It is said that the name “Led Zeppelin” was coined by Keith Moon when Jimmy Page proposed starting a band together after the “Beck’s Bolero” session.[i] Keith is said to have replied, “it won’t just go down like a lead balloon, it will be a lead zeppelin.” Moon kept his role in the The Who, but Page seemed to do quite well with band he eventually formed. The tie-in to today’s market is that I’m afraid that no one told the President that to tariff implementation would go over similarly with investors.

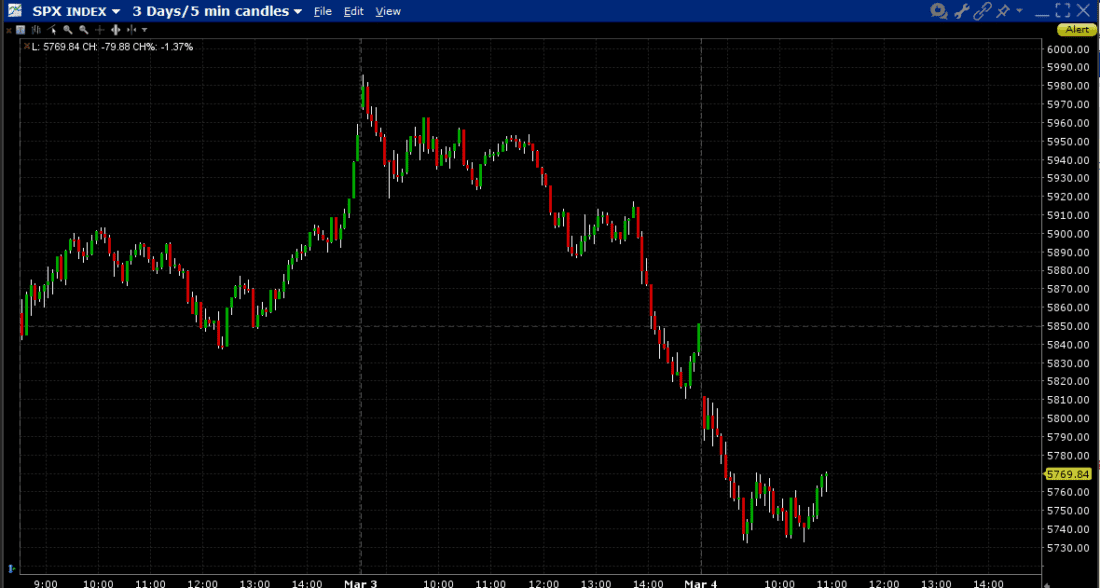

Yesterday’s trading got ugly quickly. The first leg of the decline should not have been unexpected, considering that we had an epic end-of-month markup just before Friday’s close. The early declines were simply the market giving back those suspicious late gains from the prior session. But there was no way around the tariff promise at the end of President Trump’s media event for TSMC, which occurred at about 2:42 ET.

SPX Index, 3-Days, 5-Minute Candles

Source: Interactive Brokers

Considering the near misses that accompanied prior tariff threats regarding Mexico, Canada and others, the market had been in a bit of wait-and-see mode about tariffs – not willing to react too much until they seemed imminent. There was some hope that a reprieve might have been announced at tonight’s joint session of Congress, but it was unequivocal that tariff implementation would indeed occur before the speech.

