In many ways, Singapore is the jewel of Southeast Asia with the country having a thriving economy, unusually strong fiscal discipline, an unblemished credit rating and an equity market with attractive relative valuations. Other characteristics include robust finance, technology and tourism sectors that are likely to benefit from secular growth. From a geographical perspective, Singapore’s strategic location has allowed it to become a global trade hub and its immigration policies are likely to attract foreign talent, including professionals, students and entrepreneurs. The country is also benefiting from synchronized monetary policy easing by global central banks, while China’s stimulus measures are another potential growth driver.

Singapore Economy Catches a Tailwind

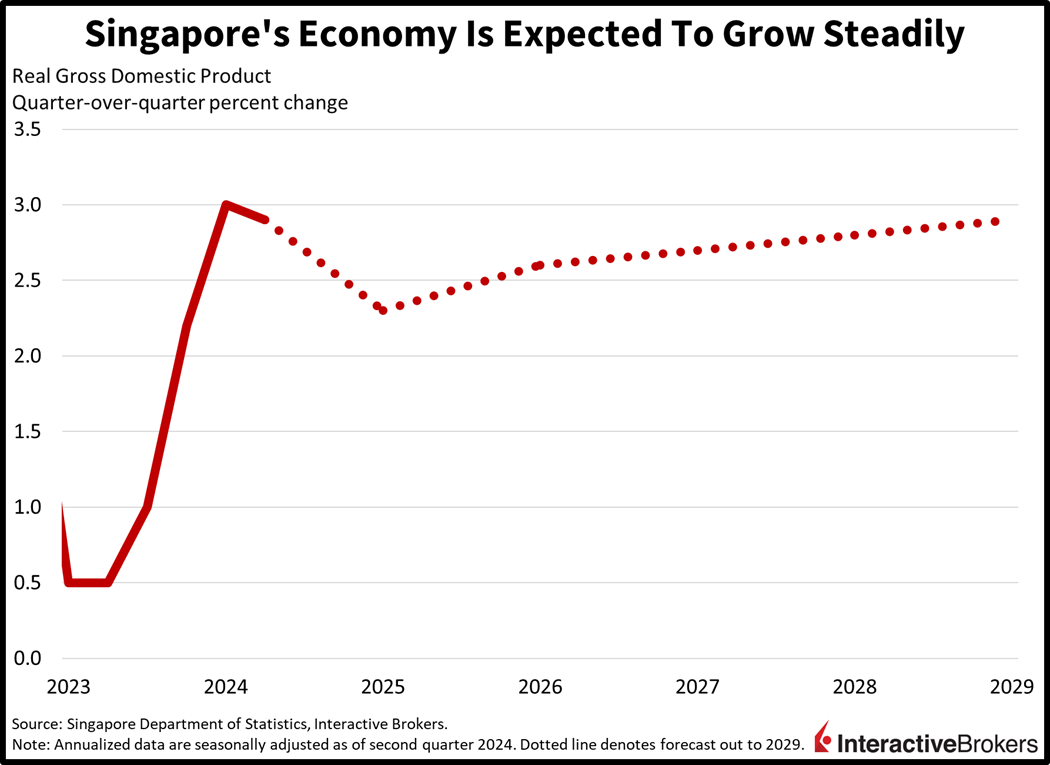

In a September survey of 21 economists conducted by the country’s central bank, the Monetary Authority of Singapore (MAS), the median forecast for 2024 GDP growth was upgraded from 2.4% to 2.6%, a result of the country benefiting from strong external factors, including better-than-expected performance in the US. The MAS, for its part, expects expansion to range from 2.0% to 3.0%. Economists also expect current-quarter GDP growth of 2.6%. Price pressures are also expected to cooperate against the backdrop, with the median outlooks for headline and core inflation for this year at 2.6% and 2.9%, respectively, down from 2.8% and 3.0% in a June survey. The encouraging estimates come after the country’s economy expanded by 3.0% and 2.9% year-over-year (y/y) as of the first and second quarters. The country’s finance and insurance sector grew 6.7% y/y, a result, in large part, of lighter global interest rates and buoyant investor sentiment causing transaction activity to surge. Other sectors with potent performance included wholesale trade and the information and communications group. While manufacturing weakened, electronics strengthened with rising demand for smartphones, computers and artificial intelligence chips. Additionally, the country’s transportation and storage category advanced 5.4% while an increase in international travel drove a 4.3% uptick in the accommodation sector.

Capital Markets Feature Attractive Valuations

Singaporean equities are attractively valued with the iShares MSCI Singapore ETF (EWS) having a price-to-earnings ratio (P/E) of 11.27 as of early October. This is considerably below Vietnam’s P/E of 15.74, Thailand’s P/E of 18.10, and Taiwan’s P/E of 21.7. Many companies in Singapore are considered value firms with nearly half of EWS allocated to financials. The ETF tracks the MSCI Singapore 25/50 Index and comprises mid- and large-size companies. It represents approximately 85% of the Singapore equity market. The strong representation of financial companies points to Singaporean equities benefiting from the synchronized easing of monetary policies by many central banks, a development that could increase the vibrancy of capital markets. The ETF’s largest position, for example, is DBS Group Holding, a banking conglomerate with operations in Singapore, Hong Kong, China, Indonesia, Malaysia, Japan, Vietnam, Dubai, the US and other locations.

One potential bright spot for Singapore is the country’s industry focusing on developing alternative energy products. While this business sector has strong exposure to Taiwan and Vietnam, it may also benefit from its trading with China, which expects to generate 50% of its increase in energy from 2020 to 2050 through renewable sources. Additionally, the domestic clean energy market offers growth opportunities with sustainable sources providing only 3.2% of Singapore’s electricity.

