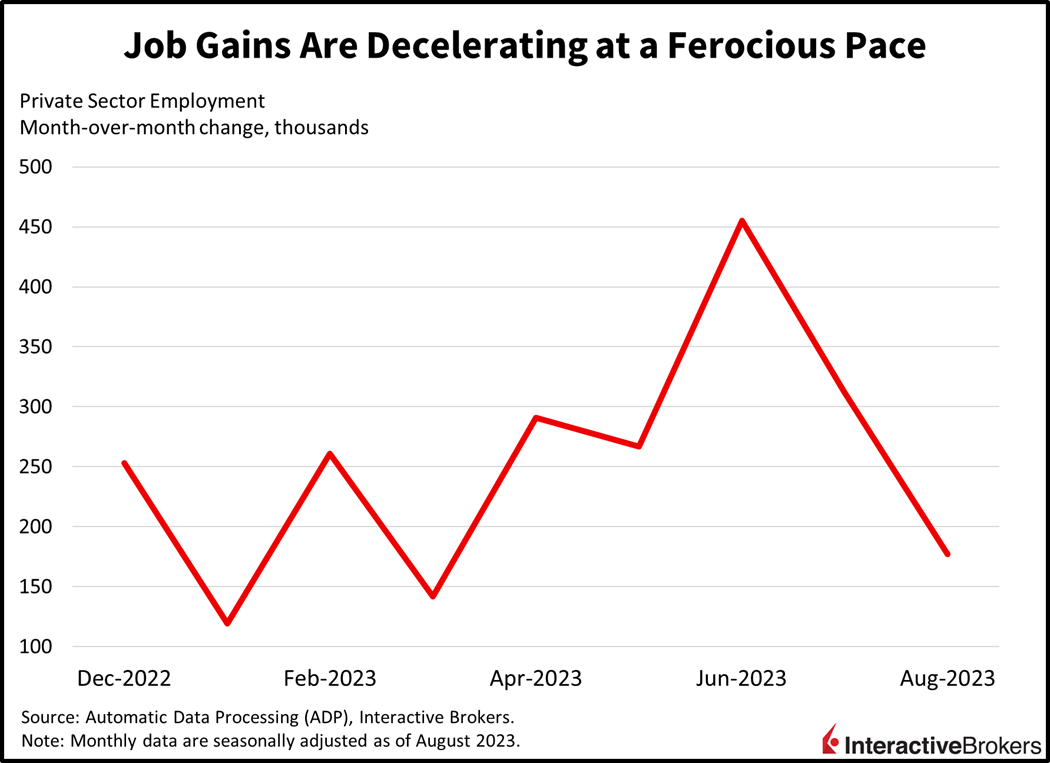

Optimism that an easing labor market may help slow inflationary pressures got a boost this morning with ADP’s National Employment Report showing that job growth slowed significantly in August. The report and this morning’s downward revision to GDP imply that the inflation-ridden, red-hot services sector may finally be reaching supply and demand balance, a welcome development relieving market players of further monetary policy intensity at the moment. This morning’s data is supporting optimism that was ignited yesterday by a weaker-than-expected Job Openings and Labor Turnover Survey release.

According to ADP, private payroll growth slowed to 177,000 in August, slightly less than the 195,000 expected and a sharp deceleration from July’s 312,000 and June’s 455,000 workforce additions. Furthermore, about a third of job gains were concentrated in the non-cyclical education and health sectors while the cyclical areas added only at the margins. Gains were broad based, however, led by the following categories:

- Education and health services, 52,000 additions

- Trade, transportation and utilities, 45,000 additions

- Leisure and hospitality, 30,000 additions

- Professional and business services, 15,000 additions

- Manufacturing, up 12,000 additions

Other services, construction, natural resources and mining, and information all added below 10,000 jobs. The finance sector’s payrolls were unchanged during the period, which was weaker than July.

From a regional perspective, the South, Northeast, and West added 119,000, 59,000 and 13,000 jobs while the Midwest shed 15,000. Large employers added the most workers, followed by medium firms, which were trailed by small firms. Wage growth decelerated to 5.9% and 9.5% for job stayers and job changers, respectively.

GDP Revised Downward

GDP this morning was revised to 2.1% from its previously estimated 2.4%. Business investment was adjusted from 5.7% to 3.3% while consumption was bumped from 1.6% to 1.7%. The Core PCE Price Index, the Fed’s preferred inflation gauge, was adjusted lower from 3.8% to 3.7%. Corporate profits contracted for the third-consecutive quarter to a quarterly decline of 0.4% and year-over-year (y/y) decline of 6.5%. Still, corporate profits contracted at a much a slower rate when compared to the previous period’s 4.1% quarterly rate contraction.

Businesses Rush to the Edge and Consumers Build Lego Structures

While the labor market may be cooling, demand for corporate computing technology is likely to increase, maintains Hewlett Packard (HP), which upgraded its earnings forecast last night. For its fiscal 12-month period ending in October, the tech company expects to generate earnings per share (EPS) between $2.11 and $2.15 compared to its earlier guidance of $2.06 to $2.14. The company’s revenue forecast for the current quarter is a range of $7.2 billion and $7.5 billion compared to the consensus expectation of $7.49 billion. For its fiscal third quarter, revenue climbed 1%, with its edge technology that facilitates computing where data is created offsetting declines in storage and data center products. The company’s second-quarter EPS of $0.49 exceeded the consensus expectation of $0.47.

Meanwhile, consumers are busy building Lego kits. For the second quarter, many big-name toy companies such as Mattel and Hasbro have experienced double-digit revenue declines, but Lego just reported that sales in its first six months of this year climbed 1% to approximately $4 billion. During the same period, however, higher costs for raw materials, shipping and energy caused Lego earnings to decline 17% y/y to $742 million. The company is addressing the higher shipping costs by opening a plant in Virginia.

Equities Eye Fourth Day of Gains

Markets are carefully bullish this morning with equities seeking their fourth consecutive daily gain. Participation is broad with most sectors higher and homebuilders leading, climbing 1.1%. Meanwhile, utilities, communication services and real estate are down. The small-cap Russell 2000 Index is leading other indices with a 0.6% gain, all of which are higher. Yields and the dollar are softer in response to this morning’s data depicting slower economic momentum. The 2- and 10-year Treasury maturities are down 3 and 2 basis points (bps) to 4.87% and 4.11% while the Dollar Index is down 36 bps to 103.12. Despite a sharp decline in U.S. inventories, WTI crude oil reversed early gains and is now unchanged on the day at $81.28 per barrel as traders examine demand uncertainty amidst pending supply developments.

Consumer and Business Challenges Escalate

The softening labor market and downward GDP revisions are favorable for curtailing inflation, but overall demand within the economy may weaken too quickly, thereby creating challenges for both corporate earnings and consumers. High levels of consumer savings resulting from record amounts of stimulus payments during the depths of the COVID-19 pandemic are dwindling while credit card debt is soaring as Americans struggle with higher costs of living. Meanwhile, many consumers will resume student loan payments next month, creating an additional strain on household finances. At the same time, reduced job openings and slower employment growth give workers less clout in negotiating compensation. In aggregate, these factors are likely to cause consumers to cut back on their spending sharply before year-end, creating significant hurdles for corporate revenues and earnings at a time of high interest rates, persistent inflation and reduced credit availability. At this juncture, however, markets are loving weaker economic data while rooting for a soft landing without considering risks of recession and deteriorating profitability.

Visit Traders’ Academy to Learn More about Economic Indicators

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!