Traders cheered this morning’s better than expected CPI report. After several doses of unpleasant news in recent weeks, a positive surprise seemed quite welcome. Stock futures soared in the immediate aftermath, though as the morning proceeded, the gains faded. So much for a vibe shift?

After last month’s upside surprise, this morning brought lower than expected readings for both the headline and Core CPI. Both came in with a monthly rise of +0.2% when expectations for both were +0.3%. Considering that last month’s headline gain was +0.5% and the core’s was +0.4%, today brought welcome relief on the inflation front. Those who reminded us that last month’s bump was not necessarily the start of a new trend were proven correct – at least for this month.

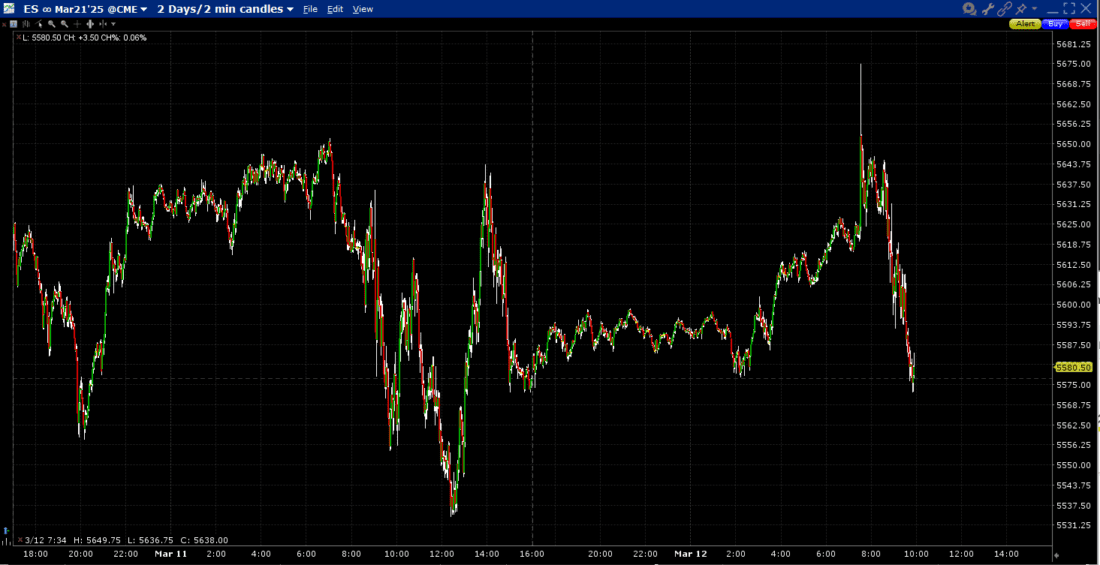

We can see the somewhat stupendous immediate move on the chart below. ES futures shot up over 90 points in the first minute, about 1.6%, though about 1/3 of that gain faded quickly. This is when it is important to remember a theme that we have discussed recently – volatility begets volatility. When markets are volatile, market makers typically respond by widening their bid-ask spreads and shrinking their posted sizes. That reduces liquidity, meaning that relatively modest amounts of buying and selling can move prices substantially when buyers and sellers are sufficiently motivated. And since traders typically also widen markets and shrink sizes when they know that market moving news is about to be released, the markets were especially thin this morning. It wouldn’t surprise me if the first few trades resulted from market orders in a very thin environment.

ES March ’25 Futures, 2-Days, 2-Minute Candles

Source: Interactive Brokers

After the initial rush, pre-market futures settled in around yesterday’s highs, and those levels persisted through the opening. Unfortunately, SPX sold off from its highs not once, but twice yesterday. The latter drop yesterday seemed to imply that few traders were willing to go home long ahead of both a key economic report and several hours of potential tariff news. This morning’s dip implies that the 5650 is being viewed by some traders as short-term resistance. We’ll get a better read on that the next time that SPX rises to that level.