The country’s strong credit rating and stable currency have traditionally made its bonds attractive. The most recent issuance of Singapore Savings Bonds resulted in yields of 2.25% per year for a one-year holding period and 2.56% per year for a 10-year period.

Monetary Policy Focuses on Currency

The gross value of Singapore’s imports and exports of goods and services is more than 300% of the country’s GDP and the country’s domestic expenditures are heavily weighted toward imports. The MAS, therefore, focuses its monetary policy on managing the value of the Singapore dollar against a trade-weighted basket of currencies. It manages the currency exchange rate, or the Singapore Dollar Nominal Effective Exchange Rate (S$NEER), by intervening in the spot foreign exchange market. The MAS also establishes a target trading band for the currency. For example, during the Covid-19 pandemic, the MAS lowered the currency’s appreciation rate to 0%. At its July meeting, the MAS announced that it had previously decided to maintain its current policy band, which offers upside potential for the Singaporean dollar.

Singapore’s key interest benchmark, the overnight interest rate (SORA), is based on the volume-weighted average rate of borrowing in the unsecured overnight interbank market. As such, it is determined by market factors. It is currently at 3.38%. As central banks increasingly ease monetary policies, the risk of the Singapore dollar weakening is reduced, which could make investing in the country more appealing.

Fiscal Policy Sparkles

Singapore uses debt issuance for investing rather than to plug shortfalls in government revenue. As a result, when factoring the value of Singapore’s investments, the country’s net debt-to-GDP ratio is 0%, a level that has persisted for nearly three decades. As a result, Singapore is the only Asian country with AAA credit scores from all the major rating agencies.

Risks to Economy and Markets

Singapore has no hydrocarbon resources, so it imports oil, leaving its economy susceptible to energy commodity price swings, such as the recent increase in crude resulting from the escalation in the Middle East conflict. Additionally, Singapore’s exporting could be hurt by continued geopolitical and trade tensions. A significant portion of Singapore’s exports to China are part of the global value chain, or a network of countries that work together to produce products. In this case, China imports unfinished items from Singapore and completes the products before exporting them. Singapore’s exporting activity, therefore, could face challenges if US and European tariffs on imports from China are increased. This development could test Singapore’s ability to quickly find trading partners that are able to finish products and ship them to other markets, including the US and Europe. Singapore could also leverage its existing trading partners such as Mexico, which has displaced China as the largest provider of goods to the US. Singapore’s biggest category of exports to Mexico consists of integrated circuits, semiconductor devices and office machine parts.

China’s sluggish economy is another concern. Indeed, the International Monetary Fund recently estimated that a 1 percentage point decline in China’s GDP would cause a 0.2 percentage point annual headwind to Singapore’s economy over five years. However, China has already rolled out fiscal stimulus and has signaled that additional aggressive actions to improve economic growth are possible. These developments could help improve Singapore’s trading volume with the country as their economies are heavily interconnected.

ForecastTrader Expectations

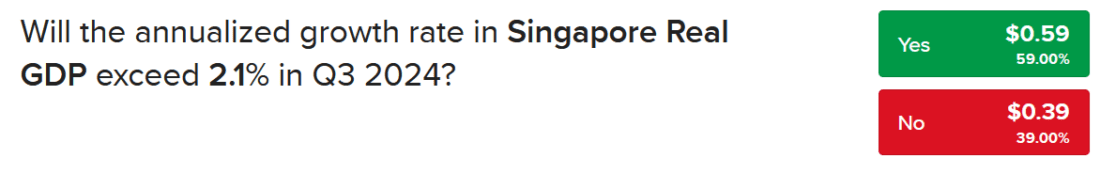

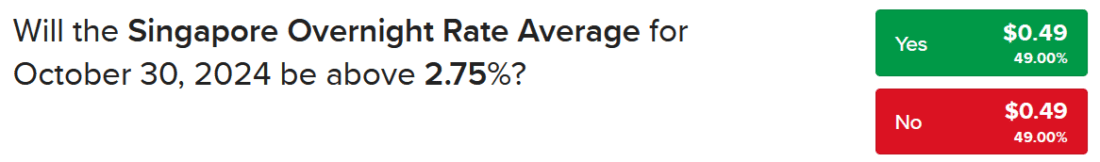

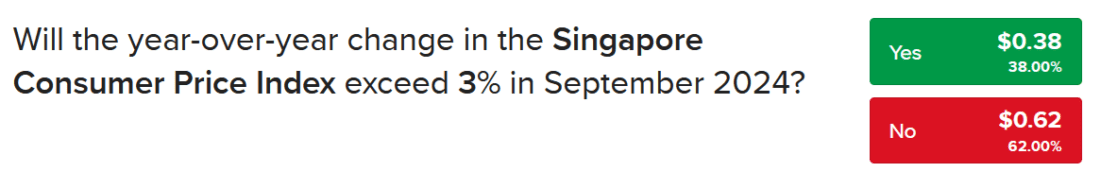

IBKR ForecastTrader participants appear to be in alignment with recent expectations. While economists expect third-quarter GDP growth of 2.6%, the IBKR ForecastTrader contract asking if GDP will exceed 2.1% shows a 59% likelihood of that occurring. Meanwhile, ForecastTrader contracts reflect coinflip probabilities that the SORA will exceed 2.75% on October 30, with both the No and Yes versions offering 49% odds. Investors also anticipate somewhat benign inflation with the contract asking if the y/y CPI in September will exceed 3% pointing to less than a 40% chance.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!