Although I have a major commitment outside the office today, I couldn’t let the markets’ reaction to today’s jobs report go without comment. Thus, today’s article will be brief and somewhat off-the-cuff.

- Yesterday we wrote that we needed a “Goldilocks” report, somewhere around consensus. On balance that’s what we got. The headline Payrolls number was in the ballpark (142k vs 165k), though 2-month revisions were quite large (-86k). Balancing that out, we had the Unemployment Rate fall to 4.2% as expected, and Average Hourly Earnings rose more than expected at 0.4% (vs 0.3% exp). My read is that the pace of hiring has clearly slowed, but we’re not firing either. From a dual mandate point of view, they can certainly assert that we remain closer to maximum employment than not.

- That’s why Fed Funds futures show basically a coin flip for a 50bp cut in the FOMC meeting that occurs in a week and a half. There’s nothing sufficient in today’s report to push us in either direction. It’s also why after 2-year yields plunged by 9 basis points after the number, the gain is down to about 1bp now

- We will need to listen carefully to the Fed talking heads next week before the quiet period. The market tends to ignore the ensemble cast in favor of the leading man (Powell), but since this is a Fed that prefers consensus and dislikes surprising investors, we need as many clues as we can get. Put it this way: if the odds for a cut are split 50/50 between 25 and 50bp, then by definition, half the market will be surprised. Maybe next week’s CPI and PPI reports will add clarity

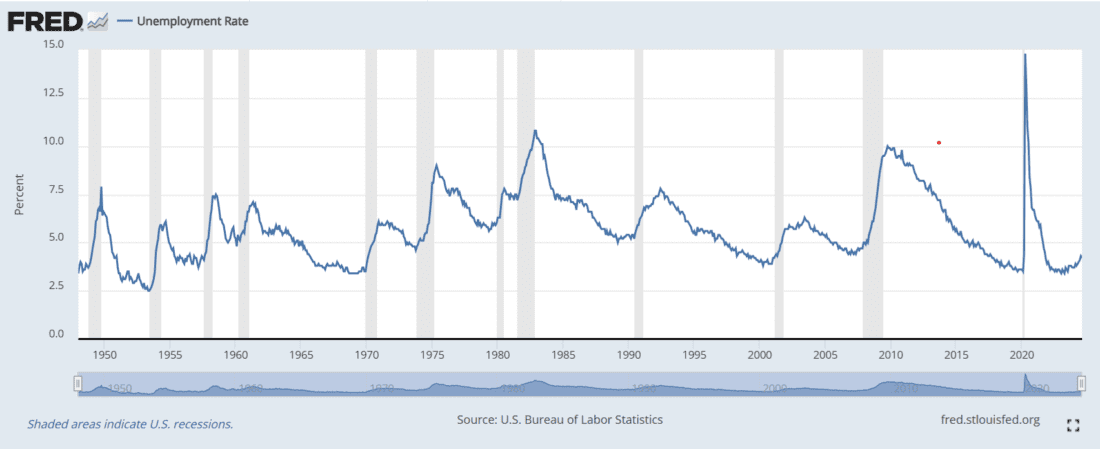

- Someone asked me this morning if the soft-landing narrative is in peril. I’m not sure why (especially given the paucity of precedents for them). The AtlantaFed GDPNow model projects 2.1% GDP growth. That is indeed consistent with a soft landing. An unemployment rate of 4.2% is something historically enviable, though it is indeed above its lows. And if we should doubt a soft landing, how can we expect double-digit earnings growth for the S&P 500 next year?

US Unemployment Rate Since 1948

Source: St. Louis Federal Reserve

- As for the “monetary policy is too restrictive” argument, my retort is “based upon what?” A stock market that is in spitting distance of all-time highs? A corporate bond market that absorbed $80bn in new issuance in three days this week without blinking? We’ve all become liquidity addicts, hoping desperately for a fresh dose whether we really need it or not.

- Re VIX – The Cboe Volatility Index (VIX) remains relatively firm after a dip this morning. The dip in VIX made sense – remember, VIX is constructed to reflect the market’s best estimate for volatility over the coming 30 days (not as a fear gauge). Thus, when we put a potential volatility-causing event in the rear-view mirror, it’s normal to see VIX dip. But with the Fed meeting a toss-up, traders began placing additional focus on the “in-play” FOMC meeting in a week-and-a-half. The firm VIX tells me that institutional investors are still seeking volatility protection ahead of that event, though not aggressively.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking the link below. Multiple leg strategies, including spreads, will incur multiple transaction costs. "Characteristics and Risks of Standardized Options"

Hi Steve,

thanks for your valuable insights as usual. I know that you mentioned that VIX is not a fear gauge, but I still fail to understand why not. As far as I understand, VIX increase in price due to demand for volatility protection. If investors and traders are buying VIX, they expect volatility and risk (normally to downside) to increase. So, isn’t a fear gauge after all?

Thanks again.

An options contract requires a buyer and a seller. That is why VIX is an index and not rightly an indicator, and not a fear indicator. SO NEVER draw a conclusion about the direction of a stock or fund merely from a number of puts (or calls) bought and therefore sold against it.

Funny, he seems to be only one I heard all day Friday who says the job s # was in line. Everyone else said it was much too low or disappointing.