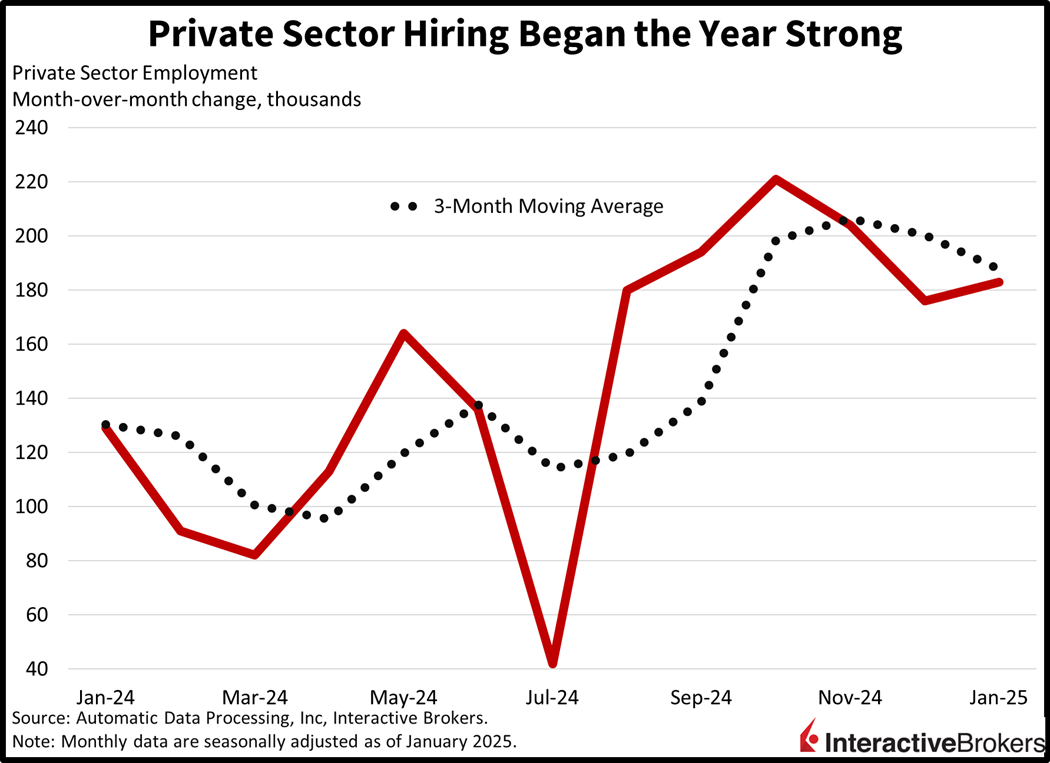

Investors were embracing the risk-off playbook today as lackluster earnings results from Alphabet (GOOG) and Advanced Micro Devices (AMD) coincided with a weaker-than-expected ISM services print and a US Treasury announcement communicating steady auction sizes for the next few quarters. Meanwhile, an upside beat in the ADP jobs report failed to counter the defensive winds of the morning, with market participants trimming equity exposure in favor of fixed-income and metals despite US private sector employers adding 183,000 workers in cyclical fashion last month. Emblematic of the AM rush toward safe-haven assets were 2- and 10-year yields reaching their lowest levels in over a month and gold hitting a fresh all-time high. But in the afternoon, stocks have since rebounded from earlier lows and all major US benchmarks are now in the green as lighter costs of capital motivate some purchasing.

