The great energy debate is back in the news with some of the Magnificent Seven pushing investments into the nuclear field. Whether nuclear power falls under the category of “clean energy” is open to interpretation, however Amazon, Google, and Meta are seeking to triple nuclear power worldwide by 2050. As the Trump Administration talks of expanding its energy footprint to other regions of the world, sector specialists are likely to keep an eye on the nuclear industry in the coming months. One company that falls into this category is Oklo Inc. (NYSE: OKLO).

Based in California, OKLO designs and manufactures fission reactors to produce nuclear energy to sell to its customers. The company’s goal is to produce affordable and clean energy at their power plants that is accessible to all who need it. OKLO has steadily been increasing the capacity of their reactors to produce more megawatts as demand continues to rise.

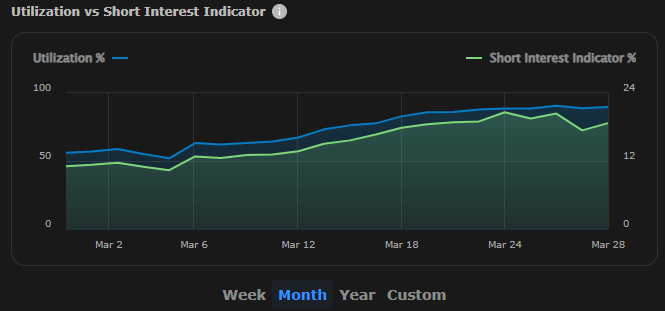

While the capacity of the reactors rises, so does Utilization for OKLO. Using the Orbisa Securities Lending Dashboard in TWS, we can see that the month of March began with a rate of 52% and as of March 28th, the rate has risen to 90%. The stock’s Utilization has steadily increased as more shares were loaned. The Short Interest Indicator also observed the same behavior in March, beginning at 11% and reaching 19% on March 28th. OKLO is being lent at a much higher borrow fee due to market demands.

OKLO Utilization vs Short Interest Indicator (past month)

Source: Interactive Brokers Securities Lending Dashboard. Data is provided by Orbisa.

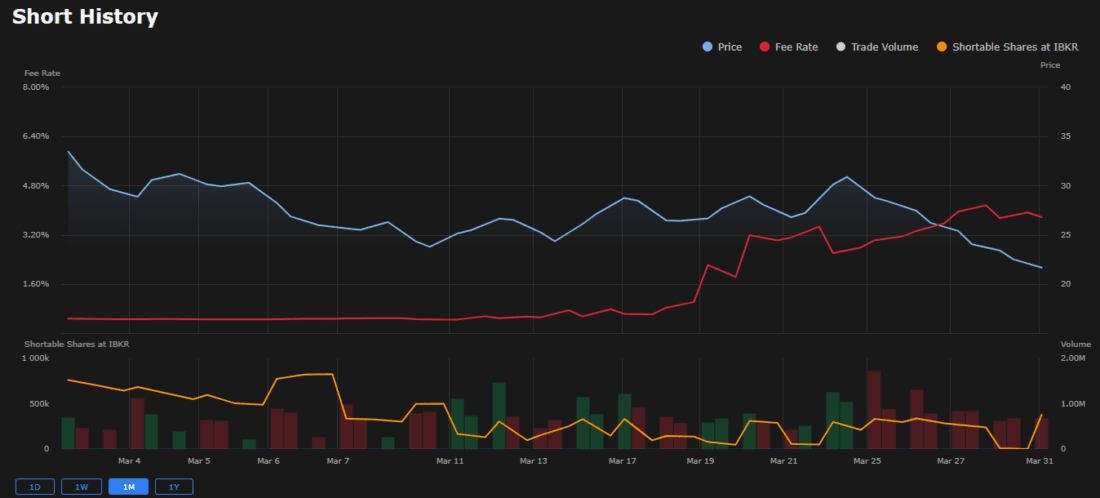

During the same time period, OKLO’s share price has decreased 22% from $28.69 on March 3rd to $22.33 on March 28th. The decline has coincided with the movement of the market, however the On-Loan Quantity and Value have increased significantly for this position (10M to 18M and $339M to $447M, respectively). Growths of this magnitude will often result in the fee rate tagging along for the ride up. The borrow fee started March at 0.45% before reaching a 4%-handle by the end of the month.

OKLO Short History (3/3/2025-3/31/2025)

As of March 31st, IBKR has 290k shortable shares. Despite the sharp increase in OKLO shares being lent out, IBKR is working to maintain an inventory for those looking to sell the position short. There will be fluctuations throughout the day with popular shorts, but even if shares are not readily available IBKR will track client demand and source locates as needed. We currently have nine different securities lending counterparties with locates available for OKLO in that event.

The nuclear sector might continue to hold the attention of short sellers as the technology advances, and for those looking to be on the short side IBKR will try to make that possible. OKLO is currently one of the hottest shorts at IBKR. Whether their reactors will be able to produce clean and affordable nuclear energy is likely being closely monitored by energy sector traders.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Securities Lending Desk, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Securities Lending Desk and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Short Selling

Short selling is an advanced trading strategy involving potentially unlimited risks and must be done in a margin account.

Disclosure: Day Trading

Day Trading can be extremely risky and may not be appropriate for individuals with limited resources, investment experience or low risk tolerance. Please review the Day Trading Risk Disclosure Statement before deciding whether Day Trading is appropriate for you.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!