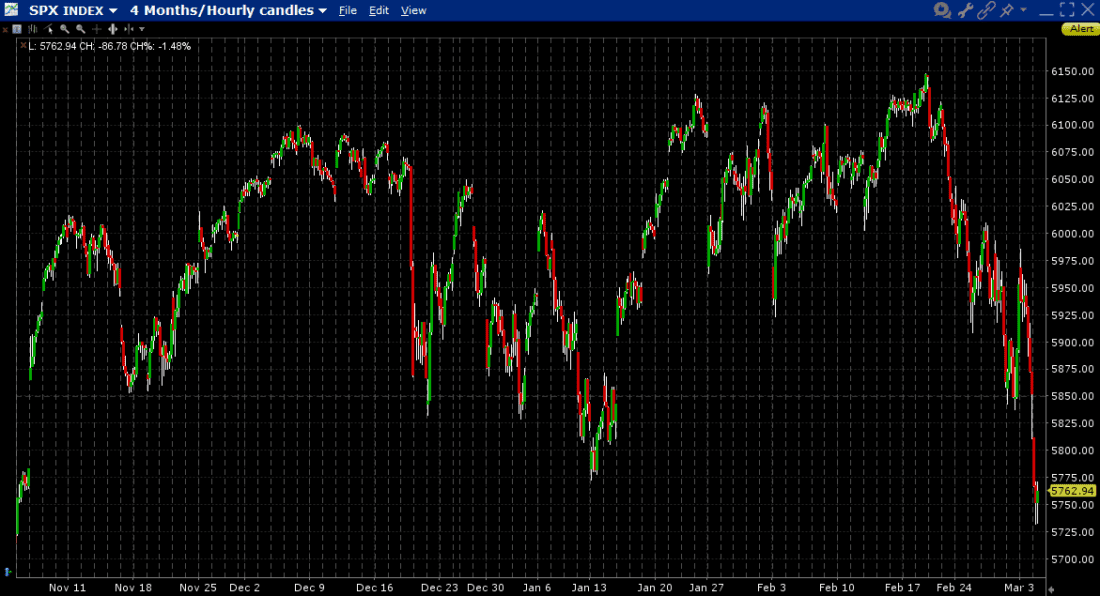

As a result, we’ve given back nearly all of the post-election rally. For reference, SPX closed at 5782.76 on Election Day, with a gap to 5864.89 on the next day’s open. As I type this, we’re below the lowest level of November 5th, and have closed the gap between the Election Day close and the next day’s open (that said, the gap was already closed on Jan 13th). The open question is whether today’s move is capitulation or confirmation of a medium-term top. Considering that today is shaping up to be an outside reversal – higher intraday high today accompanied by a close below Friday’s low, the market has some work to do if a bounce is in order.

