Use the Securities Lending Dashboard to analyze short sale metrics for these and other stocks.

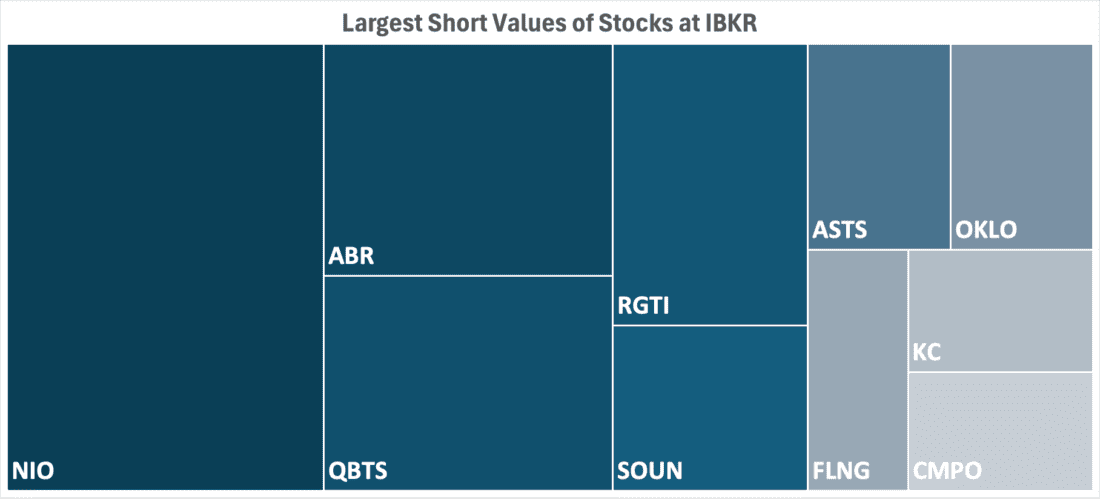

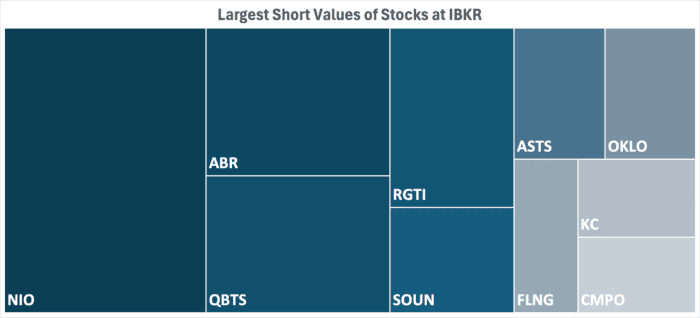

Largest Short Values of Stocks at IBKR

| Rank | Stock | Description |

| 1 | NIO | NIO INC – ADR |

| 2 | ABR | ARBOR REALTY TRUST INC |

| 3 | QBTS | D-WAVE QUANTUM INC |

| 4 | RGTI | RIGETTI COMPUTING INC |

| 5 | SOUN | SOUNDHOUND AI INC-A |

| 6 | ASTS | AST SPACEMOBILE INC |

| 7 | OKLO | OKLO INC |

| 8 | FLNG | FLEX LNG LTD |

| 9 | KC | KINGSOFT CLOUD HOLDINGS-ADR |

| 10 | CMPO | COMPOSECURE INC-A |

Excludes stocks with borrow fees less than 1%

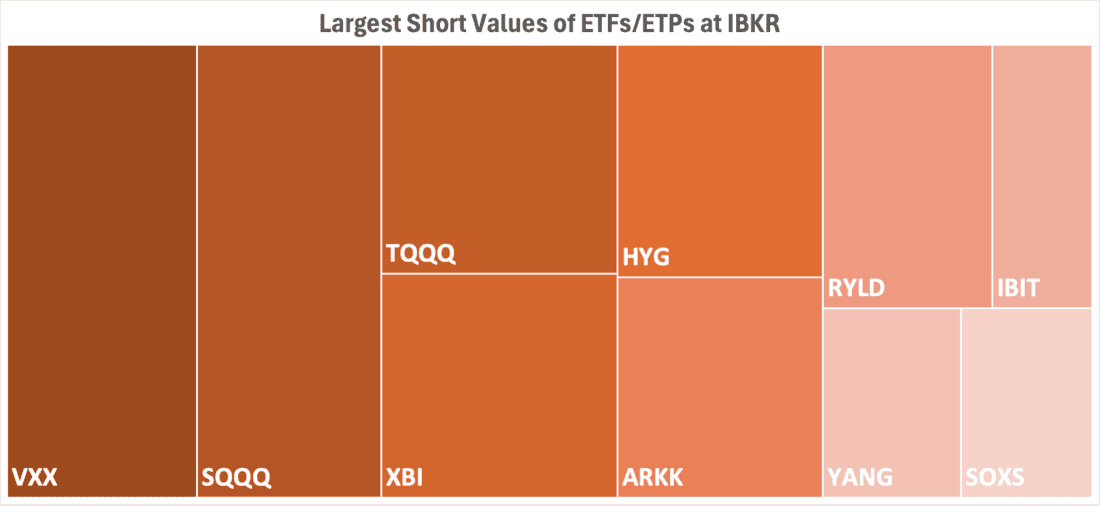

Largest Short Values of ETFs / ETPs at IBKR

| Rank | ETF | Description |

| 1 | VXX | IPATH SERIES B S&P 500 VIX |

