Some of us rarely stop thinking about the Federal Reserve (ugh), so even two days prior, it’s not too soon to consider what might occur during and after Wednesday’s FOMC meeting. Although few fireworks are expected, investors are hoping for some improved clarity about the rates picture going forward.

As of today, Monday, it appears that market expectations for this meeting are minimal. There is literally no expectation for a hike this week. OK, it’s technically not zero per se, but I would assert that when Fed Funds futures show a 0.8% chance, that’s as close to zero as practicable. Rate hike probabilities for upcoming meetings are also modest, with November currently showing 32% and December showing 46% chances of a 25-basis point hike. Bottom line, the market has decided that we may or may not get one more hike by the end of the year, and it’s essentially a coin flip.

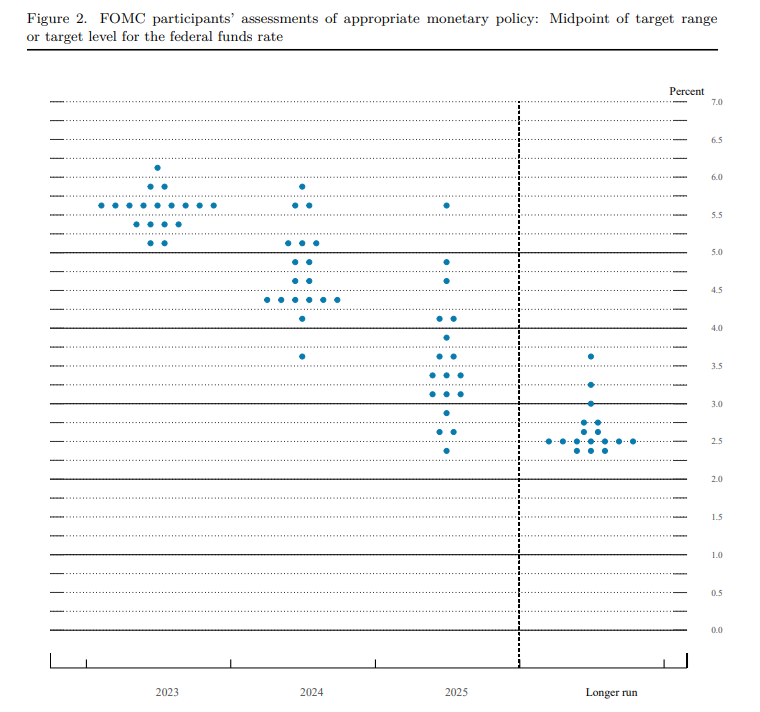

Looking ahead to next year, futures have priced in a cut as soon as June-July of next year, with July futures implying a near certainty for a 25-bp cut and another one to three likely by the end of 2024. After spending most of this year pushing back upon the Fed’s resolve to maintain rates through 2023, it appears that the market’s expectation is broadly in line with the FOMC’s last Summary of Economic Projections (SEP), commonly referred to as the “Dot Plot”:

Source: Summary of Economic Projections, June 14, 2023 (federalreserve.gov)

The SEP is updated every other meeting, so traders will be eagerly poring over the fresh dot plot when it is released on Wednesday. The median projection for year-end 2023 is currently 5.625%, and 2024’s median year-end projection is 4.625%. These are broadly consistent with the current Fed Funds futures’ projections of 5.446% and 4.572%, respectively. Now that traders are generally in synch with Fed policymakers, any change in projections should be quickly incorporated into market expectations.

The question, of course, is how those might be interpreted. It is clear that equity traders love any hint of lower rates. It’s a fixation, if not an addiction. But what if a lower rate path is predicated on broadly weaker economic projections? Will traders simply resume their usual pattern of hearing what they want to? Think about the market’s reaction to Chair Powell’s use of the word “neutral” in July 2022 and “disinflation” last February. In the former case, other Fed leaders pushed back on “neutral” almost immediately, while in the latter, we had a stellar two-day rally until the January Payrolls report brought it to an abrupt end on Friday of that week.

