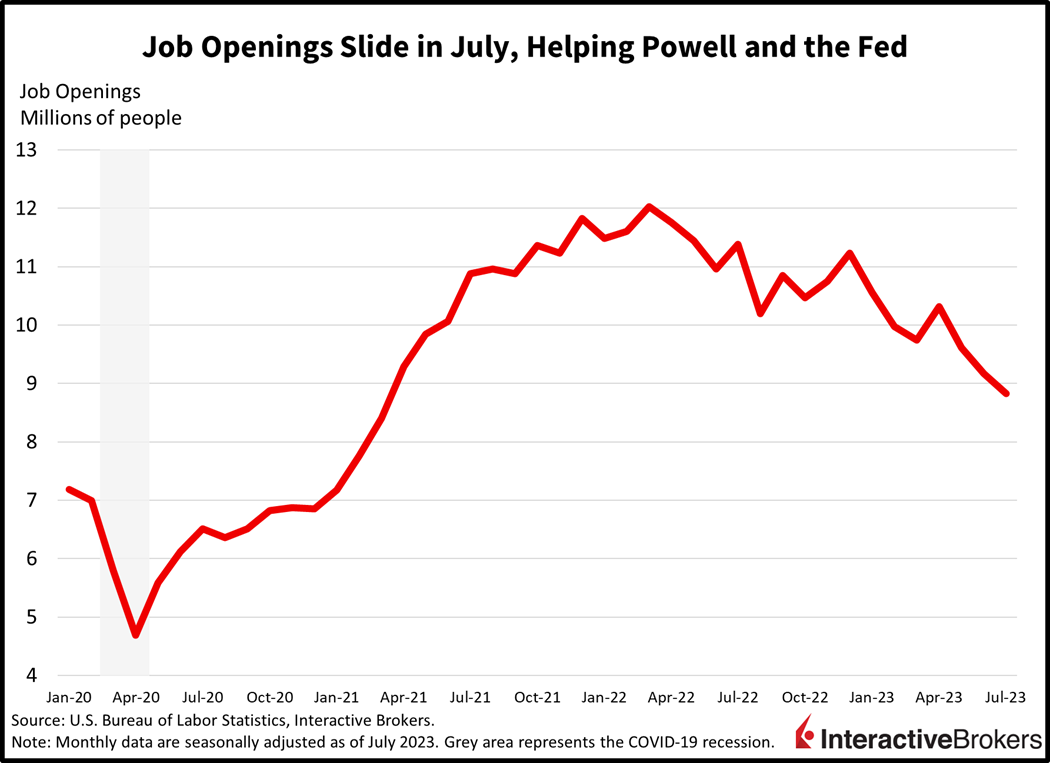

A combination of weakening consumer confidence and job openings missing expectations is pointing to less pressure on the Federal Reserve to continue tightening its monetary policy. Markets are cheering the reports, which point to progress on the long inflation battle.

This morning’s Job Openings and Labor Turnover Survey, or JOLTS, illustrates that employers are slowing hiring amidst a challenging economic landscape characterized by sticky inflation, high interest rates and reduced credit availability. July job openings fell to 8.827 million, much softer than the median estimate of 9.465 million and down sharply from June’s 9.165 million. Quits, furthermore, declined from 3.802 million in June to 3.549 in July, providing further evidence of a weakening job market as workers may be less confident that they can find new jobs. Taken together, the job openings and quits data implies that companies aren’t as hungry for labor while workers are more attached to their jobs. Furthermore, data from Indeed show that job openings continued to slide in August.

Also this morning, the Conference Board Consumer Confidence Index declined sharply in August as shoppers reflected constrained budgets driven by rising food and gasoline prices. Consumer confidence came in at 106.1, offsetting the progress made in the previous two months. August’s read fell well below the expectation for 116, which was similar to July’s level of 117. Both the Present Situations Index and the Expectations Index declined to 144.8 and 80.2, respectively, from 153 and 88.

House Prices Climb

Confidence among homeowners, however, received some support from residential real estate prices rising, even as mortgage rates have climbed. The S&P CoreLogic Case-Shiller National House Price Index climbed 0.7% month-over- month (m/m) in June and was flat year-over-year (y/y), while the 20-city index jumped 0.9% m/m but was down 1.2% y/y. Mortgage interest rates have soared above 7%, which has created a shortage of inventory. Many homeowners with record-low mortgage rates are reluctant to relocate because they would face higher monthly payments for their new homes due to the rise in interest rates. The lack of existing homes is pushing up activity in the new home market.

Retailers Bemoan Weak Sales but Remain Optimistic

Second-quarter earnings reports from certain retailers include optimism that consumers may increase spending later this year, but are still in the financial doldrums as illustrated by the following examples:

- Best Buy, which cut jobs at many of its stores and had suspended buybacks until late in 2022, said its second-quarter comparable sales declined 6.2% y/y but explained that 2023 is likely to be a low spot in consumer spending. An increase in sales of digital gaming systems was overshadowed by a decline in purchases of appliances, mobile phones and home theaters. Additionally, online sales dropped 7.1% y/y. Analysts expected earnings per share (EPS) of $1.06 and revenues of $9.52 billion, while Best Buy generated EPS of $1.22 and revenue of $9.58 billion. For the full year, Best Buy expects comparable sales to decline from between 4.5% and 6% compared to earlier guidance calling for a decline of 3% to 6%. Nevertheless, the company increased its adjusted earnings per share guidance from between $5.70 and $6.50 to between $6 and $6.40.

- Big Lots also exceeded expectations with its $1.14 billion in revenues beating the consensus expectation of $1.10 billion despite a 15.4% decline in sales. The company believes its comparable sales decline will moderate in the remaining months of this year.

Markets Show Relief from Fed Tightening Fears

After choppy trading following Powell’s hawkish comments last week in Jackson Hole, markets are cheering the soft job opening data that implies policymakers are making progress in the battle against inflation. Equity indices are higher across the board with technology leading as the Nasdaq Composite Index rises 1.2%. Participation is broad with all sectors higher except for energy and consumer staples. Bonds are catching a bid as well as odds of further Fed hikes soften: the 2- and 10-year Treasury maturities are down 13 and 5 basis points (bps) to 4.93% and 4.16%. The Dollar Index is roughly unchanged, however, as the greenback gains against the euro and Canadian dollar while it’s down relative to the yen and pound sterling. Energy markets are quiet today, with WTI crude up 0.2% to $80.27 as traders consider weak demand prospects from China, OPEC + production cuts and the possibility of Venezuelan supply coming online.

Investor Optimism Faces Additional Labor Market Hurdles

Optimism regarding progress in fighting inflation faces a challenge with ADP scheduled to release its National Employment Report tomorrow. A report of strong hiring could quickly dash investors’ hopes that the labor market is weakening but if job creation is soft, then investors may continue to bid up equity prices. A weak ADP report could also imply that consumers’ spending clout, in aggregate, may weaken as workers may have fewer options in the job markets and may be less likely to negotiate higher compensation. While the resulting decline in demand from softening wage gains may help curtail inflation, it also illustrates that the Fed’s battle against price increases comes at the cost of a slowing economy and consumer weakness.

Visit Traders’ Academy to Learn More about Economic Indicators

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!