| 2 | SQQQ | PROSHARES ULTRAPRO SHORT QQQ |

| 3 | TQQQ | PROSHARES ULTRAPRO QQQ |

| 4 | XBI | SPDR S&P BIOTECH ETF |

| 5 | HYG | ISHARES IBOXX HIGH YLD CORP |

| 6 | ARKK | ARK INNOVATION ETF |

| 7 | RYLD | GLOBAL X RUSSELL 2000 COV CL |

| 8 | IBIT | ISHARES BITCOIN TRUST ETF |

| 9 | YANG | DRX DLY FTSE CHINA BEAR 3X |

| 10 | SOXS | DIREXION DAILY SEMI BEAR 3X |

Excludes ETFs with borrow fees less than 1%

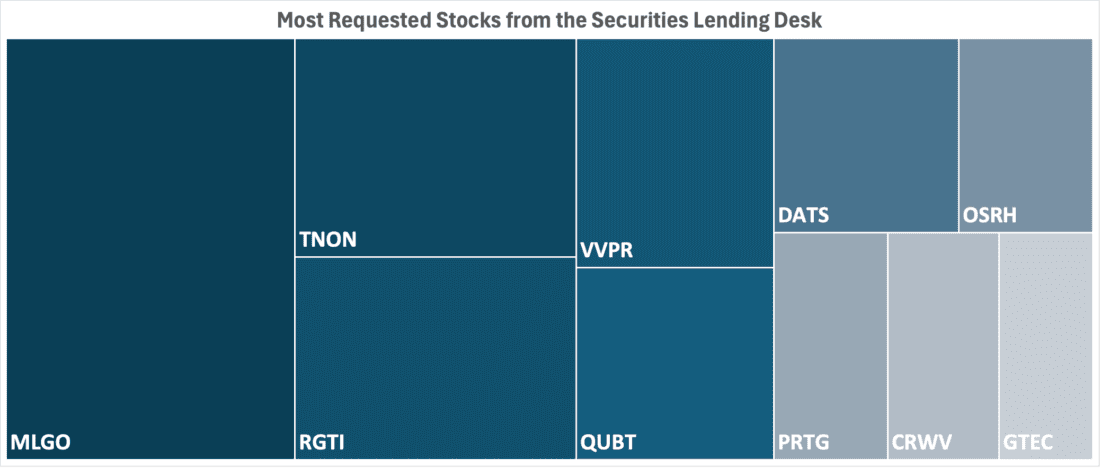

Most Requested Stocks from the Securities Lending Desk

| Rank | Stock | Description |

| 1 | MLGO | MICROALGO INC |

| 2 | TNON | TENON MEDICAL INC |

| 3 | RGTI | RIGETTI COMPUTING INC |

| 4 | VVPR | VIVOPOWER INTERNATIONAL PLC |

| 5 | QUBT | QUANTUM COMPUTING INC |

| 6 | DATS | DATCHAT INC |

| 7 | OSRH | OSR HOLDINGS INC |

| 8 | PRTG | PORTAGE BIOTECH INC |