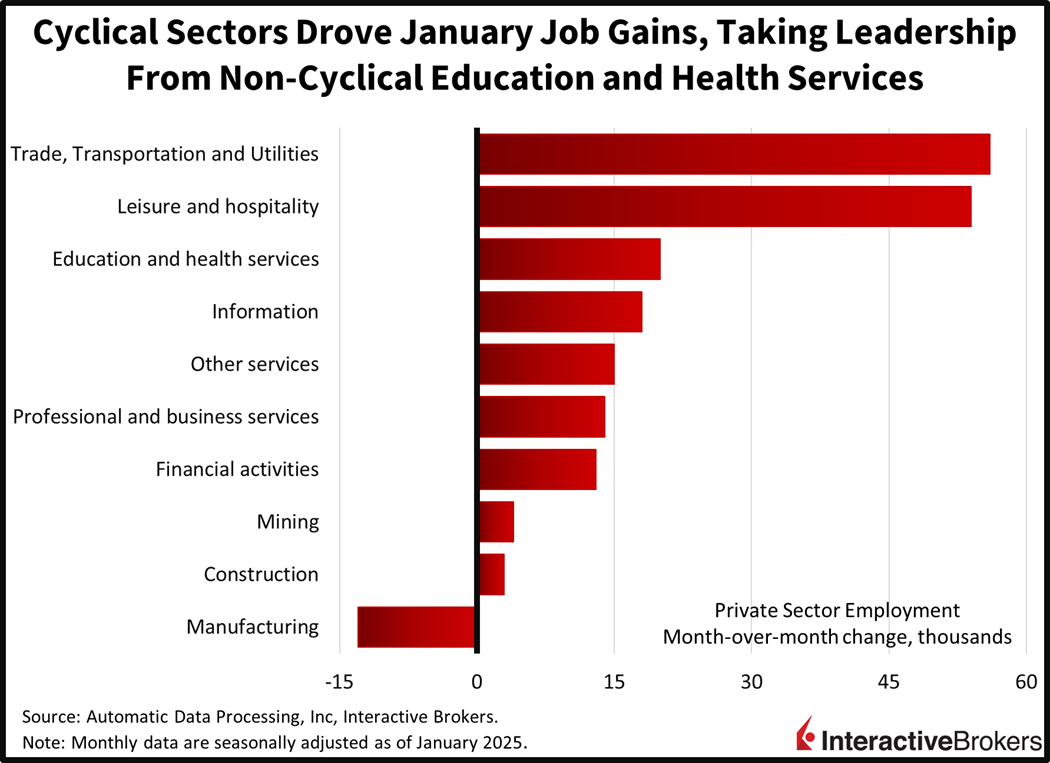

Cyclical Sectors Assume Hiring Leadership

The US private sector accelerated its hiring to start the year with businesses of all sizes contributing to the cyclical momentum, according to payroll processing firm ADP. All 11 sectors ex-manufacturing drove the headline strength of 183,000, which surpassed the 150,000 median estimate as well as the 176,000 from December. The economically sensitive trade/transportation/utilities and leisure/hospitality categories comprised more than half of the gain, boosting headcounts by 56,000 and 54,000. Education and health services and information were also sizeable supporters, raising rosters by 20,000 and 18,000. All other segments except for manufacturing, which lost 13,000, added 15,000 or less. Small (1-49 employees), medium (50-499 employees) and large firms expanded payrolls by 39,000, 92,000 and 69,000. Wage pressures, meanwhile, were bifurcated across job changers and job stayers, with the year-over-year (y/y) changes in annual pay shifting from 4.6% and 6.9% to 4.7% and 6.8% during the period.

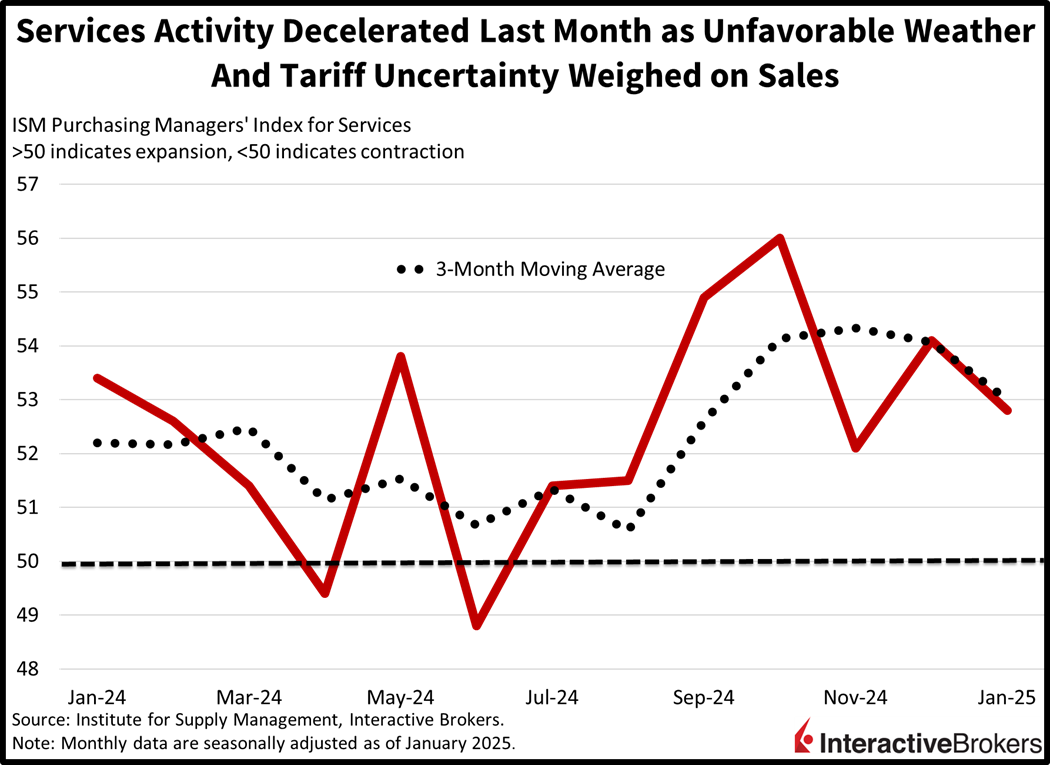

Demand for Services Softens

Economic activity decelerated in the services sectors last month, as survey respondents blamed unfavorable weather conditions and trade uncertainty for slower demand. The Institute for Supply Management’s (ISM) Purchasing Managers’ Index for Services came in at 52.8, beneath the median estimate of 54.3 and the 54 from December. Monthly scores for prices, business production and new orders decelerated to 60.4, 54.5 and 51.3, weighing on the headline. Countering some of the softening, however, were employment and new export orders, which accelerated to 52.3 and 52. The hiring figures confirm the cyclical buoyancy within the ADP report.