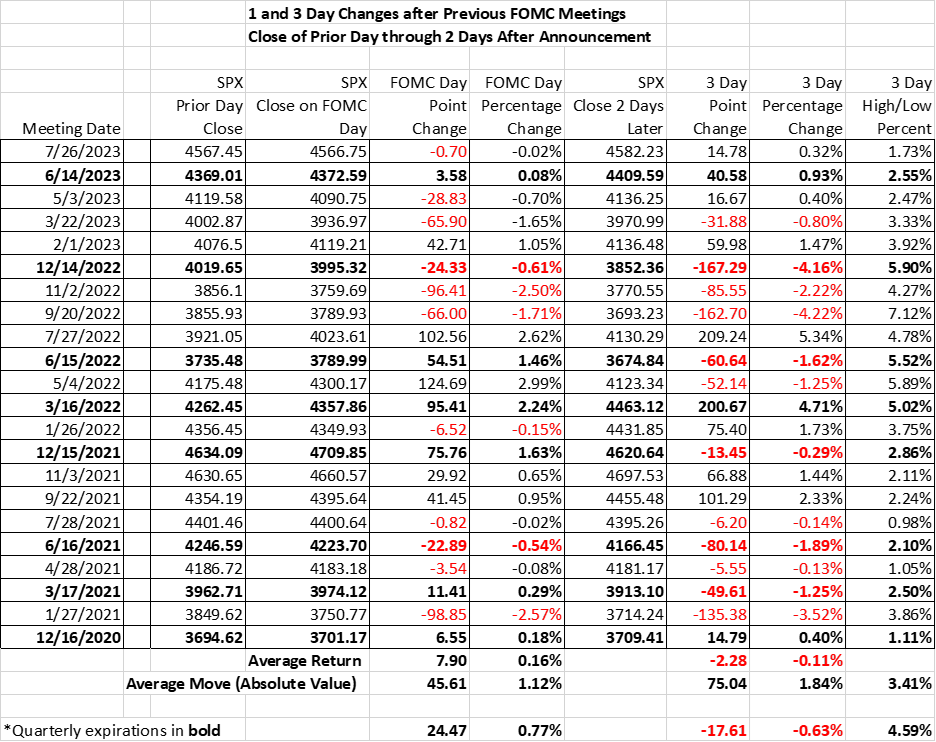

Given the relatively somnolent, if not outright complacent, nature of volatility over the past few months, it should be unsurprising that equity market reactions to recent FOMC meetings have been less volatile as well:

Source: Interactive Brokers

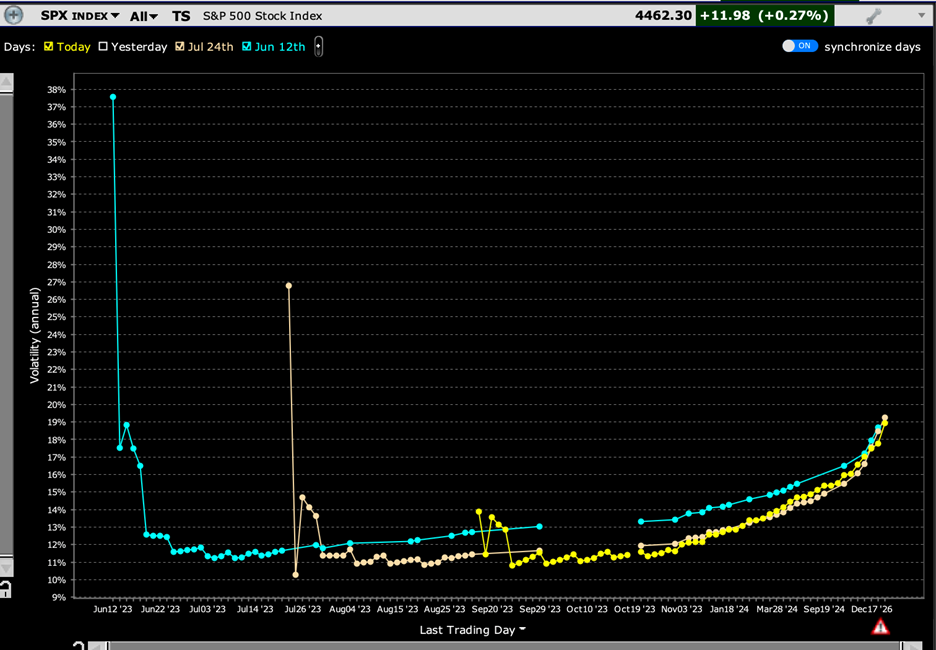

Notice how the 1-day and 3-day close-to-close and the 3-day high/low percentage changes have all been relatively modest and steadily declining after the past few meetings. Have we simply gotten better pricing the potential outcomes of FOMC meetings and press conferences, or do we simply care less? As we look back toward the implied volatility term structure for the S&P 500 (SPX) ahead of this week’s meeting vis-à-vis the prior two, we see that volatility assumptions for the Wednesday of the meeting have declined from 18.825% in June to 14.7% in July to 13.65% today.[i] Bearing in mind the “Rule of 16,” those roughly imply one-day average moves of 1.18%, 0.92% and the current 0.85%

SPX, Term Structure of Implied Volatilities, June 12th, 2023 (blue), July 24th, 2023 (peach), September 18th, 2023 (yellow)

Source: Interactive Brokers

There are two other concepts that I find useful when trading in the aftermath of an FOMC meeting:

- The first move is often the wrong move. Markets are thin and wide as traders process the outcome of the commentary, especially Mr. Powell is inadvertently portraying “Goldilocks in a suit” and offering two sides of each policy

- Traders react and investors consider. Traders are responding to every utterance and nuance of the FOMC statement and Powell’s press conference. Investors tend to wait until the following day before making macro moves based on that information. The Thursday reaction is more likely the “real” reaction as a result.

—

[i] Interestingly, we see the implied volatilities of same-day options dropping dramatically. That is likely the result of traders being less fearful of 0DTE-inspired one-day moves and more willing to sell those rapidly decaying options.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Security Futures

Security futures involve a high degree of risk and are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading security futures, please read the Security Futures Risk Disclosure Statement. For a copy visit ibkr.com

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!