| 9 | CRWV | COREWEAVE INC-CL A |

| 10 | GTEC | GREENLAND TECHNOLOGIES HOLDI |

Includes requests from the past week

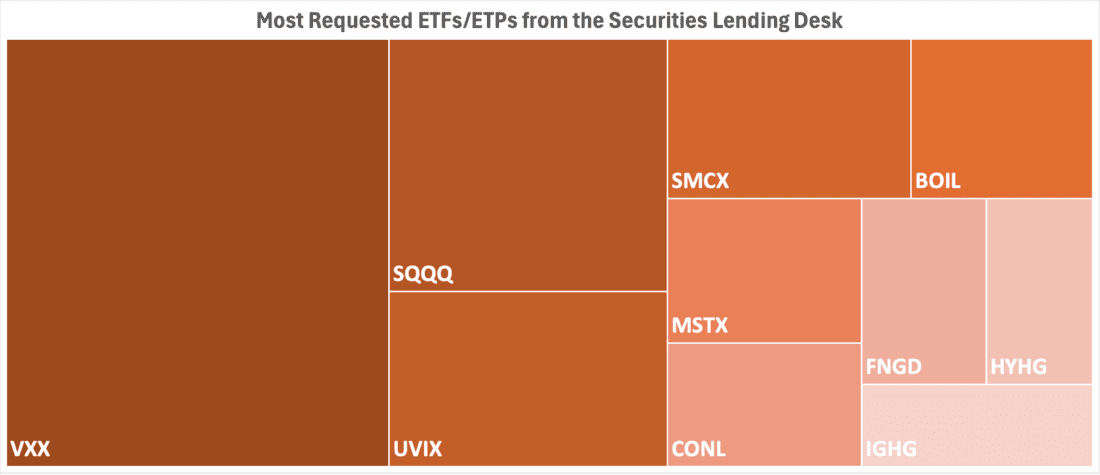

Most Requested ETFs / ETPs from the Securities Lending Desk

| Rank | ETF | Description |

| 1 | VXX | IPATH SERIES B S&P 500 VIX |

| 2 | SQQQ | PROSHARES ULTRAPRO SHORT QQQ |

| 3 | UVIX | 2X LONG VIX FUTURES ETF |

| 4 | SMCX | DEFIANCE DLY TRG 2X LNG SMCI |

| 5 | BOIL | PROSHARES ULTRA BLOOMBERG NA |

| 6 | MSTX | DEFIANCE DLY TRG 2X LNG MSTR |

| 7 | CONL | GRANITESH 2X LNG COIN ETF-US |

| 8 | FNGD | MICROSECTORS FANG+ INDEX -3X |

| 9 | HYHG | PROSHARES HIGH YIELD INTERES |

| 10 | IGHG | PROSHARES IG HEDGED |

Includes requests from the past week

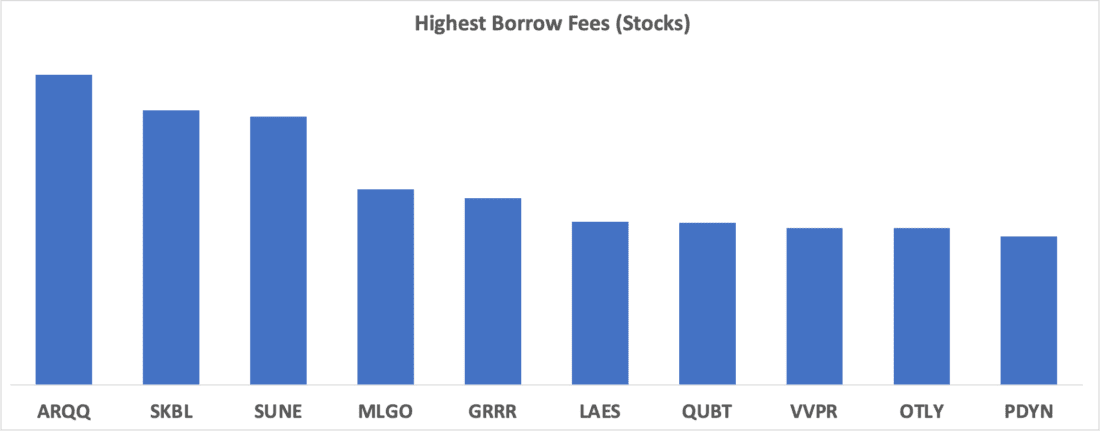

Highest Borrows Fees (Stocks)