Investors Rush to Safety

Risk-off sentiments were dominating Wall Street as investors clamored for gold bars and Treasurys until stocks reversed from red to green. The small-cap, rate-sensitive, Russell 2000 Index is leading the way; it’s up 1.1% and the Nasdaq 100, S&P 500 and Dow Jones Industrial benchmarks have flipped from losses to gains and are now up 0.3%, 0.2% and 0.2%. Sectoral participation is positive with 9 out of 11 segments higher as communication services and consumer discretionary are lower by 1.4% and 0.8% whereas real estate, utilities and health care are piloting the bullish recovery; they’re higher by 1.4%, 1.1% and 0.9%. Turning to fixed-income and currencies, the yield curve is shifting south in bull-flattening motion and the greenback is weakening as a result. The 2- and 10-year Treasury maturities are changing hands at 4.17% and 4.42%, 5 and 10 basis points (bps) lighter in today’s trading. Furthermore, the greenback is depreciating relative to most of its major counterparts, including the euro, pound sterling, franc, yen and Aussie and Canadian tenders, which is contributing to the Dollar Index weakening by 52 bps. It is appreciating versus the Chinese yuan, however. Commodities are benefiting from the softer greenback, with gold, silver, copper and lumber higher by 1%, 0.9%, 0.8% and 0.1%, although crude oil is lower by 1.9%. WTI is trading at $71.31 per barrel on the back of a surge in crude inventories that together with an uptick in gasoline supplies arrived well ahead of expectations in this morning’s weekly report form the US Energy Information Administration.

Overreaction at the Long End

I don’t think today’s developments justify such a dramatic move at the long end of the curve despite the Treasury refunding announcement reflecting steady issuance levels for 2025. Both the ISM-Services and ADP-Employment reports reflected accelerating hiring conditions amidst continued cost pressures at points of sale and through worker compensation. These dynamics are more consistent with steady or climbing interest rates rather than lighter yields; however, geopolitical and trade uncertainty are clearly generating interest in fixed-income assets. Finally, I believe this stage of the economic cycle alongside the domestic political backdrop is supportive of stronger growth, upside risks to inflation and taller term premiums rather than the other way around.

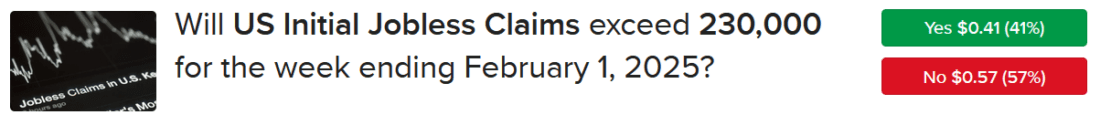

ForecastEx Weekly Pick

Chief Strategist Steve Sosnick and Senior Economist José Torres like the “No” Forecast Contract for a figure above 230,000 in this Thursday’s initial unemployment claims. The “No,” currently priced at $0.57, pays a dollar if correct. Torres adds that the last 15 weeks have only featured a number above 230,000 once.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

International Roundup

Europe Inflation Eases and UK Car Sales Fall

The European Union Producer Price Index rose 0.4% m/m in December compared to the analyst consensus forecast for a 0.5% increase and November’s 1.7% gain, according to estimates from Eurostat. On a y/y basis, the gauge was flat and slightly better than analysts’ expectation for a 0.1% decline and the preceding month’s 1.2% dip. For the full year, prices dropped 4.2% compared to 2023. Regarding m/m results, the following sectors increased by the stated amounts:

- Energy, 1.3%

- Durable consumer goods, 0.2%

- Capital goods, 0.1%

- Non-durable consumer goods, 0.1%

UK Shoppers Drive Past Auto Dealerships

UK car sales professionals spent more time gazing out of their showroom windows waiting for customers last month with auto transactions falling 2.5% y/y, according to the Society of Motor Manufacturers and Traders (SMMT). It was the fourth-consecutive month of declining cash register activity and the weakness existed among both fleet and private purchasers. Volumes for cars with internal combustion engines tanked 15.3% while purchases of pure battery electric vehicles (EVs) advanced 41.6%.

South Korea Inflation Picks Up

Consumer prices climbed 2.2% y/y in January, accelerating from 1.9% in the last month of 2024 and narrowly exceeding the forecast of 2.1%. Core prices, which exclude energy and food, climbed 1.9%. The import-dependent country attributed the inflation uptick to its weaker currency and higher energy prices.

Wanderlust Crimps Singapore Retailing

Singapore’s retail spending malaise continued in December, with consumer outlays dipping 2.9% y/y and 1.5% m/m. Excluding motor vehicles, the results were even worse – transactions dropped 4% and 3.5%. The headline decline was broad-based with the watches and Jewelry group, the mini-marts and convenience stores classification and the wearing apparel and footwear segment experiencing m/m declines ranging from 6% to 11.1%. Conversely, Singaporeans flocked to car dealerships, pushing automobile sales up 13.2%.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!