SPX Index, 4-Months, 1-Hour Candles

Source: Interactive Brokers

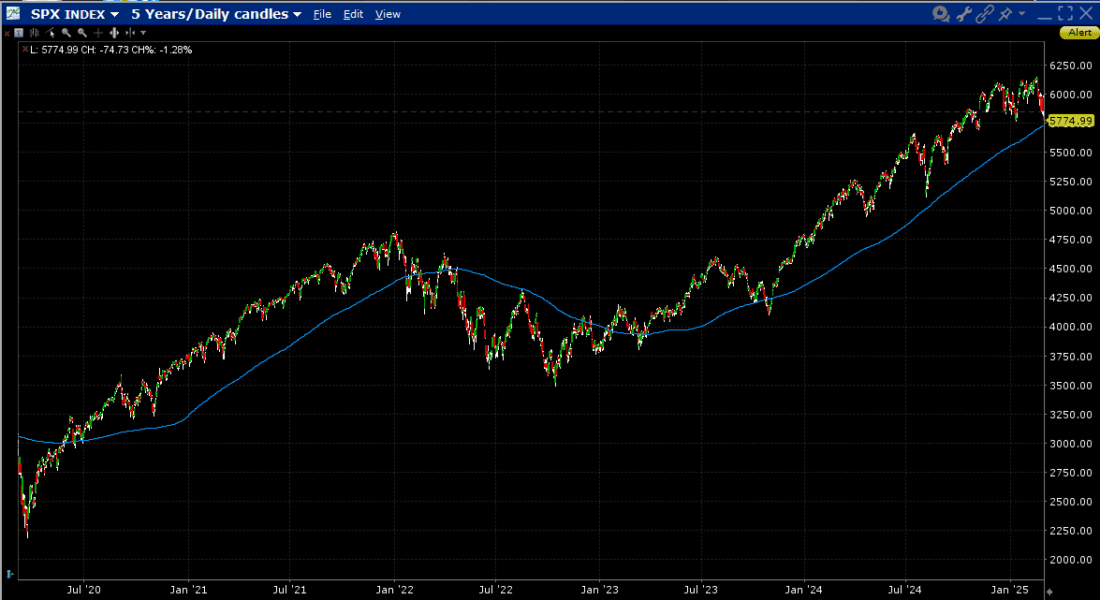

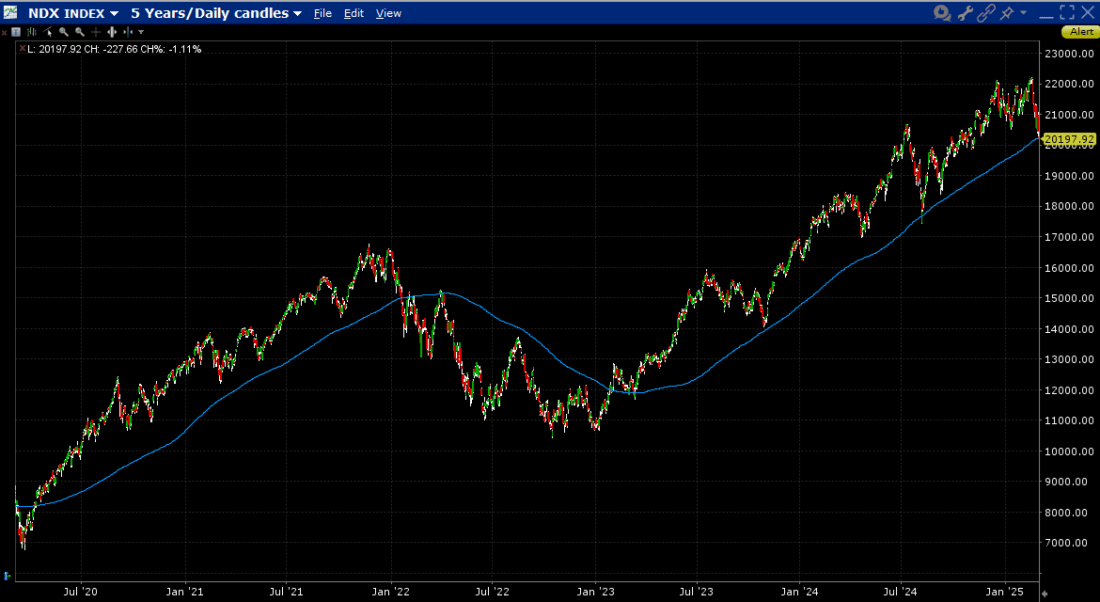

That said, could a bounce be in order? Certainly. Both the S&P 500 (SPX) and Nasdaq 100 (NDX) indices tested their 200-day moving averages successfully this morning, and one could certainly posit that a bounce is in order after such sharp recent selloffs. We can see from the charts below that while both indices might have briefly breached their 200-day averages during the past two years, that long-term trend has held. It reasonable for risk-tolerant traders to take a shot at finding a tradeable bottom around these levels. As I type this, the bounce seems to be occurring. Whether it sticks has much to do with overall risk tolerance and exogenous events.

SPX Index, 5-Years, Daily Candles

Source: Interactive Brokers

NDX Index, 5-Years, Daily Candles

Source: Interactive Brokers

It is important to remember that intraday moves can be exacerbated during periods of higher volatility because liquidity can become constrained. I believe that I’ve discussed[ii] the sign that used to hang above my desk when we were active options market makers:

- Raise vols

- Widen spreads

- Shrink sizes

These were the standard defensive moves that we undertook when markets got hectic. The logic:

- When there is high demand for anything, one should expect prices to rise. The same applies for volatility protection. The marketplace was eager to buy volatility, so this reflects normal supply and demand.

- This reflects both uncertainty and supply/demand. Wider spreads mean that buyers will need to pay a greater premium to buy, and this also protects the market maker against if the mood changes

- The amount of capital that one is willing to risk should change with market conditions. The riskier the market environment, the smaller the desired commitment.

It should be clear that the latter two diminish market liquidity. While I can’t be 100% certain that current market-makers utilize that rubric, I’d be shocked if they didn’t do something similar. It’s a basic form of both self-preservation and profit maximization. It also means that relatively modest amounts of buying and selling can move prices substantially when buyers and sellers are sufficiently motivated.

My advice under those circumstances is to think like a market maker. Lower your risk tolerance, raise your price targets, and get paid to provide liquidity by using limit orders inside the wider markets instead of chasing stocks and options. I’m not sure that everyone will take this to heart in this FOMO-driven environment. We’ve seen not only a willingness to buy dips, which can be done using that suggested tactic, but also a desire to chase rallies. That might work, but realize that rather than exploiting market inefficiency, you’re facilitating it. If you chase, you make more money for whomever is on the other side of the trade. Is that what you really want to be doing right now?

[i] Listen for “Moon the Loon’s” scream at the 1:32 mark that introduces Zep’s future sound and perhaps the onset of all heavy rock.

[ii] I can’t find the link where I explained this topic.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

I believe this is a draft that was accidently published? The first paragraph needs work. The images provided don’t support the assertion of the article. After reading this article, I am not convinced the writer is an expert in this field.

@Melissa – I agree, the first part was badly written, and the rest didn’t get any better. I listened to what Warren Buffett said last week and got the “H” outta the market – he’s selling, and what he said about tariffs, and a turn-down should say something – trade wars never work – especially “blanket tariffs” Wait until prices go even higher, starting tomorrow and within 6 months or less. I’m short this market – read what Buffett said he sure is a lot smarter than this author will ever be!

The market, like the DemocRAT party, has been having some overblown tantrums. The reaction to the tariffs is only equaled by the massive overreaction to the most recent CPI print which was brought to us by the failed Biden admin. Maybe write about that if you care to. Good article. P.S. After the behavior of the DemocRAT party at the President’s speech to Congress I’ve finally realized they’re the party of rage and childish grievance I WAS a Democrat. I no longer recognize my old party. I’m a Republican now. I choose the side of the good guys.

@Paddy – Looks like you didn’t understand what Buffet said – I guess you are smarter than him – ROFL

My IQ was tested at 148 most recently. A drop from 152 on my previous testing. Getting older does affect one’s thinking. I think I’ll pass on responding to your comment. It appears to have come from an adolescent. You must be a DemocRAT.

Hilarious – That you will pass on commenting because your not smarter than Buffet like l told you. Who cares about your dopey IQ proclamation because if you understood what Buffet was saying you would head for the exits too – LOL Take a Econ 101 course where they talk about tariffs and trade wars – looks like you flunked out already – genius – ROFL

Moon kept his role in the The Who, but Page. Not sure what that means Steve. Please advise.