stimulative or restrictive, but he also said he believes the natural interest rate is below the current rate. While he is encouraged by the strong rate of job creation in Europe, he is concerned about investment being nearly flat.

Investors Rush to Defensive Assets

Investors are scooping up Treasurys, gold bars and greenbacks to protect against the backdrop of cool economic data, rising downturn risks and international headwinds. Market participants are indeed avoiding stocks, with all major US equity indices trading south on the session. The small-cap Russell 2000 is leading the charge lower with a loss of 1.6%. The Dow Jones Industrial, S&P 500 and Nasdaq Composite benchmarks are losing 0.4%, 0.3% and 0.1%. Every sector is lower minus technology, which is moving modestly higher by 0.2%. Industrials, consumer discretionary and materials are taking the most pain, plunging by 1.6%, 1.1% and 1%. In fixed-income and currency land, the dollar and bonds are catching bids, with the US currency index up 32 bps while Treasury borrowing costs across the 2- and 10-year maturities dwindle by 1 and 3 bps. With the exception of the Swiss franc, the US dollar is indeed gaining relative to all of its major contemporaries, including the euro, pound sterling, yen, yuan and Aussie and Canadian dollars. Commodities are mostly higher, with gold, crude oil, silver and lumber travelling north by 1.2%, 0.5%, 0.5% and 0.2%. Copper is the exception though, posting a 0.3% decline.

Cyclicals Feel the Brunt

As we conclude this week, which featured softer economic numbers overall, the next seven days may confirm or deny some of the recent trends. Market participants will watch Tuesday’s release of May retail sales data closely, and they expect the information to reflect an acceleration from April, which would add weight to the robust ISM-services figure from last week. Thursday and Friday, meanwhile, will bring unemployment claims, housing starts and flash PMIs, which will offer additional insights into consumer strength, corporate appetite for labor, price pressures, construction activity, manufacturing momentum and more. Finally, the investor community is starting to take notice of rising, but still modest, odds of an economic slump, as traders punish cyclical aspects of the stock market, namely the Dow and Russell.

Visit Traders’ Academy to Learn More About Consumer Sentiment and Other Economic Indicators

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!