Furthermore, as some traders might have feared, there were at least two pieces of tariff news. As usual, equity traders viewed them unfavorably. The European Union announced retaliatory tariffs on industrial and agricultural products, and reports emerged that Canada would take similar measures. Consumer sentiment has been taking a beating, with tariffs weighing negatively on their perceptions about future inflation. Continued tariff talk mitigates the positive CPI news.

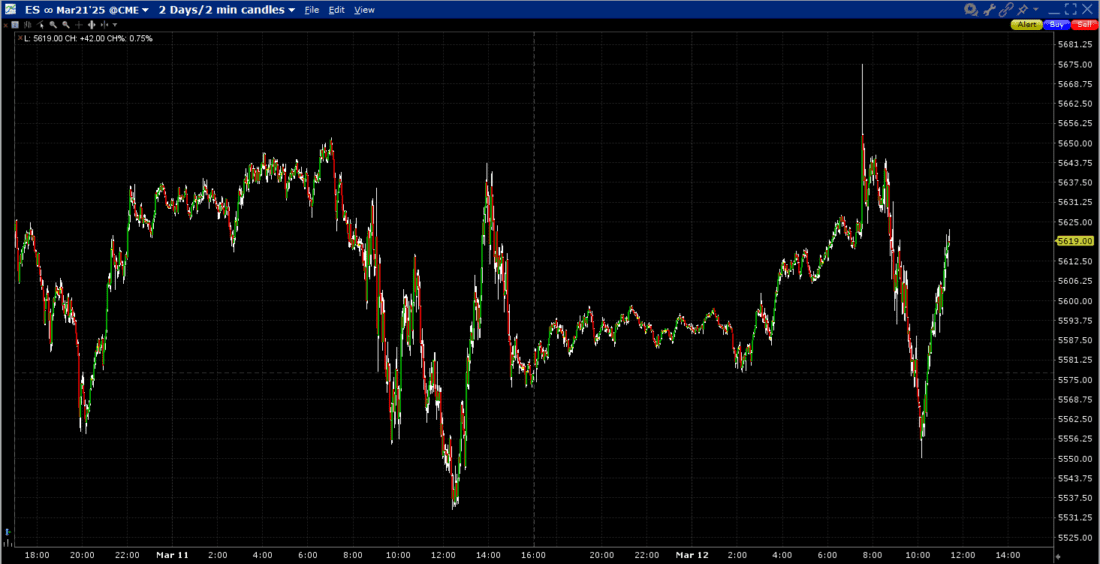

One concern about the aforementioned potential resistance level might also point to the notion that momentum has shifted. When we are in an uptrend, as we were for the past 2+ years, it typically behooves traders to buy dips. That worked spectacularly well for many traders. But when trends turn lower, selling rallies becomes the preferred tactic for many. It is too early to say if trends have definitively turned. Shorter-term trends certainly have; longer-term trends have not definitively done so yet. That is why we continue to see resolute buyers in favored names like Nvidia (NVDA) and Tesla (TSLA). With rallies of +6.5% and + 8%, respectively, those stocks are doing their best to keep broader indices in positive territory.

Interestingly, fixed income markets have not been overly enthused with the inflation report. Rate cut expectations have moved modestly lower, not higher, despite the improved inflation report, and yields are about 4bp higher across the curve. I have been asked many times if the recent rally in bond prices was more reflective of weaker economic projections or a flight to safety from nervous stock markets, and I have found it difficult to separate the two concurrent motivations. We seem to have gotten a clue about that today, since it is more likely that the rise in rates was about ebbing risk concerns than a broad improvement in economic expectations.

Oh, by the way, bulls need to thank the TSLA and NVDA faithful. Markets have improved substantially as I’ve been writing this piece. What a difference a couple of hours can make when markets are volatile.

ES March ’25 Futures, 2-Days, 2-Minute Candles

Source: Interactive Brokers

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!