| Rank | Stock | Description |

| 1 | ARQQ | ARQIT QUANTUM INC |

| 2 | SKBL | SKYLINE BUILDERS GROUP HOL-A |

| 3 | SUNE | SUNATION ENERGY INC |

| 4 | MLGO | MICROALGO INC |

| 5 | GRRR | GORILLA TECHNOLOGY GROUP INC |

| 6 | LAES | SEALSQ CORP |

| 7 | QUBT | QUANTUM COMPUTING INC |

| 8 | VVPR | VIVOPOWER INTERNATIONAL PLC |

| 9 | OTLY | OATLY GROUP AB |

| 10 | PDYN | PALLADYNE AI CORP |

Excludes stocks with short value less than $1M

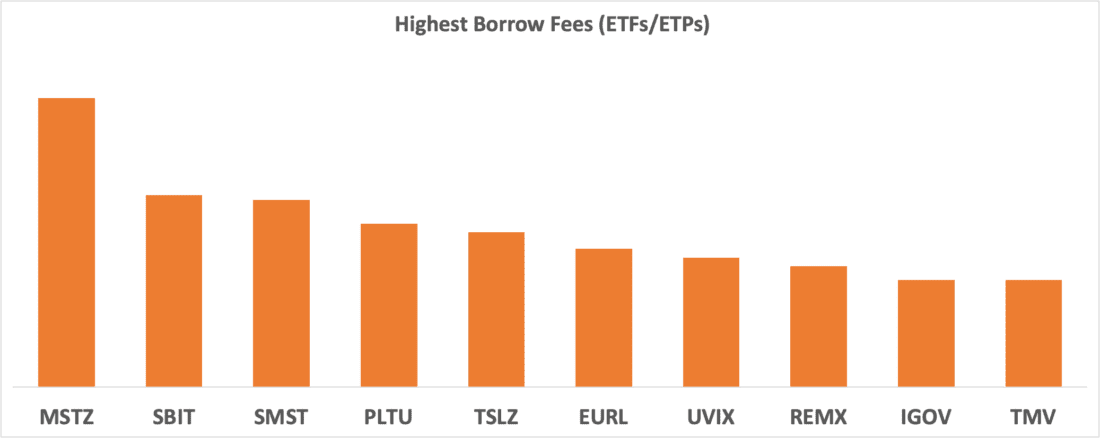

Highest Borrow Fees (ETFs / ETPs)

| Rank | ETF | Description |

| 1 | MSTZ | T-REX 2X INVERSE MSTR DT ETF |

| 2 | SBIT | PROSHARES ULTRASHORT BITCOIN |

| 3 | SMST | DEFIANCE DLY TRG 2X SHR MSTR |

| 4 | PLTU | DIREXION DLY PLTR BULL 2X SH |

| 5 | TSLZ | T-REX 2X INVERSE TESLA DLY |

| 6 | EURL | DRX DLY FTSE EUROPE BULL 3X |

| 7 | UVIX | 2X LONG VIX FUTURES ETF |

| 8 | REMX | VANECK RAR EARTH ND STG-USDI |

| 9 | IGOV | ISHARES INTERNATIONAL TREASU |

| 10 | TMV | DRX DLY 20+ YR TREAS BEAR 3X |

Excludes ETFs with short value less than $1M

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Securities Lending Desk, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Securities Lending Desk and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Margin Trading

Trading on margin is only for experienced investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Disclosure: Cryptocurrency based Exchange Traded Products (ETPs)

Cryptocurrency based Exchange Traded Products (ETPs) are high risk and speculative. Cryptocurrency ETPs are not suitable for all investors. You may lose your entire investment. For more information please view the RISK DISCLOSURE REGARDING COMPLEX OR LEVERAGED EXCHANGE TRADED PRODUCTS.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Complex or Leveraged Exchange-Traded Products

Complex or Leveraged Exchange-Traded Products are complicated instruments that should only be used by sophisticated investors who fully understand the terms, investment strategy, and risks associated with the products. Learn more about the risks here: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=4155

Disclosure: Day Trading

Day Trading can be extremely risky and may not be appropriate for individuals with limited resources, investment experience or low risk tolerance. Please review the Day Trading Risk Disclosure Statement before deciding whether Day Trading is appropriate for you.

Can anyone share insight as to why the inverse, leveraged ETFs are being shorted so much? Obviously, there is no borrow fee for the NON-inverse version. Is it some sort of hedge that I’m not grasping? Is this a way to avoid the decay on a leveraged position?

There are a few reasons why inverse leveraged ETFs are frequently shorted: 1. **Hedging Strategy** – Some traders short inverse leveraged ETFs as a hedge against their long positions in the underlying asset. Since inverse ETFs move in the opposite direction of the asset they track, shorting them can act as a way to balance exposure. 2. **Decay Avoidance** – Leveraged ETFs suffer from **volatility decay** due to daily compounding. This means that over time, their returns can diverge significantly from the expected multiple of the underlying asset’s performance. Shorting an inverse leveraged ETF can be a way to capitalize on this decay rather than suffer from it. 3. **Margin & Borrowing Costs** – While non-inverse ETFs may not have a borrow fee, inverse leveraged ETFs often do. However, traders may still prefer shorting them due to their predictable decay and the ability to structure trades that benefit from their long-term underperformance. 4. **Market Sentiment & Arbitrage** – Some investors short inverse leveraged ETFs when they expect the market to rise, using them as a way to express bullish sentiment. Additionally, arbitrage opportunities can arise due to pricing inefficiencies in these ETFs.

Yes, Likely a pairs trade by institutions to capture volatility decay inherent in the inverse etfs. We have been chopping around a lot lately, I think the inverse ETFS work best in a trending market and do not make the equivalent index moves in periods where we are up one day and down the next.